Market Definition

The market encompases technologies and solutions that allow homeowners to store excess energy, typically from renewable sources, such as solar power, for later use. The report outlines the major factors driving the market, along with key drivers and the competitive landscape shaping the growth trajectory over the forecast period.

Residential Energy Storage Market Overview

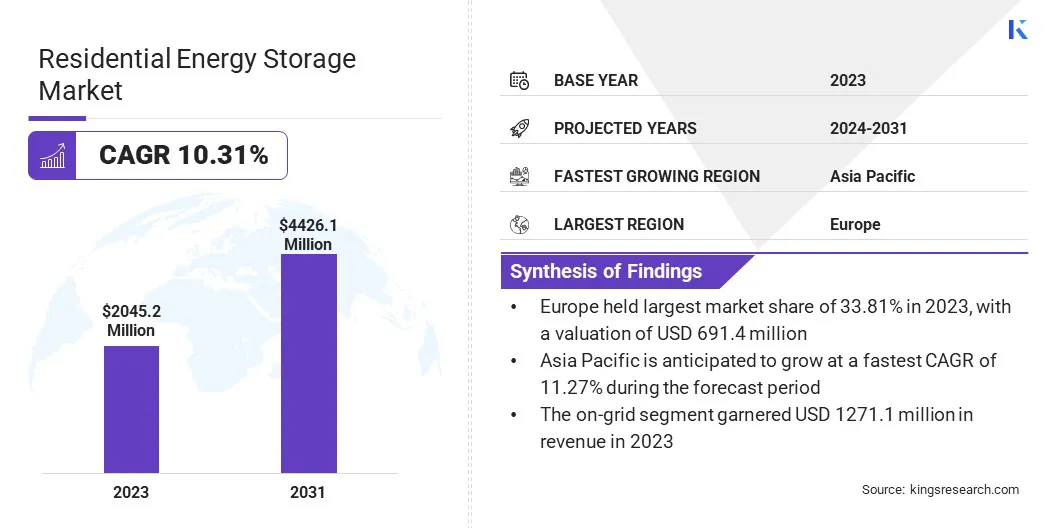

Global residential energy storage market size was USD 2045.2 million in 2023, which is estimated to be valued at USD 2227.4 million in 2024 and reach USD 4426.1 million by 2031, growing at a CAGR of 10.31% from 2024 to 2031.

The rising demand for renewable energy, particularly solar power, is hignlighting the need for energy storage solutions to ensure a stable supply during non-generation periods.

Major companies operating in the residential energy storage industry are Tesla, Panasonic Corporation, BYD Company Limited, Enphase Energy, sonnen, Inc., VARTA AG, Delta Electronics, Inc., Huawei Technologies Co., Ltd., Eaton, SMA Solar Technology AG, LG Electronics, PYTES Energy, Dyness Digital Energy Technology Co., Ltd., BST POWER, SUNGROW, and others.

The market is expanding rapidly, fueled by demand in rural and remote areas with limited grid access. Off-grid communities are increasingly adopting energy storage solutions to store renewable energy, ensuring a stable and independent energy supply.

This shift presents a significant market opportunity as these regions seek sustainable and cost-effective alternatives to unreliable grid systems.

- In June 2024, data from the International Energy Agency (IEA), International Renewable Energy Agency (IRENA), United Nations Statistics Division (UNSD), World Bank, and World Health Organization (WHO) indicate that 685 million people remain without electricity access. This highlights a notable demand for residential energy storage to provide decentralized renewable energy solutions, particularly in rural and remote areas.

Key Highlights:

- The residential energy storage industry size was recorded at USD 2045.2 million in 2023.

- The market is projected to grow at a CAGR of 10.31% from 2024 to 2031.

- Europe held a market share of 33.81% in 2023, with a valuation of USD 4 million.

- The lithium-ion batteries segment garnered USD 786.4 million in revenue in 2023.

- The on-grid segment is expected to reach USD 2724.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 11.27% during the forecast period.

