Market Definition

Pedicle screw systems are surgical implants used to stabilize and align the spine during corrective or reconstructive procedures. They consist of screws anchored into vertebrae and connected through rods to provide structural fixation.

The market scope covers polyaxial, monoaxial, and other system types that address indications such as spinal degeneration, trauma, and deformities. These systems are widely applied in thoracolumbar, cervical, and lumbar fusion surgeries, with adoption rising due to the shift toward minimally invasive techniques.

Pedicle Screw Systems Market Overview

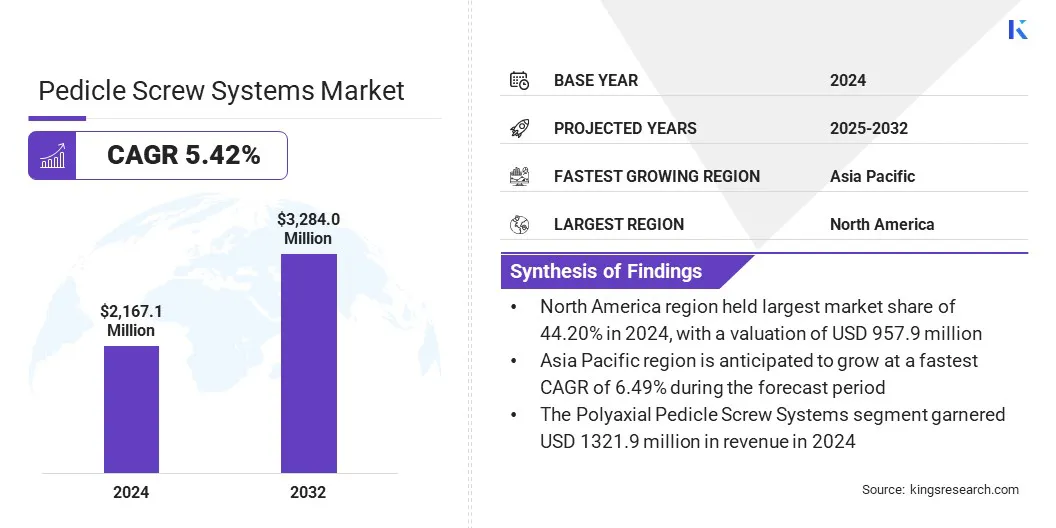

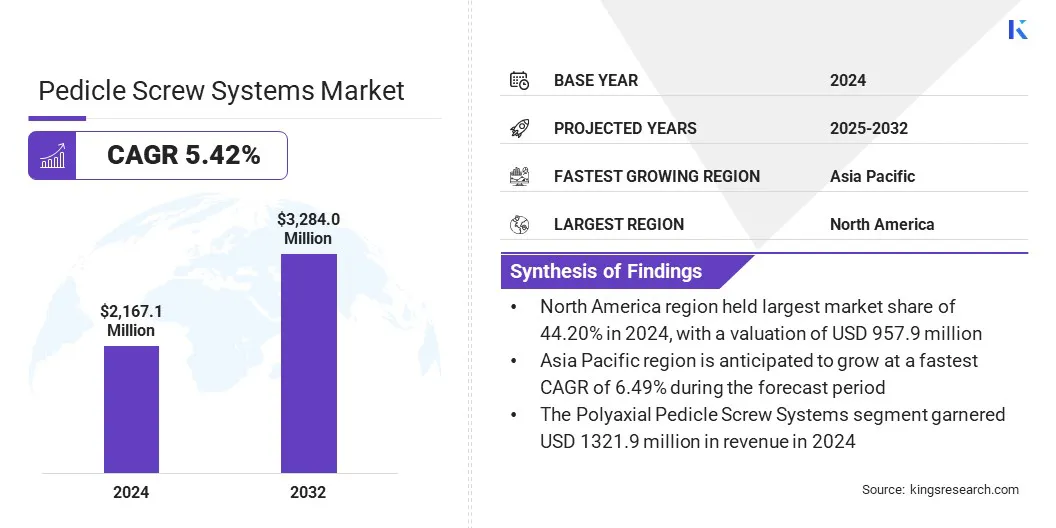

The global pedicle screw systems market size was valued at USD 2,167.1 million in 2024 and is projected to grow from USD 2,269.3 million in 2025 to USD 3,284.0 million by 2032, exhibiting a CAGR of 5.42% during the forecast period.

This growth is attributed to the growing cases of spinal cord related injuries, which are increasing the demand for pedicle screw systems for spinal stabilization and corrective surgeries. The market is also witnessing advancements such as 3D-printed titanium pedicle screw systems, offering customized implants that enhance surgical precision and implant strength. These systems are increasingly used in complex thoracolumbar, cervical, and lumbar fusion procedures.

