Seismic Monitoring Equipment Market Size

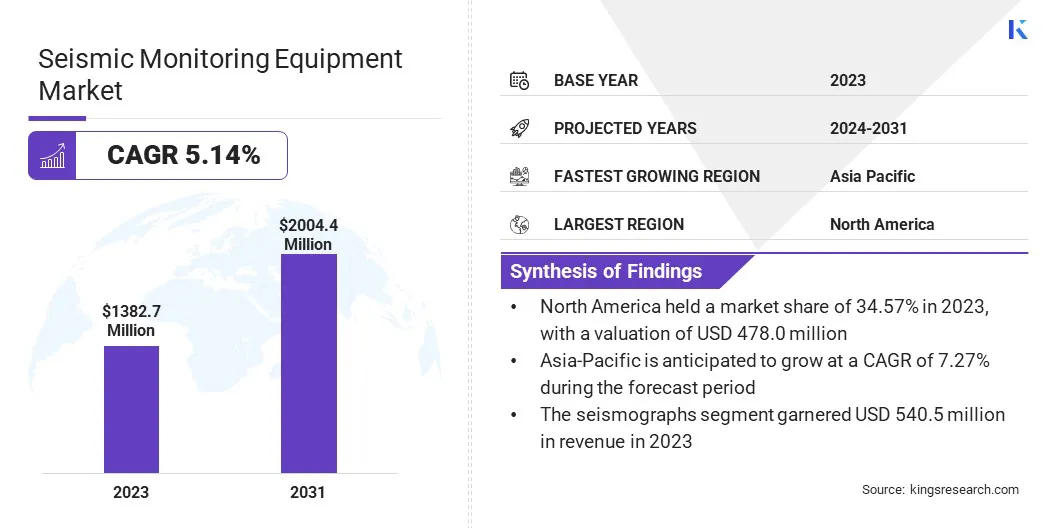

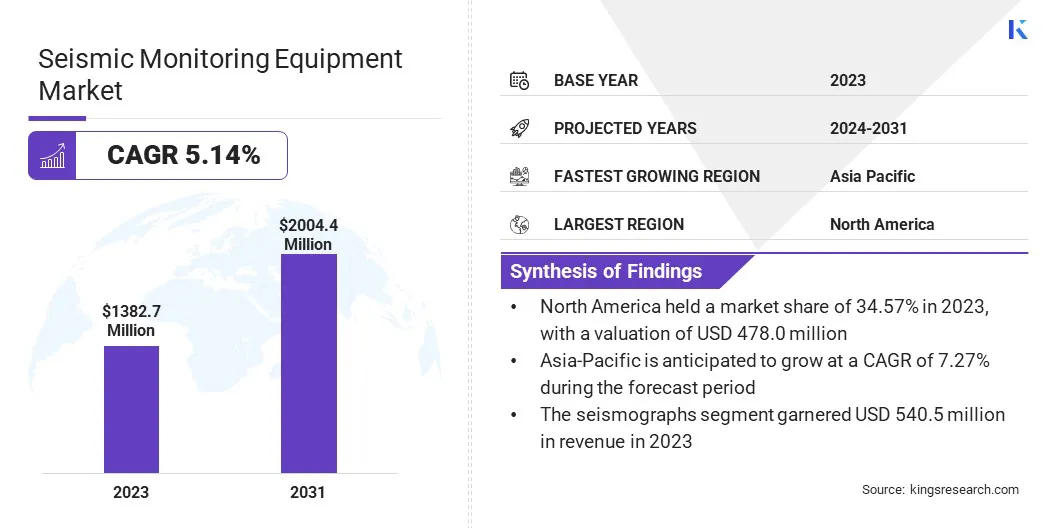

The global Seismic Monitoring Equipment Markett size was valued at USD 1382.7 million in 2023 and is projected to grow from USD 1430.3 million in 2024 to USD 2004.4 million by 2031, exhibiting a CAGR of 4.94% during the forecast period. The market is expanding significantly, driven by rapid urbanization and infrastructure development in seismic-prone regions.

Growing investments in research and development are leading to innovations in monitoring technologies, enhancing data accuracy and operational efficiency. Additionally, the rising demand for regulatory compliance in the construction and mining sectors is prompting industries to adopt advanced seismic solutions, thereby propelling market growth.

In the scope of work, the report includes products offered by companies such as Kinemetrics, Güralp Systems Ltd., GeoSIG Ltd., Nanometrics Inc., IMV Corporation., DMT, Reftek Systems Inc., SERCEL, DNV AS, Geospace Technologies, and others.

The market is experiencing robust growth, mainly due to increasing demand for advanced systems across various sectors, including oil and gas exploration, construction, and disaster management. Rising seismic activity in earthquake-prone regions, coupled with the need for early warning systems, is fueling investments in cutting-edge monitoring technologies.

