Semiconductor Memory Market Snapshot

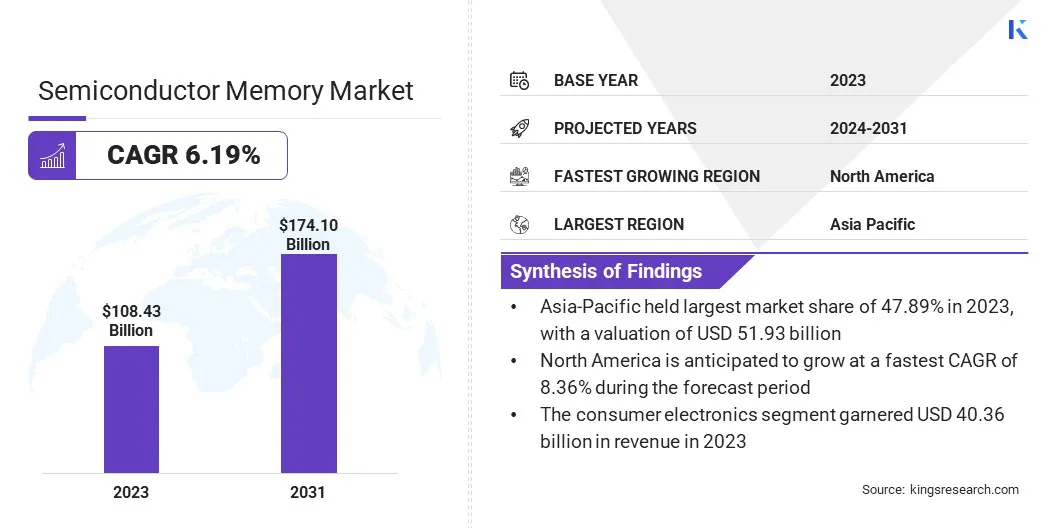

The global semiconductor memory market size was valued at USD 108.43 billion in 2023, which is estimated to be valued at USD 114.34 billion in 2024 and is projected to reach USD 174.10 billion by 2031, growing at a CAGR of 6.19% from 2024 to 2031.

The market is experiencing steady growth due to the rising demand for consumer electronics and the surging adoption of electric vehicles. Advancements in cloud computing and data centers are further fostering this growth.

Key Market Highlights:

- Market Value (2023): USD 108.43 Billion.

- Forecasted Value (2031): USD 174.10 Billion.

- CAGR (2024-2031): 6.19%.

- Fastest Growing Region (2024-2031): North America market is anticipated to grow at a CAGR of 8.36% over the forecast period.

- Largest Region: Asia-Pacific market accounted for the largest revenue share of 47.89% in 2023, valued at USD 51.93 billion.

- The consumer electronics segment captured the largest share of 37.22% in 2023.

- The DRAM segment led the semiconductor memory market in 2023, reaching a valuation of USD 52.75 billion.

Key Companies in Semiconductor Memory Market

- Integrated Silicon Solution Inc.

- Micron Technology, Inc.

- Macronix International Co., Ltd.

- Samsung

- SK HYNIX INC.

- NXP Semiconductors

- Winbond Electronics Corporation

- KIOXIA Singapore Pte. Ltd.

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- Renesas Electronics Corporation.

Semiconductor Memory Market Overview

There is a surge in the incorporation of artificial intelligence and machine learning in the automotive sector. These advanced technologies are utilized in applications such as autonomous driving, where artificial intelligence (AI) algorithms process vast amounts of data from sensors to enable real-time decision-making and navigation.

Machine learning enhances predictive maintenance by analyzing vehicle data to identify potential issues before they occur, improving reliability and reducing downtime.

These applications require high-performance semiconductor memory to store and process large volumes of data efficiently, fueling the demand for cutting-edge memory solutions. Manufacturers are innovating and launching new products to meet this growing need.

- For instance, in July 2023, Samsung Electronics announced the mass production of its automotive Universal Flash Storage (UFS) 3.1 solution, designed for in-vehicle infotainment (IVI) systems. This solution, designed to deliver industry-leading energy efficiency, empowers automotive manufacturers to enhance the mobility experience for their customers.

Semiconductor memory is a digital data storage technology that utilizes semiconductor-based integrated circuits to store information. It is a crucial component in modern electronic devices, enabling efficient data processing and storage in devices such as computers, smartphones, and consumer electronics.

Semiconductor memory can be categorized into volatile and non-volatile types, offering fast data retrieval and storage. Commonly used in smartphones, tablets, laptops, and gaming consoles, Dynamic Random Access Memory (DRAM) and Flash memory support rapid data processing, seamless multitasking, and high-speed storage.

Analyst’s Review

Governments frequently enforce stringent export regulations on advanced semiconductor memory chips, mandating licenses for shipments to specific regions and restricting the sale of certain technologies to designated countries. Market players are focusing on industries such as consumer electronics, automotive and transportation, IT & telecommunication, and aerospace and defense.

