Market Definition

Semiconductor chemicals are high-purity materials used in the fabrication and processing of semiconductor devices. These include wet chemicals, etchants, photoresists, CMP (chemical mechanical planarization) slurries, dopants, and deposition precursors that enable critical steps such as wafer cleaning, photolithography, etching, doping, and thin-film deposition.

Manufactured to ultra-high purity standards (often 99.9999% or higher), these chemicals prevent defects and ensure consistent performance of integrated circuits and microchips. Their role is fundamental in supporting advancements in logic devices, memory chips, power electronics, and emerging technologies such as 5G, AI accelerators, and electric vehicle semiconductors.

Semiconductor Chemical Market Overview

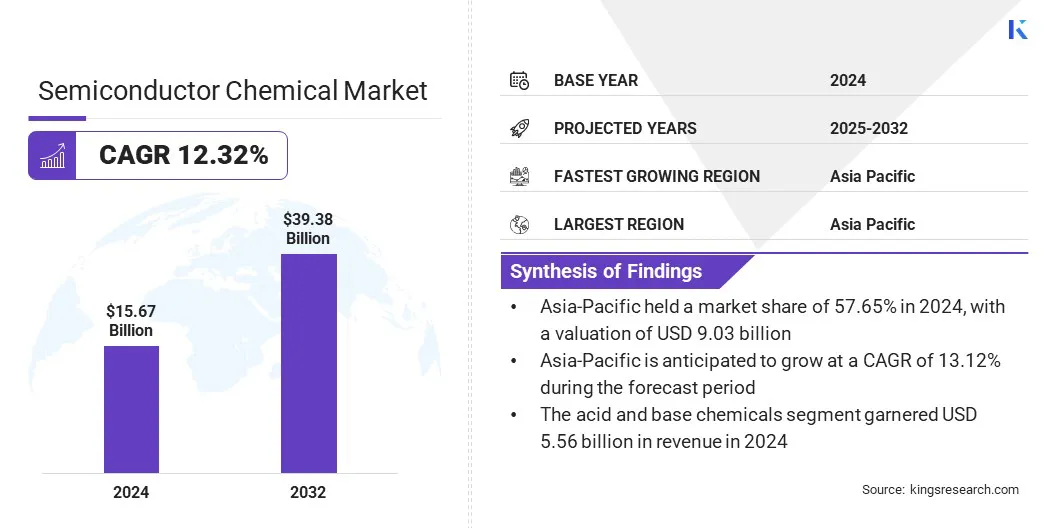

The global semiconductor chemical market size was valued at USD 15.67 billion in 2024 and is projected to grow from USD 17.46 billion in 2025 to USD 39.38 billion by 2032, exhibiting a CAGR of 12.32% during the forecast period.

This growth is driven by its critical role in advanced chip manufacturing, supported by rising demand for high-performance computing, 5G connectivity, electric vehicles, and consumer electronics. Increasing complexity of semiconductor designs and the shift to smaller technology nodes are boosting the need for ultra-high-purity chemicals in processes such as photolithography, etching, cleaning, and deposition.

Key Highlights:

- The semiconductor chemical industry size was recorded at USD 15.67 billion in 2024.

- The market is projected to grow at a CAGR of 12.32% from 2025 to 2032.

- Asia-Pacific held a share of 57.65% in 2024, valued at USD 9.03 billion.

- The acid & base chemicals segment garnered USD 5.56 billion in revenue in 2024.

- The integrated circuits segment is expected to reach USD 20.62 billion by 2032.

- North America is anticipated to grow at a CAGR of 11.76% over the forecast period.

Major companies operating in the semiconductor chemical market are TOKYO OHKA KOGYO CO., LTD., JSR Corporation., Sumitomo Chemical Co., Ltd., FUJIFILM Holdings America Corporation, DuPont., SK chemicals., Honeywell International Inc., BASF, Eastman Chemical Company, Resonac Holdings Corporation., Arkema, Mitsubishi Chemical Group Corporation, Saint-Gobain, Solvay, and Parker Hannifin Corp.

Rising purity requirements, rapid scaling of semiconductor fabrication, and the need for localized supply chains are key factors driving the semiconductor chemicals market. To address these demands, manufacturers are increasingly forming strategic alliances with chemical suppliers and technology partners.

