Rubber Process Oil Market Size

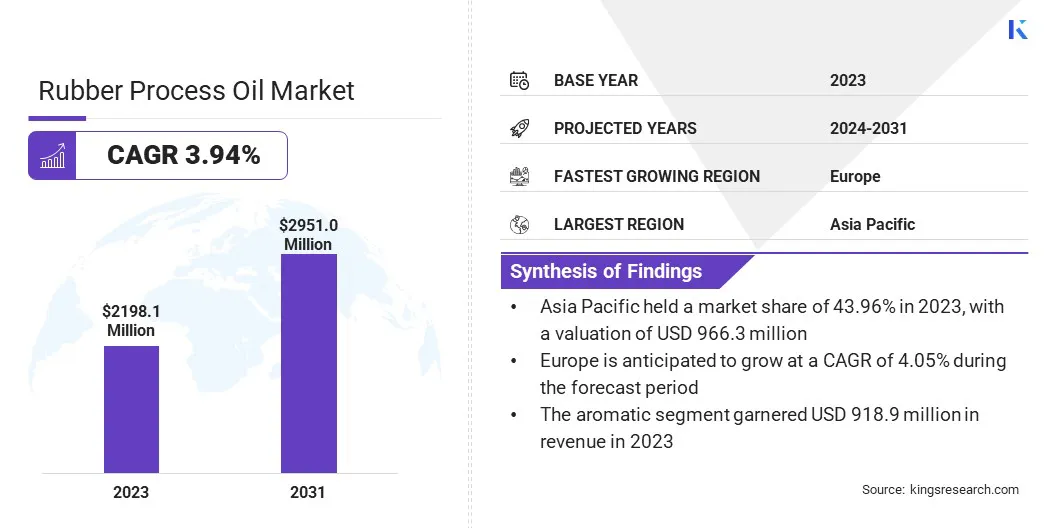

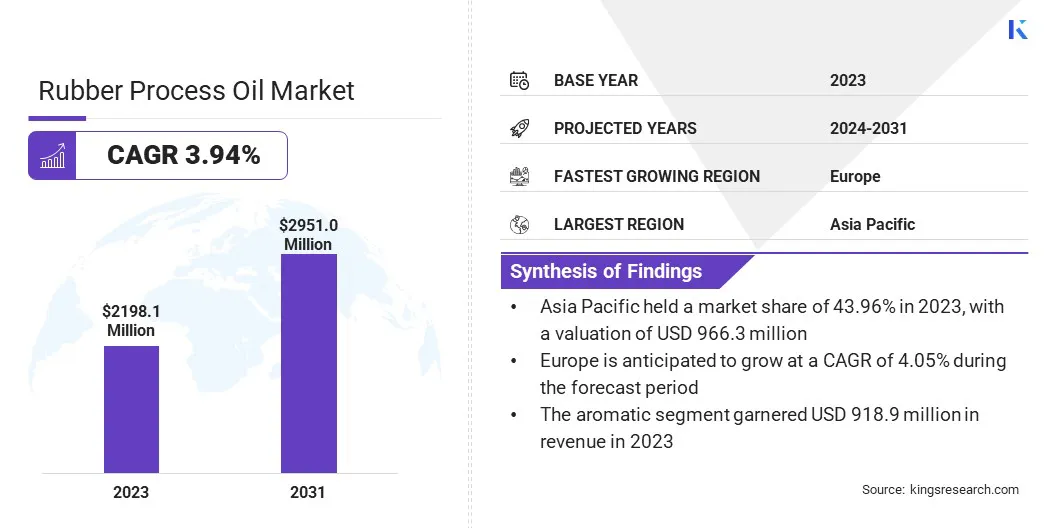

The global Rubber Process Oil Market size was valued at USD 2,198.1 million in 2023 and is projected to grow from USD 2,251.7 million in 2024 to USD 2,951.0 million by 2031, exhibiting a CAGR of 3.94% during the forecast period. The rising consumption of rubber-based consumer goods, such as footwear, sports equipment, and household items, has also fueled the demand for rubber process oil (RPO).

The flexibility, softness, and durability provided by RPO make it essential in the production of these goods. In the scope of work, the report includes products offered by companies such as Chevron Corporation, Panama Petrochem Ltd., Shell Plc, Apar Industries Ltd., Eagle Petrochem, Orgchim Biochemical Holding, Gandhar Oil Refinery Ltd., TotalEnergies, Hollyfrontier Refining & Marketing LLC, Behran Oil Company, and others.