To meet consumer demand, companies are forming partnerships and collaborating with governments globally to promote memory utilization. Moreover, leading players are investing in research and development to introduce innovative memory solutions.

- For instance, in February 2023, Texas Instruments Incorporated announced a USD 11 billion investment to establish a new 300-mm semiconductor wafer production facility in Utah, United States. This expansion aims to expand its manufacturing capacity to meet the growing demand for semiconductors in the electronics sector.

Semiconductor Memory Market Growth Factors

The surging demand for electronic devices is propelling the growth of the semiconductor memory market. As consumer electronics, including smartphones, tablets, and wearable devices, become more advanced, the need for high-performance, reliable, and energy-efficient memory solutions has increased.

Semiconductor memory, particularly DRAM (Dynamic Random-Access Memory) and NAND flash memory, plays a critical role in enabling faster data processing and storage capabilities in these devices.

Furthermore, the rising adoption of cloud computing, data centers, and automotive applications is boosting the demand for robust memory systems. Consumer electronics manufacturers are focusing on product innovation to provide seamless user experience to consumers.

- For instance, in May 2023, according to the Japan Electronics and Information Technology Industries Association, a trade organization based in Japan, the total production of electronic devices in the country reached USD 6,722 million.

The semiconductor memory market faces challenges due to the complex manufacturing processes required for advanced memory chips, such as DRAM and NAND flash memoryThese processes, including photolithography, etching, and precise layer stacking, involve high costs, specialized equipment, skilled labor, and controlled environments.

Consequently, production costs increase, and lead times lenghthen. To mitigate these challenges, leading industry players are implementing strategic solutions, with growing adoption of automation and artificial intelligence (AI) in areas such as quality control and manufacturing optimization. These advancements aim to reduce costs and improve overall efficiency in memory chip production.

Semiconductor Memory Industry Trends

The increasing demand for high-performance memory solutions is bolstering the growth of the semiconductor memory industry. As industries such as data centers, artificial intelligence, machine learning, gaming, and cloud computing evolve, the demand for faster, more efficient, and higher-capacity memory solutions has intensified.

Semiconductor memory, including DRAM and NAND flash, is essential in enhancing processing speeds, data storage, and rapid data access for modern applications.

This demand is further fueled by the growing use of smart devices, the Internet of Things (IoT), and autonomous systems, all of which rely on high-performance memory. Market leaders are launching products to meet these growing consumer needs.

- For instance, in October 2024, Samsung launched its latest DRAM, designed with enhanced capabilities to support AI and machine learning applications. These advancements focus on accelerating data processing speeds and improving energy efficiency, addressing the growing demands of data centers and next-generation mobile devices. Additionally, tThe new architecture boosts system scalability and strengthens security to mitigate the risk of data center failures.

The shift toward 3D NAND technologies is propelling the growth of the semiconductor memory market. This shift is primarily driven by the growing demand for increased storage capacity, faster data access speeds, and improved power efficiency.

Unlike traditional 2D NAND flash memory, which stores data in a single layer, 3D NAND =stacks memory cells vertically, facilitating a higher data density in the same physical space. This enables the production of memory chips with larger capacities without expanding their size, meeting the growing needs of applications such as cloud computing, artificial intelligence, and mobile devices.

Additionally, 3D NAND offers enhanced endurance and reliability, making it a preferred choice for both consumer electronics and enterprise-grade storage solution.

Segmentation Analysis

The global market has been segmented based on type, application, and geography.

By Type

Based on type, the market has been categorized into SRAM, MRAM, DRAM, flash ROM, and others. The DRAM segment led the semiconductor memory market in 2023, reaching a valuation of USD 52.75 billion.

DRAM is utilized in personal computers, laptops, gaming consoles, and servers, where high-speed data storage and retrieval are essential. The increasing demand for cloud computing, artificial intelligence (AI), and high-performance computing has spurred advancements in DRAM technology, including higher capacities and faster speeds.

Additionally, the rising popularity of smartphones and tablets, which require energy-efficient memory solutions, has boosted the adoption of DRAM. Market players are investing to increase the production of DRAM, adding segmental expansion.

- For instance, in April 2024, SK Hynix announced an investment of USD 3.86 billion to establish a new chip factory in South Korea, which will serve as a production base for its upcoming DRAM chips.

By Application

Based on application, the semiconductor memory industry has been segmented into consumer electronics, IT & telecommunication, automotive, industrial, aerospace & defense, medical, and others. The consumer electronics segment captured the largest share of 37.22% in 2023.

The growing adoption of smartphones, tablets, laptops, smart TVs, and other consumer electronics is surging demand for semiconductor memory solutions. These devices rely on high-performance memory to support efficient data storage, retrieval, and seamless functionality.

Rising consumer demand for advanced features, such as greater storage capacity, faster processing speeds, and superior multimedia capabilities, is highlighting the need for innovative memory technologies in consumer electronics. Additionally, the risse of devices such as wearables, VR headsets, and smart home appliances is further boosting demand for semiconductor memory.