Such collaborations enable the co-development of advanced formulations tailored to next-generation devices, while also supporting regional production to mitigate supply chain risks. Joint ventures are further fostering technology transfer, expanding R&D capabilities, and accelerating innovation in photoresists, etchants, and CMP slurries.

Global players are leveraging these partnerships to secure market share, strengthen regional presence, and align closely with the evolving requirements of semiconductor fabrication facilities.

- In March 2023, FLOSFIA Inc. partnered with JSR Corporation to develop an iridium-based film deposition material for the mass production of iridium gallium oxide (α-(IrGa)₂O₃). This breakthrough led to the world’s first P-type power semiconductor with corundum-type gallium oxide (α-Ga₂O₃). The innovation supports large-scale industrial applications by achieving stable P-type characteristics, marking a significant advancement in next-generation semiconductor materials.

Market Driver

Rising Demand for Advanced Consumer Electronics

The semiconductor chemical market is witnessing strong growth, primarily driven by rising demand for advanced consumer electronics such as smartphones, tablets, and wearable devices. Device manufacturers are pushing for smaller, faster, and more energy-efficient chips, which has increased the need for high-purity chemicals used in photolithography, cleaning, and etching processes.

Furthermore, the ongoing drive toward device miniaturization is intensifying the requirement for high-purity chemicals used in photolithography, cleaning, and etching. These precise formulations are essential to achieve defect-free wafer production and ensure reliability in smaller, faster, and more energy-efficient chips, which remain central to next-generation computing and connected technologies, therby driving the market demand.

- According to the Semiconductor Industry Association, the Advanced Manufacturing Investment Credit (Section 48D) and related manufacturing grant incentives have driven substantial investments in the U.S. semiconductor sector, with over 130 projects across 28 states totaling more than USD 600 billion in private investments since 2020.

Market Challenge

High Cost of Developing Advanced Chemical Formulations

A key challenge impeding the progress of the semiconductor chemical market is the high cost of developing advanced chemical formulations. Specialized chemistries such as EUV photoresists, advanced etchants, and high-purity cleaning agents require extensive R&D, state-of-the-art facilities, and strict quality controls, increasing production costs. This limits market entry for smaller suppliers and increases reliance on a few large manufacturers, creating potential supply chain bottlenecks.

To address this challenge, companies are investing in collaborative R&D initiatives, scaling production to reduce per-unit costs, and diversifying product portfolios to balance premium and cost-effective solutions. Partnerships with semiconductor fabs are fostering joint innovation, accelerating the commercialization of advanced materials, and mitigating financial risks.

Market Trend

Growing Demand for Advanced Lithography Chemicals

A major trend influencing the semiconductor chemical market is the transition to smaller process nodes in chip manufacturing, boosting demand for advanced lithography chemicals, including photoresists and ancillaries optimized for extreme ultraviolet (EUV) lithography. Manufacturers are scaling production to meet requirements for enhanced resolution, reduced line-edge roughness, and compatibility with high-volume EUV tools.

This trend reflects the industry's efforts to sustain Moore’s Law by enabling higher transistor density and improved device performance. Continuous R&D investment in next-generation lithography chemicals has strengthened their position in advanced semiconductor fabrication, particularly for applications in AI, high-performance computing, and 5G technologies.

- In January 2025, Lam Research Corporation announced that imec qualified its dry photoresist (dry resist) technology. This technology enhances resolution, throughput, and yield in extreme ultraviolet (EUV) lithography, highlighting the critical role of advanced semiconductor chemical solutions in next-generation chip production.

Semiconductor Chemical Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

High-Performance Polymers, Acid & Base Chemicals, Adhesives, Solvents, Others

|

|

By End Use

|

Integrated Circuits, Discrete Semiconductors, Sensors, Optoelectronics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (High-Performance Polymers, Acid & Base Chemicals, Adhesives, Solvents, and Others): The acid & base chemicals segment earned USD 5.56 billion in 2024, mainly due to the increasing demand for high-purity chemicals in advanced node manufacturing, coupled with their widespread application across both logic and memory semiconductor production.

- By End Use (Integrated Circuits, Discrete Semiconductors, Sensors, and Optoelectronics): The integrated circuits segment held a share of 53.32% in 2024, supported by growing demand in consumer electronics, automotive electronics, and data centers.

