Market Definition

Silica sand, also known as industrial sand, is a high-purity form of quartz (SiO₂) composed mostly of silicon and oxygen. It is typically white or colorless and features a consistent grain size. It is categorized by grade: glass grade for solar panels and containers, foundry grade for metal casting, and chemical grade for industrial processes.

The report offers a thorough assessment of the main factors driving the market, along with detailed regional analysis and the competitive landscape influencing the market dynamics.

Silica Sand Market Overview

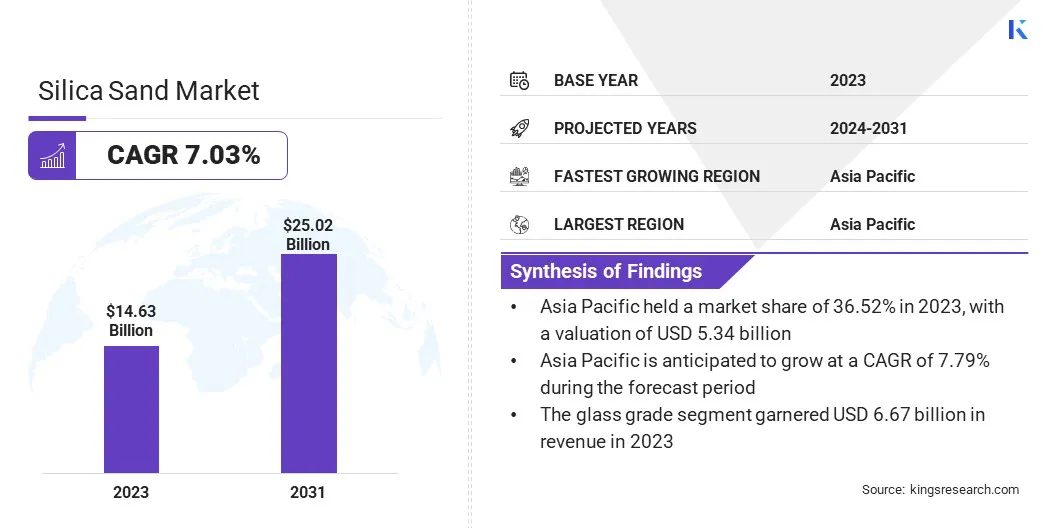

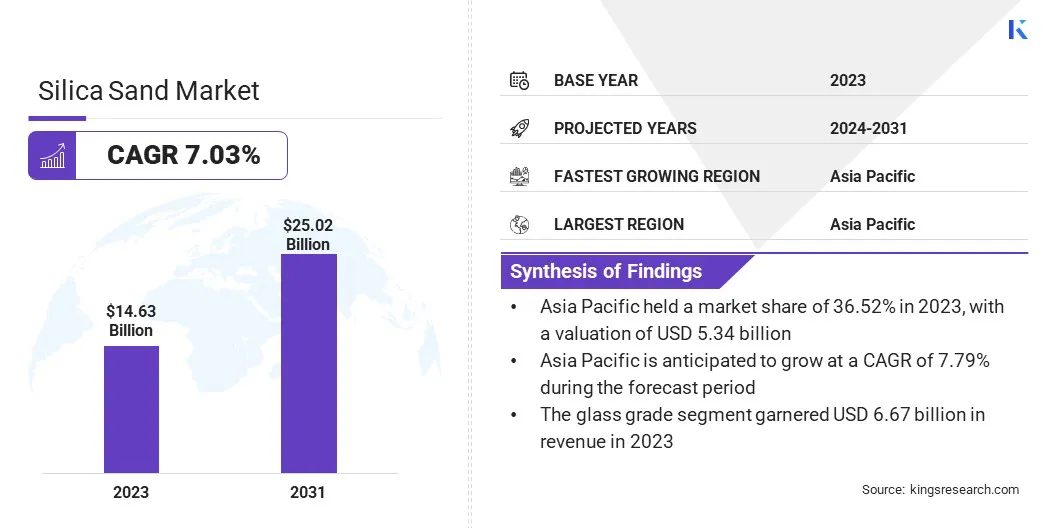

The global silica sand market size was valued at USD 14.63 billion in 2023, which is estimated to be USD 15.55 billion in 2024 and reach USD 25.02 billion by 2031, growing at a CAGR of 7.03% from 2024 to 2031.

