Sebacic Acid Market Size

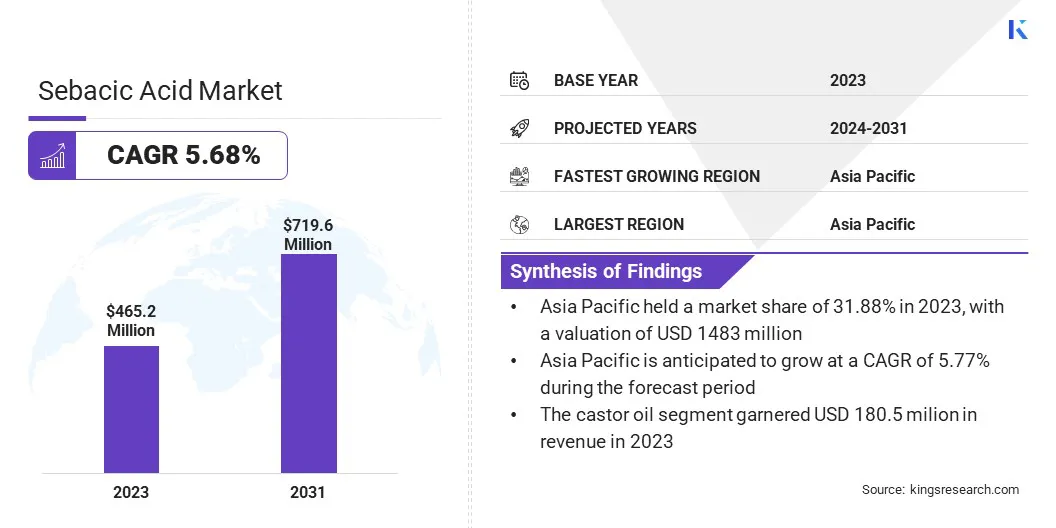

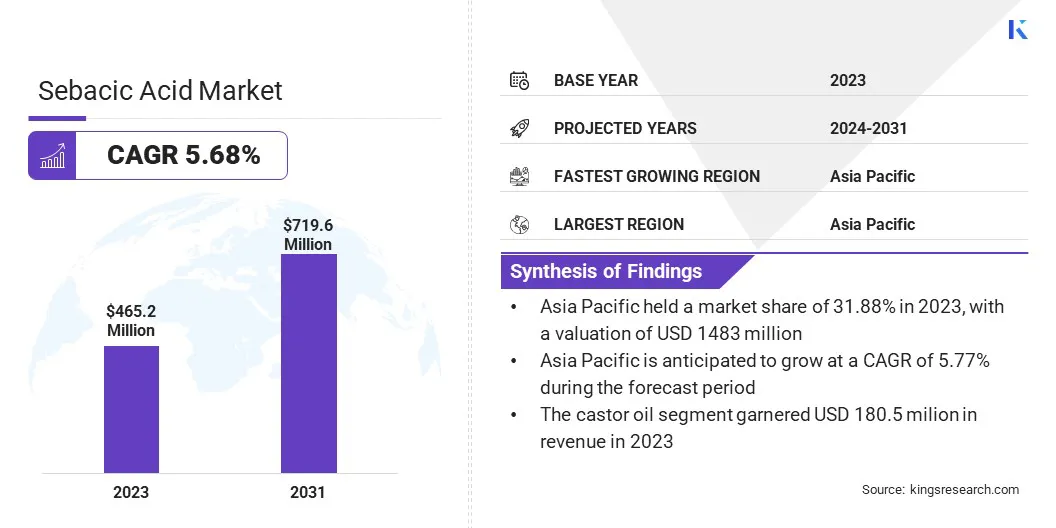

The Global Sebacic Acid Market size was valued at USD 465.2 million in 2023 and is projected to grow from USD 488.81 million in 2024 to USD 719.6 million by 2031, exhibiting a CAGR of 5.68% during the forecast period. A notable shift toward eco-friendly and sustainable materials is significantly contributing to the growth of the market.

Derived from renewable sources such as castor oil, sebacic acid is a vital raw material for producing biodegradable polymers, including polyamides and polyesters. These polymers are widely utilized in industries such as packaging and textiles for their environmental benefits.

In the scope of work, the report includes products offered by companies such as Akrema, Shanxi Zhengang Chemical Co., Ltd., HOKOKU CORPORATION, Croda International Plc, Inolex, Inc., SEBACIC INDIA LIMITED, BASF SE, Tokyo Chemical Industry Co., Ltd., EVONIK, Corvay, and others.

The sebacic acid market is expanding due to its rising use in personal care and cosmetic products. Sebacic acid is used as an emollient and thickening agent in skincare formulations, offering improved texture and moisturizing properties.

