Market Definition

The market encompasses a broad ecosystem of products, technologies, and end users involved in the development and manufacturing of biologics using disposable bioreactor systems.

This market includes various product segments such as single-use bioreactor systems, assemblies, media bags, and other related consumables. It covers different types of bioreactor technologies including stirred-tank, wave-induced, and bubble-column designs.

The market serves diverse cell types such as mammalian, bacterial, yeast, and genetically engineered cells. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Single Use Bioreactors Market Overview

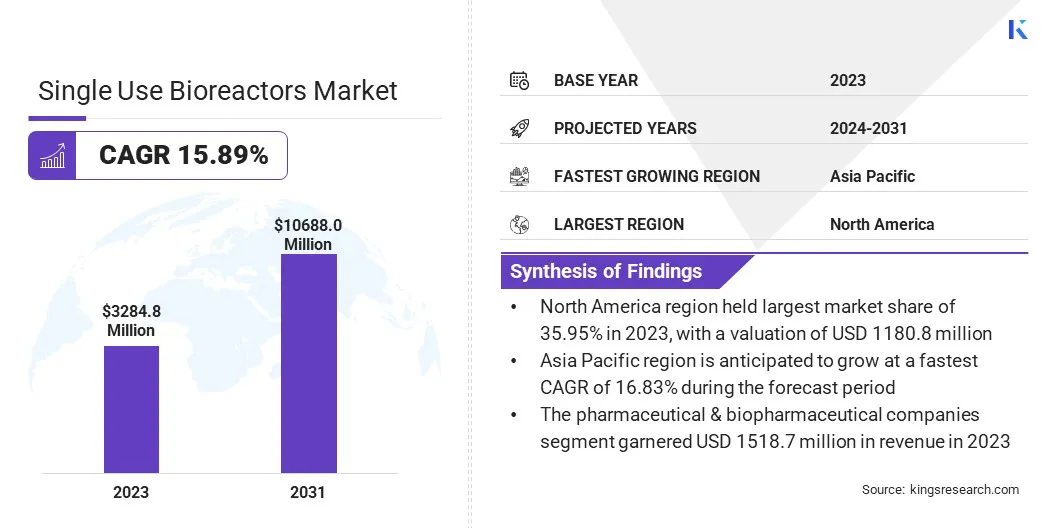

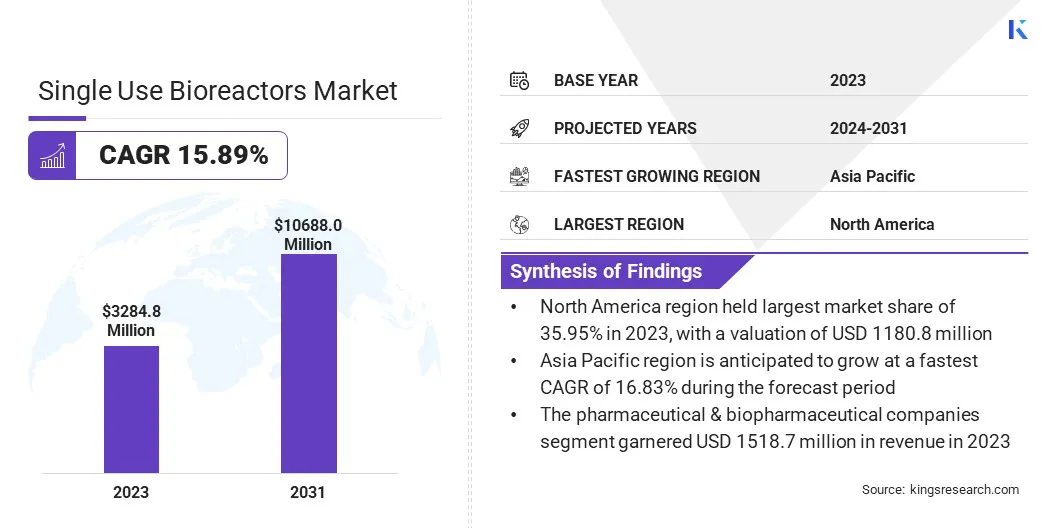

The global single use bioreactors market size was valued at USD 3284.8 million in 2023 and is projected to grow from USD 3805.8 million in 2024 to USD 10688.0 million by 2031, exhibiting a CAGR of 15.89% during the forecast period.

The increasing demand for biologics, vaccines, and cell therapies is driving the market. Flexibility, scalability, and the reduced risk of contamination offered by single-use systems are major contributors to their adoption across biopharmaceutical manufacturing.

Major companies operating in the single use bioreactors industry are bbi-biotech, Getinge AB, ZETA, Cytiva, Distek, Inc., PBS Biotech, Inc., Cellexus, Thermo Fisher Scientific Inc., Pall Corporation, Eppendorf SE, Celltainer, Sartorius AG, ABEC, Merck KGaA and Stobbe Tech.

