Market Definition

The market encompasses the production, formulation, and application of nanoscale silver particles, typically ranging from 1 to 100 nanometers. These nanoparticles are synthesized using physical, chemical, and biological methods, including chemical reduction, laser ablation, and green synthesis.

The market also includes formulations in colloidal suspensions, powders, and inks tailored for specific industrial and biomedical uses. Silver nanoparticles (AgNPs) play a crucial role in nanotechnology-driven innovations across multiple sectors, including healthcare, electronics, food packaging, textiles, and water treatment.

Silver Nanoparticles Market Overview

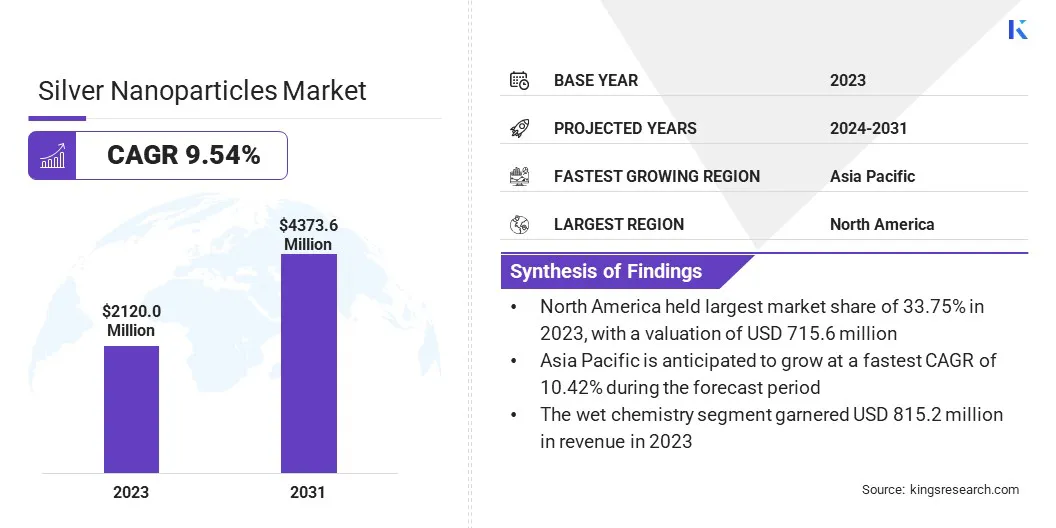

The global silver nanoparticles market size was valued at USD 2120.0 million in 2023 and is projected to grow from USD 2311.2 million in 2024 to USD 4373.6 million by 2031, exhibiting a CAGR of 9.54% during the forecast period.

This growth is attributed to the rising demand for AgNPs in the healthcare sector, leading to their increased use in wound dressings, medical textiles, and drug delivery systems.

Additionally, the growing need for high-performance coatings in electronics, automotive, and consumer goods is boosting the market. The adoption of AgNPs from electronic waste is further supporting sustainable applications, reducing material costs, and enhancing environmental benefits.

Major companies operating in the silver nanoparticles industry are nanoComposix, Sigma-Aldrich, Hongwu International Group Ltd, American Elements, Emfutur Technologies, Bayer, BASF, Sukgyung AT Co., Ltd., QuantumSphere, Inc., KCIL-NanoXpert Technologies, Ascensus, PlasmaChem GmbH, Meliorum Technologies, Inc., BBI Solutions, and Nanogate AG.

The market is registering strong growth, due to their rising demand in the healthcare sector. Increasing concerns over hospital-acquired infections (HAI) have led to the greater adoption of antimicrobial coatings in medical devices, surgical instruments, and wound dressings.

Pharmaceutical companies are incorporating AgNPs into drug delivery systems to enhance bioavailability and therapeutic efficacy. The growing focus on advanced materials for healthcare applications is accelerating investment in silver-based nanotechnology, strengthening the market's long-term expansion.

- In January 2025, researchers at the Medical University of Varna, Bulgaria, conducted a study examining the in vitro anti-melanoma activity of AgNPs synthesized through “green” reduction using catechins from Camellia sinensis and superficially charged with chlorhexidine diacetate (Cx+).

The antiproliferative effects were evaluated on human keratinocytes (HaCaT) and human melanoma (SH-4) cell lines. Melanoma, an aggressive skin cancer resulting from abnormal melanocyte proliferation, was the focus of this research.

The findings indicate the potential application of this innovation in localized chemotherapy for early-stage or post-operative skin melanoma treatment. Healthcare industries are adopting nanotechnology-driven solutions, boosting investments in medical-grade silver nanoparticles. These factors are supporting the market growth.

Key Highlights:

- The silver nanoparticles industry size was valued at USD 2120.0 million in 2023.

