Market Definition

RNA therapeutics are a class of medicines that use ribonucleic acid (RNA) molecules to modulate gene expression, replace faulty proteins, or regulate cellular functions to treat diseases. It includes mRNA therapies, siRNA therapies, antisense oligonucleotides (ASOs), microRNA therapeutics, and other RNA-based platforms.

The market encompasses the research, development, manufacturing, and commercialization of RNA-based therapies designed to prevent, treat, or manage diseases by targeting specific RNA molecules in the body.

RNA Therapeutics Market Overview

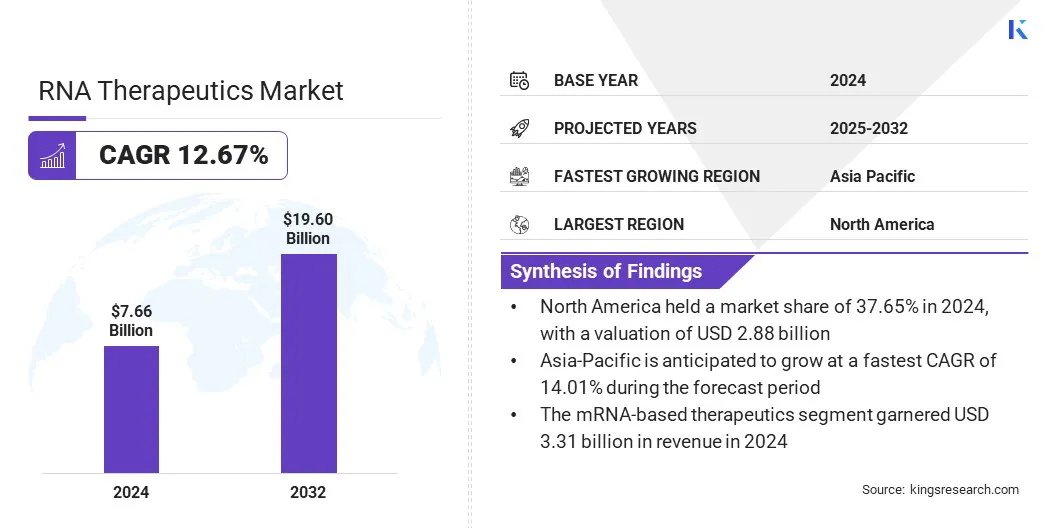

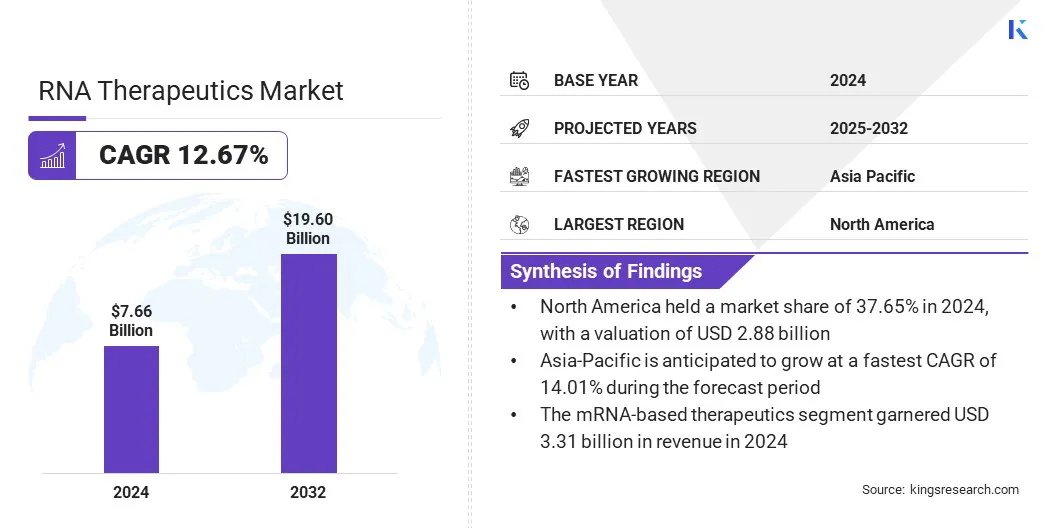

The global RNA therapeutics market size was valued at USD 7.66 billion in 2024 and is projected to grow from USD 8.50 billion in 2025 to USD 19.60 billion by 2032, exhibiting a CAGR of 12.67% over the forecast period.

Market growth is driven by the increasing prevalence of genetic and rare diseases, which is fueling demand for precision-targeted RNA-based therapies. The advancement of RNA delivery technologies, such as lipid nanoparticles, polymeric carriers, and conjugate-based systems, is further supporting the development of safer and more effective therapies.

Key Highlights:

- The RNA therapeutics industry size was recorded at USD 7.66 billion in 2024.

- The market is projected to grow at a CAGR of 12.67% from 2025 to 2032.

- North America held a share of 37.65% in 2024, valued at USD 2.88 billion.

- The mRNA-based therapeutics segment garnered USD 3.31 billion in revenue in 2024.

- The infectious diseases segment is expected to reach USD 7.48 billion by 2032.

