Market Definition

Industry 4.0 refers to the integration of advanced digital technologies such as artificial intelligence, Internet of Things, robotics, and data analytics into industrial processes. It aims to establish intelligent and interconnected manufacturing systems that enhance productivity, flexibility, and efficiency. Industry 4.0 enables real-time decision-making, predictive maintenance, and automation, transforming traditional manufacturing into smart, data-driven operations.

Industry 4.0 Market Overview

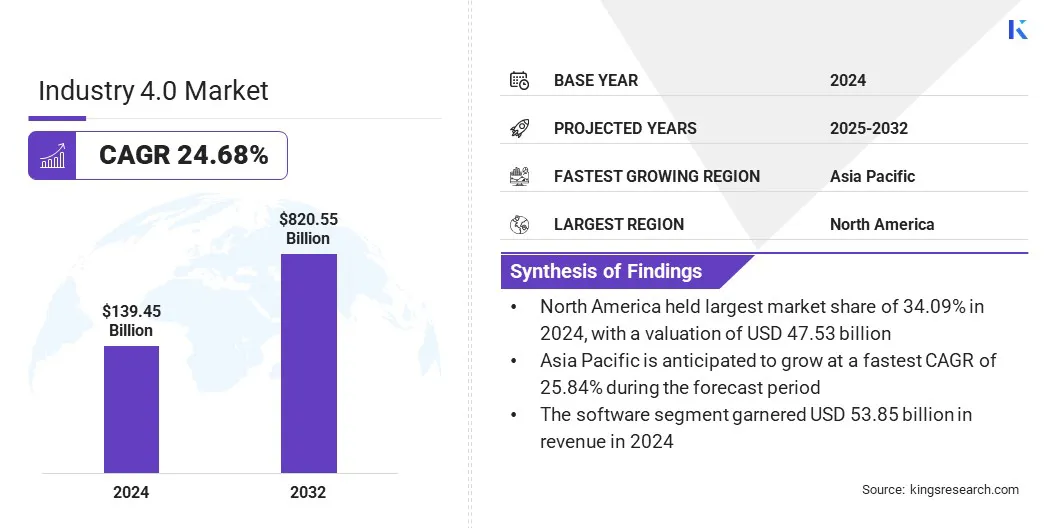

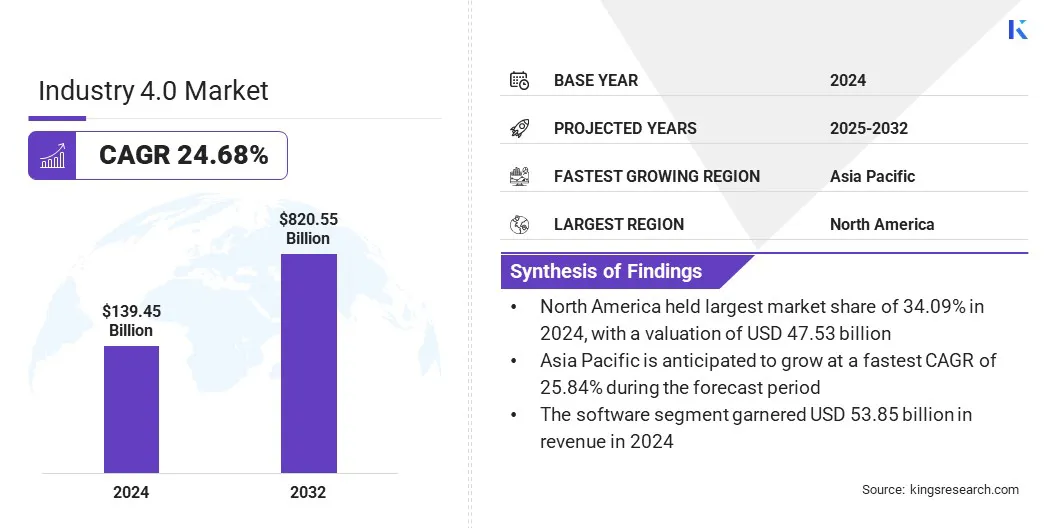

The global industry 4.0 market size was valued at USD 139.45 billion in 2024 and is projected to grow from USD 173.06 billion in 2025 to USD 820.55 billion by 2032, exhibiting a CAGR of 24.68% during the forecast period.

