Reprocessed Medical Devices Market Size

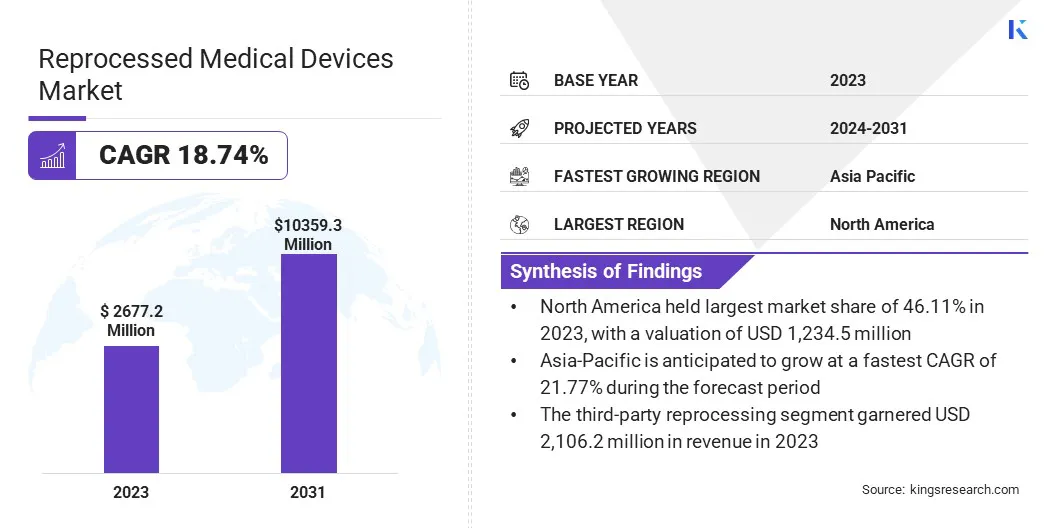

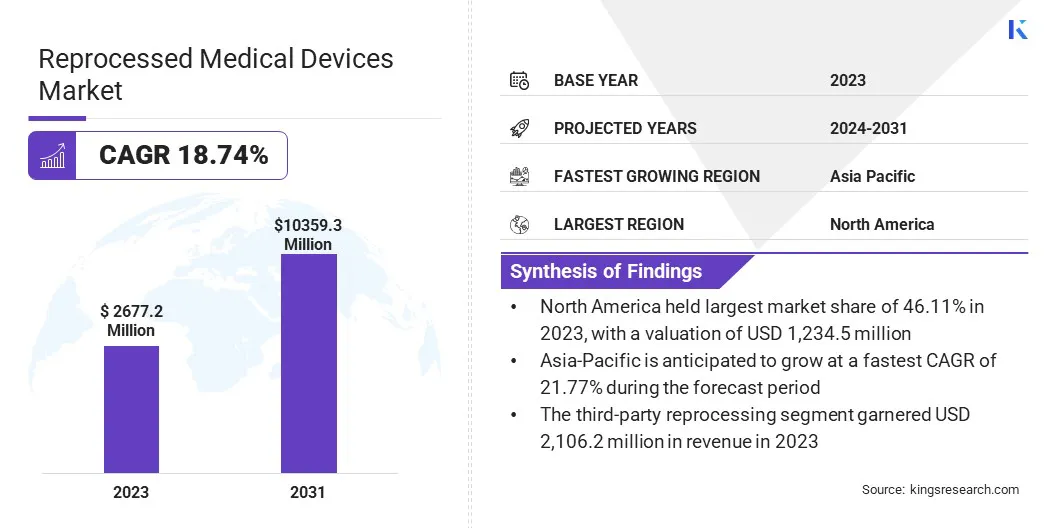

The global reprocessed medical devices market size was valued at USD 2,677.2 million in 2023 and is projected to grow from USD 3,112.1 million in 2024 to USD 10,359.3 million by 2031, exhibiting a CAGR of 18.74% over the forecast period.

The cost-effectiveness of reprocessed medical devices is contributing significantly to this growth, as they are considerabley more affordable than new devices. This allows healthcare providers, particularly in resource-limited settings, to reduce expenses while maintaining quality care and improving patient access to essential medical equipment.

In the scope of work, the report includes products offered by companies such as Stryker, INNOVATIVE HEALTH, NEScientific, Inc., Medline Industries, LP, Arjo, Vanguard AG, SureTek Medical, Medical Device Business Services, Inc. (Johnson & Johnson Services, Inc.), STERIS, MEDSALV AUSTRALIA PTY LTD, and others.

The reprocessed medical devices industry is a dynamic and evolving sector within healthcare, focused on providing cost-effective, sustainable alternatives to single-use devices. The market is characterized by its increasing acceptance among healthcare providers seeking to manage expenses without compromising patient care quality.