Key Highlights:

- The pedicle screw systems industry size was USD 2,167.1 million in 2024.

- The market is projected to grow at a CAGR of 5.42% from 2025 to 2032.

- North America held a share of 44.20% in 2024, valued at USD 957.9 million.

- The polyaxial pedicle screw systems segment garnered USD 1,321.9 million in revenue in 2024.

- The minimally invasive surgery segment is expected to reach USD 1,695.5 million by 2032.

- The spinal degeneration segment is projected to generate a revenue of USD 1,250.4 million by 2032.

- The thoracolumbar fusion segment is estimated to reach USD 1,980.2 million by 2032.

- The hospitals segment garnered USD 1,201.7 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 6.49% over the forecast period.

Major companies operating in the pedicle screw systems market are Zimmer Biomet, Stryker, Globus Medical, B. Braun SE, NuVasive, Inc., Orthofix Medical Inc., Narang Medical Limited, Bonetech Medisys, HCM ORTHOCARE PVT.LTD, Medicon eG, SOFEMED, Aysam Orthopaedics & Medical Devices, Z-Medical GmbH & Co. KG, MiRus, LLC, and Clariance SAS.

Companies are developing modular pedicle screw systems that allow flexible configuration, easier implantation, and compatibility with both open and minimally invasive procedures. These designs improve surgical workflow, reduce procedure time, and enhance adaptability for complex spinal anatomies. This approach supports broader clinical adoption and enables surgeons to address a wide range of spinal conditions with greater precision.

- In February 2025, Medtronic launched the CD Horizon ModuLeX spinal system for deformity procedures, integrated with its AiBLE ecosystem. The modular screw platform enables surgeons to tailor screw shanks and heads to patient-specific anatomy while improving visibility and assembly confidence.

Market Driver

Growing Prevalence of Spinal Cord Injuries

The expansion of the pedicle screw systems market is propelled by the growing prevalence of spinal cord injuries worldwide. Rising road accidents, workplace injuries, and sports-related trauma are creating demand for surgical intervention to stabilize the spine.

Pedicle screw systems provide rigid fixation, maintain vertebral alignment, and support fusion across affected segments. Growing adoption of advanced pedicle screw systems in hospitals and surgical centers is fueling market growth.

- In April 2024, the World Health Organization (WHO) reported that over 15 million people worldwide are living with spinal cord injury (SCI). Most cases result from trauma, including falls, road traffic incidents, or violence, most of which are preventable.

Market Challenge

High Risk of Surgical Complications Limiting Pedicle Screw Systems Adoption

A major challenge limiting the growth of the pedicle screw systems market is the risk of surgical complications, including screw misplacement, nerve damage, and implant failure. These risks can limit adoption, as surgeons and hospitals may prefer established techniques or hesitate to use new systems.

To address this challenge, manufacturers are developing advanced navigation and robotic-assisted technologies that enhance precision during implantation. Companies are also providing comprehensive surgeon training and simulation programs to reduce errors and improve patient outcomes, supporting wider adoption of pedicle screw systems.

Market Trend

Rising Use of Advanced 3D-printed Titanium Pedicle Screw Systems

The pedicle screw systems market is witnessing a notable trend toward the use of advanced 3D-printed titanium pedicle screw systems. These systems allow screws to be customized to a patient’s specific spinal anatomy, improving stability and surgical outcomes.

The 3D printing process enhances implant strength and durability while reducing the risk of complications during surgery. This trend is enabling manufacturers to provide precise solutions for complex spinal procedures, fostering innovation in the market.

- In May 2025, Eminent Spine received FDA 510(k) clearance for its 3D printed titanium pedicle screw system, becoming the first FDA-cleared 3D printed pedicle screw globally. The system features cannulated, fenestrated screws with a 3D lattice surface, hybrid thread patterns, and self-harvesting cutting flutes to enhance fixation and bone preservation.

Pedicle Screw Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Polyaxial Pedicle Screw Systems, Monoaxial Pedicle Screw Systems, Others

|

|

By Surgery Type

|

Open Surgery, Minimally Invasive Surgery

|

|

By Indication

|

Spinal Degeneration, Spinal Trauma, Spinal Deformities, Others

|

|

By Application

|

Thoracolumbar Fusion, Cervical Fusion, Lumbar Fusion

|

|

By End User

|

Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Research & Academic Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Polyaxial Pedicle Screw Systems, Monoaxial Pedicle Screw Systems, and Others): The polyaxial pedicle screw systems segment earned USD 1,321.9 million in 2024, largely due to its versatility in accommodating complex spinal anatomies and supporting both open and minimally invasive procedures.

- By Surgery Type (Open Surgery and Minimally Invasive Surgery): The open surgery segment held a share of 52.50% in 2024, fueled by its widespread use in treating severe spinal deformities and trauma cases.