Additionally, advancements and real-time monitoring technologies are enhancing the efficiency and consistency of bioprocessing, making single-use bioreactors an attractive option for both clinical and commercial production. In addition, the growing need for flexible, cost-effective, and scalable production solutions is further driving the growth of the market.

- In April 2023, Cytiva introduced its X-platform bioreactors to streamline single-use upstream bioprocessing. Available in 50 and 200 L capacities, the bioreactors feature Figurate automation software to improve efficiency, ease of use, and supply chain integration. Based on Xcellerex technology, the X-platform supports the production of monoclonal antibodies, cell and gene therapies, and viral vectors.

Key Highlights:

Key Highlights:

- The single use bioreactors industry size was valued at USD 3284.8 million in 2023.

- The market is projected to grow at a CAGR of 15.89% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 1180.8 million.

- The single-use bioreactor systems segment garnered USD 1170.9 million in revenue in 2023.

- The stirred-tank SUBs segment is expected to reach USD 3956.2 million by 2031.

- The bacterial segment is expected to reach USD 3806.0 million by 2031.

- The vaccine segment is expected to reach USD 2936.2 million by 2031.

- The process development segment is expected to reach USD 3990.7 million by 2031.

- The pharmaceutical & biopharmaceutical companies segment garnered USD 1518.7 million in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 16.83% during the forecast period.

Market Driver

"Rising Demand for Rapid Biologic and Cell Therapy Production"

The single use bioreactors market is primarily driven by the rising demand for biologics and cell therapies. As pharmaceutical companies shift focus toward targeted treatments, such as monoclonal antibodies, vaccines, and gene therapies, the need for efficient and flexible biomanufacturing solutions has increased.

Single-use systems support rapid process development and reduce downtime between production cycles, making them ideal for high-throughput biologic production. Their ability to scale from small-batch clinical trials to full-scale commercial manufacturing makes them essential in meeting growing therapeutic demands, especially in areas such as oncology, immunology, and rare diseases.

- In April 2025, Thermo Fisher Scientific introduced the 5L DynaDrive Single-Use Bioreactor, designed to accelerate process development. The bioreactor offers seamless scalability from 1 liter to 5,000 liters, enabling the cost-effective transition from bench to commercialization. The 5L DynaDrive combines high performance with a user-friendly design, providing enhanced scalability, increased productivity, and sustainability in bioprocessing.

Market Challenge

"High Cost of Single-use Components"

A major challenge in the single use bioreactors market is the high cost of single-use components. These systems, although cost-effective in terms of facility setup and maintenance, can be expensive to replace and dispose of, particularly in large-scale production.

The frequent need for new bioreactor bags, filters, and other consumables can lead to significant operational expenses. A solution to this challenge is the development of more affordable and sustainable materials for single-use components.

Innovations in biopolymer technology, as well as advancements in recycling and reusing certain components, could help lower costs and reduce the environmental impact associated with disposable systems.

Market Trend

"Increasing Use of Mobile Bioreactors"

The growing adoption of mobile bioreactors is a key trend in the single use bioreactors market. These compact and portable systems offer flexibility and scalability, allowing manufacturers to efficiently expand or relocate production without significant infrastructure changes.

Mobile bioreactors reduce facility costs and enable faster time-to-market. This shift is due to the increasing need for modular production systems, that can quickly adapt to varying production volumes and market demands.

As the demand for on-demand and decentralized manufacturing rises, mobile bioreactors provide a cost-effective and agile solution for biopharmaceutical companies.

- In April 2025, Culture Biosciences unveiled Stratyx 250, a cloud-integrated mobile bioreactor, designed for cell culture process development. The bioreactor accelerates bioprocess development, enables real-time remote monitoring and control, and reduces costs. It integrates data analysis and automated cloud-based process control, improving accuracy, speed, and accessibility.

Single Use Bioreactors Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Single-use bioreactor systems (Up to 10L, 11-100L, 101-500L, 501-1500L, Above 1500L) , Single-use assemblies, Single-use media bags (2D Bags, 3D Bags, Others), Others

|

|

By Type

|

Stirred-tank SUBs, Wave-induced SUBs, Bubble-column SUBs, Others

|

|

By Cell

|

Bacterial, Mammalian, Yeast, Others

|

|

By Molecule

|

Vaccines, Monoclonal Antibodies, Gene Modified Cells, Stem Cells, Others

|

|

By Application

|

Process Development, Research & Development (R&D), Bioproduction

|

|

By End User

|

Pharmaceutical & Biopharmaceutical Companies, Contract Research Organizations & Manufacturing Organizations, Academic & Research Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Single-use bioreactor systems, Single-use assemblies, Single-use media bags, Others): The single-use bioreactor systems segment earned USD 1170.9 million in 2023, due to the growing demand for flexible, scalable biomanufacturing solutions.

- By Type (Stirred-tank SUBs, Wave-induced SUBs, Bubble-column SUBs, and Others): The stirred-tank SUBs segment held 37.37% of the market in 2023, due to their broad adoption in commercial-scale biologics production.