The global trend toward organic and natural beauty products is further fueling this demand, as sebacic acid aligns with the eco-conscious consumer preferences. Personal care companies are leveraging sebacic acid to formulate innovative, sustainable products, thereby contributing to market expansion.

Sebacic acid, a naturally occurring dicarboxylic acid primarily derived from castor oil, consists of a 10-carbon chain. It is used in the production of chemicals and materials, including lubricants, plastics, cosmetics, and biodegradable polymers.

Sebacic acid plays a crucial role in manufacturing polyamides, polyesters, and bio-based materials, offering environmentally friendly alternatives to petroleum-based products.

Its broad applications across the automotive, aerospace, packaging, and agriculture industries make it an essential for developing sustainable and high-performance products.

Analyst’s Review

Companies in the sebacic acid market are adopting a range of strategic initiatives to foster market expansion, with a strong emphasis on sustainability and the growing demand for plant-based and bio-based products. A key approach involves forming strategic collaborations and co-creation initiatives.

- In April 2024, Toray Industries, Inc. partenered with Yoshida Co. to develop materials for Tanker bags using Ecodear N510, a fully plant-based nylon fiber. The bags' outer fabric will be made from Ecodear N510, produced by polymerizing sebacic acid derived from castor oil.

By partnering with raw material suppliers, research institutions, and other industry players, companies are able to pool resources and share expertise in developing innovative, eco-friendly solutions.

These collaborations are particularly focused on leveraging renewable resources, such as castor oil, to produce bio-based sebacic acid derivatives that meet the rising demand for sustainable alternatives in industries such as automotive, packaging, personal care, and textiles.

In addition to collaboration, companies are investing heavily in research and development to enhance the performance and versatility of bio-based sebacic acid products. This includes improving the efficiency of production processes and exploring new applications for sebacic acid derivatives in high-performance materials such as biodegradable plastics, coatings, and lubricants.

These investments are critical in addressing rising demand for both sustainable and high-performance products.

Sebacic Acid Market Growth Factors

The growing use of sebacic acid in the production of bio-based fibers and dyes in the textile industry is fueling the expansion of the market. The rising demand for eco-friendly textiles, supported by consumer preference for sustainable fashion, is significantly contributing to the growth of the sebacic acid market.

Additionally, its role in developing durable and lightweight fabrics is making it a preferred choice for manufacturers.

- In January 2022, Toray Industries expanded its Ecodear product line with the introduction of Ecodear N510, its first 100% plant-based nylon 510 fibre. This new fibre is produced using a spinning process that incorporates sebacic acid from castor oil and pentamethylenediamine from corn.

Government initiatives promoting the adoption of renewable and bio-based materials are influencing the sebacic acid market. Policies that support green chemistry and environmental sustainability are increasing demand for sebacic acid across various industries, including packaging and automotive.

Favorable regulatory frameworks in regions such as Europe and Asia-Pacific are leading to investments in sebacic acid production facilities and fostering innovation.

However, the high cost of raw materials, particularly castor oil, which is the primary feedstock for producing bio-based sebacic acid production is hindering market expansion. Fluctuations in castor oil prices and the limited availability of high-quality seeds can disrupt the supply chain and increase production costs.

To address this challenge, companies are investing in research to explore alternative feedstocks, such as palm kernel oil or other plant-based oils. Additionally, they are adopting more efficient production processes, such as using waste and recycling technologies, to reduce their reliance on expensive raw materials and lower their overall production costs.

Sebacic Acid Industry Trends

The growth of renewable energy sectors, such as solar and wind, is creating a robust demand for sebacic acid. It is used in producing eco-friendly materials such as bio-based composites and coatings, which enhance the durability and efficiency of solar panels and wind turbines.

With increasing global investments in clean energy, the demand for sustainable, high-performance materials like sebacic acid is expected to rise. This trend is fueling the growth of the sebacic acid market, particularly in regions focused on transitioning to renewable energy sources.

- In February 2024, the S. Department of Defense (DOD) awarded a total of USD 192.5 million across seven contracts to enhance domestic manufacturing of essential chemicals. Lacamas Laboratories received USD 86.2 million contract to establish production of non-energetic chemicals, including salicylic acid and sebacic acid.

The demand for lightweight and durable materials in sectors such as construction, automotive, and aerospace is contributing to the growth of the sebacic acid market. Sebacic acid-based polymers and coatings are widely preferred for their ability to reduce weight while maintaining structural integrity. This aligns with industry efforts to improve energy efficiency and reduce carbon emissions.

