Market Definition

The market encompasses the collection, processing, and analysis of information captured by Earth observation satellites. These services involve complex data formulation techniques, including geospatial mapping, image correction, and analytics integration, to deliver actionable insights.

The market serves a wide array of applications such as precision agriculture, environmental monitoring, urban planning, defense intelligence, and disaster response. It also supports sectors like oil and gas exploration, maritime surveillance, and infrastructure development by providing high-resolution imagery and real-time data streams.

The report explores key drivers of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

Satellite Data Services Market Overview

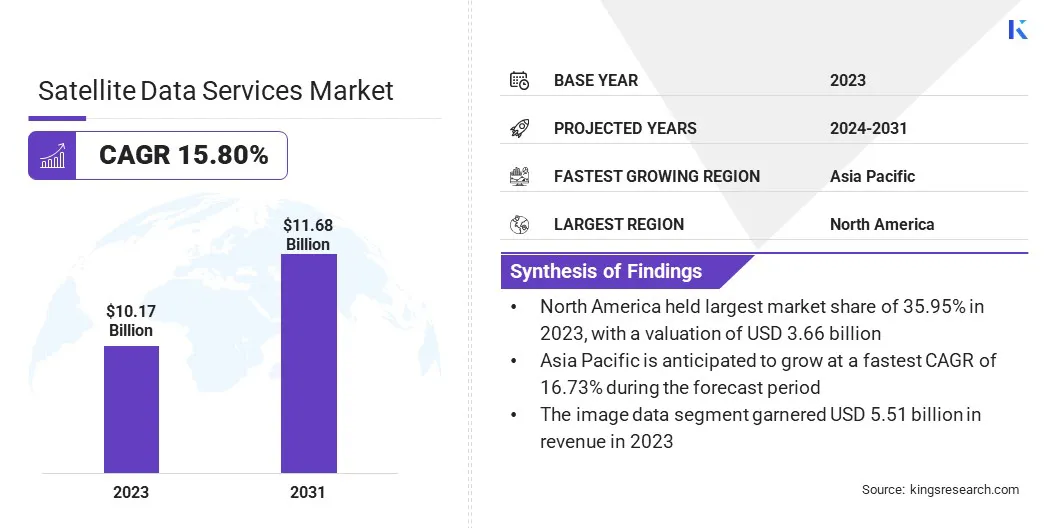

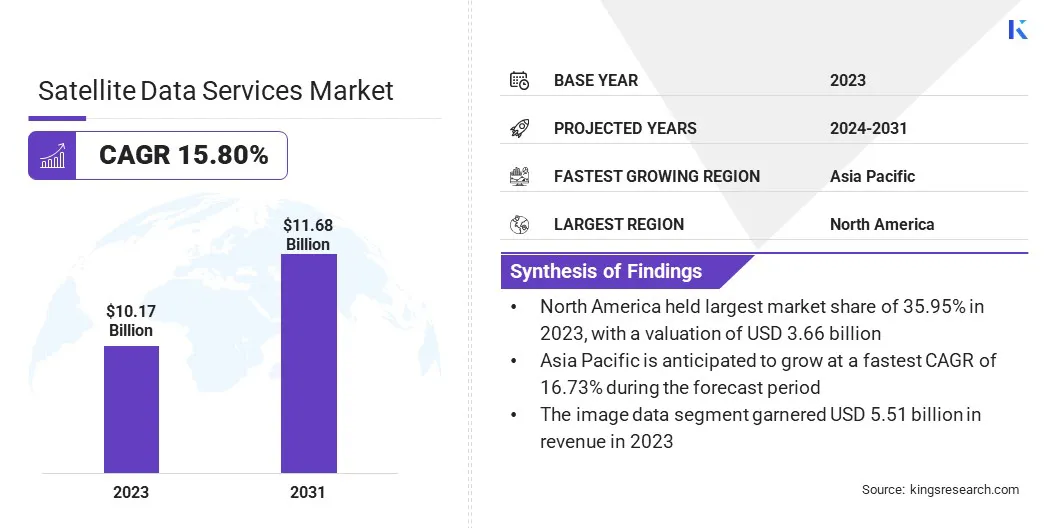

The global satellite data services market size was valued at USD 10.17 billion in 2023 and is projected to grow from USD 11.68 billion in 2024 to USD 32.62 billion by 2031, exhibiting a CAGR of 15.80% during the forecast period.

