Market Definition

The market encompasses the development and adoption of connected, technology-enabled devices and systems that enable remote monitoring, management, and support of health and wellness in residential settings.

These solutions leverage Internet of Things (IoT) devices, wearable sensors, telemedicine platforms, artificial intelligence (AI), and mobile applications to track vital signs, detect emergencies, manage chronic conditions, and provide personalized care interventions without requiring patients to visit clinical settings.

Smart Home Healthcare Market Overview

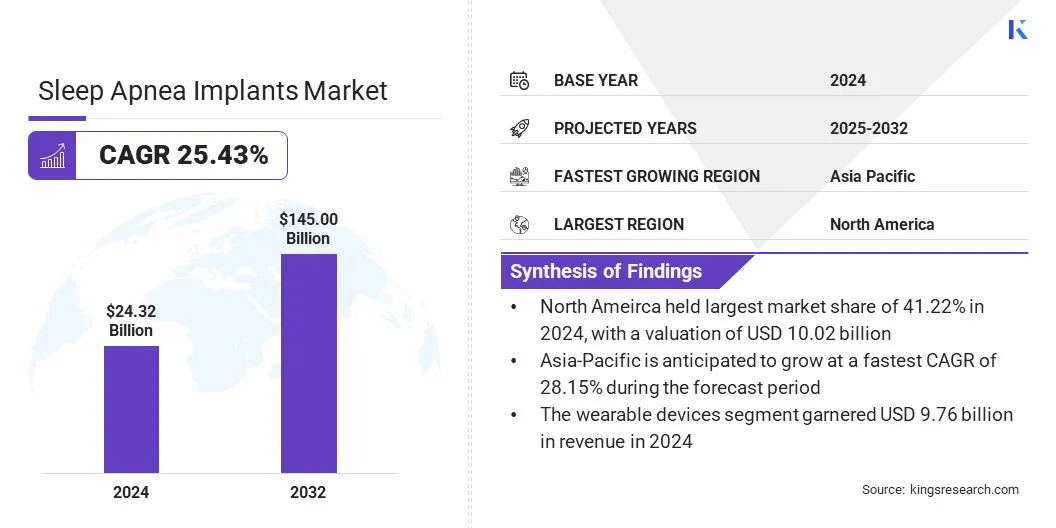

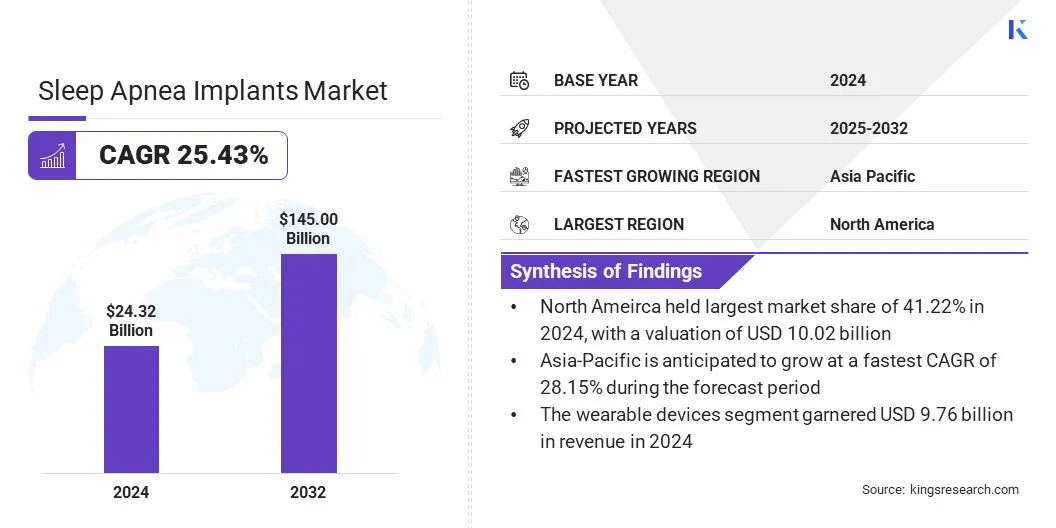

The global smart home healthcare market size was valued at USD 24.32 billion in 2024 and is projected to grow from USD 29.69 billion in 2025 to USD 145.00 billion by 2032, exhibiting a CAGR of 25.43% during the forecast period.

This growth is fueled by increasing demand for home-based care, rising prevalence of chronic diseases, and aging populations. Advancements in IoT, wearable devices, and AI technologies are enhancing remote monitoring, personalized care, and patient engagement, reinforcing their critical role in healthcare delivery and wellness management.

