Market Definition

An ultra-low temperature (ULT) freezer is a specialized storage device designed to preserve biological samples, pharmaceuticals, and other temperature-sensitive materials at m -40°C to -86°C. It is essential in research, clinical, and biopharmaceutical environments where long-term sample integrity is critical. Their design ensures consistent temperature control, reliability, and compliance with laboratory standards.

Ultra Low Temperature Freezer Market Overview

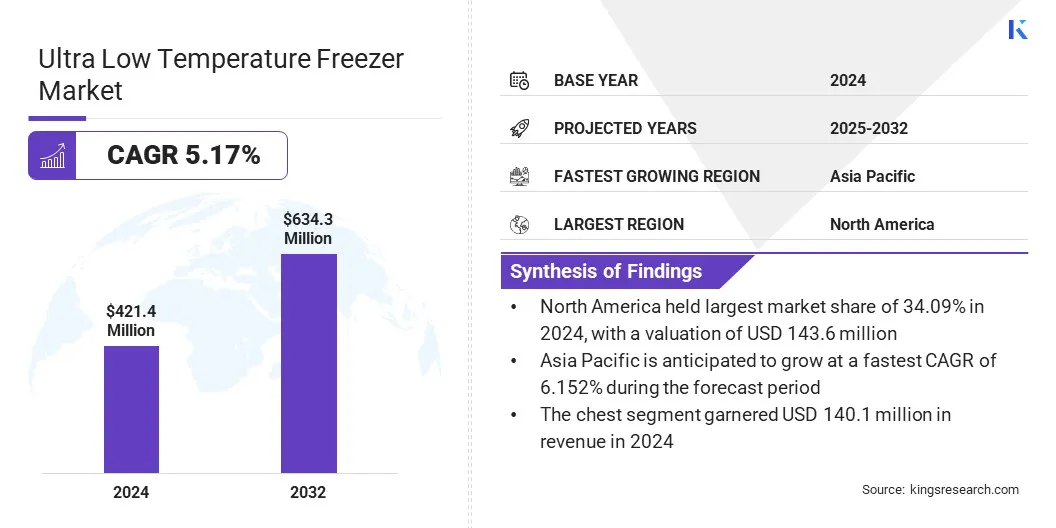

The global ultra low temperature freezer market size was valued at USD 421.4 million in 2024 and is projected to grow from USD 441.9 million in 2025 to USD 634.3 million by 2032, exhibiting a CAGR of 5.17% during the forecast period.

This growth is driven by the increasing need for secure storage of temperature-sensitive vaccines and expanding global immunization initiatives. Rising vaccine production volumes are creating sustained demand for reliable ultra-low temperature storage systems.

Key Highlights:

- The ultra low temperature freezer industry size was recorded at USD 421.4 million in 2024.

- The market is projected to grow at a CAGR of 5.17% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 143.6 million.

- The chest segment garnered USD 140.1 million in revenue in 2024.

- The blood & blood products segment is expected to reach USD 166.6 million by 2032.

- The biotechnology segment is anticipated to witness the fastest CAGR of 5.69% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.15% through the projection period.

Major companies operating in the ultra low temperature freezer market are Thermo Fisher Scientific Inc., Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.), NuAire, Inc., BINDER GmbH, Cole-Parmer Instrument Company, LLC, Esco Micro Pte. Ltd., PHC Corporation, Eppendorf SE, Haier Biomedical, Trane Technologies plc, Arctiko, BioLife Solutions, Inc., LAUDA DR. R. WOBSER GMBH & CO. KG, Avantor, Inc., and Liebherr-Hausgeräte GmbH.

Growing research in genomics, cell biology, and regenerative medicine is boosting the demand for ultra-low temperature freezers. Bio-banks require reliable preservation systems to store large volumes of biological samples over extended periods.

Expanding drug discovery activities are further fueling adoption, as pharmaceutical and biotechnology companies increasingly depend on controlled storage environments. This growth is further supported by the rising number of research collaborations and clinical studies, highlighting the need for advanced cold storage infrastructure across global life sciences facilities.

- In July 2025, the Biomedical Division of PHC Corporation entered an exclusive distribution agreement with MaxCyte to expand access to its ExPERT cell engineering platform. The collaboration enhances ultra-low temperature freezer applications by supporting advanced cell therapy research requiring precise cryogenic storage of engineered cells and biological materials.

What technological innovations are driving advancements in automated ultra-low temperature freezers?

Automation is reshaping the ultra low temperature freezer market by improving operational accuracy, reducing manual intervention, and enhancing temperature consistency. Automated systems enable precise sample tracking, controlled access, and integration with laboratory information management systems. These advancements streamline workflows in high-throughput facilities such as pharmaceutical manufacturing and research laboratories.

The transition from conventional to automated ULT systems reflects a strong emphasis on efficiency, traceability, and compliance with stringent biostorage regulations, aligning with the growing demands of scientific and clinical research operations.