The growth of the market is driven by increasing reliance on real-time geospatial intelligence across defense and security sectors for rapid decision-making in mission-critical operations. Additionally, satellite data is playing a growing role in disaster management, supporting early warnings, damage assessments, and resource coordination during natural catastrophes.

Major companies operating in the satellite data services industry are Maxar Technologies, Planet Labs PBC, Airbus, ICEYE, L3Harris Technologies, Inc., Earth-i Ltd., Geocento, NV5 Global, Inc., Satellite Imaging Corporation, Telstra Enterprise International, Ursa Space Systems, Inc., Gisat s.r.o., BlackSky, SATPALDA, Trimble Inc.

The market is advancing due to its growing importance in disaster preparedness and response. Satellite imagery is widely used to assess damage, track natural disasters such as hurricanes, wildfires, and floods, and support humanitarian aid.

Governments and emergency agencies depend on near real-time Earth observation data to coordinate relief efforts, allocate resources, and restore infrastructure efficiently. This operational reliance continues to reinforce the demand for satellite-based intelligence in crisis management frameworks.

- In March 2025, ICEYE successfully launched four additional satellites featuring 25 cm resolution, further expanding its synthetic aperture radar (SAR) satellite constellation. This latest deployment enhances ICEYE’s capabilities in delivering high-resolution imagery, reinforcing its position as a leading technology provider for complex applications such as natural disaster response and national security operations.

Key Highlights:

- The satellite data services market size was recorded at USD 10.17 billion in 2023.

- The market is projected to grow at a CAGR of 15.80% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 3.66 billion.

- The image data segment garnered USD 5.51 billion in revenue in 2023.

- The private segment is expected to reach USD 13.61 billion by 2031.

- The defense & security segment secured the largest revenue share of 24.47% in 2023.

- The government & military segment is poised for a robust CAGR of 15.92% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 16.73% during the forecast period.

Market Driver

Rising Demand for Real-Time Geospatial Intelligence in Defense and Security

The market is witnessing steady growth due to the increased reliance on real-time geospatial intelligence for defense and homeland security operations. Governments and military agencies are deploying Earth observation technologies to track border activities, monitor conflict zones, and plan tactical missions with precision.

The strategic use of satellite-derived imagery improves situational awareness, supports surveillance operations, and strengthens national defense infrastructure, creating strong demand across global security frameworks.

- In February 2025, Fujitsu and MAIAR introduced their Geospatial-Intelligence as a Service (GEO IaaS) solution at DGI (Geospatial Intelligence for Defence and Security) 2025. Designed to enhance military intelligence capabilities, the platform integrates advanced technologies, including artificial intelligence, machine learning, and geospatial analytics, with on-demand human expertise. This combination enables the delivery of real-time, actionable intelligence, providing a strategic edge through a seamless fusion of data-driven insights and operational support.

Market Challenge

Data Integration and Interoperability Constraints

A key challenge limiting the growth of the satellite data services market is the lack of standardized frameworks for integrating and processing diverse data formats from multiple satellite platforms. This fragmentation often leads to inefficiencies and delays in deriving actionable insights.

To address this issue, companies are increasingly investing in unified data platforms and adopting open architecture solutions to streamline integration. Collaborations with cloud service providers and the use of AI-based data fusion technologies are also being explored to enhance cross-platform compatibility and support real-time analytics, thereby improving data usability and accelerating decision-making across industries.

Market Trend

Expansion of Climate Monitoring and Environmental Management Programs

The market is gaining momentum due to the expansion of global environmental and climate monitoring programs. Agencies and organizations are utilizing Earth observation data to track deforestation, monitor oceanic patterns, and assess greenhouse gas emissions.

High-resolution satellite imagery supports early detection of ecological disruptions and informs international sustainability policies. This increased institutional focus on climate resilience is broadening the applications of satellite data in environmental governance and risk assessment.

