Gaskets Market Size

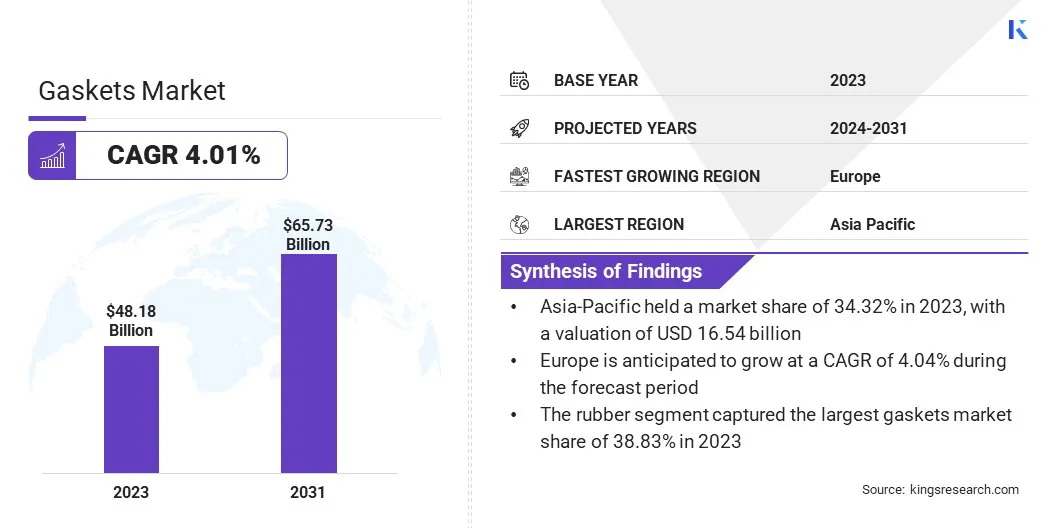

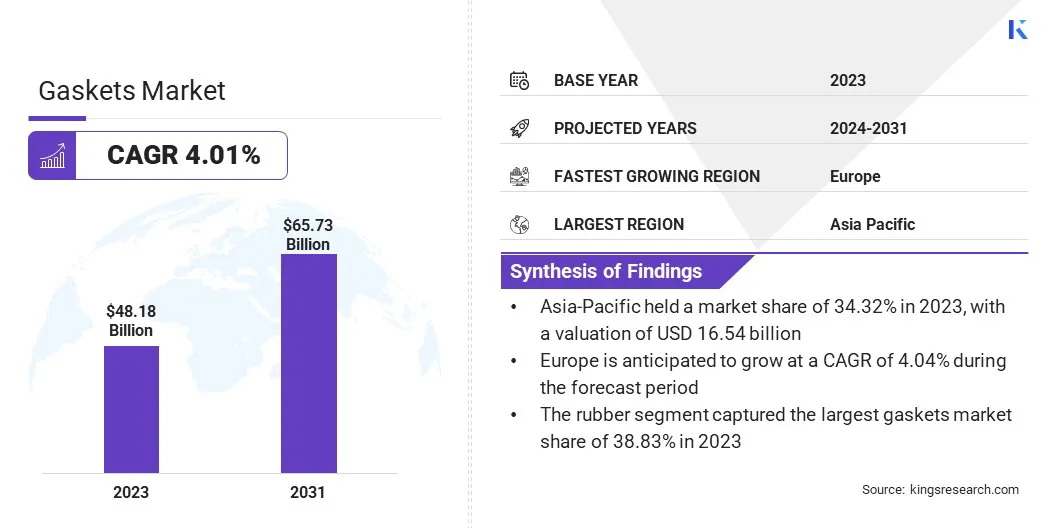

The global Gaskets Market size was valued at USD 48.18 billion in 2023 and is projected to grow from USD 49.91 billion in 2024 to USD 65.73 billion by 2031, exhibiting a CAGR of 4.01% during the forecast period. Increasing demand for high-performance gaskets and their growing use in electric vehicles are boosting product sales.

In the scope of work, the report includes products offered by companies such as Dana Limited, Freudenberg SE, ElringKlinger AG, Flexitallic Group, PARKER HANNIFIN CORP, ARMACELL, IDT GmbH, AB SKF, RAM Gaskets, Phelps Industrial Products, LLC, Trelleborg Group, and others.

The development of bio-based gaskets represents a significant opportunity in the gaskets market due to the growing demand for sustainable and eco-friendly products. These gaskets are manufactured using renewable materials, such as plant-based polymers, instead of traditional, petroleum-based synthetic materials.

The shift toward bio-based gaskets is supported by the increasing environmental concerns and stringent regulations aimed at reducing carbon footprints and toxic emissions. Major industries such as automotive, construction, and oil and gas are exploring bio-based alternatives to reach their sustainability goals and meet the demands of eco-conscious consumers.