- In May 2025, Haier Biomedical launched the UltraECO ULT Freezer range, combining high performance with enhanced energy efficiency. The range supports laboratories, biobanks, and research institutions in meeting sustainability goals while ensuring reliable ultra-low temperature performance and sample security.

Why do high purchase and operational costs continue to limit the expansion of the ultra low temperature freezer market?

High acquisition and operational costs remain a major restraint limiting the expansion of the market. These systems require significant initial investment and continuous power consumption to maintain extremely low temperatures, leading to increased ownership expenses.

Smaller research institutions and clinical facilities face budget limitations, restricting widespread adoption. Maintenance costs, calibration requirements, and replacement of key components further add to long-term expenditure, creating barriers for price-sensitive users across emerging economies and academic laboratories.

To address this challenge, manufacturers are developing energy-efficient compressors, eco-friendly refrigerants, and modular systems that reduce power consumption and maintenance frequency. Strategic collaborations and leasing options are further enabling cost optimization and broader accessibility.

How is the trend toward IoT integration influencing the ultra low temperature freezer market?

Manufacturers are incorporating smart monitoring technologies into ultra-low temperature freezers to enhance visibility and operational reliability. IoT-enabled systems facilitate real-time temperature tracking, remote alerts, and predictive maintenance through data analytics.

Connectivity solutions ensure continuous monitoring and rapid response to performance deviations, minimizing sample loss risk. The adoption of such digital solutions aligns with the increasing regulatory focus on traceability and data integrity, helping research institutions and pharmaceutical companies maintain consistent storage standards and improve laboratory efficiency.

- In October 2025, PharmaWatch partnered with Accucold to introduce an integrated vaccine storage solution that combines purpose-built refrigeration systems with IoT-based monitoring. This collaboration enhances ultra-low temperature freezer applications by ensuring precise temperature control, regulatory compliance, and enhanced protection for vaccines, biologics, and other temperature-sensitive research materials.

Ultra Low Temperature Freezer Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Chest, Upright, Benchtop, Others

|

|

By Application

|

Blood & blood products, Organs, Pharmaceuticals, Forensic & genomic research, Others

|

|

By End User

|

Bio-Banks, Biotechnology, Academic & Research Laboratories, Industrial and chemical research, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Chest, Upright, Benchtop, and Others): The chest segment generated USD 140.1 million in revenue in 2024, mainly due to higher demand for large-capacity storage systems used for long-term preservation in research and clinical laboratories.

- By Application (Blood & blood products, Organs, Pharmaceuticals, Forensic & genomic research, and Others): The organs segment is poised to record a CAGR of 5.69% through the forecast period, propelled by increasing transplantation activities and growing adoption of advanced preservation techniques in healthcare facilities.

- By End User (Bio-Banks, Biotechnology, Academic & Research Laboratories, Industrial and chemical research, and Others): The bio-banks segment is estimated to hold a share of 28.11% by 2032, fueled by expanding genomic research initiatives and rising investments in large-scale biological sample storage infrastructure.

What is the market scenario in North America and Asia-Pacific region?

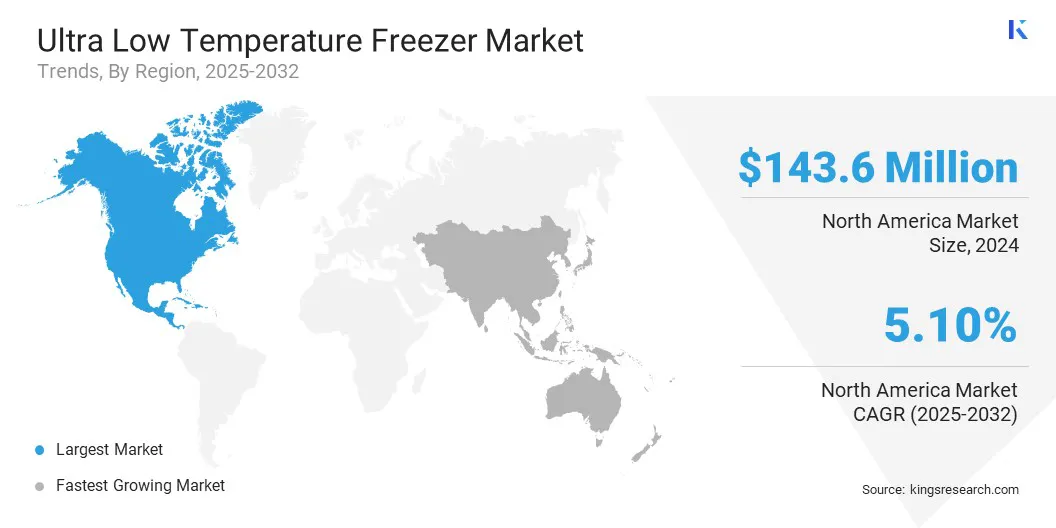

Based on region, the global ultra low temperature freezer market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America ultra low temperature freezer market share stood at 34.09% in 2024, valued at USD 143.6 million. The region’s strong position is fueled by the extensive presence of pharmaceutical and biotechnology research facilities, along with a high concentration of biobanks and academic laboratories.

