Market Definition

The market encompasses the development, deployment, and commercialization of advanced artificial intelligence models for natural language processing (NLP).

It includes companies engaged in research, training, and optimization of LLMs, along with cloud service providers offering LLM-based solutions through APIs and enterprise platforms. Additionally, the market spanss industries adopting LLMs for applications such as chatbots, content generation, and code development.

Large Language Models Market Overview

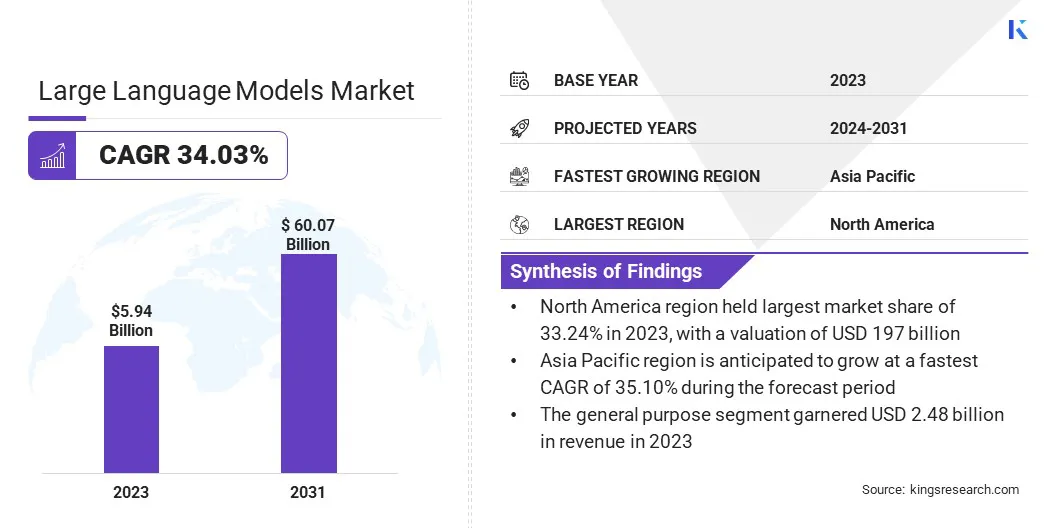

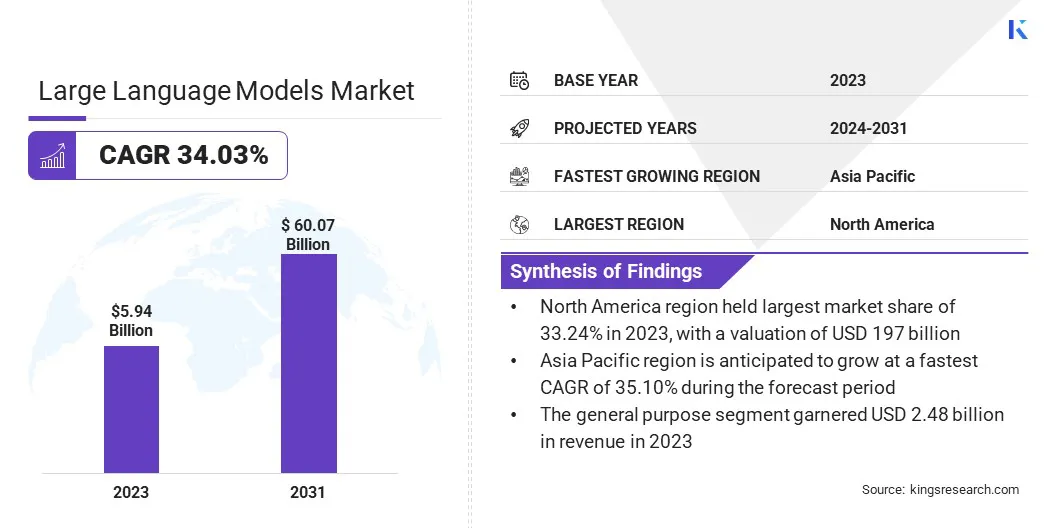

The global large language models market size was valued at USD 5.94 billion in 2023 and is projected to grow from USD 7.73 billion in 2024 to USD 60.07 billion by 2031, exhibiting a CAGR of 34.03% during the forecast period.

Market growth is driven by increasing adoption across diverse industries such as technology, healthcare, finance, retail, and customer service. The growing demand for AI-driven automation, enhanced conversational AI, and advanced data analysis capabilities is fueling investment in LLM research and development.

Major companies operating in the large language models industry are Microsoft, Mistral AI, STABILITY AI LTD, IBM, AI21 Labs, Anthropic, Google, EleutherAI, G42, Alibaba, Amazon.com, Inc., DeepSeek, Meta, Cohere, and LightOn.

The integration of LLMs into business workflows, content creation, and software development is expanding their commercial potential. Strategic partnerships, mergers, and government initiatives supporting AI innovation are further boosting market growth, positioning LLMs as a critical component in the global AI landscape.