Moreover, industrialization in emerging economies, particularly in Asia-Pacific and Latin America, has led to a high demand for industrial rubber products. The expansion of manufacturing facilities and the increasing need for efficient material handling solutions, including conveyor belts, have also propelled the rubber process oil market.

Rubber Process Oil (RPO) is a specialized oil used in the formulation and manufacturing of rubber products. These oils are integral in improving the processability, flexibility, and durability of rubber compounds, making them easier to handle during production. RPOs act as softening agents, enhancing the elasticity and reducing the viscosity of rubber, which facilitates molding, extrusion, and other processing methods.

They are widely used in the production of tires, hoses, seals, footwear, conveyor belts, and various industrial rubber goods. The choice of RPO depends on specific application requirements, such as temperature resistance, compatibility with rubber types, and environmental considerations.

Analyst’s Review

Companies in the Rubber Process Oil (RPO) market are capitalizing on the rapid industrialization in emerging economies by enhancing the quality and durability of essential rubber products. These companies are strategically focusing on integrating RPO into their manufacturing processes to meet the growing demand for high-performance rubber components in various industrial applications.

- According to the United Nations Industrial Development Organization, the industrial sectors experienced a 2.3% growth in 2023, reflecting a strong post-pandemic recovery across manufacturing, mining, utilities, and more. Manufacturing, in particular, drove this momentum with a notable 3.2% increase, underscoring its pivotal role in the industrial resurgence.

Countries across Asia-Pacific, Latin America, and Africa are experience significant economic growth, which is fueling manufacturing activities as well as infrastructure projects. This industrial boom is creating a substantial demand for rubber products like conveyor belts, seals, hoses, and gaskets, which are critical for modern industrial operations.

By incorporating RPOs, companies are ensuring that these products are flexible, durable, and capable of withstanding rigorous demands of industrial applications.

Rubber Process Oil Market Growth Factors

The increasing demand for rubber process oil within the automotive industry acts as a significant factor propelling its market growth. The rising global vehicle production, particularly of electric vehicles,is expected to drive the need for high-quality rubber components such as tires, seals, and hoses.

RPO enhances the flexibility, durability, and overall performance of these automotive products. The growth trajectory of the automotive sector, therefore, is directly reflecting in the expansion of the RPO market.

- According to a 2024 report by Our World in Data, global car sales reached 76.67 million units in 2023. This total comprised 62.87 million non-electric cars and 13.80 million electric vehicles.

The global surge in infrastructure development projects is significantly driving the growth of the rubber process oil market. Governments and private sectors are investing heavily in the construction and upgradeof roads, bridges, commercial buildings and industrial facilities, which is driving the demand for durable and high-performance rubber products.

Rubber process oils play a critical role in enhancing the quality and longevity of conveyor belts, gaskets, and seals. Additionally, governments worldwide are implementing policies to reduce carbon emissions and promote sustainable practices, which is driving the adoption of RPO formulations to meet these policy requirements.

Manufacturers are focused on developing low-emission, non-carcinogenic RPOs to comply with stricter environmental requirements and invest in greener alternatives.

- In November 2023, the U.S. government announced a USD 2 million investment in 150 federal building projects across 39 states, all utilizing materials designed to minimize carbon emissions. This initiative is part of the country's broader strategy to leverage government purchasing power in the fight against climate change. The administration has set ambitious goals, aiming for a net-zero emissions federal building portfolio by 2045 and achieving net-zero emissions in government procurement by 2050.

However, the growing focus on sustainability is leading industries to explore bio-based or synthetic rubber alternatives. This shift could potentially reduce the demand for rubber process oil, especially in regions with strong environmental awareness. To mitigate this challenge, companies are investing in research and development to create more sustainable RPO formulations that align with environmental standards.

Additionally, manufacturers are enhancing the performance and eco-friendliness of their RPO products to better compete with alternative materials. They are also focusing on strategic partnerships with green technology firms and recycling and upcycling processes to maintain market relevance and address environmental concerns.

Rubber Process Oil Market Trends

The rising demand for a wide range of consumer products, including footwear, sports equipment, household items, and electronic accessories is a significant trend driving the rubber process oil market growth. As manufacturers strive to meet these demands, they increasingly rely on advanced RPO formulations to enhance the functional properties of their products.

This growing application of RPO in consumer goods is expected to deliver value-added benefits across various product categories and support its market growth over the forecast period.

