Market Definition

The market encompasses the development, deployment, and utilization of an open-source software framework designed to facilitate the creation and control of robotic systems.

This market includes a comprehensive suite of tools, libraries, and services that provide critical functionalities such as hardware abstraction, inter-process communication, and algorithmic processing, enabling the development of sophisticated robotic applications.

Robot Operating System Market Overview

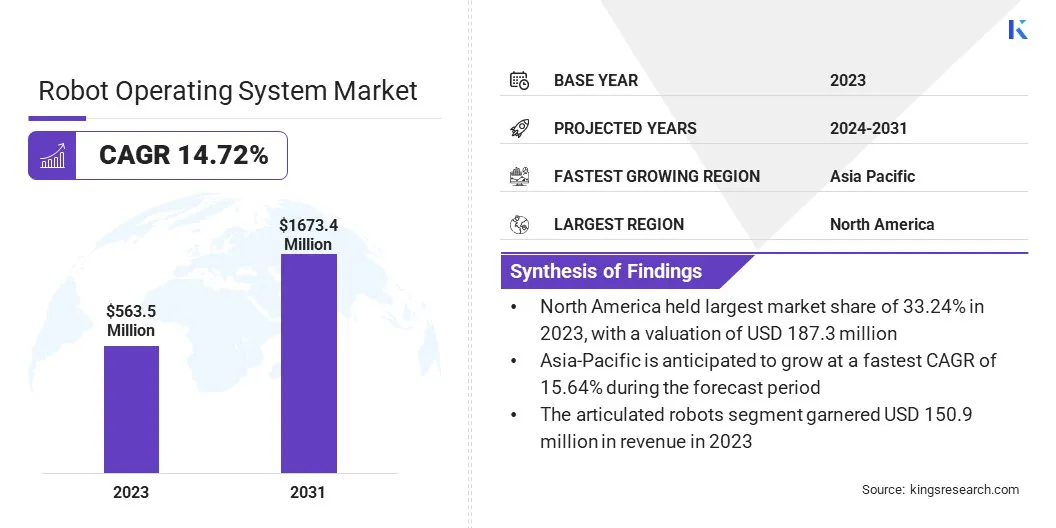

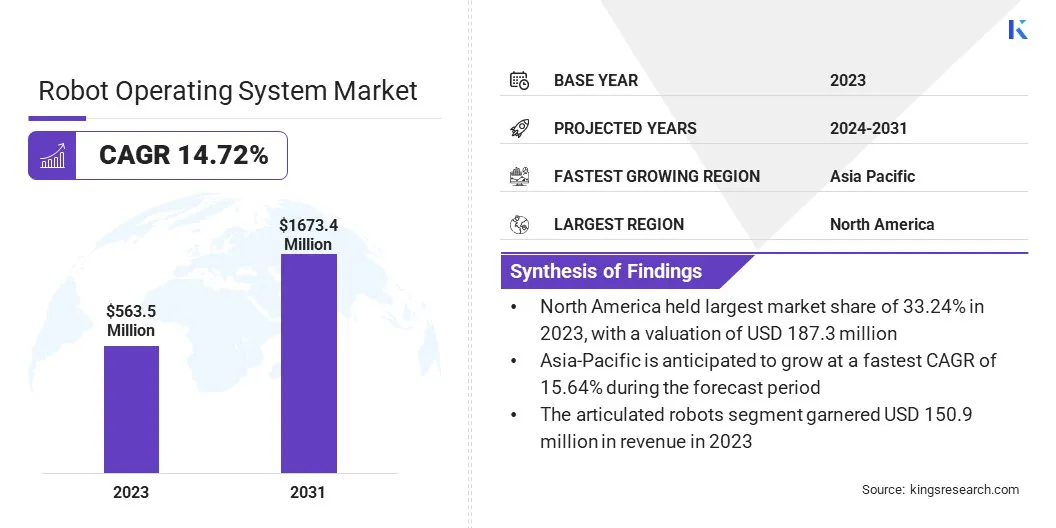

The global robot operating system market size was valued at USD 563.5 million in 2023 and is projected to grow from USD 639.8 million in 2024 to USD 1673.4 million by 2031, exhibiting a CAGR of 14.72% during the forecast period.

This growth is fueled by the increasing adoption of robotics and automation technologies across various industries, including manufacturing, healthcare, logistics, and defense.

Major companies operating in the robot operating system industry are ABB, Rockwell Automation, Inc., KUKA AG, iRobot Corporation, Universal Robots A/S, Cyberbotics Ltd, Husarion Sp. z o.o., Microsoft Corporation, Neobotix GmbH, Wind River Systems, Inc., Stanley Innovation, Inc., TOSHIBA CORPORATION, ROBOTIS, Comau S.p.A., and ROBOTEON.