- In February 2025, L3Harris Technologies completed the Preliminary Design Review (PDR) for the development of a next-generation high-resolution imager intended for the National Oceanic and Atmospheric Administration’s (NOAA) Geostationary Extended Observations (GeoXO) satellite system. The GeoXO program is designed to deliver real-time imagery that supports monitoring of weather patterns, ocean dynamics, and environmental conditions across the Western Hemisphere.

Satellite Data Services Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Image Data, Data Analytics

|

|

By Deployment

|

Private, Public, Hybrid

|

|

By Application

|

Defense & Security, Energy & Utilities, Agriculture & Forestry, Environmental & Climate Monitoring, Engineering & Infrastructure Development, Marine, Others

|

|

By End Use

|

Commercial, Government & Military, Service Providers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Image Data, Data Analytics): The image data segment earned USD 5.51 billion in 2023 due to its critical role in providing detailed visual intelligence for applications such as urban planning, defense surveillance, environmental monitoring, and disaster management.

- By Deployment (Private, Public, Hybrid): The private segment held 42.17% of the market in 2023, due to the rising investment by commercial enterprises in advanced satellite infrastructure to support high-resolution imaging, real-time analytics, and tailored data applications across industries such as energy, agriculture, and logistics.

- By Application (Defense & Security, Energy & Utilities, Agriculture & Forestry, Environmental & Climate Monitoring, Engineering & Infrastructure Development, Marine, Others): The defense & security segment are projected to reach USD 8.01 billion by 2031, owing to the rising need for real-time geospatial intelligence to support surveillance, threat detection, and mission-critical decision-making in increasingly complex security environments.

- By End Use (Commercial, Government & Military, Service Providers): The government & military segment is poised for significant growth at a CAGR of 15.92% through the forecast period, attributed to its consistent demand for high-resolution geospatial intelligence to support national security operations, surveillance, and strategic decision-making across defense and emergency response applications.

Satellite Data Services Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America satellite data services market share stood around 35.95% in 2023 in the global market, with a valuation of USD 3.66 billion. This dominance is due to the sustained demand from U.S. federal agencies such as the Department of Defense, NOAA, and NASA, which continue to rely on commercial satellite data for Earth observation, intelligence, surveillance, reconnaissance (ISR), and climate monitoring.

Moreover, long-term government programs like the National Reconnaissance Office’s EnhancedView and Electro-Optical Commercial Layer (EOCL) have established strategic collaborations with private satellite operators. These initiatives contribute significantly to the stability and expansion of the market in the region.

Additionally, North America’s vulnerability to climate-induced disasters, including hurricanes and wildfires, has led to increased investment in satellite data by agencies like the National Oceanic and Atmospheric Administration (NOAA) and The Federal Emergency Management Agency (FEMA). Real-time geospatial intelligence is critical for early warning systems, evacuation planning, and damage assessments.

Recent NOAA upgrades to the GOES and GeoXO satellite systems, combined with FEMA’s reliance on commercial data for post-disaster recovery, are creating a steady demand for satellite data services. These factors are driving the market growth in this region.

Asia Pacific is poised for significant growth at a robust CAGR of 16.73% over the forecast period. The Asia Pacific region is witnessing rapid development in Earth observation capabilities, with multiple public and private sector investments directed toward enhancing imaging, data processing, and analytics infrastructure.

Moreover, the growing deployment of low-Earth orbit (LEO) satellites to support region-wide surveillance and environmental tracking is further driving the growth of the market. This has broadened access to localized satellite data, which is increasingly used by enterprises, researchers, and government agencies for sector-specific applications, including climate risk modeling and urban development.

According to the World Teleport Association, a substantial share of new satellite deployments in Asia Pacific is expected to occur in non-geostationary orbits (NGSO) by 2030, largely propelled by the expansion of large-scale constellations in Low Earth Orbit (LEO). This growth is being strongly driven by the rapid rise in residential consumer broadband demand, which remains heavily concentrated on LEO-based infrastructure.