- The biopharmaceutical & biotechnology companies segment is anticipated to witness the fastest CAGR of 14.48% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 14.01% over the forecast period.

Major companies operating in the RNA therapeutics market are Moderna, Inc, BioNTech SE, Alnylam Pharmaceuticals, Inc, Ionis Pharmaceuticals, Inc, Pfizer Inc, Sarepta Therapeutics, Inc, Arcturus Therapeutics, Inc, CureVac SE, Arrowhead Pharmaceuticals, Inc, Silence Therapeutics, Novartis AG, AstraZeneca, ReCode Therapeutics, Inc, Orna Therapeutics, Inc, and Creyon Bio, Inc.

Increasing collaboration between biotech and pharmaceutical companies is driving the development of novel RNAi-based therapies, thereby driving market growth. Additionally, the expansion of specialized RNAi platforms, combined with clinical development and regulatory expertise, is accelerating the adoption of innovative RNA-based therapeutics.

- In May 2025, Biogen entered a strategic research collaboration with City Therapeutics to develop novel RNAi-based therapies targeting central nervous system diseases. Under this collaboration, City Therapeutics will use its RNAi platform to create an RNAi trigger molecule, integrated with Biogen’s proprietary drug delivery platform and Biogen will conduct clinical development, regulatory filings, and commercialization of the novel RNAi-based therapies targeting central nervous system diseases.

Market Driver

Rising Prevalence of Genetic and Chronic Diseases

A key factor propelling the growth of the RNA therapeutics market is the rising prevalence of genetic and chronic diseases. Increasing incidences of inherited disorders, rare diseases, and chronic conditions such as cancer, cardiovascular, and metabolic disorders are creating a need for innovative therapies.

Pharmaceutical companies are focusing on the development of RNA-based therapies, including mRNA, siRNA, and antisense oligonucleotides, to provide targeted and precision-based treatment.

Healthcare providers are increasingly adopting these innovative therapies to address unmet medical needs and improve patient outcomes. This growing emphasis on personalized and effective treatment options is accelerating demand for RNA-based therapeutics and driving market growth.

- In May 2024, according to the National Cancer Institute (NCI), an estimated 14,910 new cancer cases are expected among individuals aged 0–19, with approximately 1,590 projected fatalities.

Market Challenge

High Development and Manufacturing Costs

A key challenge limiting the growth of the RNA therapeutics market is the high development and manufacturing costs of advanced RNA-based therapies. Producing mRNA, siRNA, and antisense oligonucleotides requires specialized equipment, complex synthesis, purification, and delivery systems, along with extensive preclinical and clinical testing. Strict quality control and regulatory compliance further increase production expenses and limit market growth.

To address this challenge, market players are investing in advanced production technologies and automated manufacturing processes to improve efficiency and reduce expenses in RNA-based therapeutics.

Companies are forming strategic partnerships with contract development and manufacturing organizations (CDMOs) to share expertise and infrastructure for efficient production of RNA therapeutics. Additionally, they are adopting scalable manufacturing platforms to enable faster scale-up and support the efficient commercialization of RNA-based therapeutics.

Market Trend

Integration of AI in RNA Therapeutics and Delivery Platforms

A key trend influencing the RNA therapeutics market is the integration of artificial intelligence (AI) in RNA therapeutic design and delivery platforms. Companies are leveraging AI to optimize RNA sequences, predict molecular interactions, and enhance delivery efficiency to target cells and tissues.

This is improving therapeutic precision, reducing off-target effects, and increasing overall efficacy. The growing focus of key players on AI-driven innovation is accelerating the development of safer and personalized RNA-based therapies across genetic disorders and central nervous system conditions.

- In February 2024, UT Southwestern Medical Center partnered with Pfizer to develop improved RNA delivery technologies for genetic medicine therapies. The collaboration leverages UT Southwestern’s expertise in RNA biology and delivery systems, along with Pfizer’s RNA knowledge, AI design capabilities, and rapid manufacturing infrastructure. It aims to advance RNA-based therapeutics and expand applications in cell-targeted and gene-editing therapies.

RNA Therapeutics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

mRNA-based Therapeutics, RNA Interference, Antisense Oligonucleotides, Others

|

|

By Indication

|

Infectious Diseases, Oncology, Cardiovascular Disorders, Neurological Disorders, Others

|

|

By End User

|

Hospitals & Clinics, Research & Academic Institutes, Biopharmaceutical & Biotechnology Companies, Contract Research and Manufacturing Organizations

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (mRNA-based Therapeutics, RNA Interference, Antisense Oligonucleotides, and Others): The mRNA-based therapeutics segment earned USD 3.31 billion in 2024 due to its broad application in vaccines and therapeutic development across multiple disease areas.

- By Indication (Infectious Diseases, Oncology, Cardiovascular Disorders, and Neurological Disorders): The infectious diseases segment held 37.65% of the market in 2024, driven by the rising demand for RNA-based vaccines and antiviral therapies.