- By Indication (Spinal Degeneration, Spinal Trauma, Spinal Deformities, and Others): The spinal degeneration segment is projected to reach USD 1,250.4 million by 2032, owing to the rising prevalence of degenerative spine disorders in aging populations.

- By Application (Thoracolumbar Fusion, Cervical Fusion, and Lumbar Fusion): The thoracolumbar fusion segment is projected to reach USD 1,980.2 million by 2032, owing to the increasing number of complex spinal procedures in this region.

- By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Research & Academic Institutes): The hospitals segment earned USD 1,201.7 million in 2024, supported by advanced surgical infrastructure and skilled spine surgeons.

Pedicle Screw Systems Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America pedicle screw systems market share stood at 44.20% in 2024, valued at USD 957.9 million. This dominance is reinforced by the well-established healthcare sector and streamlined regulatory approvals for new products, which enable rapid adoption of advanced surgical technologies.

Hospitals and surgical centers are able to integrate navigation and robotic-assisted systems efficiently, increasing the usage of pedicle screw systems in both open and minimally invasive procedures. This strong infrastructure and regulatory environment support continuous product launches and clinical adoption, sustaining regional dominance in the market.

- In September 2025, Brainlab received FDA 510(k) clearance and launched its Spine Mixed Reality Navigation system in the U.S. The system combines optical navigation with mixed reality, providing surgeons with real-time visualization of entry and target points for pedicle screw placement. It offers an ergonomic view directly in the sterile field for both standard and minimally invasive spine procedures.

The Asia-Pacific pedicle screw systems industry is poised to grow at a significant CAGR of 6.49% over the forecast period. The growth is propelled by rising investments from both government healthcare programs and private hospital chains aimed at expanding hospital infrastructure and upgrading surgical facilities.

These investments are specifically supporting the adoption of minimally invasive spine surgeries and advanced pedicle screw systems. Expanding hospital networks and increasing access to advanced surgical technologies are accelerating regional market growth.

- In July 2025, Adani Group announced plans to build an AI-first, multidisciplinary healthcare ecosystem in India. The initiative aims to integrate affordability, scalability, and global best practices across healthcare services. The initiative is backed by a USD 7.01 billion investment across healthcare, education, and skill development.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates pedicle screw systems under the Center for Devices and Radiological Health (CDRH) through the 510(k) premarket notification pathway, requiring manufacturers to demonstrate substantial equivalence to legally marketed devices.

- In Europe, pedicle screw systems are monitored under the European Union Medical Device Regulation (EU MDR 2017/745), where manufacturers must obtain CE marking by meeting clinical evaluation, quality management, and post-market surveillance requirements.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) governs pedicle screw systems under the Pharmaceutical and Medical Device Act (PMD Act), requiring review of safety, performance, and quality standards prior to market entry.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates pedicle screw systems under the Medical Device Rules, 2017, classifying these devices as high-risk and requiring import licensing, clinical investigation, and quality certification.

Competitive Landscape

Key players in the pedicle screw systems industry are developing advanced solutions that integrate navigation and robotic-assisted technology to enhance precision in spine surgery. Companies are creating platforms supporting both open and minimally invasive procedures through real-time surgical guidance and advanced imaging integration.

Enhanced software features are improving accuracy, workflow efficiency, and compatibility with operating room systems. Firms are launching applications that unify planning, visualization, and execution, while expanding capabilities to address complex spinal deformities and trauma cases.

- In June 2025, ChoiceSpine launched its ChoiceSpine App for surgical use on the eCential Op.n robotic and navigation platform. The app integrates advanced navigation and robotic-assisted technology with ChoiceSpine’s pedicle screw systems, supporting both open and minimally invasive spine procedures. It enhances implant placement precision, reduces radiation exposure, and improves procedural efficiency.

Top Key Companies in Pedicle Screw Systems Market:

- Zimmer Biomet

- Stryker

- Globus Medical

- B. Braun SE

- NuVasive, Inc.

- Orthofix Medical Inc.

- Narang Medical Limited

- Bonetech Medisys

- HCM ORTHOCARE PVT.LTD

- Medicon eG

- SOFEMED

- Aysam Orthopaedics & Medical Devices

- Z-Medical GmbH & Co. KG

- MiRus, LLC

- Clariance SAS

Recent Developments

- In April 2024, DePuy Synthes showcased its TriALTIS Spine System and TriALTIS Navigation Enabled Instruments at IMAST 2024 in San Diego. This next-generation posterior thoracolumbar pedicle screw system combines advanced implants and instrumentation with enabling technologies to address complex spine conditions, including degenerative, tumor, trauma, and deformity pathologies.