Semiconductor Chemical Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific semiconductor chemical market share stood around 57.65% in 2024 in the global market, with a valuation of USD 24.19 billion . This dominance is attributed to the region’s concentration of semiconductor manufacturing hubs, including leading foundries and integrated device manufacturers. Furthermore, strong demand for consumer electronics, rapid 5G infrastructure growth, and increasing adoption of AI and automotive chips are further fueling chemical demand.

Supportive national policies, such as China’s “Made in China 2025” and South Korea’s K-Semiconductor Strategy, are supporting regional self-sufficiency through capacity expansions. These initiatives are expected to solidify Asia-Pacific’s leadership position and sustain long-term demand for specialized, high-purity chemicals critical to advanced semiconductor nodes.

- In January 2023, Merck acquired Mecaro Chemicals Inc., a South Korean semiconductor chemical manufacturer. The deal strengthened Merck’s Semiconductor Solutions portfolio by adding advanced production capabilities, modern R&D facilities, and nearly 100 skilled employees in Korea. This acquisition reinforced Merck’s regional presence and expanded its capacity to meet the growing demand for high-performance semiconductor materials.

The North America semiconductor chemical industry is estimated to grow at a robust CAGR of 11.76% over the forecast period. This growth is supported by policy support and private investments. The U.S. CHIPS and Science Act, along with the Advanced Manufacturing Investment Credit, has stimulated domestic semiconductor production, prompting multinational companies to expand fabrication facilities.

Strategic collaborations between chemical suppliers and semiconductor manufacturers are enhancing the supply chain and ensuring access to high-purity chemicals critical for advanced node production. Rising demand from defense electronics, data centers, and automotive semiconductors further positions North America as a key hub for semiconductor chemicals.

Regulatory Frameworks

- In the U.S., the semiconductor chemicals market is regulated primarily by the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA). Manufacturers must comply with chemical safety standards, waste management rules, and emissions control policies. Additionally, the Occupational Safety and Health Administration (OSHA) sets workplace safety requirements for handling hazardous chemicals.

- The European Chemicals Agency (ECHA) enforces REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations, which impose strict testing, registration, and reporting obligations on chemical suppliers. Environmental compliance under directives such as RoHS (Restriction of Hazardous Substances) further impacts semiconductor chemical formulations.

- In Asia-Pacific, China’s Ministry of Ecology and Environment regulates chemical use through the MEE Order No. 12, requiring registration and risk assessments. South Korea enforces K-REACH in line with EU standards, while Taiwan has implemented Chemical Substance Registration (CSR) systems to ensure transparency and sustainability in semiconductor manufacturing.

- In Japan, the Chemical Substances Control Law (CSCL) governs the use and import of chemicals, mandating environmental impact assessments and safety compliance. The Industrial Safety and Health Law (ISHL) also regulates handling and workplace safety in semiconductor fabs using advanced chemicals.

- Internationally, the OECD provides guidelines for chemical safety testing and environmental protection. Growing emphasis on green chemistry and sustainability is fueling regulatory harmonization across regions.

Competitive Landscape

Major players in the semiconductor chemicals market are focusing on product development, process innovation, and strategic partnerships to strengthen supply resilience and meet evolving industry demands. High-purity chemicals for next-generation nodes support greater precision, higher yields, and enhanced device performance.

Firms are also investing in regional production facilities and joint ventures to secure supply chains and reduce single-source dependency. These efforts align with industry priorities such as sustainability, miniaturization, and cost optimization, and compliance with environmental regulations.

Key Companies in Semiconductor Chemical Market:

- TOKYO OHKA KOGYO CO., LTD.

- JSR Corporation.

- Sumitomo Chemical Co., Ltd.

- FUJIFILM Holdings America Corporation

- DuPont

- SK chemicals.

- Honeywell International Inc.

- BASF

- Eastman Chemical Company

- Resonac Holdings Corporation.

- Arkema

- Mitsubishi Chemical Group Corporation.

- Saint-Gobain

- Solvay

- Parker Hannifin Corp

Recent Developments

- In October 2023, FUJIFILM Corporation acquired the electronic chemicals business of Entegris, Inc. (formerly CMC Materials KMG Corporation) for USD 700 million. The unit rebranded as FUJIFILM Electronic Materials Process Chemicals, strengthens the company's semiconductor materials portfolio.