Market Definition

The market encompasses semiconductor materials and technologies that utilize layered silicon on insulator structures to enhance performance, energy efficiency, and scalability in electronic components. SOI wafers have a thin silicon layer separated from the main substrate by silicon dioxide, which reduces unwanted capacitance and power loss.

Chip manufacturers, foundries, and OEMs utilize SOI-based solutions to develop high-performance, low-power integrated circuits, particularly in demanding applications such as 5G, IoT (Internet of Things), autonomous vehicles, and AI accelerators.

These technologies find applications across various sectors, including consumer electronics, automotive systems, data centers, RF communications, and industrial automation.

Silicon on Insulator Market Overview

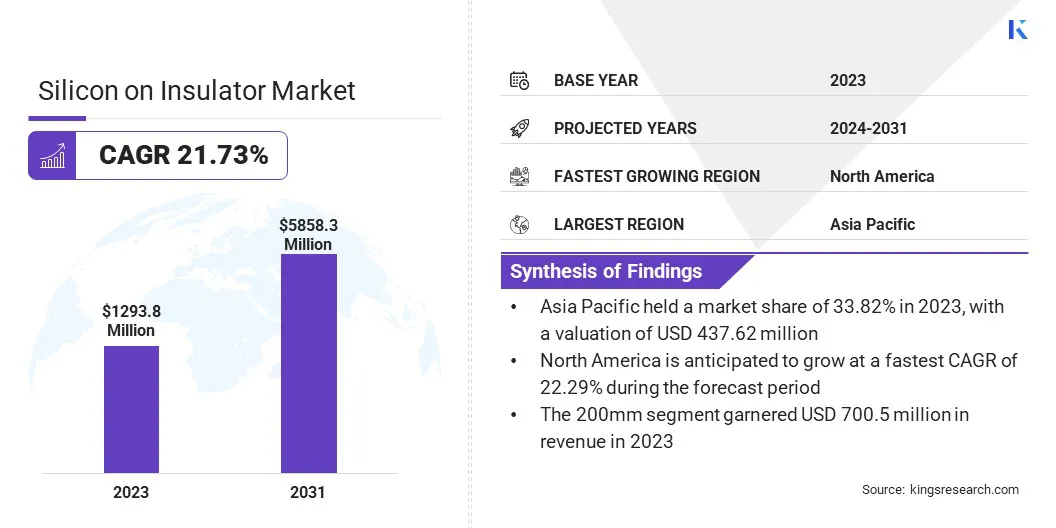

The global silicon on insulator market size was valued at USD 1293.8 million in 2023 and is projected to grow from USD 1479.1 million in 2024 to USD 5858.3 million by 2031, exhibiting a CAGR of 21.73% during the forecast period.

The Silicon-on-Insulator (SOI) market is growth driven by the surge in demand for high-performance, energy-efficient consumer electronics such as smartphones, tablets, and wearables is accelerating SOI adoption due to its low power consumption and high-speed performance.

with the global expansion of 5G networks and IoT ecosystems is increasing the need for SOI-based chips that enable reliable, high-frequency communication. Additionally, In the automotive sector, the transition to electric vehicles and autonomous driving is fueling demand for SOI semiconductors that offer durability and efficiency for ADAS and power systems.

Major companies operating in the silicon on insulator industry are Atomera, GlobalWafers, Honeywell International Inc., NXP Semiconductors, Okmetic, Qorvo, Shanghai Simgui Technology, Shin-Etsu Chemical, Silicon Valley Microelectronics, Skyworks Solutions, Soitec, STMicroelectronics, Sumco, Taiwan Semiconductor Manufacturing, and Tower Semiconductor.

The growing emphasis on on-chip photonics and integrated optical technologies is driving demand for affordable, high-quality SOI materials. Recent developments that allow researchers and smaller institutions to access SOI substrates in low volumes are removing entry barriers and fostering innovation in photonics.