- In June 2024, Cognizant launched its first healthcare Large Language Model (LLM) solutions under its generative AI partnership with Google Cloud. These solutions, built on Google Cloud’s Gemini models and Vertex AI platform, streamline healthcare administrative processes and enhance business outcomes.

Key Highlights:

- The large language models industry size was recorded at USD 5.94 billion in 2023.

- The market is projected to grow at a CAGR of 34.03% from 2024 to 2031.

- North America held a share of 33.24% in 2023, valued at USD 1.97 billion.

- The general purpose segment garnered USD 2.48 billion in revenue in 2023.

- The text segment is expected to reach USD 21.27 billion by 2031.

- The autoregressive segment is projected to generate a revenue of USD 23.13 billion by 2031.

- The chatbots and virtual assistant segment is likely to reach USD 17.47 billion by 2031.

- The healthcare segment garnered USD 1.69 billion in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 35.10% over the forecast period.

Market Driver

"Rising Enterprise Adoption and AI Advancements"

The large language models (LLMs) market is experiencing rapid growth, driven by increasing enterprise adoption and advancements in AI infrastructure. Businesses across various industries, including finance, healthcare, e-commerce, and customer service, are leveraging LLMs to enhance automation, improve customer engagement, and streamline data analysis.

The ability of LLMs to generate human-like text, assist in decision-making, and personalize user experiences has made them a valuable tool for digital transformation.

Additionally, advancements in AI infrastructure and computing power are supporting market expansion. Advancements in high-performance computing (HPC) resources, cloud-based AI platforms, and specialized AI chips (such as GPUs and TPUs) has improved the training and deployment efficiency of LLMs. These innovations enable the development of more powerful, scalable models, fueling their adoption and commercial viability.

Market Challenge

"High Computational Costs and Energy Consumption"

A major challenge hampering the expansion of the large language models (LLMs) market is the high computational cost and energy consumption required for training and deploying. LLMs rely on vast datasets and high-performance computing resources, leading to substantial infrastructure expenses and increased carbon footprints.

The reliance on specialized hardware, such as GPUs and TPUs, further raises costs, limiting accessibility for smaller enterprises. This challenge can be addressed through the development of more efficient model architectures, such as mixture-of-experts (MoE) models, which activate only a fraction of the model’s parameters per query, reducing computational demands.

Market Trend

"Multimodal Capabilities and Open-Source Innovation"

The large language models (LLMs) market is witnessing significant expansion, fueled by the rise of multimodal LLMs and open-source expansion. Multimodal LLMs, capable of processing text, images, audio, and video, are gaining traction in content creation, healthcare diagnostics, and interactive AI. These models enhance user engagement by providing richer, more contextual responses, increasing their commercial value.

Additionally, the expansion of open-source LLMs is fostering innovation and accessibility. Companies and research institutions are increasingly releasing open-source models, allowing developers to customize and optimize them for specific applications.

This trend democratizes AI, allowing businesses, startups, and researchers to leverage advanced LLMs without relying solely on proprietary solutions, accelerating global AI advancements.

- In March 2024, Databricks launched DBRX, a general-purpose open-source large language model (LLM) developed by its Mosaic Research team. DBRX outperforms leading open-source LLMs, including LLaMA2-70B, Grok-1 and Mixtral, in language understanding, programming, mathematics, and logic.

Large Language Models Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Domain Specific, General purpose, Multilingual

|

|

By Modality

|

Text, Images, Audio, Video

|

|

By Architecture

|

Autoregressive, Autoencoding, Hybrid

|

|

By Application

|

Chatbots And Virtual Assistant, Code Generation, Content Generation, Customer Service, Language Translation, Sentiment Analysis

|

|

By Industry Vertical

|

Healthcare, BFSI, Education, Media & Entertainment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Domain Specific, General purpose, and Multilingual): The general purpose segment earned USD 2.48 billion in 2023 due to its widespread adoption across multiple industries.

- By Modality (Text, Images, Audio, Video): The text segment held a share of 35.56% in 2023, attributed to the extensive use of LLMs in document processing, chatbots, and content generation.

- By Architecture (Autoregressive, Autoencoding, and Hybrid): The autoregressive segment is projected to reach USD 23.13 billion by 2031, owing to its effectiveness in generating coherent and contextually accurate text.

- By Application (Chatbots and Virtual Assistant, Code Generation, Content Generation, and Customer Service): The chatbots and virtual assistant segment is estimated to generate a revenue of USD 17.47 billion by 2031, owing to its increasing enterprise adoption for customer engagement and automation.

- By Industry Vertical (Healthcare, BFSI, Education, Media & Entertainment, and Others): The healthcare segment earned USD 17.18 billion in 2023, mainly propelled by the growing use of LLMs in medical research, diagnostics, clinical documentation, and patient interaction.

