Market Definition

Silicone gel is a semi-solid, flexible material composed of silicone polymers, often used in medical, cosmetic, and industrial applications. It is known for its soft, cushioning properties, biocompatibility, and resistance to moisture and temperature variations.

Silicone gel is commonly found in scar treatment sheets, breast implants, medical dressings, and electronic encapsulation for protection against environmental damage.

Silicone Gel Market Overview

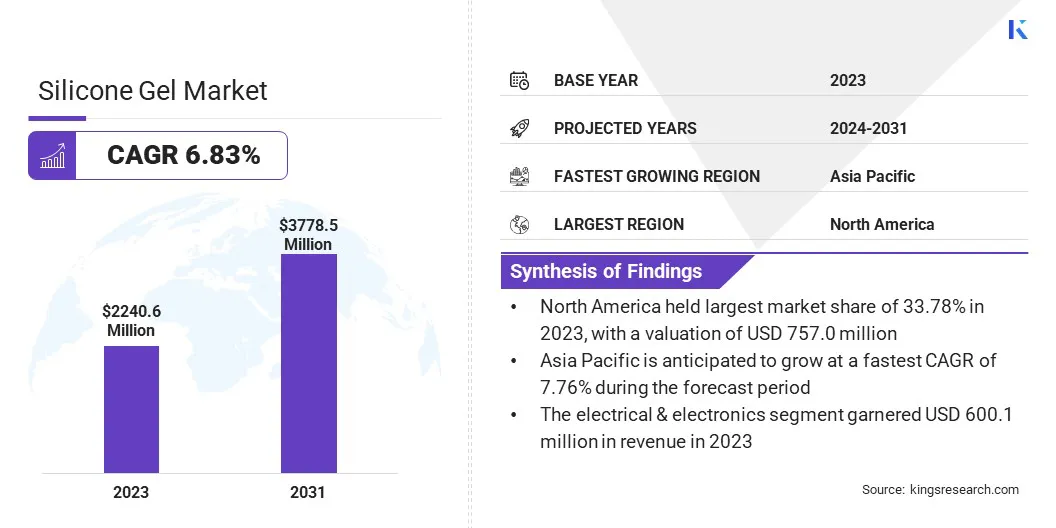

The global silicone gel market size was valued at USD 2,240.6 million in 2023 and is projected to grow from USD 2,379.0 million in 2024 to USD 3,778.5 million by 2031, exhibiting a CAGR of 6.83% during the forecast period.

The market is experiencing steady growth, driven by increasing demand across various industries, including healthcare, electronics, cosmetics, and automotive. In the healthcare sector, the rising adoption of silicone gel in wound care, scar treatment, and medical implants is fueling market expansion.

Additionally, the growing use of silicone gel in consumer electronics for thermal management and insulation is enhancing its market potential. Furthermore, its skin-friendly properties boost adoption in skincare and beauty products.

Major companies operating in the global silicone gel industry are The Dow Chemical Company, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Elkem ASA, CHT Germany GmbH, Novagard Solutions, Inc., KCC SILICONE CORPORATION, Avantor, Inc., Siltech Corporation, Mitsubishi Chemical Group Corporation, RAG-Stiftung, Henkel AG & Co. KGaA, Taica Corporation, Mativ Holdings, Inc., and TECHSiL Ltd.

Moreover, the automotive sector is utilizing silicone gel for vibration damping and sealing applications, contributing to market growth. Technological advancements in silicone-based materials and increasing investments in research and development are anticipated to foster innovation and expand applications, ensuring sustained market growth in the coming years.

- In November 2024, Evident launched the IXplore IX85 automated inverted microscope system, featuring advanced silicone gel pad technology. This innovation aligns with the objective to eliminate the need for oil wiping or replacement, thereby enhancing efficiency and usability in scientific research.

Key Highlights:

- The global silicone gel market size was valued at USD 2240.6 million in 2023.

- The market is projected to grow at a CAGR of 6.83% from 2024 to 2031.

- North America held a share of 33.78% in 2023, valued at USD 757.0 million.

- The electrical & electronics segment garnered USD 600.1 million in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 7.76% over the forecast period.

Market Driver

"Increasing Demand Across Diverse Industries"

The silicone gel market is experiencing significant growth, driven by increasing demand across multiple industries, particularly healthcare and electronics. In healthcare, its biocompatibility, flexibility, and protective properties make it essential for wound care, scar treatment, prosthetics, and implants due to its biocompatibility, flexibility, and protective properties.

Rising healthcare expenditures and advancements in medical technology are propelling its adoption in surgical and therapeutic treatments. In the electronics industry, silicone gel is increasingly utilized for thermal management, insulation, and protective coatings in consumer electronics, automotive electronics, and industrial devices.