This growth is driven by the integration of AI, analytics, and machine learning in manufacturing systems, enabling predictive maintenance, process optimization, and improved operational efficiency through real-time, data-driven insights.

Key Highlights:

- The Industry 4.0 industry size was recorded at USD 139.45 billion in 2024.

- The market is projected to grow at a CAGR of 24.68% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 47.53 billion.

- The software segment garnered USD 53.85 billion in revenue in 2024.

- The industrial internet of things segment is expected to reach USD 24.08 billion by 2032.

- The oil & gas segment is anticipated to witness the fastest CAGR of 24.83% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 25.84% through the projection period.

Major companies operating in the Industry 4.0 market are ABB, Cisco Systems, Inc., Cognex Corporation, Siemens AG, Schneider Electric SE, Rockwell Automation, Honeywell International Inc., Emerson Electric Co., Intel Corporation, IBM Corporation, NVIDIA Corporation, DENSO CORPORATION, FANUC CORPORATION, Robert Bosch GmbH, and Hitachi, Ltd.

Market growth is fueled by national initiatives aimed at advancing industrial modernization, digital infrastructure, and advanced manufacturing capabilities. Governments across Europe, Asia, and North America are supporting automation through funding, tax incentives, and policy frameworks to enhance smart factory adoption.

Public-private collaborations further accelerate technology adoption among small and medium enterprises. These measures strengthen industrial competitiveness, promote sustainability, and support the development of Industry 4.0 ecosystems.

- In December 2024, the Ministry of Heavy Industries launched the SAMARTH Udyog Bharat 4.0 initiative under the Capital Goods Competitiveness Scheme. The program included the establishment of four Smart Advanced Manufacturing and Rapid Transformation Hubs, including C4i4 Lab Pune, IITD-AIA Foundation Delhi, I4.0 India IISc Bengaluru, and Smart Manufacturing Cell CMTI Bengaluru.

What factors are accelerating the adoption of digital twin and extended reality technologies in industrial operations?

The surging adoption of digital twin and extended reality technologies in industrial design, predictive maintenance, and production planning is fueling the growth of the Industry 4.0 market. Manufacturers are leveraging virtual replicas of physical systems to simulate operations, analyze performance, and reduce downtime.

The integration of augmented and virtual reality further enhances workforce training and equipment visualization. Moreover, government initiatives promoting digital infrastructure and industrial innovation are boosting the adoption of such immersive technologies, highlighting the importance of digital twin and extended reality in Industry 4.0 transformation.

- In March 2025, Ericsson, Volvo Group, and Bharti Airtel entered a research partnership to explore Extended Reality, Digital Twin, and AI applications in manufacturing. Leveraging 5G and 5G Advanced, the collaboration aims to enhance industrial efficiency, support Industry 4.0 advancements, and create new business opportunities for telecom providers.

Integration complexity across legacy systems remains a major barrier in implementing Industry 4.0 technologies. Many manufacturing facilities operate outdated machinery and fragmented IT infrastructures that lack compatibility with modern automation platforms. The lack of standardized communication protocols and data interoperability restricts the scalability of digital initiatives, increasing implementation costs and extending modernization timelines.

To address this challenge, companies are increasingly deploying middleware solutions, edge gateways, and standardized communication protocols to connect legacy assets with modern platforms. Strategic investments in interoperability frameworks, modular automation systems, and industrial IoT integration tools enable seamless data exchange and enhance operational continuity across hybrid industrial ecosystems.

The widespread adoption of smart robotics and autonomous machines to improve production accuracy, reduce human intervention, and streamline repetitive operations is emerging as a major trend influencing the Industry 4.0 market.