- By Cell (Bacterial, Mammalian, Yeast, and Others): The bacterial segment is projected to reach USD 3806.0 million by 2031, owing to the increasing use of microbial systems for rapid biologics manufacturing.

- By Molecule (Vaccines, Monoclonal Antibodies, Gene Modified Cells, and Stem Cells): The vaccines segment is projected to reach USD 2936.2 million by 2031, on account of rising global vaccination initiatives and biotech investments.

- By Application (Process Development, Research & Development (R&D) and Bioproduction): The process development segment earned USD 1239.5 million in 2023, due to the rising need for efficient upstream process optimization.

- By End User (Pharmaceutical & Biopharmaceutical Companies, Contract Research Organizations & Manufacturing Organizations, Academic & Research Institutes): The pharmaceutical & biopharmaceutical companies held 46.23% of the market in 2023, owing to large-scale investments in biologics and personalized medicine production.

Single Use Bioreactors Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America single use bioreactors market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 1180.8 million. This dominance is due to its strong biopharmaceutical manufacturing capabilities, early adoption of single-use technologies, and well-established regulatory support.

The North America single use bioreactors market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 1180.8 million. This dominance is due to its strong biopharmaceutical manufacturing capabilities, early adoption of single-use technologies, and well-established regulatory support.

The presence of a large number of contract development and manufacturing organizations (CDMOs) and continued investments in biologics and cell therapy production have also contributed to market leadership.

In addition, high R&D spending and advanced infrastructure across the U.S. and Canada have supported the widespread integration of single-use systems in commercial and clinical-scale operations.

The Asia Pacific single use bioreactors industry is poised to grow at a significant growth at a CAGR of 16.83% over the forecast period. The region’s growth is driven by expanding biotechnology sectors in countries such as China, India, South Korea, and Japan.

Rising investments in biomanufacturing facilities, increasing government support for life sciences, and a growing number of local CDMOs are contributing to market expansion.

In addition, the cost-effectiveness of establishing production facilities in the region and increasing demand for biosimilars and vaccines, are accelerating the adoption of single-use technologies across both research and production environments.

- In April 2025, AGC Biologics revealed the integration of two 5,000 L DynaDrive Single-Use Bioreactors from Thermo Scientific at its new Yokohama, Japan facility. This strategic move enhances the company’s single-use technology network, positioning the facility as one of Japan’s most advanced sites for large-scale mammalian biologics production. GMP operations are scheduled to commence in 2027.

Regulatory Frameworks

- In the U.S, Single Use Bioreactors are regulated under the Food and Drug Administration (FDA) guidelines, specifically through the Current Good Manufacturing Practices (cGMP), which require biomanufacturing equipment, including disposable systems, to meet strict quality, sterility, and validation standards.

- In India, the Central Drugs Standard Control Organization (CDSCO), regulates Single Use Bioreactors under the Drugs and Cosmetics Act and Rules, where facilities using disposable systems for biologics manufacturing, must adhere to GMP standards that ensure equipment validation, quality control, and sterility assurance.

Competitive Landscape

Key players are expanding their product portfolios through continuous innovation in bioreactor design, automation, and scalability. They are investing in modular and customizable solutions to cater to diverse bioproduction requirements.

Strategic partnerships and collaborations with contract manufacturers and research organizations are being used to enhance distribution networks and technical capabilities. Several players are increasing their manufacturing capacity, by setting up new production facilities and upgrading existing infrastructure to meet rising demands.

Mergers and acquisitions are being used to gain access to advanced technologies and expand regional presence. Companies are actively securing funding through private investments, public offerings, and strategic financing agreements to accelerate research, scale production, and drive global expansion.

- In January 2025, PBS Biotech secured USD 17 million in follow-on growth capital from BroadOak Capital Partners and Avego Management, LLC. The funding will support new product innovation, process development services, quality system improvements, and operational expansion. PBS Biotech is also expanding its ISO 9001:2015 manufacturing capacity to support over USD 100 million in annual revenue.

List of Key Companies in Single Use Bioreactors Market:

- bbi-biotech

- Getinge AB

- ZETA

- Cytiva

- Distek, Inc.

- PBS Biotech, Inc.

- Cellexus

- Thermo Fisher Scientific Inc.

- Pall Corporation

- Eppendorf SE

- Celltainer

- Sartorius AG

- ABEC

- Merck KGaA

- Stobbe Tech

Recent Developments (Product Launch)

- In September 2024, Merck launched the Mobius ADC Reactor, the first single-use reactor designed specifically for antibody drug conjugate (ADC) manufacturing. The system increases production efficiency by 70%, compared to traditional stainless steel or glass methods, and utilizes Ultimus Film for enhanced leak resistance.

Key Highlights:

Key Highlights: The North America single use bioreactors market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 1180.8 million. This dominance is due to its strong biopharmaceutical manufacturing capabilities, early adoption of single-use technologies, and well-established regulatory support.

The North America single use bioreactors market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 1180.8 million. This dominance is due to its strong biopharmaceutical manufacturing capabilities, early adoption of single-use technologies, and well-established regulatory support.