The demand for advanced, flexible, and cost-effective solutions to support the development of autonomous systems, such as industrial robots, drones, and autonomous vehicles, is fueling the market.

The ongoing evolution of Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) technologies is expected to further accelerate the adoption of Robot Operating System (ROS), enabling more intelligent and efficient robotic applications.

- In November 2024, Wandelbots introduced NOVA, the world’s first agnostic operating system designed specifically for industrial robotic automation. With NOVA, the company paves the way for a new era of automation, establishing higher standards for efficiency, accessibility, and innovation.

Key Highlights

- The robot operating system industry size was valued at USD 563.5 million in 2023.

- The market is projected to grow at a CAGR of 14.72% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 187.3 million.

- The articulated robots segment garnered USD 150.9 million in revenue in 2023.

- The pick & place segment is expected to reach USD 267.7 million by 2031.

- The metal & machinery segment is anticipated to register the fastest CAGR of 14.88% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 15.64% during the forecast period.

Market Driver

Advancements in Robotics Technologies

Advancements in robotics technologies, such as AI, ML, computer vision, and sensor innovations, are contributing to the growth of the robot operating system market. These technologies enable robots to adapt to their environments, improve performance, and make adjustments to their actions, enhancing efficiency and reliability.

Developments in computer vision have improved the ability of robots to perceive and navigate their surroundings with greater accuracy, which is important for tasks like object recognition, autonomous navigation, and real-time problem-solving.

Innovations in sensors and actuators have also improved the precision, mobility, and safety of robotic systems, allowing them to function in more varied and unstructured environments.

- In June 2024, NVIDIA revealed that several of the world’s top companies in robotics are adopting the NVIDIA Isaac robotics platform for the research, development, and production of next-generation AI-powered autonomous machines and robots

Market Challenge

Complexity of Integration

The complexity of integration is one of the primary challenges in the robot operating system market. ROS provides a flexible and robust framework for developing robotic applications, incorporating it into existing systems can be technically challenging.

Adapting ROS to work with proprietary hardware, various software components, or legacy systems often requires significant customization and expertise. The modular design of ROS allows for flexibility; however, it can also lead to compatibility issues when different hardware or software modules do not integrate smoothly.

This integration complexity can slow down development, increase costs, and limit scalability, particularly for organizations with limited resources or robotics expertise.

Leveraging the expanding ecosystem of pre-built ROS solutions, libraries, and frameworks can simplify integration with specific hardware and applications. Adopting ROS 2, which offers enhanced real-time capabilities, better security, and more robust communication protocols, can further ease integration with modern systems.

Collaborating with experienced developers or consulting firms specializing in ROS can help mitigate technical difficulties and reduce the learning curve. Investing in training programs to build in-house expertise will also enable teams to handle integration challenges more effectively.

Market Trend

Transition to ROS 2

Transition to ROS 2 is a significant trend in the robot operating system market, as it brings critical advancements over its predecessor ROS 1. ROS 2 addresses key limitations such as real-time capabilities, enhanced security, and improved scalability, making it suitable for a wider range of industrial, automotive, and mission-critical applications.

ROS 2 features improved communication protocols that enable more efficient data exchange between processes, reduced latency, and better support for multi-robot systems. It offers broader compatibility with modern operating systems and better integration with cloud computing and edge computing platforms, making it a more versatile and future-proof solution for advanced robotics.

- In November 2023, Acceleration Robotics announced the release of ROBOTCORE ROS 2 and ROBOTCORE RTPS marking a significant milestone in robotics networking. This innovative technology, prototyped with an FPGA, allows robots to exchange information in less than 2.5 microseconds, enabling ultra-fast communication.

Robot Operating System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Articulated Robots, Cartesian Robotics, Collaborative Robots, SCARA Robots, Others

|

|

By Application

|

Pick & Place, Plastic Injection & Blow Molding, Testing and Quality Inspection, Metal Sampling & Press Trending, End of Line Packaging, Mapping & Navigation, Inventory Management, Home Automation & Security, Personal Assistance

|

|

By End Use

|

Automotive, Electrical & Electronics, Metal & Machinery, Chemicals, Food & Beverages, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Articulated Robots, Cartesian Robotics, Collaborative Robots, SCARA Robots, Others): The articulated robots segment earned USD 150.9 million in 2023, due to their widespread adoption in manufacturing and automation for tasks requiring high flexibility and precision.

