Market Definition

Outboard engines are compact propulsion systems that combine the engine, gearbox, and propeller into a single external unit mounted on the boat’s transom. They enable precise navigation and simplified maintenance across various marine environments.

The market covers engines powered by gasoline, diesel, and electric fuels across 2-stroke, 4-stroke, and electric configurations. These systems are widely used in recreational, commercial, and military vessels to ensure efficient power delivery and dependable performance.

Outboard Engines Market Overview

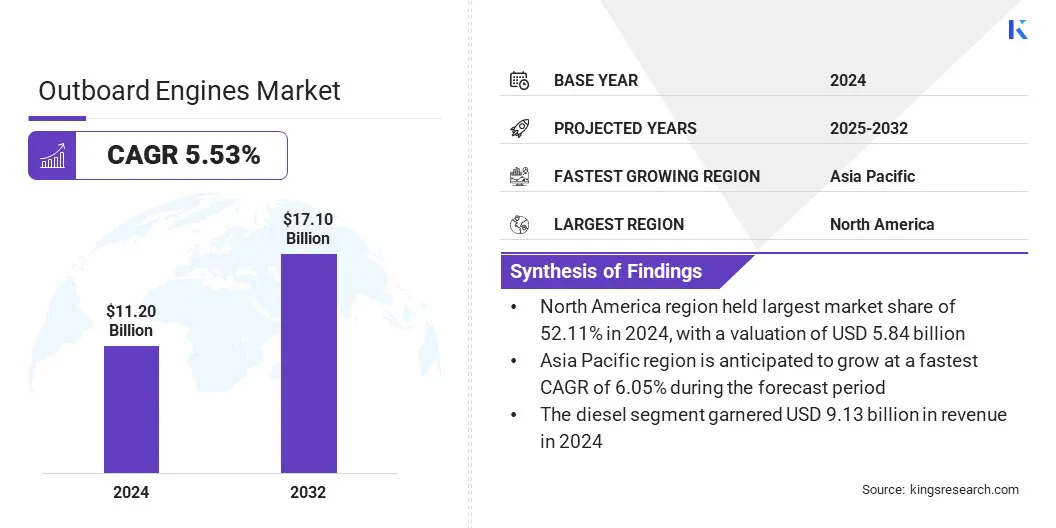

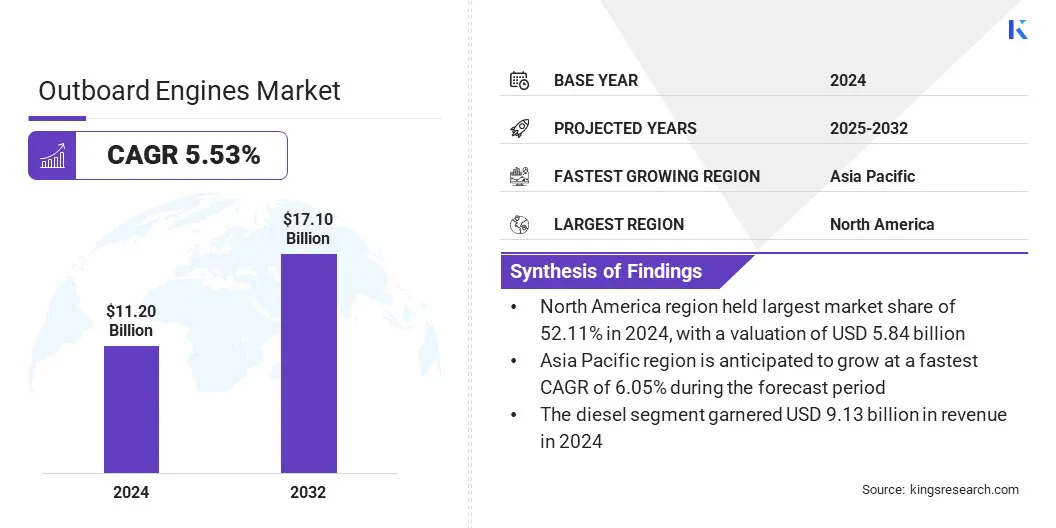

The global outboard engines market size was valued at USD 11.20 billion in 2024 and is projected to grow from USD 11.74 billion in 2025 to USD 17.10 billion by 2032, exhibiting a CAGR of 5.53% during the forecast period.

This growth is fuelled by the rising popularity of recreational boating and water sports, which has increased demand for efficient and dependable propulsion systems. Additionally, the market is witnessing a notable shift toward sustainable and low-emission marine solutions, with a growing focus on electric and hybrid engines.

Key Market Highlights:

- The outboard engines industry size was recorded at USD 11.20 billion in 2024.