Furthermore, Precision farming, crop health monitoring, irrigation planning, and deforestation tracking in Asia Pacific are increasingly reliant on high-frequency satellite imagery. The incorporation of Earth observation data into agricultural technology platforms is enabling data-driven decisions at scale, thereby accelerating the expansion of the satellite data services market in this region.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) governs satellite communications through Title 47, Part 25 of the Code of Federal Regulations. It oversees licensing for satellite and earth stations, spectrum allocation, and orbital debris mitigation. The National Oceanic and Atmospheric Administration (NOAA) regulates commercial remote sensing satellite operations under the Land Remote Sensing Policy Act.

- The EU Space Programme (2021–2027) consolidates space governance under the European Union Agency for the Space Programme (EUSPA). It supports data services through Copernicus and ensures coordination with ESA. Regulations emphasize security, service continuity, and open data access while encouraging commercial innovation through standardized satellite operations across EU member states.

- The UK operates under the Space Industry Act 2018 and the Space Industry Regulations 2021, which provide a legal framework for spaceflight activities, satellite operations, and licensing procedures. The Civil Aviation Authority (CAA) manages licenses for orbital and suborbital launches, spaceports, and satellite operators, ensuring safety, environmental protection, and national security.

- Japan enforces the Act on Ensuring Appropriate Handling of Satellite Remote Sensing Data (Act No. 77 of 2016), which regulates commercial distribution and security of satellite imagery. The act requires licenses for data acquisition and defines standards for data sensitivity, ensuring government control over distribution while supporting private sector participation.

Competitive Landscape:

Market players are actively pursuing strategic partnerships with government organizations to deliver advanced and resilient Satellite Communications (SATCOM) solutions. These collaborations are aimed at addressing growing demand for secure, high-speed, and low-latency connectivity across defense and public sector operations.

By aligning with government requirements and integrating hybrid SATCOM technologies, companies are enhancing operational capabilities while reinforcing their presence in the defense communications space. This approach is contributing to the growth of the market by expanding the adoption of secure, real-time connectivity solutions in mission-critical environments.

- In April 2025, L3Harris Technologies formed a strategic partnership with Kuiper Government Solutions LLC (KGS), a subsidiary of Amazon.com, Inc., to provide advanced and resilient SATCOM solutions for government and defense applications globally. The alliance aims to develop hybrid SATCOM capabilities offering secure, high-speed, and low-latency connectivity worldwide.

List of Key Companies in Satellite Data Services Market:

- Maxar Technologies

- Planet Labs PBC

- Airbus

- ICEYE

- L3Harris Technologies, Inc.

- Earth-i Ltd.

- Geocento

- NV5 Global, Inc.

- Satellite Imaging Corporation

- Telstra Enterprise International

- Ursa Space Systems, Inc.

- Gisat s.r.o.

- BlackSky

- SATPALDA

- Trimble Inc.

Recent Developments (Partnerships/Product Launch)

- In April 2025, Airbus partnered with Amazon to strengthen its High Bandwidth Connectivity Plus (HBCplus) programme by incorporating high-speed, low-latency inflight connectivity (IFC) via Amazon’s low Earth orbit (LEO) satellite network, Project Kuiper. Under a newly signed Memorandum of Understanding, both companies plan to integrate Project Kuiper’s connectivity solution into Airbus' line-fit and retrofit catalogue offered through managed service providers.

- In March 2025, Arianespace successfully launched the Airbus-built CSO-3 (Composante Spatiale Optique) Earth observation satellite aboard Ariane 6’s inaugural commercial flight from the European Spaceport in Kourou. CSO-3 completes the three-satellite CSO constellation, delivering ultra-high-resolution geospatial intelligence to the French Armed Forces and its allied partners under the MUSIS programme (Multinational Space-based Imaging System for surveillance, reconnaissance, and observation).

- In March 2025, Planet Labs PBC showcased its first light images from its Pelican-2 satellite, capturing the Port of Laem Chabang in eastern Thailand. Pelican-2 delivers enhanced capacity, higher resolution, and reduced latency. Equipped with NVIDIA’s most advanced chip, it enables edge-based AI processing. This integration of AI capabilities with high-precision spatial data marks a significant advancement in commercial satellite imagery and signals the evolving potential of real-time geospatial intelligence in the coming years.

Project Kuiper,