Market Definition

The market encompasses garments and accessories embedded with sensors, actuators, and electronic components that monitor physiological, environmental, or performance-related data. These products integrate textile engineering with advanced technologies to deliver functional capabilities such as biometric tracking, temperature regulation, posture correction, and interactive feedback.

The report includes segmentation by product type, technology, end use, and region. Smart clothing solutions are applied across healthcare, sports and fitness, military and defense, and consumer lifestyle segments to enhance user experience, support real-time monitoring, and enable data-driven insights in everyday and specialized applications.

Smart Clothing Market Overview

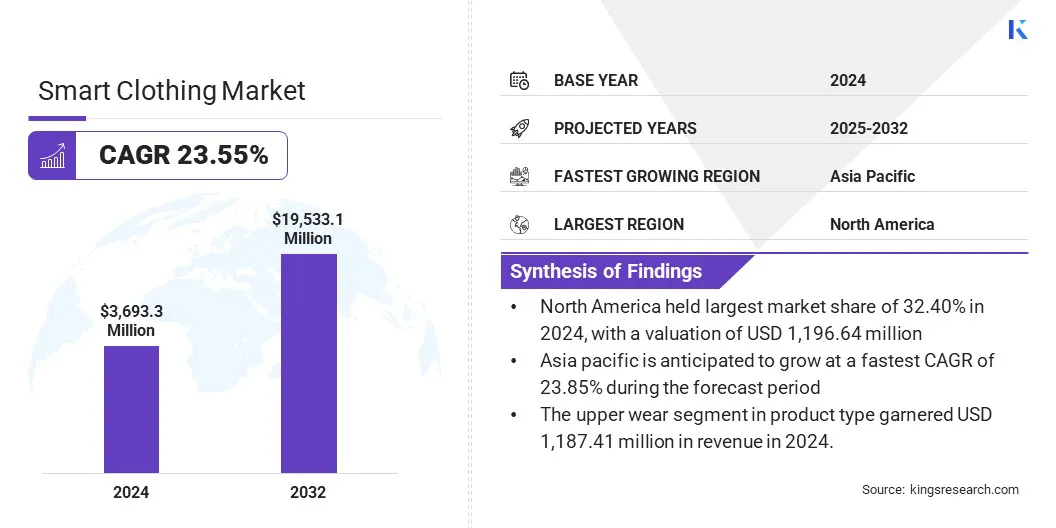

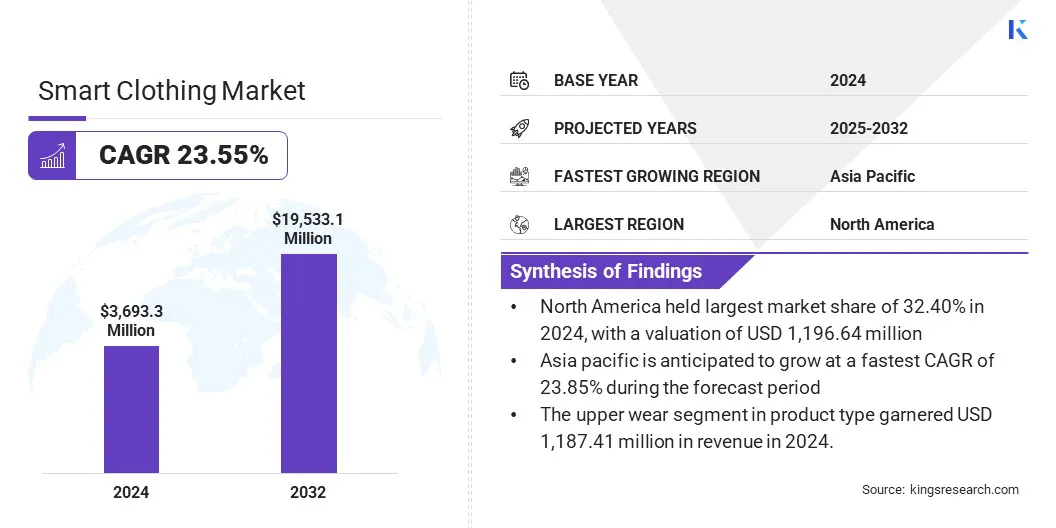

The global smart clothing market size was valued at USD 3,693.33 million in 2024 and is projected to grow from USD 4,450.16 million in 2025 to USD 19,533.17 million by 2032, exhibiting a CAGR of 23.55% over the forecast period.

This growth is driven by increasing adoption of smart apparel by hospitals, fitness centers, professional sports organizations, and consumers to enable continuous physiological monitoring, activity tracking, and performance optimization.

Key Market Highlights:

- The smart clothing industry size was recorded at USD 3,693.33 million in 2024.

- The market is projected to grow at a CAGR of 23.55% from 2025 to 2032.