Industrial robots equipped with advanced sensors and AI algorithms enable adaptive manufacturing, consistent quality, and flexible production through the integration of collaborative robots. These innovations strengthen operational efficiency and safety in manufacturing plants while aligning the deployment of intelligent robotics with Industry 4.0 objectives centered on automation, connectivity, and self-optimizing production ecosystems.

- In October 2025, the International Federation of Robotics reported that global sales of professional applications reached nearly 200,000 units in 2024, reflecting a 9% year-on-year increase.

Industry 4.0 Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Technology

|

Industrial Internet of Things, Robotics & Automation, Artificial Intelligence & Machine Learning, Big Data & Advanced Analytics, Additive Manufacturing, Augmented Reality & Virtual Reality, Digital Twin & Simulation, Blockchain, Others

|

|

By Vertical

|

Manufacturing, Construction, Automotive, Energy & Utilities, Oil & Gas, Food & Beverage, Aerospace & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The software segment generated USD 53.85 billion in revenue in 2024, mainly due to rising adoption of industrial IoT platforms, digital twin solutions, and AI-driven analytics for real-time process optimization.

- By Technology (Industrial Internet of Things, Robotics & Automation, Artificial Intelligence & Machine Learning, Big Data & Advanced Analytics, Additive Manufacturing, Augmented Reality & Virtual Reality, Digital Twin & Simulation, Blockchain, and Others): The robotics and automation segment is poised to record a CAGR of 25.69% through the forecast period, propelled by increasing demand for intelligent manufacturing, precision operations, and workforce efficiency enhancement.

- By Vertical (Manufacturing, Construction, Automotive, Energy & Utilities, Oil & Gas, Food & Beverage, Aerospace & Defense, and Others): The manufacturing segment is estimated to hold a share of 23.01% by 2032, fueled by large-scale implementation of smart factories, connected machinery, and predictive maintenance solutions in industrial production facilities.

- Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

What is the market scenario in North America and Asia Pacific region?

The North America industry 4.0 market accounted for a share of 34.09% in 2024, valued at USD 47.53 billion. This dominance is reinforced by the region’s advanced technological infrastructure and early adoption of automation. Companies in the region are increasingly investing in smart manufacturing, digital twins, and data-driven process optimization to improve production efficiency.

- In March 2025, Siemens announced a USD 285 million investment to establish advanced manufacturing facilities in Fort Worth, Texas, and Pomona, California. The initiative aims to produce electrical equipment for commercial, industrial, and construction applications while supporting AI data centers across the U.S.

The expansion of industrial IoT ecosystems and the integration of AI-enabled analytics enhanced operational visibility across manufacturing facilities. Collaboration between technology providers and industrial firms accelerated digital transformation initiatives, reinforcing North America’s position as a major market for Industry 4.0 innovation.

The Asia-Pacific industry 4.0 industry is expected to expand at a CAGR of 25.84% over the forecast period. This growth is propelled by large-scale industrial modernization and rapid digital transformation. Expanding manufacturing bases and rising automation investments are fueling demand for connected production systems and robotics.

Regional enterprises are adopting industrial IoT platforms, digital twin technologies, and predictive maintenance tools to optimize operations. Notably, India’s manufacturing sector is undergoing rapid transformation through the adoption of AI and ML, enabling smart factory development.

The NASSCOM Industry 4.0 Adoption Report projects digital technologies to comprise 40% of total manufacturing expenditure by 2025, up from 20% in 2021. Additionally, increasing collaborations among technology vendors and industrial enterprises are accelerating the deployment of smart factory solutions, thereby supporting regional market expansion.

- In March 2025, Goa Shipyard Limited signed a Memorandum of Understanding with IIT Hyderabad, Neer Interactive Solutions, the Center for Geospatial AI and Digital Twins, and AMS College to advance AI-driven shipbuilding. The collaboration focuses on integrating Geospatial Digital Twin technologies and Industry 4.0 principles to modernize design, security, and operational efficiency.

Regulatory Frameworks

- In the EU, the Artificial Intelligence Act (AI Act) governs the deployment and use of AI systems. It establishes a risk-based framework ensuring transparency, safety, and accountability in industrial automation and data-driven manufacturing processes relevant to Industry 4.0.