- By Application (Pick & Place, Plastic Injection & Blow Molding, Testing and Quality Inspection, Metal Sampling & Press Trending, End of Line Packaging, Mapping & Navigation, Inventory Management, Home Automation & Security, Personal Assistance): The pick & place segment held 16.36% share of the market in 2023, due to its widespread use in manufacturing and logistics for enhancing efficiency in product handling, assembly, and packaging operations.

- By End Use (Automotive, Electrical & Electronics, Metal & Machinery, Chemicals, Food & Beverages, Healthcare, Others): The automotive segment is projected to reach USD 411.0 million by 2031, owing to the increasing adoption of robotics for automation in assembly lines and precision manufacturing, and the growing demand for autonomous vehicles.

Robot Operating System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 33.24% share of the robot operating system market in 2023, with a valuation of USD 187.3 million. This dominance is reinforced by the region's strong focus on technological innovation, industrial automation, robust R&D activities, and significant investments in robotics and AI.

Industries such as automotive, healthcare, and manufacturing in the U.S. and Canada are increasingly adopting ROS-based solutions to enhance operational efficiency, reduce costs, and improve production capabilities.

The region's advanced infrastructure, coupled with supportive government initiatives promoting the development and deployment of robotics technologies, is further fueling the robot operating systems market in North America.

The robot operating system market in Asia Pacific is poised for significant growth at a robust CAGR of 15.64% over the forecast period. This growth is fueled by rapid industrialization, increased automation in manufacturing, and the expanding adoption of robotics in emerging economies such as China, Japan, and India.

The region's growing focus on smart manufacturing and the adoption of Industry 4.0 technologies are fueling the demand for advanced robotics solutions, particularly in sectors like automotive, electronics, and logistics.

The rising investments in research and development, along with the increasing presence of local robotics startups, are contributing to the accelerating market growth in the region.

- In October 2024, LG Electronics showcased its Self-driving AI Home Hub and open Software Development Kit (SDK) at ROSCon 2024, the robot operating system conference in Odense, Denmark. The SDK package offers developers access to a range of Open APIs and programming tools, allowing for greater control over the Self-driving AI Home Hub and smooth integration of its software through ROS 2 and the SDK.

Regulatory Frameworks

- The International Organization for Standardization (ISO) regulates the safety of industrial robots through the ISO 10218 standard, which specifies safety requirements for the design, construction, and operation of robotic systems to protect operators and personnel in industrial settings.

- The U.S. Food and Drug Administration (FDA) regulates medical device quality management systems through 21 CFR Part 820, which sets requirements for the design, production, and distribution of medical devices, including robotics used in healthcare.

- The European Union (EU) regulates the essential health and safety requirements for machinery through the Directive 2006/42/EC of the European Parliament to ensure the protection of workers and safe operation of machinery within the EU.

Competitive Landscape

Open-source frameworks are widely used in research and industries. They offer flexibility and modularity, with newer versions supporting real-time operations and security. Real-time operating systems focus on high reliability and performance for safety-critical applications, while simulation platforms provide virtual environments for testing.

The shift toward ROS 2 has further strengthened its position, providing improved real-time capabilities, security, and multi-robot support, making it suitable for more complex industrial and commercial applications. Cloud-based systems offer scalable development and deployment, integrating ML and analytics.

- In October 2024, Clearpath Robotics, a part of Rockwell Automation, introduced the Husky A300, the next-generation version of its flagship rugged mobile robotic platform. The Husky A300 delivers enhanced performance, durability, and flexibility, enabling robotics researchers and innovators to address complex challenges in challenging environments.

List of Key Companies in Robot Operating System Market:

- ABB

- Rockwell Automation, Inc.

- KUKA AG

- iRobot Corporation

- Universal Robots A/S

- Cyberbotics Ltd

- Husarion Sp. z o.o.

- Microsoft Corporation

- Neobotix GmbH

- Wind River Systems, Inc.

- Stanley Innovation, Inc.

- TOSHIBA CORPORATION

- ROBOTIS

- Comau S.p.A.

- ROBOTEON

Recent Developments (M&A/Partnerships/Agreements/Product Launch)

- In October 2024, Comau announced its continued support for ROS within its Intrinsic platform. This integration aims to enhance the flexibility and scalability of industrial robots by enabling seamless communication and control.

- In May 2024, XTEND, the developer of XOS, announced the completion of its $40M Series B round, led by Chartered Group, with additional participation from both existing and new strategic investors, including Clal-Tech.

- In October 2023, Idealworks, a BMW Group subsidiary, announced that it gained Agile Robots AG as its majority shareholder. This strategic partnership aims to enhance the capabilities of Idealworks in developing agile, flexible robotics solutions for warehouse automation.