- North America held a market share of 32.40% in 2024, with a valuation of USD 1,196.64 million.

- The upper wear segment in product type garnered USD 1,187.41 million in revenue in 2024.

- The male gender segment is expected to reach USD 9,493.90 million by 2032.

- The online distribution channel segment was estimated at USD 2,341.57 million in 2024.

- The sports and fitness segment is forecasted to grow at the fastest CAGR of 27.05% over the forecast period.

- Asia Pacific is anticipated to grow at a steady rate of 23.85% over the forecast period.

Major companies operating in the smart clothing market are AiQ Smart Clothing, DuPont, Myontec, Myzone, Owlet UK, Sensoria, Siren, TORAY INDUSTRIES, INC., Vulpes Electronics GmbH, Wearable X, Athos Therapeutics, Hexoskin, Under Armour, Inc., Hexoskin (Carré Technologies Inc.), and OMsignal Ltd.

Advancements in smart materials, textile-integrated sensing technologies, and the integration of AI-driven clothing systems are accelerating the development and adoption of flexible smart clothing capable of capturing complex body movements, posture, and biomechanical forces in real time

- In January 2025, Myant introduced Skiin Generation 2 and the Myant Care platform, which enable continuous, medical grade monitoring of cardiovascular and respiratory health through apparel. The developments strengthen Myant’s leadership in the market by demonstrating the use of intelligent textiles in providing connected, and personalized healthcare solutions across multiple end use stages.

What factors are driving the demand for smart clothing across different end use sectors?

The demand for smart clothing is driven by the growing use of wearable health monitoring solutions by healthcare providers and consumers, along with increased focus on fitness, performance optimization, and preventive care among individuals. Adoption is further supported by employers deploying sensor-enabled garments to improve worker safety and ergonomics across industrial and occupational environments.

Additionally, advancements in textile-integrated sensors, AI-enabled analytics, and connected wearable platforms are enabling real-time health and activity monitoring, supporting adoption across healthcare, sports and fitness, military and defense, and consumer lifestyle segments.

- In April 2025, Researchers at Cornell University developed SeamFit which is an AI-powered smart clothing solution, designed for athletes, fitness users, and physical therapy patients. The clothing tracks posture and automatically logs exercises while maintaining the look, comfort, and washability of regular apparel. It uses flexible conductive threads embedded in garment seams to capture body movements, which are analyzed by a machine-learning pipeline to identify exercises and count repetitions with high accuracy.

The rising adoption of connected AI-enabled systems in clothing and apparels is expanding the market growth of smart clothing. Advancements in wearable sensors and real-time data analytics are enabling continuous health monitoring, performance tracking, and worker safety across healthcare, fitness, and industrial environments.

Additionally, the integration of smart clothing with digital platforms and IoT ecosystems further improves usability, scalability, and data-driven decision-making for consumers using smart clothing and apparel.

- In July 2024, NIKE launched Aerogami, an apparel technology featuring moisture-reactive vents that automatically open and close upon sweating. The technology was developed by Nike Explore Team and Nike Sport Research Lab (NSRL) to aid runners in regulating body temperature while exercising.

Smart Clothing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Upper Wear, Lower Wear, Inner Wear, Footwear, Others

|

|

By Gender

|

Male, Female, Unisex

|

|

By Distribution Channel

|

Online, Offline

|

|

By End User

|

Defense and Military, Sports and Fitness, Apparel & Fashion, Healthcare, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Upper Wear, Lower Wear, Inner Wear, Footwear, and Others): The Upper Wear segment earned USD 1,187.41 million in 2024 due to high consumer demand for smart shirts, jackets, and vests in sports, fitness, and healthcare applications, attributed to their ability to integrate sensors for precise monitoring of vital signs such as heart rate, breathing rate, and body temperature near the torso.

- By Gender (Male, Female, and Unisex): The male gender in smart clothing held 24.74% of the market in 2024. The high rate of adoption of smart clothing in men is attributed to the rising physical activities, performance tracking in sports and fitness and recovery monitoring.

- By Distribution Channel (Online, Offline): The online distribution channel is projected to reach USD 13,650.21 million by 2032. The high share of online distribution channel is attributable majorly to the convenience associated with e-commerce platforms offering easy access, detailed product comparisons, customer reviews, and home delivery.

- By End User (Defense and Military, Sports and Fitness, Apparel & Fashion, Healthcare, Industrial, and Others): Sports and Fitness end use is projected to reach USD 5,812.48 million by 2032. The high share is driven by the rising and demand for real-time monitoring of metrics like heart rate, breathing, muscle activity, and performance data in sports for performance optimization, enhancing endurance, and preventing injuries.

What is the market scenario in North America and Asia-Pacific region?