- Mitsubishi Chemical Group’s plant-derived bioengineering plastic, DURABIO, secured two bio-based product certifications in Europe in December 2022. These certifications were awarded by DIN CERTCO, Germany, and NEN, the Netherlands, affirming DURABIO's compliance with European bio-based standards.

- Similarly, in October 2023, Avient Corporation's Stat-Tech TPEs demonstrated the advanced use of rubber materials in preventing electromagnetic and radio frequency interference. These elastomers, with resistivity from 100Ω to 10^10Ω, highlight the evolving role of rubber in critical electrical applications requiring both flexibility and conductive properties.

Bio-based gaskets reduce the environmental impact and demonstrate comparable performance to their conventional counterparts in terms of durability, temperature resistance, and chemical stability.

Additionally, as the technology behind bio-based materials advances, these gaskets will become more cost-competitive, which will drive their adoption. This trend presents manufacturers with the opportunity to differentiate themselves in a competitive market by offering innovative, sustainable sealing solutions that cater to the evolving needs of various industries.

Companies investing in research and development of bio-based gaskets are likely to gain a competitive edge, positioning themselves as leaders in the transition toward greener industrial practices.

Gaskets are essential sealing components designed to fill the space between two or more mating surfaces, preventing leakage of fluids or gases, even under extreme conditions. They are widely used across industries to ensure the integrity and safety of mechanical assemblies, particularly in environments where precision and reliability are critical. Gaskets are made from a variety of materials, each chosen on the basis of specific application requirements.

Common raw materials used to manufacture gaskets include rubber, silicone, metal, graphite, and more recently, advanced polymers and composites. The choice of material depends on factors such as temperature, pressure, chemical exposure, and mechanical load.

In the automotive industry, gaskets are crucial to ensure proper functioning of engines, transmissions, and exhaust systems by preventing leaks of oil, coolants, and gases. In the oil and gas industry, gaskets are used in pipelines and refineries to maintain the safe containment of hazardous substances.

Additionally, gaskets are integral in the operation of heavy machinery, electronics, and industrial equipment, where they prevent contamination and protect sensitive components. The versatility and reliability of gaskets make them indispensable in maintaining the efficiency, safety, and longevity of industrial systems.

Analyst’s Review

The gaskets market is witnessing robust growth, driven by technological advancements, expanding industrial applications, and an increasing focus on sustainability. Companies operating in this market are strategically focusing on innovation and product differentiation to stay competitive.

They are heavily investing in research and development to introduce advanced gaskets that offer improved performance, durability, and resistance to extreme conditions.

The shift toward bio-based and environmentally friendly gaskets is also a key area of focus, as companies aim to align with global sustainability trends and regulatory requirements. Current growth in the market is thereby supported by the expansion of key industries such as automotive, oil and gas, and renewable energy, all of which require reliable sealing solutions.

Companies are also adopting strategic partnerships, mergers, and acquisitions to strengthen their market position, expand their product portfolios, and enter new markets.

- In June 2023, Pipeotech engineered the DeltaV-Seal for Nitric Acid applications, particularly in fertilizer plants. Precision-made from 304L stainless steel, this new seal mirrors the design of Pipeotech’s existing gaskets. Its versatility allows manufacturing in materials compatible with the facility's pipework system.

Moreover, as the competition intensifies, companies are emphasizing cost-efficiency and supply chain optimization to maintain profitability while meeting the rising demand for high-quality gaskets. Major areas of focus for companies include staying ahead of technological trends, in terms of the integration of smart technologies and the development of custom-engineered gaskets that meet specific customer requirements.

Companies must navigate challenges related to raw material price volatility and ensure compliance with increasingly stringent environmental regulations. The success of companies in the global gaskets market will depend on their ability to innovate, adapt to changing market dynamics, and deliver solutions that address both current and future industrial needs.

What are the major factors affecting the market growth?

The rising demand from the automobile industry is a significant driver for the gaskets market, driven by the continuous growth and innovation within the automotive sector. Gaskets are crucial components in vehicles, ensuring the proper sealing of engines, transmissions, exhaust systems, and other critical parts.

As automakers increase their focus on improving fuel efficiency, reducing emissions, and enhancing vehicle performance, the need for high-quality, durable gaskets has intensified. The push toward electric and hybrid vehicles is further amplifying this demand, as these vehicles require specialized gaskets that can withstand unique thermal and mechanical stresses associated with electric powertrains.

- For instance, in 2023, according to the International Energy Agency, nearly 14 million new electric cars were registered worldwide, increasing the global total to 40 million. Electric car sales in 2023 exceeded 2022 figures by 3.5 million, marking a 35% year-on-year growth.