- In September 2024, Indorama Ventures Public Company Limited (IVL), a global leader in sustainable chemicals, received ISCC+ certification for three of its fiber manufacturing sites. IVL also introduced a new Bio-based high-tenacity PA4.10 (M.B.) yarn, produced in Obernburg, Germany, for tire and specialty applications. This yarn is made from a 100% bio-content polymer derived from bio-based Sebacic Acid and bio-based Di-Amino Butane (DAB) through mass balancing.

Segmentation Analysis

The global market has been segmented based on source, form, application, and geography.

By Source

Based on source, the market has been segmented into castor oil, adipic acid, and others. The castor oil segment led the sebacic acid market in 2023, reaching a valuation of USD 180.5 million. Castor oil, a renewable, bio-based feedstock, aligns with the growing global demand for sustainable and eco-friendly materials.

This makes it an attractive option for companies aiming to meet regulatory standards and consumer preferences for green products. Its high ricinoleic acid content is ideal for producing high-quality sebacic acid through efficient, cost-effecitve processes. Moreover, the availability of castor oil, particularly in India and China, supports the growth of the castor oil segment.

By Form

Based on form, the market has been classified into powder, granular, and flakes. The powder segment secured the largest revenue share of 37.84% in 2023.

Powdered sebacic acid offers ease of handling, storage, and transportation, making it highly suitable for industries such as automotive, cosmetics, and plastics, where precise formulations and large-scale production are crucial. It facilitates efficient integratation into manufacturing processes, such as in the production of bio-based polyamides and biodegradable plastics.

Additionally, the powder form enhances the stability, shelf life, and cost-effectiveness advantages, aligning with the growing demand for sustainable, bio-based products across various sectors.

By Application

Based on application, the market has been divided into plastics & polymers, chemical synthesis, lubricant, cosmetics, and others. The chemical synthesis segment is poised to witness significant growth, registering a CAGR of 5.84% through the forecast period.

Chemical synthesis is favored for sebacic acid production due to its scalability and efficiency, allowing for the large-scale production of high-purity material. It is integral to industries such as automotive, textiles, packaging, and personal care, where it is widely used in the production of polymers, lubricants, surfactants, and plasticizers.

The process meets high-volume demands while ensuring cost-effectiveness and consistent quality, making it crucial for sebacic acid production.

Sebacic Acid Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific sebacic acid market accounted for a substantial share of around 31.88% in 2023, valued at USD 148.31 million. The region, particularly China, India, and Japan, houses major automotive manufacturing hubs.

As the demand for lightweight, durable, and eco-friendly materials increases, sebacic acid derivatives are finding applications in automotive components such as fuel tanks, coatings, and interior parts. Additionally, sebacic acid is essential in producing bio-based polyamides and resins, enhancing the sustainability and performance of automotive products.

- According to the International Energy Agency's 2024 report, China represented nearly 60% of global new electric car registrations in 2023, with 8.1 million new electric vehicles registered, marking a 35% increase from 2022. Additionally, China became the largest auto exporter in 2023, shipping over 4 million cars, including 1.2 million electric vehicles.

Additionally, countries in the region are increasingly adopting bio-based plastics for applications in packaging, textiles, and electronics. This shift supports the expansion of the Asia-Pacific market, as bio-based plastics offers an environmentally friendly alternative to traditional petroleum-based plastics.

Europe sebacic acid market is set to witness significant growth, recording a CAGR of 5.76% over the forecast period. Europe has been a leader in sustainability, with governments and industries prioritizing eco-friendly alternatives. The European Union's Green Deal and Circular Economy Action Plan promote bio-based chemicals, including sebacic acid, to reduce fossil fuel dependence.

The shift toward sustainable materials in various sectors such as automotive, packaging, and textiles is bolstering the growth of the Europe market.

Furthermore, there is an increasing shift among European consumers toward eco-friendly personal care and cosmetic products. This is leading to the growing use of sebacic acid in the formulation of biodegradable and sustainable personal care products such as shampoos, lotions, and soaps, aiding regional market expansion.

Competitive Landscape

The global sebacic acid market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Sebacic Acid Market

- Akrema

- Shanxi Zhengang Chemical Co., Ltd.

- HOKOKU CORPORATION

- Croda International Plc

- Inolex, Inc.

- SEBACIC INDIA LIMITED

- BASF SE

- Tokyo Chemical Industry Co., Ltd.

- EVONIK

- Corvay

Key Industry Developments

- February 2024 (Expansion): Arkema's high-performance polymers division led the "Commitment to Sustainable Castor Farming in India" initiative, conducting over 380 capacity-building training sessions for farmers. This program aims to boost the production of sebacic acid by promoting sustainable farming practices.

The global sebacic acid market has been segmented as:

By Source

- Castor Oil

- Adipic Acid

- Others

By Form

By Application

- Plastics & Polymers

- Chemical Synthesis

- Lubricant

- Cosmetics

- Others

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America