Seismic Services Market Size

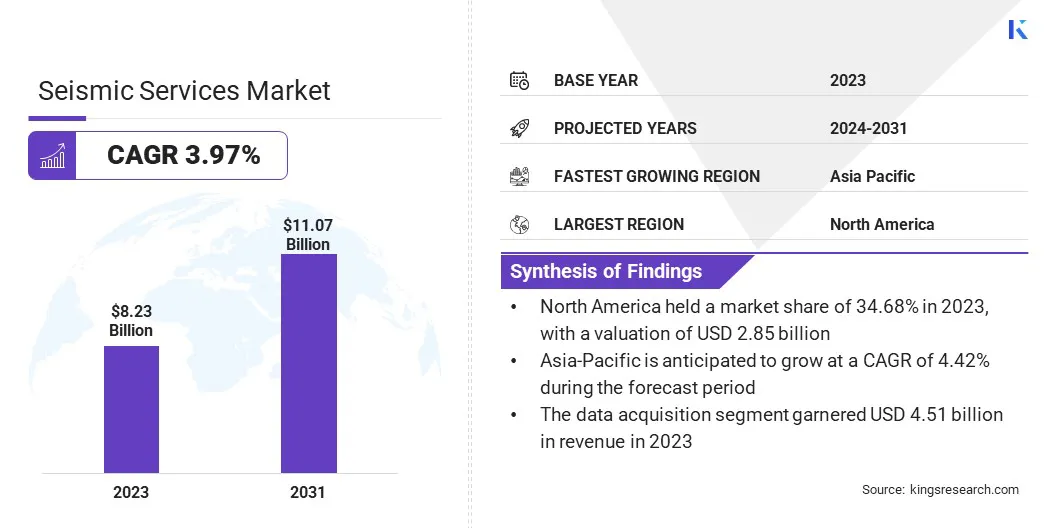

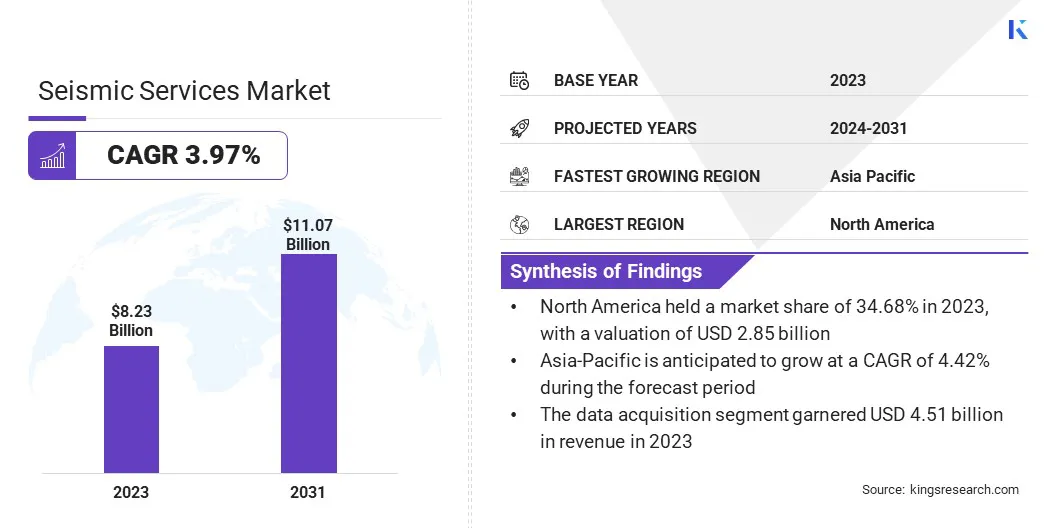

The global Seismic Services Market size was valued at USD 8.23 billion in 2023 and is projected to grow from USD 8.43 billion in 2024 to USD 11.07 billion by 2031, exhibiting a CAGR of 3.97% during the forecast period. The growth of the market is primarily driven by increasing global demand for energy resources, continual advancements in seismic technology, and the expansion of offshore exploration activities.

In the scope of work, the report includes solutions offered by companies such as Abitibi Geophysics, China Oilfield Services Limited, Fugro, Halliburton Company, SAExploration Holdings Inc., SeaBird Exploration, Spectrum Geophysics, Viridien, SLB, TGS, and others.

The seismic services market is growing significantly due to the increasing demand for oil and gas exploration and production. Advancements in seismic technology, including 3D and 4D seismic surveys, are enhancing the accuracy and efficiency of subsurface mapping. The rise in offshore exploration activities, especially in deepwater and ultra-deepwater regions, is further propelling market growth.