- By End User (Hospitals & Clinics, Research & Academic Institutes, Biopharmaceutical & Biotechnology Companies, and Contract Research and Manufacturing Organizations): The biopharmaceutical & biotechnology companies segment is projected to reach USD 8.56 billion by 2032, owing to their increasing investment in RNA therapeutics research, development, and commercialization.

RNA Therapeutics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America RNA therapeutics market share stood at 37.65% in 2024 in the global market, valued at USD 2.88 billion. This dominance is driven by the increasing prevalence of genetic and rare diseases across the region. Rapid advancements in RNA delivery technologies, such as lipid nanoparticles and polymeric carriers are improving the stability and efficacy of therapeutics to ensure efficient targeting in specific cells or tissues.

Growing adoption of mRNA vaccines and RNA-based therapies is expanding their use across healthcare to address a wider range of diseases and improve patient outcomes. Additionally, regional players are forming strategic collaborations to accelerate research, development, and commercialization of RNA therapeutics, thereby driving market growth across the region.

- In March 2025, Nosis Biosciences entered a research collaboration and option agreement with Daiichi Sankyo to develop cell-targeted RNA medicines. Nosis will leverage its Connexa AI-powered platform to deliver RNA therapeutics to extrahepatic tissues. The collaboration aims to expand RNA-based treatments to organs such as the heart, brain, lungs, kidneys, and muscles.

Asia Pacific is set to grow at a CAGR of 14.01% over the forecast period. This growth is driven by the rapid expansion of healthcare infrastructure and the increased availability of advanced therapies across the region. The rising prevalence of infectious diseases and genetic disorders is creating strong demand for RNA-based vaccines and therapies.

The expansion of clinical research networks and contract manufacturing organizations in the region is enabling faster development of RNA therapeutics. Additionally, regional players are focusing on strategic collaborations to strengthen research capabilities, facilitate technology transfers, and establish local RNA manufacturing infrastructure, thereby boosting market growth.

- In March 2025, Quantoom Biosciences entered a strategic collaboration with TechInvention Lifecare to expand RNA manufacturing capabilities in India. Quantoom’s RNA N-Force toolbox will support the development, scale-up, and commercialization of m(sa)RNA-based vaccines and therapeutics. The partnership aims to enhance the accessibility, scalability, and affordability of RNA-based medicines in the region.

Regulatory Frameworks

- In the U.S., the U.S. Food and Drug Administration (FDA) regulates RNA therapeutics by overseeing preclinical and clinical trials, ensuring safety, efficacy, and quality standards. It enforces Good Manufacturing Practices (GMP), reviews Investigational New Drug (IND) applications, approves new therapies, and monitors post-marketing surveillance to protect patients and ensure compliance.

- In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) oversees RNA therapeutics by regulating clinical trials, assessing safety, efficacy, and quality, and approving new medicines. It enforces GMP and GCP compliance, monitors post-marketing adverse events, and ensures RNA-based therapies meet stringent standards for safe and effective patient use.

- In China, the National Medical Products Administration (NMPA) regulates RNA-based therapies by evaluating clinical trial applications, approving innovative biologics, and enforcing GMP and Good Clinical Practice (GCP) standards. It oversees product registration, quality control, and safety monitoring, ensuring RNA therapeutics meet regulatory requirements and are safe and effective for patients.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates RNA therapeutics through approval of clinical trials, evaluation of safety and efficacy, and oversight of manufacturing quality standards under Schedule M. It monitors post-marketing safety, enforces compliance with regulatory guidelines, and ensures RNA-based medicines meet national quality and safety requirements.

Competitive Landscape

Major players in the RNA therapeutics industry are actively developing next-generation delivery platforms to improve stability, targeting, and efficacy of RNA-based therapies. They are adopting artificial intelligence and bioinformatics tools to design optimized RNA sequences and streamline the discovery of novel therapeutics. Additionally, players are focusing on strategic collaborations to improve production infrastructure and expand their therapeutic portfolio and market presence.

- In April 2025, Creyon Bio entered a global licensing and multi-target research collaboration with Eli Lilly to develop RNA-targeted oligonucleotide therapies. Creyon will use its AI-powered oligo design platform to discover and optimize drug candidates for Lilly’s selected targets. The collaboration aims to create safer and more effective therapies for patients with rare and common diseases.

Top Key Companies in RNA Therapeutics Market:

- Moderna, Inc

- BioNTech SE

- Alnylam Pharmaceuticals, Inc

- Ionis Pharmaceuticals, Inc

- Pfizer Inc

- Sarepta Therapeutics, Inc

- Arcturus Therapeutics, Inc

- CureVac SE

- Arrowhead Pharmaceuticals, Inc

- Silence Therapeutics

- Novartis AG

- AstraZeneca

- ReCode Therapeutics, Inc

- Orna Therapeutics, Inc

- Creyon Bio, Inc.

Recent Developments

- In April 2025, Novartis entered into an agreement to acquire Regulus Therapeutics, a San Diego-based clinical-stage biopharmaceutical company. The acquisition aims to gain Regulus’ lead microRNA-targeting oligonucleotide, farabursen, for the treatment of autosomal dominant polycystic kidney disease (ADPKD).