- In April 2024, UniversityWafer launched its new 220 nm device layer Silicon-on-Insulator (SOI) substrates, revolutionizing on-chip photonics research. These substrates enable researchers to purchase as few as one wafer or diced pieces, making high-quality SOI materials more accessible for photonics applications, especially for those with limited budgets.

Key Highlights:

- The silicon on insulator market size was recorded at USD 1293.8 million in 2023.

- The market is projected to grow at a CAGR of 21.73% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 437.6 million.

- The RF SOI segment garnered USD 353.2 million in revenue in 2023.

- The 200mm segment is expected to reach USD 3165.3 million by 2031.

- The bonding SOI segment is set to grow at a robust CAGR of 21.86% through the forecast period.

- The RF FEM products segment is expected to secure the largest revenue share of 29.94% by 2031.

- The consumer electronics segment is expected to reach USD 1461.2 million by 2031.

- North America is anticipated to grow at a CAGR of 22.29% during the forecast period.

Market Driver

Expansion of 5G and IoT Networks

The rapid global deployment of 5G infrastructure and the exponential rise in IoT device adoption are driving demand for advanced semiconductor technologies. These devices require chips that deliver higher data speeds,ultra-low latency and efficient power consumption and superior thermal performance to support continuous connectivity.

RF-SOI (Radio Frequency Silicon-on-Insulator) has emerged as a key enabler in this space, offering advantages such as reduced parasitic capacitance, improved signal isolation, and enhanced integration of RF components. These features make RF-SOI ideal for high-frequency applications like 5G base stations, smartphones, and smart IoT sensors, fueling growth in the SOI market.

- In July 2024, Soitec extended its partnership with UMC to introduce the first 3D IC solution for RF-SOI technology, developed for 5G applications. This enables the vertical stacking of chips, reducing chip size by over 45%, while enhancing the integration of RF components to meet 5G bandwidth needs, all while maintaining optimal RF performance.

Market Challenge

High Production Costs

The manufacturing of SOI wafers requires advanced techniques such as wafer bonding, ion implantation, and precision etching, making the process significantly more complex than that of conventional silicon wafers. These additional steps lead to higher capital investment and operating expenses.

As a result, the overall cost per unit for SOI-based components remains elevated, which can deter adoption, especially among manufacturers operating on tight margins. This is particularly challenging in consumer electronics and other high-volume, cost-sensitive markets. Reducing production costs remains a key hurdle to broader SOI market penetration.

To address this challenge, companies can invest in process optimization and automation technologies to improve manufacturing efficiency and reduce waste. Collaborations with foundries and equipment suppliers can also help scale production and lower per-unit costs.

Increasing R&D efforts to develop alternative, cost-effective SOI fabrication methods is another viable strategy. Additionally, forming strategic partnerships or joint ventures can share financial burdens and accelerate technology transfer.

Market Trend

Advancements in RF Front-End Design with SSROI Technology

The silicon on insulator market is witnessing a shift toward substrate-level innovation to meet the demands of 5G and emerging 6G technologies. Enhancements in RF-SOI substrates are enabling better power handling, reduced signal loss, and improved frequency performance in RF front-end modules.

Advanced materials and doping control techniques, such as oxygen insertion and epitaxial layering, are adopted to reduce resistance and impurity scattering. These innovations enable device makers to advance CMOS scaling while achieving greater efficiency and signal integrity.

- In February 2025, Atomera Incorporated, Soitec, and San Jose State University collaborated to present a joint paper on a novel RF-SOI substrate for enhanced RF device performance. The proposed SSROI (Super-Steep Retrograde Oxygen Insertion) substrate addresses boron diffusion issues in traditional RF-SOI by incorporating an oxygen-inserted silicon layer and an undoped epitaxial silicon layer.