- The market is projected to grow at a CAGR of 5.53% from 2025 to 2032.

- North America held a market share of 52.11% in 2024, with a valuation of USD 5.84 billion.

- The 4 stroke segment garnered USD 6.48 billion in revenue in 2024.

- The diesel segment is expected to reach USD 13.78 billion by 2032.

- The commercial segment is expected to reach USD 8.43 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.05% over the forecast period.

Major companies operating in the outboard engines market are Yamaha Motor Co., Ltd., Mercury Marine (Brunswick Corporation), Suzuki Motor Corporation, Honda India Power Products Ltd., Tohatsu Corporation, Suzhou Parsun Power Machine Co., Ltd., Hidea outboard motors, Selva S.p.A., OXE Marine, Torqeedo GmbH, ePropulsion, LEHR LLC, Zhejiang Anqidi Power Machinery Co.,Ltd., Hangzhou Seatan, and Hangkai.

Companies are developing high-horsepower premium outboard engines with improved fuel efficiency, higher torque, and integrated electronic control systems. These innovations aim to meet the growing demand for powerful and reliable marine propulsion systems in recreational and commercial sectors.

Manufacturers are also adding hybrid and electric options to offer low-emission options without compromising performance, supporting broader adoption of premium outboard engines across diverse applications.

- In July 2025, Mercury Marine, a division of Brunswick Corporation, expanded its Verado outboard lineup with the introduction of a V10 425hp model and an upgraded V10 350hp model. These engines provide higher torque, improved acceleration, better fuel efficiency, and reduced noise levels. Both models feature a compact V10 platform, Digital Throttle & Shift, and optional Joystick Piloting, suitable for repowering existing boats or new vessel builds.

How is the rising popularity of recreational boating and water sports accelerating demand for outboard engines?

Rising popularity of recreational boating and water sports activities is leading to increased participation in leisure and adventure experiences. This is creating a strong demand for boats equipped with reliable and efficient outboard engines.

- In June 2024, the Outdoor Foundation and Outdoor Industry Association released the 2024 Outdoor Participation Trends Report, showing U.S. outdoor recreation participation increased by 4.1% in 2023 to 175.8 million people.

Regions with expanding tourism and rising disposable income are witnessing greater adoption of recreational vessels. Manufacturers are responding by providing engines with enhanced performance, ease of use, and durability, which is actively contributing to the growth of the market.

How do high upfront costs of advanced 4-stroke engines limit outboard engines market growth?

High upfront costs for advanced 4-stroke and electric outboard engines significantly restrict their adoption, particularly among small recreational users and emerging commercial operators. These buyers often operate with limited budgets, making it difficult to justify the higher initial investment despite the long-term efficiency benefits. .

To address this challenge, manufacturers are introducing flexible financing options, leasing models, and bundled service packages to reduce the immediate financial burden on buyers. Furthermore, companies are improving production efficiency and leveraging technological innovations to reduce manufacturing costs and enhance price competitiveness.

How is the industry-wide shift toward electric marine propulsion driving advancements in outboard engine technologies?

The outboard engines market is witnessing a notable trend toward the widespread adoption of electric propulsion systems, as manufacturers and operators prioritize sustainable, low-emission marine solutions. Rising environmental concerns and regulatory pressure are accelerating the transition from conventional diesel and gasoline engines to electric alternatives.

Electric propulsion systems are gaining traction due to improvements in battery capacity, motor performance, and overall system integration, which enhance reliability and operational efficiency. This shift highlights the rising focus on clean, efficient, and technologically advanced marine propulsion solutions.

- In October 2024, EPTechnologies launched the FALCON, a fully electric outboard motor designed as an electric propulsion system. Its lightweight axial flux design, adjustable shaft length, and a 360° rotating propeller hub improve manoeuvrability and stability. The motor offers high efficiency, extended range, and reduced environmental impact, supported by customizable in-house lithium battery systems customized to vessel requirements.

Outboard Engines Market Report Snapshot

|

Segmentation

|

Details

|

|

By Engine Type

|

4 Stroke, 2 Stroke, Electric

|

|

By Fuel Type

|

Diesel, Electric, Gasoline

|

|

By Application

|

Commercial, Recreational, Military

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Engine Type (4 Stroke, 2 Stroke, and Electric): The 4 stroke segment earned USD 6.48 billion in 2024, mainly due to its higher fuel efficiency, lower emissions, and longer engine life, which make it the preferred choice for both recreational and commercial vessels.

- By Fuel Type (Diesel, Electric, and Gasoline): The diesel segment held a share of 81.52% in 2024, fueled by its superior torque, fuel efficiency, and reliability for heavy-duty and long-distance marine operations.