Market Driver

Rising Demand for Renewable Energy

With the rising adoption of renewable energy, particularly solar power, the demand for efficient storage of excess energy generated during the day is increasing. This is contributing significantly to the expansion of the market.

- According to a January 2025 report the Press Information Bureau (PIB) article, India’s renewable energy sector experienced remarkable growth in 2024, with 24.5 GW of solar and 3.4 GW of wind capacity added. As of January 2025, the country’s non-fossil fuel-based energy capacity stands at 217.62 GW, advancing toward its 500 GW target by 2030.

Solar energy production peaks during the day, while consumption often rises in the evening or night. Energy storage solutions, such as residential batteries, address this gap by ensuring a stable and reliable power supply. The growing demand for energy storage enhances energy independence and grid stability to the grid.

- In September 2024, Dyness launched the upgraded Powerbox G2, a cutting-edge residential energy storage solution. Designed for low-voltage applications, it offers enhanced efficiency, improved safety features, and intelligent design to meet the growing demand for reliable and sustainable energy storage.

Market Challenge

Space Requirements

A key challenge impeding the growth of the residential energy storage market is the considerable space required for installation, particularly in smaller homes with limited room. This can hinder the adoption of energy storage solutions, particularly in urban areas where space is at a premium.

To address this, manufacturers can develop compact, high-performance systems that optimize size and weight of the units, enhancing feasibility for space-constrained homeowners.

Market Trend

Vehicle-to-Grid (V2G) Technologies

The growing adoption of vehicle-to-grid (V2G) technology is emerging as a notable trend in the market as electric vehicles (EVs) as EVs serve as mobile energy storage solutions.

This innovation allows EVs to store excess energy generated from renewable sources and supply it back to the grid when needed, enhancing grid stability. As EV adoption grows, V2G is becoming integral part of energy management, enhancing energy security, optimizing usage, and enabling a more sustainable and reliable power grid.

- In October 2024, Nissan announced plans to introduce affordable vehicle-to-grid (V2G) technology by 2026, enabling electric vehicles to store and supply energy to the grid. This innovation aims to support the transition to net-zero emissions and lower electricity costs.

Residential Energy Storage Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Lithium-ion Batteries, Lead-acid Batteries, Others

|

|

By Connectivity

|

On-Grid, Off-Grid

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Lithium-ion Batteries, Lead-acid Batteries, and Others): The lithium-ion batteries segment earned USD 786.4 million in 2023, mainly fueled by high efficiency, longevity, and growing consumer demand for renewable energy solutions.

- By Connectivity (On-Grid and Off-Grid): The on-grid segment held a share of 62.15% in 2023, attribited to cost-effectiveness and seamless integration with existing grid infrastructure for reliable energy supply.