Additionally, the increasing adoption of advanced driver-assistance systems (ADAS) and other electronic features in modern vehicles necessitates the adoption of gaskets to protect sensitive components from environmental factors like moisture and dust.

The global automotive industry’s steady expansion, particularly in emerging markets such as China, India, and Southeast Asia, is thereby fueling the demand for gaskets.

As automotive production scales up to meet growing consumer demand, gasket manufacturers have the opportunity to capitalize on this trend by providing innovative solutions that cater to the evolving needs of the automotive sector with enhanced performance, durability, and sustainability.

Fluctuations in the prices of raw materials, such as rubber, metal, and advanced polymers, pose a significant challenge to the gaskets market, impacting the profitability and operational stability of manufacturers.

The market heavily relies on these materials, however, price volatility leads to increased production costs, making it difficult for companies to maintain competitive pricing without compromising on quality. This challenge is exacerbated by global supply chain disruptions, geopolitical tensions, and changes in trade policies, which thereby contribute to the unpredictability of raw material costs.

For instance, the rising cost of synthetic rubber, due to fluctuations in crude oil prices, directly affects the manufacturing costs of rubber gaskets. Mitigating this challenge requires companies to adopt strategies such as diversifying their supplier base to reduce dependency on a single source, implementing cost-effective production techniques, and exploring alternatives that offer similar performance at a lower cost.

Additionally, manufacturers consider long-term contracts with suppliers to lock in prices and hedge against future price fluctuations. These strategies, combined with continuous innovation in material science, help gasket manufacturers manage the impact of raw material price volatility and maintain their competitive edge in the market.

What are the major trends in this market?

The expansion of the oil and gas industry is a prominent trend driving growth in the global gaskets market. As global energy demand continues to rise, there is a significant increase in exploration and production activities, particularly in regions rich in natural resources. This expansion is fueling the demand for gaskets, which are critical components in ensuring the safety and efficiency of oil and gas operations.

Gaskets are extensively used in pipelines, refineries, drilling rigs, and other infrastructure to prevent leaks and ensure the containment of hazardous substances even under extreme pressures and temperatures.

The industry’s shift toward deepwater and ultra-deepwater exploration, as well as the development of unconventional fuel resources like shale gas, has further intensified the need for high-performance gaskets that can withstand harsh environments.

Additionally, the increasing adoption of advanced technologies in the oil and gas sector, such as enhanced oil recovery (EOR) techniques and digital oilfield solutions, requires specialized gaskets to maintain the integrity of equipment and systems.

Segmentation Analysis

The global market is segmented based on material, industry, end-use, and geography.

What is the market share of the rubber segment?

Based on material, the market is categorized into rubber, fiber, and metal. The rubber segment captured the largest gaskets market share of 38.83% in 2023, largely due to its versatility, cost-effectiveness, and extensive application across various industries.

Rubber gaskets are widely favored for their excellent sealing properties, flexibility, and resistance to a range of environmental factors, including temperature variations, chemical exposure, and mechanical stress. These characteristics make rubber an ideal material for gaskets used in diverse sectors such as automotive, oil and gas, and industrial machinery.

In the automotive industry, for instance, rubber gaskets are crucial for sealing engine components, transmissions, and exhaust systems, ensuring the efficient operation and longevity of vehicles. Moreover, the increasing demand for high-performance rubber gaskets in the oil and gas industry for use in pipelines and refineries to prevent leaks under extreme conditions, has bolstered the segment's dominance.

The cost-effectiveness of rubber, combined with its ability to be molded into various shapes and sizes, also contributes to its widespread adoption. Additionally, advancements in rubber compounding technologies have enhanced the material’s durability and resistance to degradation, solidifying its position as the preferred choice for gasket manufacturing.

How fast will the aerospace segment grow in this market?

Based on industry, the market is classified into automotive, aerospace, oil and gas, power generation, and others. The aerospace segment is anticipated to record a staggering CAGR of 4.68% over the forecast period, driven by several key factors that support the growing demand for gaskets in the aviation and aerospace industries.

As the global aerospace industry continues to expand, particularly with the resurgence of post-pandemic air travel and the increasing demand for military aircraft, the need for high-performance gaskets is intensifying. Gaskets play a critical role in ensuring the safety and reliability of aircraft by providing essential sealing solutions in engines, fuel systems, landing gear, and other critical components.

The aerospace industry's stringent safety and performance standards require gaskets that withstand extreme temperatures, high pressures, and exposure to aggressive chemicals, making them indispensable in aircraft manufacturing and maintenance.

Additionally, ongoing advancements in aerospace technology, including the development of next-generation aircraft with improved fuel efficiency and reduced emissions, are driving the demand for innovative gasket solutions that meet these new requirements.