The increasing adoption of solar energy globally is driving the demand for ultra-clear, low-iron silica sand, essential for high-quality solar panel glass production, positioning it as a key driver of the market.

Major companies operating in the silica sand industry are Covia Holdings LLC., APEX Geoscience Ltd, Mitsubishi Corporation., Sil Industrial Minerals, Sibelco, JFE Mineral & Alloy Company,Ltd, Quarzwerke GmbH, Badger Mining Corporation, Preferred Sands, Inc., Holcim, McLaren Minerals Limited, SRINATH ENTERPRISES, Zillion Sawa Minerals Pvt. Ltd., Indus Minechem, and Uma Minerals.

The market is registering significant growth driven by the rising demand for high-purity silica (>99.6% SiO₂), essential in manufacturing solar glass, semiconductors, and energy storage technologies. The need for ultra-clear glass and advanced electronic components increases as the adoption of clean energy accelerates globally.

The market is poised for expansion, supported by innovations in extraction and processing, as well as increasing investments in green infrastructure. The role of high-grade silica sand in enabling low-carbon technologies positions it as a critical industrial material for the future.

- In February 2025, Homerun Resources Inc. announced a preliminary Mineral Resource Estimate for its Belmonte Silica Sand District project in Bahia, Brazil, revealing 25.56 Mt measured and 38.35 Mt inferred of >99.6% SiO₂ high-purity silica, following extensive auger drilling and sample analysis.

Key Highlights:

- The silica sand industry size was valued at USD 14.63 billion in 2023.

- The market is projected to grow at a CAGR of 7.03% from 2024 to 2031.

- Asia Pacific held a market share of 36.52% in 2023, with a valuation of USD 5.34 billion.

- The glass grade segment garnered USD 6.67 billion in revenue in 2023.

- The construction segment is expected to reach USD 8.18 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 6.75% during the forecast period.

Market Driver

Rising Demand for Solar Glass

The increasing adoption of solar energy is driving the demand for ultra-clear, low-iron silica sand, a vital raw material for producing high-quality solar panel glass. This surge in demand is spurred by the rapid expansion of solar power installations and the increasing need for more efficient and durable solar panels.

Renewable energy initiatives are slowly gaining traction. The market is registering heightened interest, particularly from solar glass manufacturers seeking high-purity sand to enhance the production of advanced glass used in solar panels.

- In January 2023, Canadian Premium Sand Inc. announced successful bulk sand testing results, confirming the viability of producing solar glass-grade silica sand using low-cost, environmentally friendly processes, marking a key milestone for its Selkirk facility.

Market Challenge

Environmental Concerns

Environmental concerns pose a significant challenge to the silica sand market, as mining operations can result in habitat destruction, water pollution, and excessive land use. These environmental impacts often lead to stricter regulations, community opposition, and delays in project approvals.

Companies can adopt sustainable mining practices, such as implementing water recycling systems, using less invasive extraction methods, and restoring mined lands. Additionally, investing in environmentally friendly technologies and complying with regulatory standards can help minimize environmental damage and ensure long-term market viability.

Market Trend

Sustainability Focus

A key trend in the market is the increasing focus on sustainability and rehabilitation. Mining companies are adopting environmentally friendly practices, prioritizing rehabilitation-focused mining methods to minimize ecological disruption.

These practices not only help mitigate environmental impacts but also ensure compliance with stringent regulatory requirements, facilitating the approval process for projects. Amid growing environmental concerns, this trend is becoming crucial for securing long-term operational licenses, maintaining community support, and meeting the demands of environmentally conscious investors and consumers.

- In January 2024, VRX Silica focused on addressing the growing global demand for silica sand, crucial for glass, concrete, and electronics production. With urbanization and population growth, the company’s strategic Western Australian projects aim to meet rising global demand.

Silica Sand Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Glass Grade, Foundry Grade, Chemical Grade

|

|

By End-use Industry

|

Glass Manufacturing, Construction, Chemicals, Paints and Coatings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Grade (Glass Grade, Foundry Grade, Chemical Grade): The glass grade segment earned USD 6.67 billion in 2023, due to the rising demand for high-quality silica sand in flat, container, and solar glass manufacturing globally.