- According to a 2024 report by the World Trade Organization, the trade in sports goods and equipment has experienced remarkable growth, increasing threefold over the past 30 years. From 1996 to 2022, annual imports skyrocketed from USD 15 million to nearly USD 64 million. The footwear category stands out as the most traded segment, with global imports valued at USD 19.67 million.

Additionally, the demand for eco-friendly and non-carcinogenic oils has increased as industries seek to comply with stringent environmental regulations. This has led to the development and adoption of more sustainable RPO formulations, boosting market growth.

Furthermore, the growing emphasis on sustainable and high-performance materials has driven the demand for RPO to enhance the longevity and efficiency of rubber products. Companies are also investing in R&D to develop RPO that meets these evolving requirements, further supporting market growth.

Segmentation Analysis

The global market has been segmented based on type, application, and geography.

By Type

Based on type, the market has been segmented into aromatic, paraffinic, naphthenic, TDAE, and others. The aromatic segment led the rubber process oil market in 2023, reaching the valuation of USD 918.9 million due to its superior compatibility with a wide range of rubber types.

Aromatic RPOs are known for their excellent solubility, which enhances blending with rubber compounds andimproves flexibility, strength, and overall performance of end products. These oils also exhibit heat resistancein high-temperature environments, such as automotive tires and industrial rubber components.

The widespread use of aromatic RPOs across diverse industries, coupled with their ability to meet stringent performance standards, solidifies their dominance in the market.

By Application

Based on application, the market has been classified into tires & tubes, footwear, rubber compounding, belts & hoses, and others. The tires & tubes segment secured the largest revenue share of 58.52% in 2023 owing to the critical role RPO plays in enhancing the performance and durability of essential automotive components.

RPO is lused for manufacturing tires and tubes to improve the flexibility, elasticity, and overall processability of rubber compounds. This results in tires with better grip, longer tread life, and enhanced resistance to wear and tear, which ensures vehicle safety and performance.

Moreover, the global automotive industry’s steady growth, particularly in Asia-Pacific and Europe, drives significant demand for high-quality tires and tubes, further cementing this segment’s dominance in the RPO market.