The increasing adoption of lightweight materials in aircraft construction also necessitates the use of specialized gaskets that contribute to overall weight reduction without compromising safety.

Furthermore, the expansion of the space exploration sector, with growing investments in satellites and commercial space travel, is creating new opportunities for manufacturers to supply high-performance sealing solutions for these demanding applications.

How big is the OEM segment in the market?

Based on end-use, the market is divided into OEM and aftermarket. The OEM segment led the gaskets market in 2023, reaching a valuation of USD 29.96 billion, propelled by the rising demand from original equipment manufacturers (OEMs) across various industries, particularly automotive, aerospace, and industrial machinery.

OEMs are the primary consumers of gaskets, as they require high-quality, reliable sealing solutions that meet the stringent specifications and performance standards of their products.

The automotive industry, in particular, has been a major driver of OEM gasket sales, with automakers requiring precise, durable gaskets for engines, transmissions, and exhaust systems to ensure the optimal performance and longevity of their vehicles.

As global automotive production continues to rise, driven by both consumer demand and the shift toward electric vehicles, the demand for OEM gaskets has surged accordingly. In the aerospace sector, the need for specialized gaskets that withstand the extreme conditions encountered in-flight has also contributed to the OEM segment’s substantial revenue.

Furthermore, the ongoing trend of industrial automation and increasing complexity of machinery in manufacturing, oil and gas, and energy industries have amplified the demand for OEM gaskets, as these components are critical to maintaining the efficiency and safety of equipment.

The preference for OEM gaskets is also driven by the assurance of quality and compatibility with original equipment, reducing the risk of failures and ensuring compliance with industry regulations.

What is the market scenario in Asia-Pacific and Europe region?

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific gaskets market accounted for the highest share of 34.32% of the global market and was valued at USD 16.54 billion in 2023. This significant market share is largely driven by the rapid industrialization and urbanization across key economies such as China, India, Japan, and South Korea.

The booming automotive industry in these countries, particularly in China and India, has fueled the demand for gaskets, as these components are essential for ensuring the efficiency and reliability of vehicles.

- In 2023, India had aimed to target doubling its auto industry size to USD 180 billion by 2024. Two-wheelers and passenger cars dominated the Indian automobile market, holding 75.3% and 17.6% market shares, respectively, with small and midsized cars leading passenger car sales.

Additionally, the expanding oil and gas sector, coupled with the growth of manufacturing industries, has bolstered the demand for gaskets in the region. Moreover, the Asia-Pacific region is witnessing substantial investments in infrastructure development, which has led to increased demand for gaskets in construction equipment and machinery.

The presence of a large number of gasket manufacturers, along with the availability of raw materials at competitive prices, has also contributed to Asia-Pacific’s leading position. Furthermore, the rising focus on sustainability and the adoption of advanced manufacturing technologies are expected to drive innovation in gasket materials and designs.

Europe is poised to grow at a CAGR of 4.04% in the coming years, driven by the region’s robust industrial base and the increasing adoption of advanced technologies across various sectors.

The European market is benefiting from the well-established automotive and aerospace industries, which are key consumers of gaskets. The region's focus on innovation and sustainability has led to the development of high-performance gaskets that meet stringent environmental and safety regulations.

Additionally, the growing demand for electric vehicles (EVs) in Europe, propelled by government incentives and stringent emissions standards, is driving the need for specialized gaskets that cater to the unique requirements of EV powertrains and battery systems.

The aerospace industry in Europe, known for its advanced manufacturing capabilities, is also contributing to the market’s growth, with increasing investments in aircraft production and maintenance.

Furthermore, Europe’s commitment to renewable energy and the expansion of the wind and solar power energy sectors are creating new opportunities for gasket manufacturers as these industries require reliable sealing solutions for turbines, generators, and other equipment.

Europe continues to prioritize sustainability, technological innovation, and industrial growth, the gaskets market in the region is expected to experience steady and substantial expansion over the forecast period.

Competitive Landscape

The global gaskets market report provides valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market share across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Gaskets Market

Key Industry Developments

- June 2024 (Launch): Flexitallic unveiled the RIGFLEX RJ and FP series of reverse integrity testing gaskets. These gaskets feature a high-pressure welded test pipe and threaded connection port, enabling direct evaluation of connection integrity by monitoring pressure within the annulus between flange faces.

- August 2023 (Product Launch): ElringKlinger AG introduced the VolumesoftSeal hot gas gaskets, incorporating mica and graphite-based volume sealing rings. These gaskets deliver exceptional performance and thermal stability, specifically designed for use in commercial and light vehicles.

The global gaskets market is segmented:

By Material

By Industry

- Automotive

- Aerospace

- Oil and Gas

- Power Generation

- Others

By End-Use

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America