- According to the World Bank, Japan's 7.6 magnitude earthquake on New Year's Day 2024 demonstrated the effectiveness of resilient building strategies. In contrast, the February 2023 earthquakes in Türkiye caused over 50,000 deaths and $34 billion in damages due to widespread infrastructure failures.

The integration of IoT and AI is further enhancing real-time data collection and predictive capabilities, fostering innovation in the industry. Additionally, the expanding exploration activities in offshore and unconventional energy resources are boosting market growth. This growth is further supported by government initiatives focused on disaster preparedness and infrastructure protection.

Seismic monitoring equipment encompasses a range of instruments and technologies designed to detect, measure, and analyze seismic activity, including earthquakes and ground vibrations. This equipment typically includes seismometers, accelerometers, data recorders, and telemetry systems, which collectively provide real-time ground movement information.

Seismic monitoring is essential for various applications, such as earthquake early warning systems, resource exploration, and infrastructure safety assessments. By offering insights into seismic events, these technologies play a crucial role in enhancing public safety, informing construction practices, and enabling efficient resource management in earthquake-prone regions and industries.

Analyst’s Review

The seismic monitoring equipment market is experiencing a surge in government investments globally, reflecting a commitment to enhancing disaster preparedness and monitoring capabilities.

- In January 2023, the Indian Center deployed micro seismic observatories in Joshimath, an area facing land subsidence issues. These observatories are expected to improve the tracking and recording of earth scientists. India currently operates 152 seismological centers and plans to add 100 more, significantly enhancing the capability for real-time data collection and monitoring.

- Additionally, in October 2023, Tamil Nadu established new seismic observatories in Thanjavur, Tuticorin, Coimbatore, and Villupuram.

Such strategic investments are prompting companies to innovate and develop advanced products, thereby providing optimal solutions for end-users in various sectors.

What are the major factors affecting the market growth?

The increasing occurrence of seismic activity in earthquake-prone regions is boosting the demand for seismic monitoring equipment. Rapid urbanization and the development of critical infrastructure are intensifying the risks posed by earthquakes, leading to increased demand for early warning systems.

Governments and organizations are focused on minimizing damage through real-time monitoring solutions that protect public safety and infrastructure.

Advanced seismic technologies are being adopted to enhance detection and response capabilities. Disaster preparedness has become a priority, with both public and private sectors contributing to market growth by investing in solutions that reduce the impact of earthquake-related risks.

- In November 2023, Arahas and Quakelogic launched a new Structural Health Monitoring and Early Warning System. This innovative technology aims to enhance safety in earthquake-prone areas of the Indian Subcontinent, marking a significant advancement in the region's efforts to prepare for and mitigate risks associated with seismic events.

This focus on disaster preparedness and mitigation is leading to increased adoption, thereby fueling the expansion of the seismic monitoring equipment market.

The development of the market is constrained by the high costs of advanced technologies and the complexity of data interpretation, which limits adoption in small to mid-sized enterprises. Additionally, ensuring equipment durability in extreme environments poses operational difficulties. Key market players are addressing these challenges by developing cost-effective solutions and offering scalable systems tailored to various industries.

To enhance accessibility, companies are leveraging cloud-based platforms that streamline data analysis and interpretation. They are further investing in ruggedized equipment capable of withstanding harsh environmental conditions, ensuring reliability in extreme seismic zones. These factors are expected to foster market growth over the forecast period.

How is IOT and AI integration affecting the market?

The integration of internet of thing and AI in seismic monitoring is influencing the market, enhancing efficiency and accuracy. IoT enables seamless real-time data collection from vast sensor networks, while AI automates data analysis, allowing for quicker detection of seismic events.

- In June 2023, Nanometrics launched a cutting-edge AI-based automated event detection engine, significantly advancing passive seismic monitoring. This upgrade improves seismic data analysis with increased accuracy, faster processing times, and more comprehensive event catalogs, representing a notable advancement in the field.

These technologies improve the precision of monitoring systems and help predict earthquake occurrences more effectively, thus reducing response time and potential damage. The demand for advanced seismic solutions is rising, as industries and governments seek smarter, more proactive systems. This technological advancement is promoting rapid adoption and fostering innovation.

Seismic monitoring equipment is indispensable in hydrocarbon exploration, enabling energy companies to more accurately detect underground oil and gas reserves. Global energy demand is rising, prompting companies to intensify their exploration efforts, particularly in offshore regions and unconventional sources such as shale gas.

The adoption of advanced seismic technologies improves subsurface imaging, reducing drilling risks, and optimizing exploration efficiency. This growing emphasis on resource maximization in challenging areas is boosting the adoption of seismic solutions, which is expected to propel market expansion.

Segmentation Analysis

The global market has been segmented based on type, application, end user, and geography.

How big is the market for seismographs?

Based on type, the market has been categorized into seismographs, accelerometers, GPS-based systems, and others. The seismographs segment led the seismic monitoring equipment market in 2023, reaching a valuation of USD 540.5 million.