Residential Energy Storage Market Regional Analysis

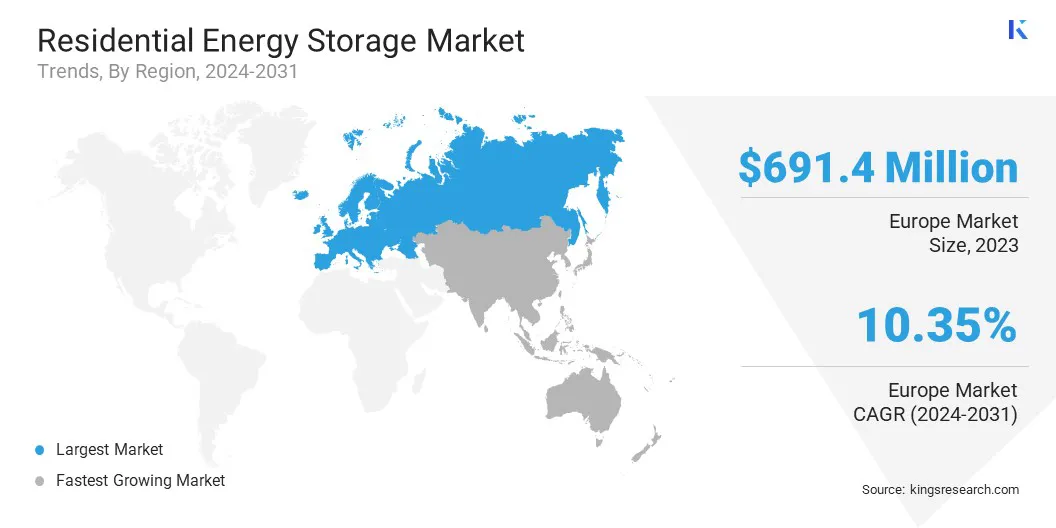

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Europe residential energy storage market share stood at around 33.81% in 2023, valued at USD 691.4 million. This dominance is reinforced by a strong commitment to sustainability and energy independence. With rising electricity costs and increasing demand for clean energy, homeowners across Europe are turning to advanced solar and battery storage solutions.

Government incentives, strict environmental regulations, and technological innovations further accelerate this adoption, positioning Europe as a key region in the global transition to efficient and resilient energy solutions.

- In November 2024, Enphase Energy launched its advanced Energy System in Romania, featuring the IQ Battery 5P and IQ8 Microinverters. This new system enhances energy efficiency, providing Romanian homeowners with improved solar storage solutions, energy independence, and seamless performance monitoring.

Asia Pacific residential energy storage industry is set to grow at a robust CAGR of 11.27% over the forecast period. This rapid growth is propelled by rising demand for reliable, clean energy solutions. As more households seek energy independence and resilience against grid outages, the region has seen increased adoption of advanced energy storage systems.

Growing awareness of environmental concerns, coupled with supportive government policies and technological advancements, has fueled the expansion of residential solar and battery systems. This trend is expected to continue, accelerating regional market growth in the coming years.

- In September 2024, Enphase Energy launched its most advanced Energy System in India, featuring the IQ Battery 5P and IQ8 Microinverters. This system provides reliable backup power, enhances energy independence, and supports the country’s transition to clean energy solutions.

Regulatory Frameworks

- In the US, solar manufacturers can leverage two federal tax credits: the 45X MPTC for domestic clean energy component production and the 48C ITC for investments in clean energy manufacturing facilities.

- In India, the PM Surya Ghar: Muft Bijli Yojana aims to provide free electricity to 10 million households by 2027 through subsidies for rooftop solar installations, enhancing energy independence .

- In the EU, the Renewable Energy Directive establishes renewable energy targets, fosters cooperation among member states, and emphasizes energy storage systems, including solar, wind, and battery storage, to support the energy transition.

Competitive Landscape

Companies operating in the residential energy storage industry are focusing on developing integrated, flexible systems that enhance energy resilience and efficiency.

They are innovating with smart technologies to improve load management, extend battery life, and enable seamless transitions to backup power during outages. These advancements aim to simplify installations, reduce costs, and boost the adoption of renewable energy solutions in homes.

- In September 2024, Eaton introduced the AbleEdge home energy management system to streamline residential solar and energy storage installations. The system features smart breakers and microgrid interconnects, enabling scalable, safe, and flexible energy solutions for homes, enhancing energy resilience.

List of Key Companies in Residential Energy Storage Market:

- Tesla

- Panasonic Corporation

- BYD Company Limited

- Enphase Energy

- sonnen, Inc.

- VARTA AG

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- Eaton

- SMA Solar Technology AG

- LG Electronics

- PYTES Energy

- Dyness Digital Energy Technology Co., Ltd.

- BST POWER

- SUNGROW

Recent Developments (Expansion/New Product Launch)

- In March 2025, BYD Energy Storage introduced its new Battery-Box HVE system with Power-Box inverters, offering flexible and modular solutions for residential energy storage. Designed for both new and existing installations, it offers scalable energy management and backup capabilities, with availability in European markets from June 2025.

- In February 2025, Enphase Energy expanded its IQ Battery 5P solution for new home projects in California. Supporting both single-phase and split-phase systems, the modular battery complies with California Title 24 regulations, enhancing solar storage efficiency.

- In May 2023, sonnen expanded production of its smart home energy storage systems in Wildpoldsried, Germany, doubling outputto 120,000 units annually to meet growing demand and support the energy transition.