Key Highlights:

- The smart home healthcare industry size was recorded at USD 24.32 billion in 2024.

- The market is projected to grow at a CAGR of 25.43% from 2025 to 2032.

- North America held a share of 41.22% in 2024, valued at USD 10.02 billion.

- The wearable devices segment garnered USD 9.76 billion in revenue in 2024.

- The diabetes segment is expected to reach USD 45.83 billion by 2032.

- The health status monitoring segment is anticipated to witness the fastest CAGR of 28.18% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 28.15% through the projection period.

Major companies operating in the smart home healthcare market are Medtronic, Siemens Healthcare Private Limited, Koninklijke Philips N.V., GE HealthCare., Honeywell, Abbott., Boston Scientific Corporation, F. Hoffmann-La Roche Ltd, 3M, BD, Sunfox Technologies Pvt Ltd., Accuhealth Technologies LLC, TytoCare Ltd., Eko Health, Inc, and AliveCor, Inc.

The rapid adoption of telemedicine and virtual care solutions is creating a strong demand for smart home healthcare devices integrated with connected platforms. Continuous patient monitoring, real-time data sharing, and seamless virtual consultations require devices that are reliable, interoperable, and easy to use.

In response, manufacturers are developing AI-enabled wearables, IoT sensors, and mobile applications to support remote care, chronic disease management, and early detection of health issues. Expanding virtual healthcare services continue to fuel demand, prompting companies to invest in technological advancements, secure data infrastructure, and user-friendly solutions to remain competitive.

- In March 2025, Airtel Business collaborated with Fortis Healthcare to launch a Smart Clinics solution leveraging Airtel’s 5G network, aimed at expanding telemedicine access across urban and rural areas. The initiative facilitates real-time consultations, integrates connected medical devices, and ensures secure management of patient health data, transforming the delivery of remote healthcare services.

What major factor driving market growth?

The global surge in chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders is boosting the demand for remote monitoring and disease management systems, fueling smart home healthcare market expansion.

- According to the World Health Organization, adults aged 18 and above living with diabetes increased from 200 million in 1990 to 830 million in 2022, with prevalence rising from 7% to 14%.

This growing health burden underscores the need for innovative healthcare solutions that support continuous monitoring and management of chronic diseases. Smart home healthcare technologies, including wearable devices and IoT-enabled systems, address this demand by providing real-time data, early detection of health issues, and personalized care plans, propelling market expansion.

What are the major obstacles for this market?

A key challenge impeding the growth of the smart home healthcare market is rising concerns over data privacy and security. Connected devices and cloud-based platforms collect large volumes of sensitive patient information, making them vulnerable to cyberattacks, unauthorized access, and data breaches.

Compliance with stringent regulations such as HIPAA in the U.S. and GDPR in Europe further increases complexity for device manufacturers and service providers. To address this challenge, companies are investing in robust cybersecurity protocols, encrypted data transmission, and secure cloud infrastructure to safeguard patient information.

Which technological trends are shaping the market?

The smart home healthcare market is witnessing a trend toward the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies into home-based care solutions.

Connected devices and wearable sensors now collect real-time health data, which AI algorithms analyze to provide predictive insights, early detection of anomalies, and personalized care recommendations. This trend enables proactive healthcare management, reduces hospital visits, and supports remote patient monitoring, aligning with the growing demand for efficient, technology-driven, and patient-centric healthcare solutions.

- In October 2023, Cedars-Sinai introduced the Cedars-Sinai Connect mobile health application, leveraging artificial intelligence to deliver virtual care across various clinical areas. The app allows patients to schedule same-day primary care appointments and provides round-the-clock virtual access to medical specialists for urgent consultations and treatment.

Smart Home Healthcare Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Wearable Devices, Home Medical Devices, Remote Patient Monitoring Systems, Connected Health Appliances

|

|

By Indication

|

Diabetes, Cardiovascular Disorders, Respiratory Diseases, Neurological & Mental Disorders

|

|

By Application

|

Health Status Monitoring, Safety and Security Monitoring, Fall Prevention & Detection, Medication Management, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Wearable Devices, Home Medical Devices, Remote Patient Monitoring Systems, and Connected Health Appliances): The wearable devices segment earned USD 9.76 billion in 2024, fueled by increasing consumer adoption of fitness and health tracking technologies.

- By Indication (Diabetes, Cardiovascular Disorders, Respiratory Diseases, and Neurological & Mental Disorders): The cardiovascular disorders segment held a share of 27.31% in 2024, propelled by the high prevalence of heart-related conditions and increasing patient awareness of early detection and monitoring.