- The market is projected to grow at a CAGR of 9.54% from 2024 to 2031.

- North America held a market share of 33.75% in 2023, with a valuation of USD 715.6 million.

- The wet chemistry segment garnered USD 815.2 million in revenue in 2023.

- The food & beverages segment is poised for a robust CAGR of 10.17% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.42% during the forecast period.

Market Driver

"Increasing Demand for High-performance Coatings"

The silver nanoparticles market is expanding with the growing need for advanced coatings across various industries. Their antimicrobial, anti-corrosive, and self-cleaning properties make them ideal for use in paints, surface treatments, and protective coatings. Sectors such as healthcare, automotive, and consumer goods are integrating AgNPs into coatings to enhance durability and hygiene.

- Published on March 26, 2025, a study by researchers at the University of Salerno, Italy, explores the development and characterization of functionalized AgNP-based coating agents for leather treatment.

AgNPs were integrated into polyurethane- and nitroemulsion-based finishing formulations and applied to ovine and bovine leather through a spray coating process. Treated leather samples showed a 90% reduction in microbial growth after 72 hours, along with improved UV resistance, exhibiting 30% less color change compared to untreated samples.

The Ag-F NPs-based coatings also enhanced abrasion and micro-scratch resistance, maintaining a stable coefficient of friction. These findings highlight the potential of Ag-F NPs as advanced leather-finishing agents for applications in the automotive, footwear, and leather goods industries. This potential of AgNPs in functional coatings is expected to drive the market.

Market Challenge

"High Production Costs and Scalability Issues"

High cost of production and challenges in scaling up manufacturing processes are significant barriers to the growth of the silver nanoparticles market. Precision in nanoparticle synthesis, maintaining stability, and achieving consistent quality require advanced technologies, leading to increased operational expenses.

Companies are investing in cost-efficient synthesis methods, such as green and chemical-free production techniques. Automation in manufacturing and process optimization is being implemented to enhance scalability while reducing production costs.

Additionally, strategic collaborations with research institutions and technology providers are helping streamline large-scale production without compromising nanoparticle performance and quality.

Market Trend

"Recycling of Silver Nanoparticles for Sustainable Applications"

The rising emphasis on sustainability is driving the recycling of AgNPs from electronic waste through green synthesis methods. This approach minimizes environmental impact while supporting resource efficiency in nanoparticle production.

Industries are increasingly incorporating recycled AgNPs into various applications, with a growing focus on textile materials. The use of AgNPs-chitosan-based nanocomposites in textiles enhances antimicrobial properties and durability, aligning with the demand for eco-friendly and high-performance fabrics.

- A study published on September 2023, in Nature highlights the green synthesis of AgNPs from electronic waste using Eichhornia crassipes leaf extract as a reducing agent. These AgNPs were applied to 100% cotton fabric with chitosan, forming a nanocomposite coating.

Characterization techniques, including FTIR and SEM, confirmed uniform deposition with an average particle size of 76.91 nm. Antimicrobial tests demonstrated significant microbial growth reduction, reinforcing the potential of this eco-friendly approach in antimicrobial textile development.

Silver Nanoparticles Market Report Snapshot

|

Segmentation

|

Details

|

|

By Synthesis

|

Wet Chemistry, Ion Implantation, Biological Method

|

|

By Application

|

Electronics & Electrical, Healthcare, Food & Beverages, Textiles, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Synthesis (Wet Chemistry, Ion Implantation, Biological Method): The wet chemistry segment earned USD 815.2 million in 2023, due to its precise control over particle size & morphology and high scalability, making it the preferred method for large-scale commercial production across industries such as healthcare, electronics, and coatings.

- By Application (Electronics & Electrical, Healthcare, Food & Beverages, Textiles, and Others): The food & beverages segment is poised for significant growth at a CAGR of 10.17% through the forecast period, due to the increasing adoption of antimicrobial packaging solutions and food preservation techniques that enhance shelf life and prevent contamination.