It operates within a highly regulated framework, ensuring safety and effectiveness. As the demand for affordable healthcare solutions rises, the market continues to grow, serving as a valuable resource for healthcare systems worldwide.

- The Food & Drug Administration (FDA) continue to regulate reprocessed single-use devices (SUDs) to ensure safety and effectiveness. Reprocessors must submit validation testing, comply with cleaning, sterilization, and performance standards, and adhere to labeling and postmarket requirements. This ensures reprocessed SUDs meet the same safety standards as original devices.

The reprocessed medical devices market involves the reuse of single-use medical devices that have been cleaned, sterilized, and refurbished for safe use in healthcare settings. This market focuses on ensuring that reprocessed devices maintain the same safety, quality, and performance standards as new devices through rigorous regulatory compliance and validation processes.

Reprocessing involves specialized procedures carried out by third-party reprocessors or healthcare facilities, ensuring that these devices are safe for reuse. It serves as a cost-effective alternative to purchasing new devices while contributing to sustainability efforts by reducing medical waste and resource consumption.

Analyst’s Review

As global healthcare costs rise, hospitals are increasingly adopting reprocessed medical devices to balance affordability with quality care. Reprocessed devices offer a cost-effective alternative to expensive single-use products, enabling healthcare providers to reduce expenses while maintaining patient safety.

- As per the American Hospital Association's May 2024 report, rising operational costs, with labor expenses accounting for nearly 60% of hospital spending, are putting significant financial pressure on healthcare systems. This makes reprocessed medical devices an increasingly attractive, cost-effective solution to help reduce overall expenditures while maintaining quality care.

Companies are focusing on strict compliance with regulatory standards, implementing advanced reprocessing technologies, and establishing partnerships with healthcare institutions. These strategies ensure the reliability and safety of reprocessed devices, positioning them as a viable solution in response to rising healthcare costs and growing demand for sustainable practices.

- In July 2024, Innovative Health, Inc. partnered with MC Healthcare to help hospitals in Japan reduce their environmental impact by collecting used single-use devices for reprocessing in the U.S. This collaboration allows U.S. hospitals to increase savings while promoting sustainable reprocessing practices in Japan.

Reprocessed Medical Devices Market Growth Factors

Cost-efficiency is a major factor contributing to the growth of the reprocessed medical devices industry, offering significant savings compared to their single-use counterparts. With healthcare providers facing increasing financial pressures, particularly in resource-constrained environments, reprocessed devices provide a cost-effective solution without compromising quality or patient safety.

This affordability allows hospitals and clinics to optimize budgets, making reprocessed medical devices an attractive option for maintaining care standards while controlling operational expenses, thus boosting their adoption across healthcare systems.

- In October 2024, Currie Medical Inc. announced a USD 1.22 million expansion in Norfolk, Virginia, U.S. focusing on medical device reprocessing. This move aligns with the growing trend of cost-efficient healthcare solutions, enabling hospitals to reduce expenses while maintaining quality care.

A key challenge impeding the growth of the reprocessed medical devices market is the complex supply chain for collecting, reprocessing, and distributing devices across healthcare networks. Logistical inefficiencies often lead to delays and higher costs. This challenge can be addressed by investing in advanced tracking and management technologies to streamline operations.

By improving coordination and monitoring, healthcare providers and reprocessing companies can enhance efficiency, reduce costs, and ensure timely delivery of safe, reprocessed devices to hospitals and clinics.

- In December 2023, Medline’s invested USD 300 million in its Healthcare Resilience Initiative (HRI) to enhance its supply chain. The company expanded its distribution and manufacturing infrastructure and enhanced medical device reprocessing capabilities through its ReNewal program, promoting sustainability and reducing landfill waste.

Reprocessed Medical Devices Industry Trends

The focus on sustainability is emerging as a significant trend in the reprocessed medical devices market. Healthcare providers are increasingly adopting environmentally-friendly practices, supported by the need to reduce waste and conserve resources.

Reprocessing single-use devices offers a sustainable solution by lowering the volume of medical waste sent to landfills and reducing the demand for raw materials. This shift toward sustainable practices supports environmental preservation and enable healthcare organizations to achieve their sustainability goals, positioning reprocessed medical devices as a vital component of greener healthcare.

- In June 2023, Loughborough University collaborated with the University of Leeds to launch ReMed project to advance circular economy approaches for small medical device waste. This initiative aims to promote sustainable reprocessing technologies, reducing waste and enhancing resource conservation in healthcare.

Technological innovation plays a significant role in driving the growth of the reprocessed medical devices industry. Advanced reprocessing technologies have enhanced device quality, ensuring that reprocessed devices meet stringent safety and performance standards. These innovations improve healthcare providers' operational efficiency by reducing processing times and reducing costs.