- In the U.S., the National Institute of Standards and Technology (NIST) Cybersecurity Framework oversees cybersecurity standards across connected manufacturing systems. It promotes secure integration of IoT devices and industrial networks, mitigating cyber risks within Industry 4.0 ecosystems.

- In Japan, the Industrial Standardization Act regulates technology standardization and quality assurance in industrial production. It facilitates interoperability across robotics, automation, and digital manufacturing systems aligned with Industry 4.0 objectives.

- In India, the National Manufacturing Policy (NMP) directs digital transformation and industrial modernization. It promotes the adoption of smart manufacturing technologies, automation, and advanced production systems under the Industry 4.0 framework.

- In China, the Made in China 2025 Initiative supervises industrial upgrading and technological innovation. It promotes intelligent manufacturing adoption and integration of digital technologies in industrial production, supporting the Industry 4.0 transition.

- In South Korea, the Manufacturing Innovation 3.0 Strategy governs policies aimed at transforming traditional factories into smart production environments. It promotes automation, connectivity, and data utilization in alignment with Industry 4.0 principles.

- In Singapore, the Smart Industry Readiness Index (SIRI) enforces assessment standards for digital transformation maturity. It assists manufacturing enterprises in benchmarking progress toward Industry 4.0 readiness through structured evaluation frameworks.

Competitive Landscape

Key players operating in the Industry 4.0 industry are focusing on mergers, partnerships, and joint ventures to expand technological capabilities and strengthen market positioning. Continuous R&D investments are being directed toward the development of automation software, robotics, and industrial connectivity solutions. Companies are integrating edge computing and advanced analytics to enhance interoperability across industrial ecosystems.

Strategic acquisitions are enabling portfolio diversification and access new digital manufacturing technologies. Collaborative agreements and memorandums of understanding (MoU) are fostering cross-industry innovation, standardization, and the integration of smart production frameworks, supporting the global advancement of Industry 4.0 ecosystems.

- In May 2025, UST signed a memorandum of understanding (MoU) with T-Works to advance innovation in manufacturing and engineering. The partnership aims to integrate smart factory systems, automotive AI platforms, and semiconductor frameworks, with a focus on developing 5G-enabled industrial IoT modules and accelerating Industry 4.0 solution deployment through joint commercialization initiatives.

Key Companies in Industry 4.0 Market:

- ABB

- Cisco Systems, Inc.

- Cognex Corporation

- Siemens AG

- Schneider Electric SE

- Rockwell Automation

- Honeywell International Inc.

- Emerson Electric Co.

- Intel Corporation

- IBM Corporation

- NVIDIA Corporation

- DENSO CORPORATION

- FANUC CORPORATION

- Robert Bosch GmbH

- Hitachi, Ltd.

Recent Developments (M&A/Partnerships/Agreements/Product Launch)

- In October 2025, ABB India expanded its Peenya capacity by launching a new variable speed drive production line, boosting output by 25%. The line integrates advanced automation aligned with Industry 4.0 standards, enhancing productivity, safety, and quality while supporting the ‘Atmanirbhar Bharat’ and ‘Make in India’ initiatives.

- In July 2025, SiMa.ai entered a go-to-market collaboration with Cisco to integrate its energy-efficient Modalix AI platform with Cisco’s IE3500 switch series. The partnership enables the deployment of edge AI solutions across industrial automation, logistics, and manufacturing, reinforcing AI adoption in Industry 4.0 applications.

- In July 2025, Emerson introduced the Ovation AI-enabled Virtual Advisor, the first generative AI advisor integrated into an automation system for the power and water sectors. Embedded within the Ovation 4.0 Automation Platform, it provides real-time operational insights, anomaly detection, and predictive maintenance to improve system efficiency and reliability.

- In May 2025, HUMAIN, a subsidiary of the Public Investment Fund, partnered with NVIDIA to accelerate AI development. The collaboration leverages NVIDIA’s computing infrastructure to advance GPU cloud capabilities, digital transformation, and Industry 4.0 innovation, positioning Saudi Arabia as a global hub for AI and automation.