As electronic devices become more compact and powerful, the demand for efficient heat dissipation and durable encapsulation materials continues to rise, fueling the growth of the market.

- In December 2024, Mentor Worldwide LLC, a part of Johnson & Johnson MedTech, received FDA approval for its MENTOR MemoryGel Enhance Breast Implants. Designed specifically for post-mastectomy breast reconstruction, this silicone gel-filled implant line offers larger sizes to accomodate women with larger body frames or extensive tissue removal.

Market Challenge

Production Costs and Regulatory Hurdles

The silicone gel market faces several challenges, particularly high production costs and regulatory compliance. Manufacturing high-quality silicone gel requires specialized processing and expensive raw materials such as silicone polymers and crosslinking agents.

Additionally, volatility in raw material prices and supply chain disruptions further increase production costs, making silicone gel-based products less affordable in price-sensitive markets.

Developing cost-effective production techniques, optimizing manufacturing processes, improving material efficiency, and exploring alternative raw materials can help mitigate this challenge.

Stringent regulatory requirements in industries such as healthcare, electronics, and food packaging pose a significant challenge to market growth. Compliance with strict safety and quality standards necessitates rigorous testing and approval processes to ensure silicone gel products meet health, environmental, and performance criteria.

These requirements can delay product launches and increase compliance costs for manufacturers. To address this challenge, companies are investing in advanced testing methods, regulatory compliance strategies, early-stage collaborations with regulatory agencies, comprehensive quality control systems, and continuous formulations updates to align with evolving global standards.

Market Trend

"Innovative Developments Driving the Market"

The silicone gel market is witnessing robust growth, mainly due to material innovation and technological advancements. A key trend is the increasing adoption of high-performance silicone gels, valued for superior flexibility, durability, and resistance to extreme temperatures.

This trend is particularly evident in sectors such as automotive, aerospace, and electronics, where high-performance silicone gels are used for sealing, insulation, and thermal management applications.

Another significant trend is the advancements in smart materials, including self-healing and high-performance silicone gels, expanding applications in wearable technology, robotics, and flexible electronics. These advanced formulations offer improved durability, adaptability, and functionality, making them ideal for next-generation electronic devices and medical implants.

Silicone Gel Market Report Snapshot

|

Segmentation

|

Details

|

|

By End-Use

|

Electrical & Electronics, Retail, Transportation, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By End-Use (Electrical & Electronics, Retail, Transportation, Healthcare, and Others): The electrical & electronics segment earned USD 600.1 million in 2023 due to the increasing demand for silicone gel in thermal management, insulation, and protective coatings for electronic components.

Silicone Gel Market Regional Analysis

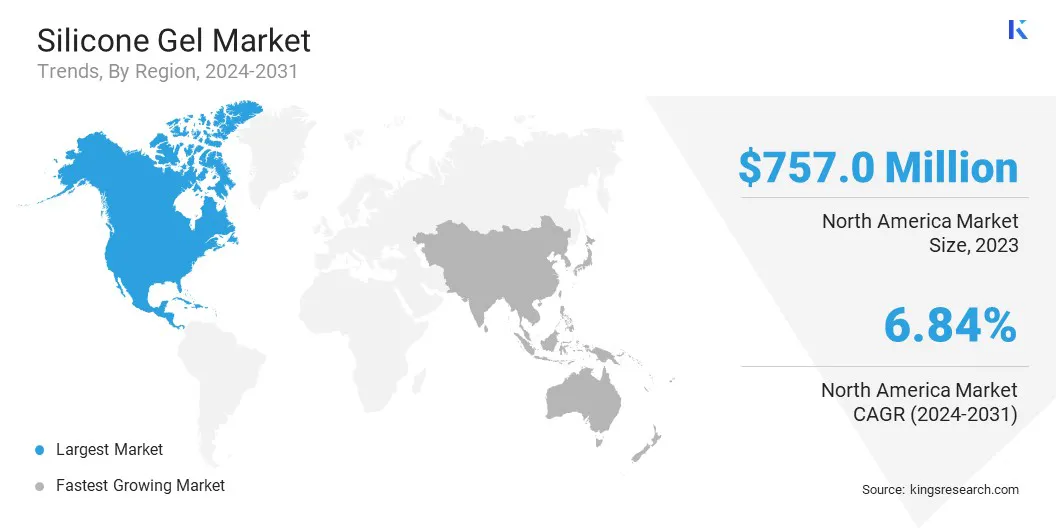

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America silicone gel market accounted for a substantial share of 33.78% in 2023, valued at USD 757.0 million. The dominance is attributed to the widespread adoption of silicone gel across key industries such as healthcare, electronics, and automotive.