Rubber Process Oil Market Regional Analysis

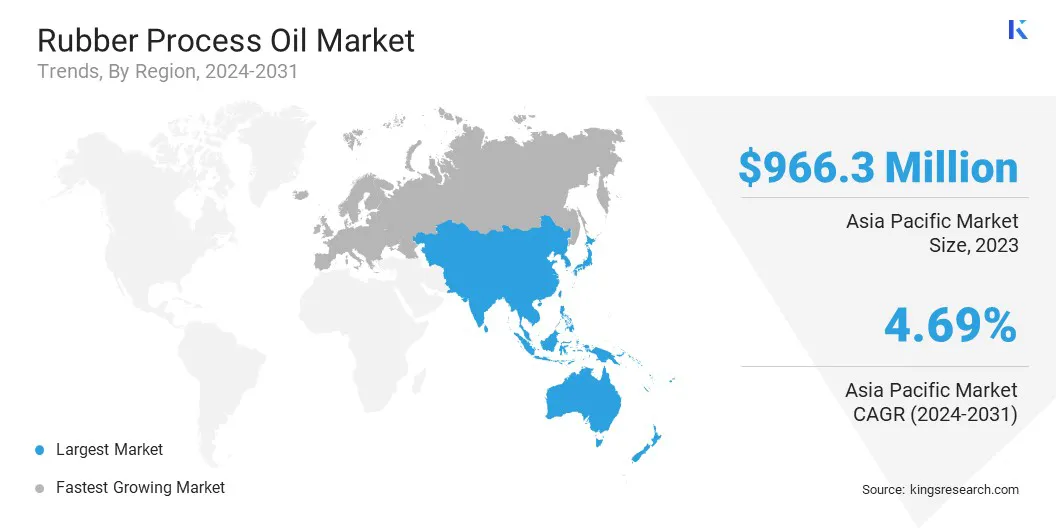

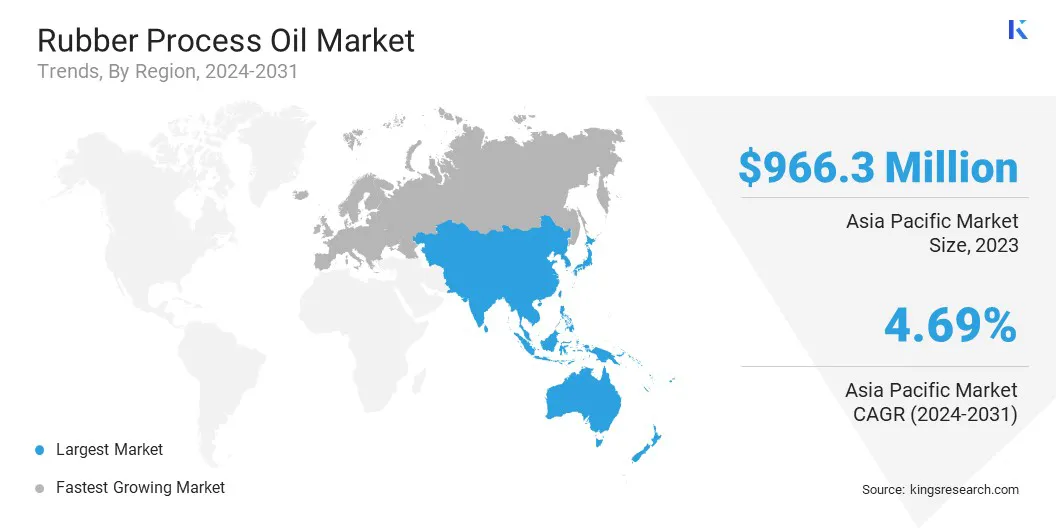

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific rubber process oil market share stood around 43.96% in 2023 in the global market, with a valuation of USD 966.3 million. Asia-Pacific is witnessing accelerated industrialization and urbanization, particularly in China, India, and Southeast Asian countries. This growth has fueled the demand for rubber products in manufacturing and automotive segments, increasing the need for RPO to enhance the performance and durability of these products.

Moreover, the Asia-Pacific region is experiencing a surge in large-scale infrastructure projects, including road construction, railways, and industrial facilities. These projects demand durable rubber materials like conveyor belts and gaskets.

Furthermore, several Asia-Pacific governments are spearheading major infrastructure initiatives and mega projects, such as China’s Belt and Road Initiative (BRI), India’s Smart Cities Mission, and various ASEAN infrastructure programs. Such developments involve the construction of vast transportation networks, bridges, tunnels, and urban developments, which is expected to further drive the demand for RPO in the region.

- For instance, in February 2023, construction commenced on a connectivity road between northern Vietnam's Hoa Binh and Hanoi, along with the Son La expressway, at a cost of over USD 75.6 million. The project, which spans approximately 50 kilometers, is a significant infrastructure development aimed at enhancing regional connectivity. The road is scheduled to be completed and open to traffic by 2027.

Europe is expected to witness significant growth at a CAGR of 4.05% over the forecast period. The increasing production of automotive vehicles in Europe is a significant factor driving the growth of the RPO market in the region. This growth reflects a high demand for high-quality rubber components, such as tires, seals, and hoses, in automotive manufacturing.

As the automotive industry continues to thrive and innovate, the need for advanced RPO formulations to enhance the performance and durability of these components remains a key driver for the Europe market.

- According to the European Automobile Manufacturers' Association in 2024, the EU car market saw a substantial growth of 13.9% in 2023, with total sales reaching 10.5 million units. Additionally, European car production experienced a notable increase, rising to nearly 15 million units, a significant year-on-year improvement of 12.6%.

The European Union's commitment to sustainability and renewable energy has led to significant investments in green infrastructure projects, such as wind farms, solar power plants, and sustainable urban developments. These projects often require high-quality rubber materials for various applications, which is likely to drive the demand for RPO for durability and material performance over the forecast period.

Competitive Landscape

The global rubber process oil market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across regions.

Strategies, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Rubber Process Oil Market

- Chevron Corporation

- Panama Petrochem Ltd

- Shell Plc

- Apar Industries Ltd.

- Eagle Petrochem

- Orgchim Biochemical Holding

- Gandhar Oil Refinery Ltd.

- TotalEnergies

- Hollyfrontier Refining & Marketing LLC

- Behran Oil Company.

Key Industry Development

- July 2024 (Acquisition): TotalEnergies acquired the Finnish rerefiner, Str Tecoil Oy, highlighting Big Oil's increasing focus on used lubricant recycling. This purchasewas aimed at enhancing the company’s ability to incorporate rerefined base oils into its finished lubricants.

The global rubber process oil market has been segmented as below:

By Type

- Aromatic

- Paraffinic

- Naphthenic

- TDAE (Treated Distillate Aromatic Extract)

- Others

By Application

- Tires & Tubes

- Footwear

- Rubber Compounding

- Belts & Hoses

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America