Silicon on Insulator Market Report Snapshot

|

Segmentation

|

Details

|

|

By Wafer Type

|

RF SOI, Fully Depleted (FD SOI), Partially Depleted (PD SOI), Power SOI, Others

|

|

By Wafer Size

|

200mm, 300mm

|

|

By Technology

|

Smart cut, Bonding SOI, Layer transfer SOI

|

|

By Product

|

RF FEM Products, MEMS devices, Power products, Optical communication, Image sensing, Others

|

|

By End Use Industry

|

Consumer electronics, Automotive, IT & Telecommunications, Industrial, Aerospace & Defence, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Wafer Type (RF SOI, Fully Depleted (FD SOI), Partially Depleted (PD SOI), Power SOI, Others): The RF SOI segment earned USD 353.2 million in 2023 due to rising demand for high-performance RF front-end modules in 5G smartphones and IoT devices.

- By Wafer Size (200mm, 300mm): The 200mm segment held 54.14% of the market in 2023, due to its cost-effectiveness and widespread use in established RF and power device manufacturing.

- By Technology (Smart cut, Bonding SOI, Layer transfer SOI): The smart cut segment is projected to reach USD 2444.3 million by 2031, owing to its high precision, scalability, and lower material wastage in SOI wafer production.

- By Product (RF FEM Products, MEMS devices, Power products, Optical communication, Image sensing, others): The RF FEM products segment held 29.90% of the market in 2023, due to the increasing integration of RF components in smartphones and wireless communication devices.

- By End Use Industry (Consumer electronics, Automotive, IT & Telecommunications, Industrial, Aerospace & Defence, Others): The consumer electronics segment earned USD 321.9 million in 2023 due to the growing use of SOI technology in mobile devices, wearable, and high-performance consumer gadgets.

Silicon on Insulator Market Regional Analysis

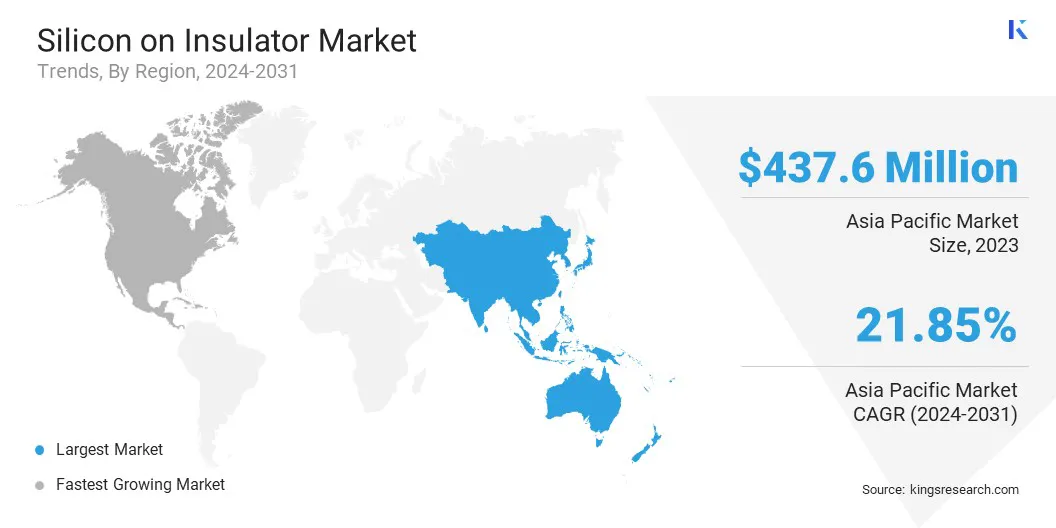

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific silicon on insulator market held a market share of around 33.82% in 2023, with a valuation of USD 437.6 million. Asia Pacific dominates the global market due to the region’s rapidly expanding semiconductor industry, particularly in countries such as Taiwan, Japan, and South Korea, which are key players in semiconductor manufacturing and innovation.

The increasing demand for advanced technologies, such as 5G, IoT, and automotive applications, is also fueling the growth of SOI substrates in the region. Additionally, the presence of major semiconductor foundries and technology companies, coupled with robust investments in research and development, is further driving the market growth in Asia Pacific.