Large Language Models Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America large language models market share stood at around 33.24% in 2023, valued at USD 1.97 billion. This dominance is reinforced by leading AI research firms, tech giants such as Google, Microsoft, and Meta, and significant investments in AI infrastructure and cloud computing.

The regional market further benefits from strong government and private sector funding for AI advancements, a robust start-up ecosystem, and widespread enterprise adoption of LLMs across finance, healthcare, and customer service.

Additionally, North America’s advanced semiconductor and computing hardware industry, particularly in the U.S., accelerate LLM development and deployment, aiding regional market expansion.

Asia Pacific large language models industry is poised to grow at a significant CAGR of 35.10% over the forecast period. This growth is fueled by increasing investments in AI research, government initiatives promoting digital transformation, and the rising demand for AI-driven automation across industries such as education, e-commerce, and telecommunications.

Several governments in the region are actively supporting AI development through funding programs, national AI strategies, and infrastructure improvements. Countries are establishing AI research hubs, promoting academia-industry collaboration, and implementing policies to advance AI adoption in public services and enterprises.

Additionally, a large internet user base, multilingual diversity, and a growing data ecosystem boost demand for LLMs tailored to local languages and applications. Enhanced AI infrastructure, including high-performance computing expansion, further accelerates adoption in both enterprise and consumer sectors.

- In September 2024, the Government of India launched BharatGen, a government-funded generative AI initiative aimed at enhancing public service delivery and citizen engagement. As India’s first government-funded multimodal Large Language Model project, it focuses on advancing AI in Indian languages and strengthening the country's position in Generative AI.

Regulatory Frameworks

- In the U.S., the National Institute of Standards and Technology (NIST) regulates AI systems, including Large Language Models (LLMs), through the AI Risk Management Framework (AI RMF), which emphasizes trustworthiness, fairness, and transparency. Additionally, the AI Bill of Rights outlines non-binding principles to protect individuals from AI-related harms, focusing on data privacy, algorithmic discrimination prevention, and decision explainability.

- In Europe, the EU AI Act regulates large language models (LLMs) based on risk levels, categorizing foundation models as high-risk or general-purpose AI. The Act mandates transparency, accountability, and bias mitigation to ensure ethical AI deployment.

Competitive Landscape

Key players in the large language models industry are focusing on technological advancements, strategic partnerships, and large-scale infrastructure investments to strengthen their market position.

They are heavily investing in training and fine-tuning proprietary LLMs, leveraging extensive datasets to improve model accuracy, efficiency, and contextual understanding.

A major competitive strategy involves cloud-based AI services, integrating LLMs into enterprise applications and offering APIs and customized AI solutions across industries such as healthcare, finance, and customer service.

Additionally, companies are expanding multimodal capabilities, extending LLMs beyond text to include image, audio, and video processing to enhance user interaction and broaden application scope.

Strategic collaborations with academic institutions, AI research labs, and cloud providers are accelerating innovation. Companies are leveraging open-source frameworks to promote developer engagement while maintaining proprietary models for commercialization.

As competition intensifies, the market is witnessing a shift toward region-specific LLMs to support local languages and cultural contexts. Additionally, advancements in edge AI and on-device processing are enhancing LLM capabilities with lower latency and enhanced privacy.

- In August 2023, G42 released Jais, the world’s highest-quality Arabic Large Language Model, as an open-source project. Developed in collaboration with Mohamed bin Zayed University of Artificial Intelligence (MBZUAI) and Cerebras Systems, Jais features 13 billion parameters and is trained on a 395-billion-token Arabic and English dataset.

List of Key Companies in Large Language Models Market:

- Microsoft

- Mistral AI

- STABILITY AI LTD

- IBM

- AI21 Labs

- Anthropic

- Google

- EleutherAI

- G42

- Alibaba

- Amazon.com, Inc.

- DeepSeek

- Meta

- Cohere

- LightOn

Recent Developments (Partnerships/New Product Launch)

- In September 2024, Fujitsu, in partnership with Cohere Inc., introduced Takane, a cutting-edge large language model (LLM) optimized for enterprise applications within secure private environments. Engineered with advanced Japanese language capabilities, Takane chieved top rankings on the Japanese General Language Understanding Evaluation (JGLUE) benchmark.

- In July 2024, the International Society of Automation launched MimoSM, an AI-powered LLM trained on ISA content. It provides insights on operational technology (OT) cybersecurity and industrial automation, leveraging ISA standards, training materials, technical reports, and industry publications.

- In June 2024, Tech Mahindra launched Project Indus, an indigenous foundational Large Language Model (LLM) supporting multiple Indic languages and dialects. The initial phase focuses on Hindi and its 37+ dialects.

- In April 2024, Snowflake launched Snowflake Arctic, an open, enterprise-grade LLM featuring a Mixture-of-Experts (MoE) architecture. Arctic is optimized for complex enterprise workloads and has demonstrated industry-leading performance in SQL code generation, instruction following, and other benchmarks.