- By Application (Commercial, Recreational, and Military): The commercial segment is projected to reach USD 8.43 billion by 2032, propelled by the growing demand for fishing, transport, and logistics vessels that require robust, high-performance outboard engines.

- Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

What is the market scenario in North America and Asia-Pacific region?

North America outboard engines market share stood at 52.11% in 2024, valued at USD 5.84 billion. This dominance is reinforced by a well-established recreational boating sector and strong consumer spending on marine activities. Ongoing collaborations among major companies to develop advanced engines and enhance overall boating experience are further boosting demand. Continued innovation and emphasis on user experience are expected to support regional market growth.

- In December 2024, McLaren Engineering and Honda Marine announced a collaboration to develop the McLaren Performance M300, a performance-inspired marine outboard engine. The engine, based on Honda’s BF250 platform, features enhanced top-end power of 300 hp, improved mid-range torque, and advanced fuel and valve management systems.

The Asia-Pacific outboard engines industry is poised to grow at a significant CAGR of 6.05% over the forecast period. This growth is propelled by rising commercial marine operations, including fishing, transport, and logistics, along with increasing recreational boating in emerging economies such as India, Indonesia, and Thailand.

Expanding coastal infrastructure and favourable government support for maritime development are further generating a strong demand for reliable outboard engines. This expansion is expected to accelerate adoption and position Asia Pacific as the fastest-growing market globally.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates outboard engines under the Clean Air Act through its Marine Spark-Ignition Engine Emission Standards, which limit both exhaust and evaporative emissions.

- In the European Union, the European Commission enforces compliance under Regulation (EU) 2016/1628, setting emission limits for non-road mobile machinery, including marine engines.

- In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) oversees type approval and emission standards for outboard motors.

- In China, the Ministry of Ecology and Environment (MEE) implements emission regulations aligned with China Marine Engine Emission Standards to control air pollutants from marine propulsion systems.

- In India, the Central Pollution Control Board (CPCB) sets emission norms for outboard engines under the Motor Vehicle Act and Bharat Stage (BS) standards.

Competitive Landscape

Key players operating in the outboard engines industry are enhancing their competitive positions through technological innovation and product development. They are incorporating high-performance engine configurations, including V6 models, to deliver higher torque and improved operational efficiency across diverse marine applications.

Companies are advancing fuel injection systems, optimizing engine weight, and refining electronic control units to boost performance and reliability. They are also developing hybrid and electric powertrains, implementing smart engine management systems, and upgrading connectivity features to meet evolving performance standards and regulatory requirements to maintain competitiveness.

- In September 2024, Mercury Marine and Mercury Racing launched the 150R and 200R V6 outboard engines at the Cannes Yachting Festival. The engines, built on a 3.4-liter V6 platform, feature enhanced torque, improved acceleration, Digital Throttle & Shift, and GPS-enabled fuel optimization. Both models include larger alternators and battery management systems to support onboard electronics and offer multiple shaft and gearcase configurations for various performance applications.

Key Companies in Outboard Engines Market:

- Yamaha Motor Co., Ltd.

- Mercury Marine (Brunswick Corporation)

- Suzuki Motor Corporation

- Honda India Power Products Ltd.

- Tohatsu Corporation

- Suzhou Parsun Power Machine Co., Ltd.

- Hidea outboard motors

- Selva S.p.A.

- OXE Marine

- Torqeedo GmbH

- ePropulsion

- LEHR LLC

- Zhejiang Anqidi Power Machinery Co.,Ltd.

- Hangzhou Seatan

- Hangkai

Recent Developments

- In January 2025, Honda Motor Co., Ltd. introduced the BF300 large-size outboard motor at the Dusseldorf Boat Show. The model features a 4,952 cm³ V8 engine delivering 300 horsepower and runs on regular gasoline. It incorporates cruise control, automatic trim adjustment, and an automatic tilt function for easier operation and docking.

- In February 2025, Honda unveiled updated versions of seven large-size outboard motors, BF250, BF225, BF200, BF150, BF140, BF135, and BF115, at the Miami International Boat Show. These updates include BF350-inspired styling, a flash-mount electronic remote-control (DBW), a 7-inch multifunction display, cruise control, automatic trim and tilt functions, and improved fuel economy supported by an oxygen sensor on select models.

- In September 2024, Wajer Yachts introduced the 38 S with outboard engines at the Cannes Yachting Festival. The model is equipped with three 5.7-liter 400 HP V10 Mercury Verado engines, enabling a top speed of 55 knots and enhanced agility. Additional updates include an enlarged roof, redesigned cockpit and console, optional solar panels, a wet bar, Garmin screens, and improved boarding and maintenance features.