Rising demand for advanced bio storage infrastructure across clinical diagnostics and life sciences research is fostering regional market expansion. Continuous investment in R&D and automation technologies is further influencing the regional market.

Manufacturers are focusing on product innovations, sustainability-driven refrigerant systems, and compliance with stringent energy standards to increase their market share and enhance operational efficiency.

- In May 2025, SCHOTT Pharma introduced its optimized SCHOTT TOPPAC freeze polymer syringes, engineered to withstand temperatures down to -180°C. This advancement supports ultra-low temperature freezer applications, enabling secure storage of highly sensitive biologics such as cell and gene therapies that are gaining increasing regulatory approvals worldwide.

The Asia-Pacific ultra low temperature freezer industry is set to grow at a CAGR of 6.15% over the forecast period. This growth is supported by expanding pharmaceutical manufacturing, increasing clinical research activities, and the establishment of new biobanking facilities.

- In September 2025, according to Invest India, India accounts for over 60% of generic medicine supplies to North America and Europe. The country’s expanding R&D ecosystem continues to reinforce its position as a leading global hub for clinical trials.

The rising need for long-term storage of vaccines, biological samples, and genetic materials is generating strong demand for reliable freezing solutions. Local and international manufacturers are scaling production capacity and developing compact, cost-efficient systems to serve emerging laboratories and healthcare institutions. Additionally, strengthened regulatory frameworks and increased private investment in research infrastructure are further contributing to regional market progress.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) Significant New Alternatives Policy (SNAP) Program governs the use of refrigerants in ultra-low temperature freezers. It promotes the transition to low-global-warming-potential alternatives, ensuring compliance with environmental standards in refrigeration systems.

- In the EU, the F-Gas Regulation (EU) No. 517/2014 regulates the use of fluorinated greenhouse gases in cooling equipment. It aims to minimize emissions from refrigeration systems, thereby impacting freezer design and refrigerant selection.

- In Japan, the Act on Rational Use and Proper Management of Fluorocarbons oversees refrigerant handling and disposal. It ensures proper maintenance and leakage prevention in ultra-low temperature systems.

- In China, the Environmental Protection Law governs manufacturing and energy efficiency standards for refrigeration equipment. It enforces sustainable production and promotes the adoption of energy-efficient ULT freezers.

- In Australia, the Ozone Protection and Synthetic Greenhouse Gas Management Act 1989 supervises the import, manufacture, and use of refrigerants, ensuring compliance with environmental performance standards in ultra-low temperature freezer production.

Competitive Landscape

Key companies operating in the ultra low temperature freezer industry are emphasizing innovation, operational efficiency, and technological differentiation to strengthen their market presence. Key strategies include expanding automated product lines, integrating IoT-based monitoring systems, and enhancing temperature control precision.

Companies are increasing investment in R&D to develop energy-efficient compressors and eco-friendly refrigerants aligned with sustainability goals. Strategic partnerships with research institutions and biotechnology firms are facilitating product validation and large-scale deployment. Market players are optimizing supply chain structures and expanding regional distribution networks to ensure consistent product availability.

The companies are increasingly developing ultra-low temperature freezers with broader temperature ranges and improved uniformity to strengthen product reliability, enhance sample integrity, and meet the evolving storage requirements of research laboratories and biopharmaceutical companies.

- In January 2025, Stirling Ultracold launched the VAULT100 upright ultra-low temperature freezer, offering a temperature range of -100°C to -20°C and ±3°C uniformity at -80°C for enhanced stability and precise temperature control.

Key Companies in Ultra Low Temperature Freezer Market:

- Thermo Fisher Scientific Inc.

- Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.)

- NuAire, Inc.

- BINDER GmbH

- Cole-Parmer Instrument Company, LLC

- Esco Micro Pte. Ltd.

- PHC Corporation

- Eppendorf SE

- Haier Biomedical

- Trane Technologies plc

- Arctiko

- BioLife Solutions, Inc.

- LAUDA DR. R. WOBSER GMBH & CO. KG

- Avantor, Inc.

- Liebherr-Hausgeräte GmbH

Recent Developments (Product Launch)

- In April 2024, Thermo Fisher Scientific introduced the Thermo Scientific TSX Universal Series Ultra-Low Temperature Freezers, featuring enhanced performance, energy efficiency, and user experience. The series supports diverse laboratory workflows while emphasizing sustainability through advanced environmental design and accessible data on each product’s ecological impact.