- By End-use Industry (Glass Manufacturing, Construction, Chemicals, Paints and Coatings, Others): The glass manufacturing segment held 30.78% share of the market in 2023, due to the expanding automotive & construction industries and increasing demand for architectural & automotive glass products.

Silica Sand Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for a market share of around 36.52% in 2023, with a valuation of USD 5.34 billion. Asia Pacific dominates the global silica sand market, due to its rapid industrialization, growing construction activities, and strong demand from manufacturing sectors like glass, ceramics, and electronics.

The region benefits from a high concentration of silica sand reserves, coupled with its well-established supply chains and cost-effective production. According to Queensland Government, Australia possesses extensive silica sand resources, including some of the world’s highest quality deposits, predominantly located in Queensland and Western Australia.

The nation contributes roughly 1% to global production; however, it stands out as a major exporter, due to its high-purity sand and robust export infrastructure. Additionally, rising urbanization, infrastructure development, and the expansion of the renewable energy sector, particularly in solar power, contribute to Asia Pacific’s position as a leader in both consumption and production of silica sand.

The market in North America is poised for significant growth at a robust CAGR of 6.75% over the forecast period. North America is becoming a rapidly growing hub for the silica sand industry, driven by the increasing demand from various industries such as construction, glass manufacturing, and renewable energy.

The region benefits from abundant high-quality silica sand reserves, making it a key player in the global supply chain. Several industries are focusing on sustainability and technological advancements, particularly in the solar and clean energy sectors. North America's strategic location and access to resources position it as a critical market for silica sand, its production, and innovations.

- In February 2024, Canadian Premium Sand Inc. received formal support from the Manitoba government for its integrated solar glass manufacturing facility in Selkirk. The project will utilize low-iron silica sand from Hollow Water First Nation and Manitoba’s hydroelectric power to produce low-carbon solar glass for North America.

Regulatory Frameworks

- In India, silica sand mining is governed by the Mines Act, 1952, ensuring worker safety, health standards, and regulated operations, alongside mandatory environmental clearances under relevant national and state laws.

- In the European Union (EU), Directive 2006/21/EC sets out guidelines to reduce environmental and health risks linked to waste generated by extractive industries, focusing on responsible handling of mining, quarrying, and mineral processing waste.

- In the U.S., the Mine Safety and Health Administration (MSHA) enforces the Federal Mine Safety and Health Act of 1977, updated by the Mine Improvement and New Emergency Response (MINER) Act of 2006. This legislation empowers the Secretary of Labor to create and update health and safety regulations aimed at protecting workers and reducing accidents across mining operations nationwide.

Competitive Landscape:

Companies in the silica sand market are actively expanding their operations to meet rising global demand, particularly from the glass, solar, and construction industries. They are investing in acquiring high-purity silica sources, enhancing processing capabilities, and improving logistics networks.

Many are also focusing on sustainability, ensuring low environmental impact and regulatory compliance. These strategic efforts aim to secure long-term supply chains and cater to emerging applications in renewable energy and advanced manufacturing.

- In May 2024, Covia expanded its silica sand portfolio by acquiring R.W. Sidley’s Industrial Minerals Division. The move strengthens Covia’s position in high-purity silica products for filtration, sports turf, and construction, enhancing its market reach across the growing industrial and specialty sand segments in North America.

List of Key Companies in Silica Sand Market:

- Covia Holdings LLC.

- APEX Geoscience Ltd

- Mitsubishi Corporation.

- Sil Industrial Minerals

- Sibelco

- JFE Mineral & Alloy Company,Ltd

- Quarzwerke GmbH

- Badger Mining Corporation

- Preferred Sands, Inc.

- Holcim

- McLaren Minerals Limited

- SRINATH ENTERPRISES

- Zillion Sawa Minerals Pvt. Ltd.

- Indus Minechem

- Uma Minerals

Recent Developments (Exploration)

- In October 2023, Allup Silica discovered a high-purity silica sand mass at its Cabbage Spot project in Western Australia, boosting potential supply for the markets in Asia Pacific. With 99.4% silica content, low impurities, and proximity to Wyndham Port, the site is strategically positioned to meet the rising demand from glass and solar industries.