With the continuous development of new technologies, reprocessed devices are becoming increasingly reliable, making them an attractive alternative to single-use devices, further promoting sustainability in healthcare systems.

- In October 2024, EROAD extended its partnership with Medline, highlighting its focus on innovation, operational efficiency, and sustainability. This renewed collaboration supports Medline’s growth objectives, enhancing logistics and supply chain capabilities. It also contributes to the reprocessed medical devices market by driving operational improvements and promoting sustainability within healthcare systems.

Segmentation Analysis

The global market has been segmented based on end use, service model, type, and geography.

By End Use

Based on end use, the market has been segmented into hospitals, home healthcare, and others. The hospitals segment led the reprocessed medical devices industry in 2023, reaching a valuation of USD 1,435.5 million.

This growth is mainly driven by rising cost pressures, sustainability goals, and advancements in reprocessing technologies. Hospitals are increasingly adopting reprocessed devices due to their cost-effectiveness and positive environmental impact. Reprocessed devices offer substantial cost savings compared to single-use alternatives, helping healthcare providers manage their budgets effectively.

Furthermore, with improving reprocessing techniques ensuring high safety and quality standards, hospitals are gaining confidence in their use. The expanding focus on reducing medical waste and promoting circular economy practices is boosting their adoption in healthcare facilities.

By Service Model

Based on service model, the market has been classified into cardiovascular, laparoscopic, gastroenterology, general surgery devices, and orthopedic devices. The cardiovascular segment secured the largest revenue share of 60.05% in 2023. This expansion is propelledby the increasing demand for cost-effective and sustainable healthcare solutions.

Cardiovascular procedures often require high-cost devices; these instruments offer hospitals significant cost savings. With advancements in reprocessing technologies ensuring the safety, performance, and reliability of these devices, healthcare providers are increasingly willing to adopt them in cardiovascular treatments.

This growing adoption is further fueled by the industry's shift toward sustainability, reducing medical waste, and minimizing the environmental footprint of healthcare practices, making reprocessed cardiovascular devices an attractive option.

By End Use

Based on end use, the market has been bifurcated into third-party reprocessing and in-house reprocessing. The third-party reprocessing segment is projected to witness significant growth, registering a robust CAGR of 19.58% through the forecast period. Healthcare providers increasingly seek cost-effective and sustainable solutions, thereby aiding segmental growth.

Third-party reprocessors specialize in refurbishing and sterilizing used medical devices to meet stringent safety and quality standards. This allows hospitals to reduce procurement costs while maintaining high standards of care. As healthcare systems focus on operational efficiency and waste reduction, third-party reprocessing offers an attractive alternative to single-use devices.

The expansion of the segment is supported by advancements in reprocessing technologies, regulatory acceptance, and a growing emphasis on environmental sustainability in healthcare practices.