The North America smart clothing market share stood at 32.40% in 2024, valued at USD 1,196.64 million. This dominant share of North America is attributed to the high adoption of wearable health and fitness monitoring solutions, strong consumer demand for connected apparel, and advanced digital health and IoT ecosystems primarily across the U.S. and Canada.

The dominant position of North America is attributed to the high adoption of wearable health and fitness monitoring solutions, robust consumer demand for connected and tech-integrated apparel in addition with a mature digital health and IoT ecosystem, particularly in the U.S. and Canada.

- In November 2025, Hexoskin received FDA clearance for its biometric smart garment and secure data management platform. The approval enables the company to sell its health monitoring smart clothing to hospitals and clinics across the U.S. The clearance further strengthens Hexoskin’s position in clinical-grade wearable diagnostics and supports its planned expansion into the U.S. healthcare market.

The Asia-Pacific smart clothing industry is set to grow at a CAGR of 23.85% over the forecast period. This growth is driven by rapid urbanization, increasing health awareness, and strong regional expertise in advanced textiles and electronics manufacturing.

In addition, government initiatives promoting digital health, smart wearables, and Industry 4.0 are accelerating the integration of technology into clothing and apparel across major economies such as China, Japan, South Korea, and India.

- In June 2024, Toray Industries, Inc. launched three new Toraysee microfiber cleaning cloth designs, marking the first design update in six years. The clothes use ultra-fine two-micron polyester microfibers that deliver high durability, washability, and scratch-free cleaning for eyewear, smartphones, and other devices. The launch highlights Toray’s continued innovation in advanced textile materials and their application in everyday consumer, medical, and manufacturing end uses across Japan.

Regulatory Frameworks

- California Consumer Privacy Act (CCPA) / California Privacy Rights Act (CPRA): The CCPA and CPRA are state-level U.S. laws that regulate how businesses collect, use, and share personal data of California residents. The act provides consumers with the right to access their shared data, delete, correct, modify, and the ability to opt out of data sharing, which generally takes place with smart clothing and apparel.

- EU Medical Device Regulation (MDR): It is a comprehensive regulatory framework that governs medical devices placed on the EU market, focusing on patient safety, clinical effectiveness, risk management, and post-market surveillance. The regulation requires manufacturers to provide clinical evidence, ensure traceability, and comply with strict quality and documentation standards.

- EU General Data Protection Regulation (GDPR): It is a legal framework that monitors collection, processing, storage, and sharing of personal data of individuals in the EU. The regulation emphasizes privacy, transparency, and user consent, and grants rights to individuals over their data, including access, correction, and deletion, requiring organizations to implement robust data protection and security measures.

- Ministry of Food and Drug Safety (MFDS) Medical Device Regulation (South Korea): The regulation governs the safety, effectiveness, and quality of medical devices and allied healthcare products thus requiring prior product approval, clinical evidence, and post-market monitoring. The market is regulated under MFDS when it serves a medical purpose, such as continuous physiological monitoring or disease management. The regulation enables adherence of digital or software-driven smart garments to compliance requirements associated with data accuracy, cybersecurity, and AI transparency.

Competitive Landscape

Major players operating in the smart clothing industry are undertaking extensive research and development initiatives, along with strategic partnerships and acquisitions, to expand their technological capabilities and business reach.

Companies are emphasizing integration of advanced digital technologies into conventional apparel designs, while ensuring washability and long-term wear durability. They are also focusing on real-time data capture and seamless connectivity with mobile applications and cloud-based analytics platforms to enhance user experience and drive broader adoption of smart clothing.

- In May 2025, DuPont Personal Protection and Epicore Biosystems partnered to advance smart wearable technologies for worker safety and well-being. The collaboration integrates DuPont’s protective clothing with Epicore’s sweat-sensing platform to provide real-time biometric insights and personalized hydration, underscoring the growing impact of data-driven smart clothing in occupational safety.

Key Companies in Smart Clothing Market:

- AiQ Smart Clothing

- DuPont

- Myontec

- Myzone

- Owlet UK

- Sensoria

- Siren

- TORAY INDUSTRIES, INC.

- Vulpes Electronics GmbH

- Wearable X

- Athos Therapeutics

- Hexoskin

- Under Armour, Inc.

- Hexoskin (Carré Technologies Inc.)

- OMsignal Ltd.

Recent Developments

- In March 2024, AiQ launched a smart cycling jersey equipped with integrated heart rate monitoring and lighting features. The jersey incorporates embedded sensors which detect the heart rate of the cyclist in real time and transmit this biometric data to connected devices for analysis, while the lighting elements help improve visibility during low-light conditions.

- In March 2024, PYKRS of Spain launched a smart jacket, PYKRS X-TREME Parka for urban commuters, cyclists, and motorcyclists with app/remote control, electroluminescent lighting for visibility, carbon fiber heating, and fall detection with GPS.