The growth of the consumer electronics segment is further supported by an expanding middle class, higher disposable incomes, and a growing preference for electronic devices in emerging markets.

Semiconductor Memory Market Regional Analysis

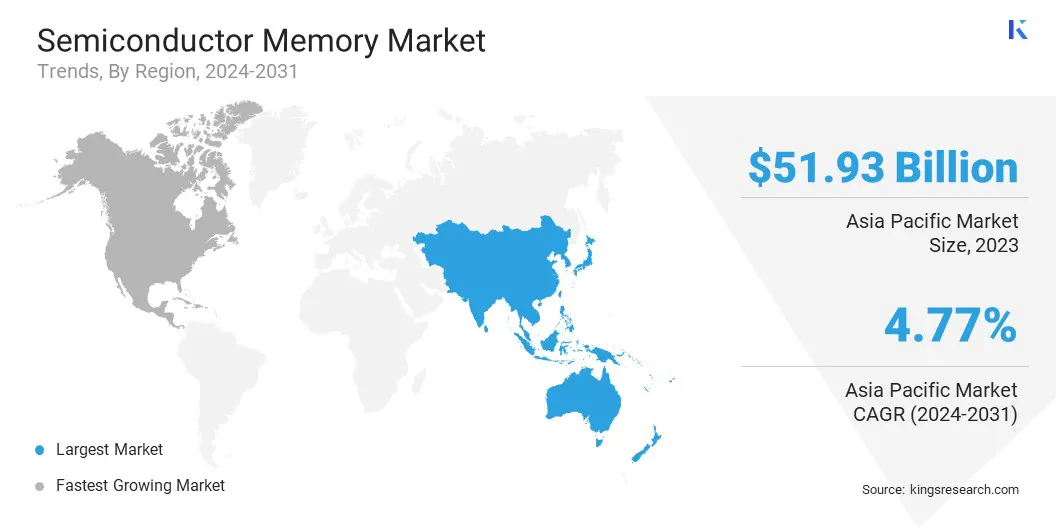

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific semiconductor memory market accounted for the largest revenue share of 47.89% in 2023, valued at USD 51.93 billion. This dominance is reinforced by ongoing technological advancements, strong manufacturing capabilities, and rising demand from industries such as automotive, consumer electronics, and IT and telecommunications.

The Asia-Pacific region, particularly China, Japan, and India, is a key hub for the semiconductor industry, with significant investments in research, development, and product innovation. The region’s growing consumer electronics market, supported by population growth and rising disposable income, is boosting demand for semiconductor memory solutions.

Additionally, government investments in infrastructure development and semiconductor production further expand the regional market.

- For instance, in May 2023, Micron Technology Inc. announced an investment of up to USD $3.7 billion in extreme ultraviolet (EUV) technology, with support from the Japanese government. The company plans to utilize the latest EUV lithography machines to produce 1-gamma chips, which are essential for the mass production of materials used in advanced applications such as imaging networks.

North America market is anticipated to grow at a CAGR of 8.36% over the forecast period. The rapid expansion of technology-driven sectors such as AI, ML, cloud computing, and data centers is propelling regional market growth.

The growing adoption of cloud computing, artificial intelligence, and the Internet of Things (IoT) further fuels the demand for high-capacity and energy-efficient memory solutions. Additionally, the increasing need for data storage in various industries, including automotive, healthcare, and consumer electronics, is fostering regional market growth.

Competitive Landscape

The global semiconductor memory market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

Key Industry Developments

- March 2024 (Launch): SK Hynix launched high-capacity HBM3 chips for data intensive applications such as data center operations, AI, and gaming. Building on its previous HBM3 success, SK Hynix delivers the highest-performing DRAM chips in the market. The company anticipates that the successful volume production of HBM3E, combined with its pioneering role as the first HBM3 provider, will reinforce its leadership in the AI memory market.

- November 2022 (Launch): Micron Technology, Inc. launched its advanced 1β (1-beta) DRAM technology and commenced shipping qualification samples to select chipset partners and smartphone manufacturers. This innovative DRAM solution is designed to enable highly responsive applications by offering superior performance and energy efficiency

- November 2022 (Partnership): Infineon Technologies AG and Taiwan Semiconductor Manufacturing Company Limited (TSMC) partnered to integrate TSMC's Resistive RAM (RRAM) Non-Volatile Memory (NVM) technology into Infineon's AURIX™ microcontroller family. This collaboration is designed to enhance microcontroller performance while significantly reducing power consumption through the adoption of advanced RRAM technology.

The global semiconductor memory market has been segmented as:

By Type

- SRAM

- MRAM

- DRAM

- Flash ROM

- Others

By Application

- Consumer Electronics

- IT & Telecommunication

- Automotive

- Industrial

- Aerospace & Defense

- Medical

- Others

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America