Reprocessed Medical Devices Market Regional Analysis

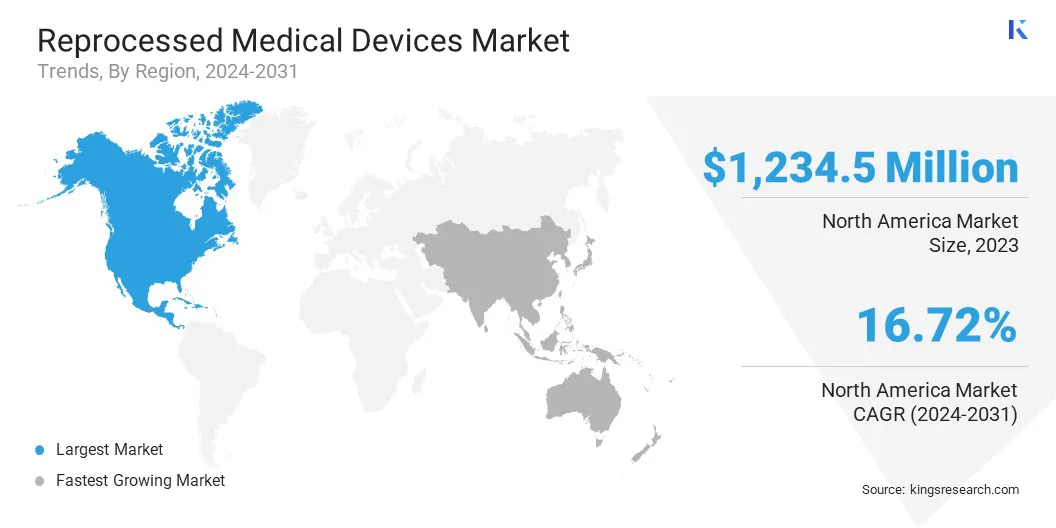

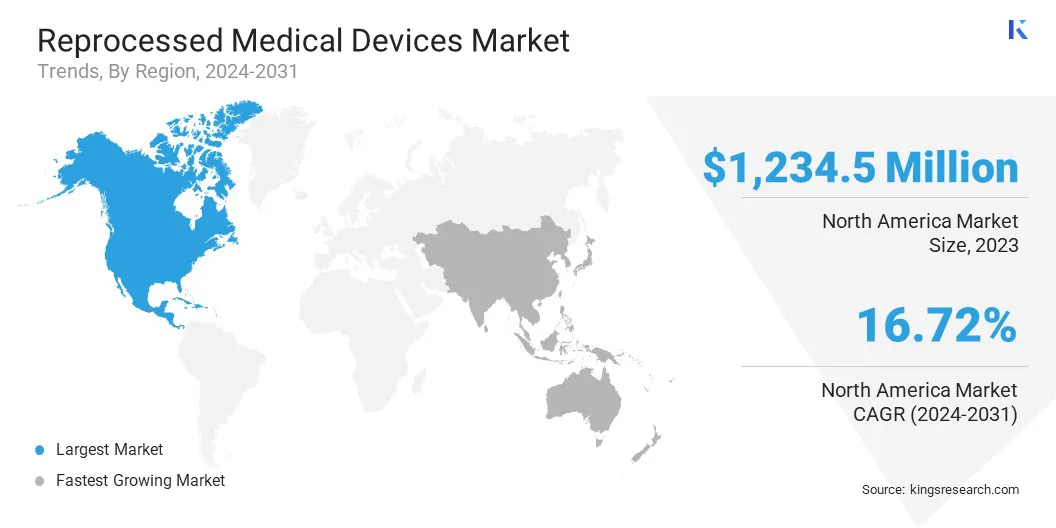

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America reprocessed medical devices market held a notable share of around 46.11% in 2023, with a valuation of USD 1,234.5 million. This dominance is reinforced by a strong healthcare infrastructure, rising healthcare costs, and growing awareness of sustainability.

The region is home to several leading reprocessing companies that specialize in refurbishing and sterilizing medical devices to meet safety and regulatory standards. With the increasing emphasis on cost-efficiency and environmental impact, hospitals and healthcare providers in the region are adopting reprocessed devices to reduce operational expenses while maintaining high-quality care.

Additionally, favorable government regulations, technological advancements, and a growing shift toward circular economy models have further solidified North America's leading market position.

Asia-Pacific is expected to grow at a robust CAGR of 21.71% over the forecast period. This growth is largely attributed to rapid advancements in the healthcare sector, a large patient population, and increasing demand for cost-effective healthcare solutions.

As healthcare systems in countries such as China, India, and Japan face financial pressures, reprocessed devices offer a viable solution to reduce costs while maintaining patient care quality. Additionally, growing awareness of environmental sustainability and the rising adoption of advanced reprocessing technologies are fueling regional market growth.

The region's expanding healthcare infrastructure, coupled with favorable regulatory environments, positions Asia Pacific as a major region in the global market.

Competitive Landscape

The global reprocessed medical devices market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic efforts such as increasing investments in research and development, setting up new manufacturing plants, and enhancing supply chain efficiency are expected to present new opportunities for market growth.

List of Key Companies in Reprocessed Medical Devices Market

- Stryker

- INNOVATIVE HEALTH

- NEScientific, Inc.

- Medline Industries, LP

- Arjo

- Vanguard AG

- SureTek Medical

- Medical Device Business Services, Inc. (Johnson & Johnson Services, Inc.)

- STERIS

- MEDSALV AUSTRALIA PTY LTD

Key Industry Developments

- November 2023 (Expansion): Medline's ReNewal program, dedicated to reprocessing single-use medical devices, expanded its Redmond, Oregon facility by 52,000 square feet. The program has extended the lifespan of numerous medical devices, reducing waste and promoting sustainability. It enables healthcare systems to reduce costs, improve environmental impact, and meet rigorous safety standards, benefiting both patients and the environment.

The global reprocessed medical devices market has been segmented as:

By End Use

- Hospitals

- Home Healthcare

- Others

By Service Model

- Cardiovascular

- Blood Pressure Cuffs

- Positioning Devices

- Cardiac Stabilization Devices

- Diagnostic Electrophysiology Catheters

- Electrophysiology Cables

- Deep Vein Thrombosis Compression Sleeves

- Laparoscopic

- Harmonic Scalpels

- Endoscopic Trocars

- Gastroenterology

- General Surgery Devices

- Balloon Inflation Devices

- Pressure Bags

- Orthopedic Devices

By Type

- Third-party Reprocessing

- In-house Reprocessing

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America