Additionally, the global energy transition towards cleaner sources is promoting the adoption of advanced seismic services for geothermal energy exploration. Government policies and initiatives to boost energy security and reduce reliance on imported oil further contribute significantly to the expansion of the market.

- In May 2022, the European Commission published the REPowerEU plan with the aim of swiftly reducing the EU's reliance on Russian fossil fuels by 2030 through a rapid transition to clean energy. The plan focused on energy conservation, clean energy production, and diversification of energy supplies. To expand renewable energy across power generation, industry, buildings, and transport, the Commission proposed increasing the directive's target to 45% by 2030. To expedite renewable deployment, the Council implemented temporary emergency regulations in December 2022 to streamline permit procedures for renewable projects and facilitate power purchase agreements. The revised Renewable Energy Directive EU/2023/2413, which came into effect in November 2023, sought to nearly double the EU's renewable energy share.

The market is characterized by a high degree of technological innovation and intense competition among leading service providers. The growing emphasis on renewable energy sources and sustainable exploration practices is further shaping the landscape of the market.

The seismic services market refers to the industry involved in providing seismic data acquisition, processing, and interpretation services. Seismic services are crucial for identifying subsurface geological formations and evaluating potential oil and gas reserves. These services utilize seismic waves to generate detailed images of the Earth's subsurface, aiding in the detection of resources and the assessment of geological structures.

The market includes various players such as seismic service providers, equipment manufacturers, and software developers. Moreover, seismic services are employed in various sectors such as mining, geothermal energy, and environmental monitoring, highlighting their diverse applications and importance in modern resource exploration.

Analyst’s Review

Manufacturers are actively focusing on technological advancements to meet increasing demands for efficiency and accuracy. This includes the development of advanced seismic imaging technologies such as 4D imaging and the integration of artificial intelligence for data processing. These innovations are crucial for enhancing exploration capabilities and reducing operational costs.

- In June 2024, TGS announced a partnership with PetroAI to help oil and gas companies (E&P companies) make better decisions. They created a system that allows E&P companies to use PetroAI's AI models on TGS's data platform. PetroAI's models analyze TGS's vast amount of underground, production, and well data. This analysis aids in predicting the performance of oil and gas wells and in identifying potential issues. The system offers pre-built, high-quality models for both existing and planned wells, at regional levels.

Moreover, manufacturers are expanding their service portfolios to cater to the needs of the diverse end-user sectors, including oil and gas and renewable energy sectors. Market participants are recommended to invest in research and development to further innovate seismic technologies while adopting sustainable practices to align with global environmental regulations.

Seismic Services Market Growth Factors

The increasing demand for energy has a significant impact on the seismic services market. Countries are actively exploring new oil and gas reserves to meet growing energy needs. Advanced seismic technologies, such as 3D and 4D seismic surveys, are enabling more accurate and efficient exploration. These technologies are providing detailed subsurface images, facilitating better decision-making for drilling and production.

The rise in offshore exploration, particularly in deepwater and ultra-deepwater regions, is further fueling market growth. Government initiatives that support energy security and exploration activities are further contributing to the demand for seismic services, making it a critical component of the energy sector.

The high cost of seismic surveys presents a key challenge to market development. These costs are often prohibitive, particularly for smaller exploration companies. To overcome this challenge, companies are investing heavily in innovative technologies that enhance the efficiency and accuracy of seismic data generation and processing.

Additionally, advancements in remote sensing and data analytics are enabling more precise surveys, thereby reducing the need for extensive fieldwork and lowering operational expenses. These solutions are crucial for making seismic services more accessible and cost-effective.

Seismic Services Market Trends

The rising advancements in artificial intelligence (AI) and machine learning (ML) are significantly influencing the market. Companies are increasingly integrating AI and ML algorithms to enhance the processing and interpretation of seismic data. These technologies are enabling more accurate predictions and faster analysis, thereby reducing both the time and cost associated with traditional seismic surveys.

AI and ML are further improving the detection of subtle geological features that might be missed by conventional methods. This trend is revolutionizing the industry by increasing efficiency and providing deeper insights into subsurface formations, thereby aiding in better decision-making for exploration and production activities.

The growing shift toward sustainable and environmentally friendly exploration practices is emerging as a prominent trend in the seismic services market. Companies are increasingly focusing on reducing the environmental impact of their operations by adopting low-impact seismic technologies and methods.

For instance, the use of nodal seismic systems and wireless sensors is minimizing disturbances to both marine and terrestrial ecosystems. Additionally, there is a growing emphasis on using renewable energy sources for powering seismic equipment. This trend aligns with global efforts to combat climate change and promotes responsible resource exploration, thereby ensuring the long-term sustainability of the seismic services industry.