- By Application (Health Status Monitoring, Safety and Security Monitoring, Fall Prevention & Detection, Medication Management, and Others): The health status monitoring segment is projected to reach USD 75.53 billion by 2032, owing to the growing adoption of wearable and IoT-enabled devices that enable real-time health insights at home.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global smart home healthcare market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America smart home healthcare market share stood at 41.22% in 2024, valued at USD 10.02 billion. This dominance is reinforced by rising adoption of home-based care solutions, advanced healthcare infrastructure, and high consumer awareness regarding preventive and chronic disease management.

The U.S. dominates the regional market, supported by favorable government initiatives, reimbursement policies for remote patient monitoring, and widespread availability of high-speed internet and 5G networks that enable seamless telemedicine services.

- In November 2024, the Alliance for Smart Healthcare Excellence was formed to promote the development of smart hospitals through the integration of cutting-edge technologies and best practices in healthcare delivery. The alliance aims to advance the adoption of cutting-edge technologies, including IoT-enabled patient monitoring, AI-driven diagnostics, and automated hospital management systems, while establishing best practices for efficient and patient-centric healthcare delivery.

The Asia-Pacific smart home healthcare industry is estimated to grow at a robust CAGR of 28.15% over the forecast period. This growth is fueled by rising healthcare expenditures, increasing prevalence of chronic diseases, and expanding digital infrastructure across key economies such as China, Japan, India, and South Korea.

Growing awareness of home-based care solutions, coupled with an aging population, is generating a robust demand for remote monitoring, telemedicine, and AI-enabled healthcare devices. Governments in the region are promoting digital health initiatives, smart hospital development, and telehealth integration, facilitating broader acceptance of smart home healthcare solutions.

- In June 2024, Apollo Telehealth, in collaboration with the Government of Manipur, launched a telemedicine-driven primary health center (PHC) in Borobeka, Manipur, aimed at improving healthcare access for communities affected by recent conflicts.

Regulatory Frameworks

- The U.S. follows FDA guidelines, which regulate medical devices, wearable health monitors, and software-as-a-medical-device (SaMD) solutions through pre-market approvals, risk classification, and post-market surveillance. HIPAA mandates the protection of patient health data collected and transmitted by connected devices, ensuring privacy and security.

- The EMA and regulatory bodies enforce compliance with the Medical Device Regulation (MDR) and in Vitro Diagnostic Regulation (IVDR). Personal health data must also adhere to GDPR, requiring secure data management, consent, and breach notifications.

- In China, smart health devices must comply with national medical device regulations and cybersecurity standards, while digital health solutions require government approvals.

- Globally, the World Health Organization (WHO) provides recommendations for connected healthcare technologies, emphasizing cybersecurity, interoperability, and ethical management of personal health data in remote monitoring and telehealth solutions.

Competitive Landscape

Key players in the smart home healthcare industry are actively adopting strategic initiatives such as partnerships, collaborations, and technology integration to expand their presence and enhance service offerings.

They are collaborating with telemedicine providers, healthcare institutions, and technology firms to develop AI-enabled wearables, IoT-connected monitoring devices, and mobile health platforms. Additionally, companies are investing in research and development to improve device interoperability, data security, and patient engagement features.

- In October 2024, AMD Global Telemedicine collaborated with Carefluence, an interoperability solutions provider, to strengthen its telehealth offerings, ensure continuity of care, and improve clinical outcomes.

Top Key Companies in Smart Home Healthcare Market:

- Medtronic

- Siemens Healthcare Private Limited

- Koninklijke Philips N.V.

- GE HealthCare.

- Honeywell

- Abbott.

- Boston Scientific Corporation

- Hoffmann-La Roche Ltd

- 3M

- BD

- Sunfox Technologies Pvt Ltd.

- Accuhealth Technologies LLC

- TytoCare Ltd.

- Eko Health, Inc

- AliveCor, Inc.

Recent Developments

- In April 2024, MedStar Health, a hospital system based in Columbia, Maryland, collaborated with DispatchHealth, an in-home care service, to provide acute care services for patients recently discharged from MedStar facilities in Washington, D.C.

- In March 2024, RamSoft, a provider of cloud-based PACS/RIS radiology solutions, entered into a five-year agreement with Premier Radiology Services to deploy RamSoft’s OmegaAI and PowerServer PACS platforms across its network of more than 1,000 teleradiology locations.

- In October 2023, Cedars-Sinai launched the Cedars-Sinai Connect mobile health application, leveraging artificial intelligence to deliver virtual care solutions for various clinical needs. The app allows patients to schedule same-day primary care visits and provides 24/7 virtual access to medical specialists for urgent consultations.