Innovations in digital seismographs are enhancing data accuracy and processing efficiency, enabling real-time monitoring and analysis. This growth is further fueled by the rising focus on disaster preparedness and risk reduction in earthquake-prone regions, compelling governments and organizations to invest in advanced monitoring solutions.

Additionally, funding for research initiatives in geosciences is surging the demand for high-quality seismographs. Stricter regulatory compliance in industries such as construction and energy necessitates reliable monitoring systems, thereby propelling segmental growth.

What is the market share of the earthquake monitoring segment?

Based on application, the market has been categorized into earthquake monitoring, volcanic activity monitoring, structural health monitoring, and others. The earthquake monitoring segment captured the largest share of 45.21% in 2023.

Increasing occurrences of earthquakes are prompting governments and organizations to invest in advanced monitoring systems that provide real-time data and early warning capabilities.

Technological innovations, including AI-driven analytics and sophisticated detection methods, are enhancing the accuracy and efficiency of earthquake monitoring solutions.

Furthermore, government initiatives aimed at improving disaster resilience are resulting in increased funding for monitoring projects. Growing public awareness of seismic risks is further bolstering the demand for effective monitoring solutions.

How big will the government segment be in 2031?

Based on end user, the market has been categorized into government, research institutions, oil & gas, mining, construction, and others. The government segment is expected to garner the highest revenue of USD 628.2 million by 2031. This growth is largely attributed to increasing investments in disaster preparedness and infrastructure resilience.

Governments are prioritizing the establishment of robust seismic monitoring systems to enhance public safety and mitigate the impact of natural disasters. Initiatives aimed at improving early warning capabilities and emergency response are fostering demand for advanced seismic technologies.

Moreover, rising awareness of climate change and its effects on seismic activity is prompting governments to allocate funds for research and monitoring projects. Collaborative efforts with research institutions and private companies are accelerating the development of innovative solutions.

- In February 2024, Kinemetrics Inc. announced a partnership with the USGS, granting the company a commercial license to provide ShakeAlert-powered earthquake early warning alerts via the OasisPlus Earthquake Response Platform. This integration allows OasisPlus users to incorporate earthquake alerts seamlessly into their emergency response workflow.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America seismic monitoring equipment market accounted for the largest share of 34.57% in 2023, with a valuation of USD 478.0 million. This notable expansion is further reinforced by significant seismic activity in regions prone to earthquakes, creating a strong demand for effective monitoring systems. Both the U.S. and Canada have well-established seismic monitoring networks, with a strong focus on enhancing earthquake preparedness and response initiatives.

- In December 2022, Güralp introduced the Certis system and the Minimus2 low-power digitizer at the American Geophysical Union Fall Meeting, highlighting regional advancements in seismic technology.

These developments, combined with ongoing investments in research and infrastructure, are anticipated to support regional market growth.

Asia-Pacific seismic monitoring equipment industry is anticipated to witness grow at the fastest CAGR of 7.27% over the forecast period, mainly due to its frequent earthquakes and volcanic activity.

Countries along the Pacific Ocean's "Ring of Fire" face some of the most challenging natural environments , intensified by severe weather systems. This highloghts the need for effective monitoring technologies to enhance disaster preparedness and response.

Research institutions in South Korea, such as the Korea Institute of Geoscience and Mineral Resources (KIGAM), are actively utilizing advanced seismic systems to analyze earthquake patterns and improve prediction models.

- In June 2024, Sercel announced the sale of a comprehensive marine seismic acquisition system to HJ Shipbuilding & Construction, a leading South Korean firm. This contract includes the Seal 428 recording system, Sentinel streamers, a Nautilus streamer positioning system, and G-Source II high-performance impulsive sources.

This commitment to enhancing seismic monitoring technology underscores the region's proactive approach to managing natural hazards and improving disaster resilience, thereby propelling regional market growth.

Competitive Landscape

The global seismic monitoring equipment market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

Top Companies in Seismic Monitoring Equipment Market

- Kinemetrics

- Güralp Systems Ltd.

- GeoSIG Ltd.

- Nanometrics Inc.

- IMV Corporation.

- DMT

- Reftek Systems Inc.

- SERCEL

- DNV AS

- Geospace Technologies

Key Industry Developments

- August 2023 (Product Launch): Sercel introduced MetaBlue, a cutting-edge data-driven solution for marine seismic survey planning and management. It helps exploration and production (E&P) companies and marine seismic service providers optimize project turnaround times by seamlessly integrating all phases of a marine seismic project.

- April 2023 (Launch): DNV launched a new joint industry project (JIP) focused on improving design certainty for wind farms in seismically active regions. This initiative aims to address and reduce the risks posed by earthquakes to wind energy infrastructure.

The global seismic monitoring equipment market is segmented as:

By Type

- Seismographs

- Accelerometers

- GPS-based Systems

- Others

By Application

- Earthquake Monitoring

- Volcanic Activity Monitoring

- Structural Health Monitoring

- Others

By End User

- Government

- Research Institutions

- Oil & Gas

- Mining

- Construction

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America