Additionally, the Indian Government has entered into Memoranda of Understanding (MoUs) with the U.S., European Union, Japan, and Singapore to strengthen international collaboration, support skill development, and advance research in the semiconductor sector. the government is focused on building a semiconductor design and manufacturing ecosystem within the country, with a strong emphasis on fostering research and development.

- In January 2025, the Indian Government approved the Semicon India Programme, with a total outlay of USD 9.2 billion, to develop the semiconductor and display manufacturing ecosystem in the country.

The silicon on insulator industry in North America is poised for significant growth at a robust CAGR 22.29% This growth is primarily driven by the region’s strong emphasis on semiconductor innovation and the increasing demand for SOI wafers in high-performance applications such as automotive, telecommunications, and consumer electronics.

Government initiatives are boosting regional semiconductor capabilities by establishing local production of advanced silicon wafers, They enhance supply chain resilience and reduce dependence on external sources. This also supports innovation and technological advancement in the semiconductor industry. .

- In July 2024, the U.S. Department of Commerce unveiled plans to award up to USD 400 million in grants to Taiwan's GlobalWafers. The funding will support projects in Texas and Missouri, marking the establishment of the first U.S. production of 300-mm silicon wafers for advanced semiconductors. It will also expand domestic manufacturing of silicon-on-insulator wafers, strengthening the nation's semiconductor supply chain.

Regulatory Framework

- In the U.S., the Department of Commerce (DOC) regulates the semiconductor industry by implementing policies to boost domestic manufacturing. It also oversees funding initiatives to support chip production and reduce dependency on foreign suppliers. The DOC plays a key role in managing export controls related to semiconductor technology.

- In the UK, the Department for Business and Trade (DBT) manages semiconductor policy and industrial strategy. It focuses on attracting investment and supporting supply chain resilience.

Competitive Landscape

Market players are expanding their manufacturing capabilities to meet the increasing demand for SOI wafers across various sectors, including telecommunications, automotive, and industrial applications. The race to improve RF performance and power efficiency, coupled with expanding production capacity, highlights the competitive nature of the SOI market.

The emphasis on next-generation mobile communications, automotive innovation, and the integration of cutting-edge technologies is driving continued collaboration and innovation across the industry.

- In December 2024, Soitec and GlobalFoundries announced their collaboration to produce advanced 300mm RF-SOI substrates for GF's leading RF-SOI technology platform, including the 9SW platform. The partnership will support 5G, 5G-Advanced, Wi-Fi, and other smart mobile device Radio Frequency Front-End modules. Soitec’s RF-SOI substrates will enhance RF performance, power efficiency, and scalability, with availability for premium smartphones and next-generation devices starting in 2025.

List of Key Companies in Silicon on Insulator Market:

- Atomera

- GlobalWafers

- Honeywell International Inc.

- NXP Semiconductors

- Okmetic

- Qorvo

- Shanghai Simgui Technology

- Shin-Etsu Chemical

- Silicon Valley Microelectronics

- Skyworks Solutions

- Soitec

- STMicroelectronics

- Sumco

- Taiwan Semiconductor Manufacturing

- Tower Semiconductor

Recent Developments (M&A/New Product Launch)

- In July 2024, L&T Semiconductor Technologies acquired the 100% stake in fabless semiconductor design startup SiliConch Systems for USD 21 million. Through this acquisition, L&T aims to enhance its presence in the fabless semiconductor space by integrating SiliConch’s SoC IP portfolio.

- In March 2023 Okmetic, a leading supplier of advanced silicon wafers for MEMS, sensor, RF, and power devices launched ts Terrace Free SOI capability for its 200 mm Bonded Silicon-On-Insulator (BSOI) and E-SOI wafers. The new technology is designed to optimize wafer usage and enhance performance for device manufacturers.

and a 61-member engineering team