Silver Nanoparticles Market Regional Analysis

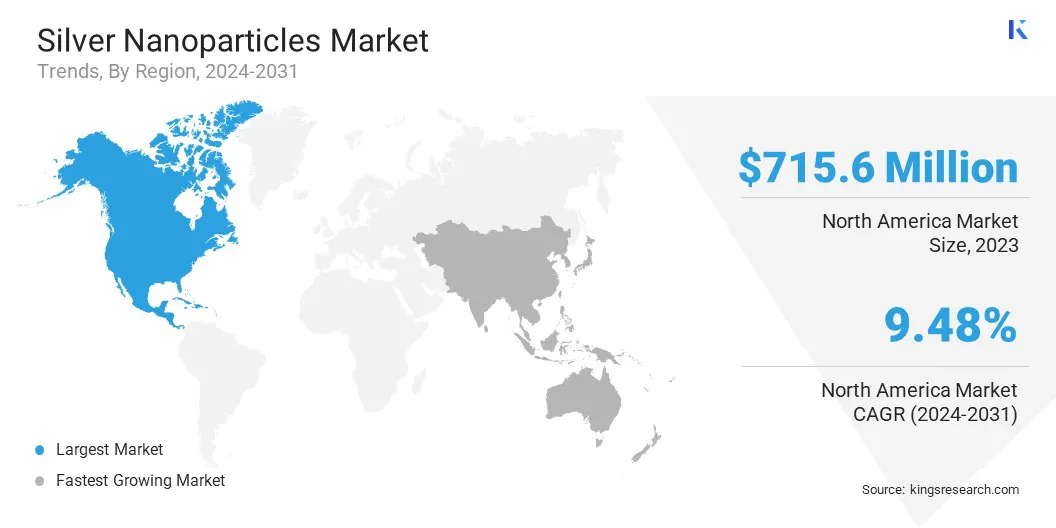

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America silver nanoparticles market accounted for a market share of around 33.75% in 2023, with a valuation of USD 715.6 million. The robust healthcare sector in North America is driving the demand for silver nanoparticles, particularly in antimicrobial coatings for medical devices, wound dressings, and implantable materials.

Regulatory support from agencies like the FDA for nanotechnology-based medical products has accelerated commercialization. Amid the rising prevalence of hospital-acquired infections (HAIs), healthcare facilities are increasingly integrating AgNPs in high-touch surfaces and surgical equipment to enhance patient safety, fueling the market growth.

Additionally, given the high-performance requirements of aircraft and defense equipment, nanotechnology-based coatings with AgNPs are being utilized to improve longevity and reliability in extreme environments.

Investments in next-generation military technology and commercial aircraft manufacturing are increasing the demand for high-performance nanomaterials, boosting the market.

The silver nanoparticles industry in Asia Pacific is poised for significant growth at a robust CAGR of 10.42% over the forecast period. Asia Pacific dominates global electronics manufacturing, with major hubs in China, South Korea, Japan, and Taiwan.

Government initiatives promoting semiconductor self-sufficiency, such as China’s Made in China 2025 and India’s Semicon India Program, are further accelerating the demand for AgNPs in electronics production.

Furthermore, the demand for advanced water purification solutions in Asia Pacific is leading to the increased adoption of AgNP-based filtration systems, accelerating market growth.

Countries like China, India, and Bangladesh, which lead global textile exports, are registering the increased adoption of AgNP-infused smart textiles. Major apparel manufacturers are leveraging AgNPs to enhance fabric durability and hygiene, contributing to the market in the region.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates AgNPs under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) when they are used for pesticidal purposes. Products containing AgNPs intended to control pests must undergo registration and evaluation for environmental and human health impacts. Additionally, the FDA oversees AgNPs in medical devices, food additives, and cosmetics, requiring manufacturers to demonstrate safety and efficacy.

- The European Chemicals Agency (ECHA) regulates nanomaterials, including AgNPs, under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation. Manufacturers and importers must provide specific data on nanomaterials, addressing their unique properties and potential risks. The Biocidal Products Regulation (BPR) also applies to AgNPs used as active substances in biocidal products, necessitating approval and inclusion in the Union list of approved active substances.

- Japan's Chemical Substances Control Law (CSCL) governs the management of chemical substances, including nanomaterials. Manufacturers and importers of silver nanoparticles must notify the Ministry of Economy, Trade and Industry (METI) and provide safety data. The National Institute of Advanced Industrial Science and Technology (AIST) conducts research to inform regulatory decisions on nanomaterials.

Competitive Landscape:

The silver nanoparticles industry is characterized by market players that are implementing strategies focused on research and development, advancing manufacturing processes, and forming collaborations with research institutions to strengthen their market position.

Investments in R&D are driving the development of high-performance silver nanoparticles with enhanced stability, controlled particle size, and improved antimicrobial efficacy, catering to industries such as healthcare, electronics, and textiles.

Companies are also optimizing manufacturing techniques, including green synthesis methods, to enhance efficiency and sustainability. Collaborations with universities and research centers are fostering innovation, accelerating product commercialization, and expanding application areas, thereby supporting the growth of the market.

List of Key Companies in Silver Nanoparticles Market:

- nanoComposix

- Sigma-Aldrich

- Hongwu International Group Ltd

- American Elements

- Emfutur Technologies

- Bayer

- BASF

- Sukgyung AT Co., Ltd.

- QuantumSphere, Inc.

- KCIL-NanoXpert Technologies

- Ascensus

- PlasmaChem GmbH

- Meliorum Technologies, Inc.

- BBI Solutions

- Nanogate AG