Segmentation Analysis

The global market is segmented based on service type, technology, end-user, and geography.

By Service Type

Based on service type, the market is categorized into data acquisition, data processing, and data interpretation. The data acquisition segment led the seismic services market in 2023, reaching a valuation of USD 4.51 billion. This notable expansion is attributed to its critical role in the initial stages of exploration.

This expansion is further propelled by the increasing demand for high-quality seismic data to identify and evaluate subsurface formations accurately. Advances in acquisition technologies, such as the development of wireless sensors and nodal systems, are enhancing data collection efficiency and reducing environmental impact.

The surge in offshore and deepwater exploration activities, which require extensive and precise data acquisition, further supports the growth of the segment. Additionally, increased investments by oil and gas companies in new exploration projects are boosting the demand for data acquisition services.

By Technology

Based on technology, the market is classified into 2D imaging, 3D imaging, and 4D imaging. The 4D imaging segment is projected to witness significant growth at a CAGR of 5.05% through the forecast period (2024-2031), mainly due to its advanced capabilities in monitoring reservoir changes over time. This technology provides dynamic insights into subsurface fluid movements, facilitating enhanced oil recovery and better reservoir management.

The growing complexity of oil and gas reservoirs is leading to the widespread adoption of 4D imaging, as it allows for more accurate and efficient exploration and production processes. Technological advancements and the integration of artificial intelligence and machine learning are further enhancing the precision and application of 4D imaging.

By End-User

Based on end-user, the market is segmented into oil & gas, mining, construction, and others. The oil & gas segment secured the largest seismic services market share of 74.95% in 2023. This growth is fostered by the continuous demand for seismic services in the oil and gas sector. This dominance is further reinforced by the critical need for detailed subsurface data to support exploration, drilling, and production activities.

The rise in global energy consumption is prompting oil and gas companies to explore new reserves, both onshore and offshore, which is contributing to the strong demand for seismic services. Furthermore, advancements in seismic technology, such as 3D and 4D imaging, are providing more accurate data, thereby enhancing decision-making processes in the oil and gas industry.

Seismic Services Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America seismic services market share stood around 34.68% in 2023 in the global market, with a valuation of USD 2.85 billion. The region’s dominance is fueled by its well-established oil and gas industry and extensive exploration activities. The region's significant investment in advanced seismic technologies, including 3D and 4D imaging, is enhancing exploration efficiency and accuracy.

The presence of major oil and gas companies and favorable government policies that support energy exploration and production further contribute to the growth of the regional market. Additionally, the increasing focus on shale gas and tight oil extraction is boosting the demand for seismic services. North America's leading position is strengthened by its technological innovation, strong industrial base, and commitment to energy security.

Asia-Pacific is poised to experience significant growth at a CAGR of 4.42% over the forecast period. This notable expansion is largely attributed to its increasing energy demand and ongoing exploration activities in emerging economies such as China, India, and other Southeast Asian countries. The region's rapid industrialization and urbanization are boosting the need for more energy resources, prompting extensive oil and gas exploration.

Governments are enacting favorable policies and offering incentives to attract foreign investments in the energy sector. Additionally, advancements in seismic technology and the growing adoption of 3D and 4D imaging are enhancing exploration efficiency, thereby supporting regional market development.

Competitive Landscape

The seismic services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Seismic Services Market

- Abitibi Geophysics

- China Oilfield Services Limited

- Fugro

- Halliburton Company

- SAExploration Holdings Inc.

- SeaBird Exploration

- Spectrum Geophysics

- Viridien

- SLB

- TGS

Key Industry Developments

- February 2024 (Partnership): Schlumberger (SLB) announced a long-term collaboration agreement with Equinor and the Subsea Integration Alliance, comprising OneSubsea and Subsea7. This agreement enabled early planning on the Wisting (Norway) and Bay du Nord (Canada) projects, with the aim of enhancing project economics through information sharing and technology innovation.

- August 2023 (Launch): Sercel launched MetaBlue, a data-driven solution for marine seismic survey planning and management. It connected every phase of a marine seismic project, thereby reducing project turnaround times and enhancing collaboration among stakeholders. MetaBlue optimized marine seismic surveys, improving operational performance and delivering high-quality seismic data for superior subsurface imaging.

The global seismic services market is segmented as:

By Service Type

- Data Acquisition

- Data Processing

- Data Interpretation

By Technology

- 2D Imaging

- 3D Imaging

- 4D Imaging

By End-User

- Oil & Gas

- Mining

- Construction

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America