The well-established healthcare sector in the United States and Canada has boosted demand for silicone gel in medical implants, wound care, and drug delivery systems. Additionally, the growing use of silicone gel in electrical and electronic applications, including thermal management solutions, conformal coatings, and encapsulation for circuit protection, has contributed significantly to regional market growth.

The presence of leading players, continuous research and development activities, and advanced manufacturing capabilities further reinforce North America's leading position in the global market.

Asia Pacific silicone gel industry is expected to register the fastest growth, growing at a CAGR of 7.76% over the forecast period. This rapid expansion is bolstered by increasing industrialization, rising healthcare expenditures, and strong growth in the consumer electronics and automotive industries.

Countries such as China, India, Japan, and South Korea are witnessing a surge in demand for silicone gel in applications such as medical devices, wearable electronics, and insulation materials for high-performance electrical components.

The growing middle-class population, rising disposable incomes, and increasing awareness of silicone gel's benefits in cosmetics and personal care are contributing to domestic market growth.

Moreover, government initiatives to promote advanced materials in industries such as automotive and electronics are fostering higher adoption rates. With ongoing investments in research, innovation, and local productionmanufacturing, the Asia Pacific region is poised to become a key market for silicone gel in the coming years.

- In December 2024, KCC Silicone and Wuxi Kolmar signed a technical agreement to advance cosmetic raw material R&D in China. The partnership aims to leverage both companies' expertise for joint projects and raw material innovation, strengthening global competitiveness through technological advancements and sustainability initiatives.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA regulates silicone gel-based medical devices, cosmetics, and pharmaceuticals through premarket approval (PMA) or 510(k) clearance.

- In Europe, the European Medicines Agency (EMA) and the European Chemicals Agency (ECHA) oversee silicone gel products under the Medical Device Regulation (MDR) and Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework.

- In China, the National Medical Products Administration (NMPA) regulates silicone gel applications for medical and cosmetic use.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) enforces the Pharmaceutical and Medical Device Act (PMD Act) for silicone-based medical devices. Strict approval processes apply to healthcare applications, while silicone gels used in cosmetics and industrial sectors must meet quality control and safety regulations.

- In India, the Central Drugs Standard Control Organization (CDSCO) governs medical-grade silicone products under the Drugs and Cosmetics Act and the Medical Device Rules (MDR). The Bureau of Indian Standards (BIS) ensures industrial-grade silicone gels meet safety and performance requirements before market entry.

Competitive Landscape

The global silicone gel market is characterized by a large number of participants, including both established corporations and emerging players. Key participants are actively investing in research and development to improve product performance, explore new applications, and create innovative formulations that align with evolving industry needs.

Competition in the market is influenced by factors such as product quality, technological innovation, pricing strategies, and distribution channels. One of the key strategies adopted by companies in this market is product innovation, with a strong focus on developing high-performance silicone gels for applications in healthcare, electronics, and automotive industries.

Companies are investing in advanced manufacturing processes to improve the durability, biocompatibility, and thermal stability of silicone gel-based products. Additionally, the increasing demand for customized solutions tailored to specific end-use industries has prompted market players to offer a diverse range of formulations.

Companies are actively forming strategic partnerships and collaborations to strengthen their global presence by partnering with raw material suppliers, research institutions, and end-use manufacturers.

- In April 2024, Nuance Medical acquired BIOCORNEUM, a leading brand in advanced scar treatment. This acquisition enhances Nuance Medical’s commitment to innovative skincare, expanding its portfolio of high-quality scar management offerings and ensuring continued advancements in silicone-based scar treatment solutions.

List of Key Companies in Silicone Gel Market:

- The Dow Chemical Company

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- Elkem ASA

- CHT Germany GmbH

- Novagard Solutions, Inc.

- KCC SILICONE CORPORATION

- Avantor, Inc.

- Siltech Corporation

- Mitsubishi Chemical Group Corporation

- RAG-Stiftung

- Henkel AG & Co. KGaA

- Taica Corporation

- Mativ Holdings, Inc.

- TECHSiL Ltd

Recent Developments (Product Launch)

- In January 2025, KCC Silicone launched SeraSense AG 21, a silicone fluid enhancing makeup longevity and gloss. With hydrophilic and hydrophobic properties, it improves pigment dispersion, moisture retention, and color durability.

- In September 2024, GC Aesthetics launched YOUTHLY, a premium breast implant brand in China, featuring the Round Collection, PERLE, and Luna XT— three advanced silicone breast implants designed for both augmentation and reconstruction.

- In March 2024, Semicosil introduced the perfecdos PDosX1, a high-precision non-contact dispensing system designed for soft to extra-soft silicone gels. Operating at frequencies of up to 300 Hz, the system ensures stable and precise application, addressing challenges such as residue buildup and dispensing inconsistencies.