Market Definition

A microcatheter is a thin, flexible medical device designed to navigate small and complex blood vessels. It is primarily used in drug delivery, embolization, angioplasty, thrombectomy, and diagnostic imaging applications. The market encompasses the development, manufacturing, and commercialization of these devices, covering product innovations and clinical applications across interventional cardiology, neurology, oncology, and peripheral vascular procedures.

Microcatheters Market Overview

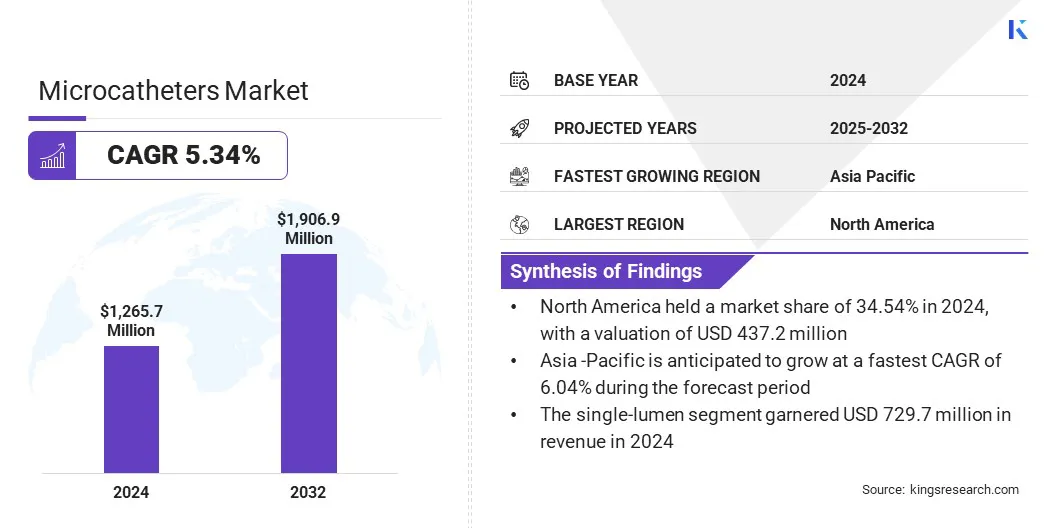

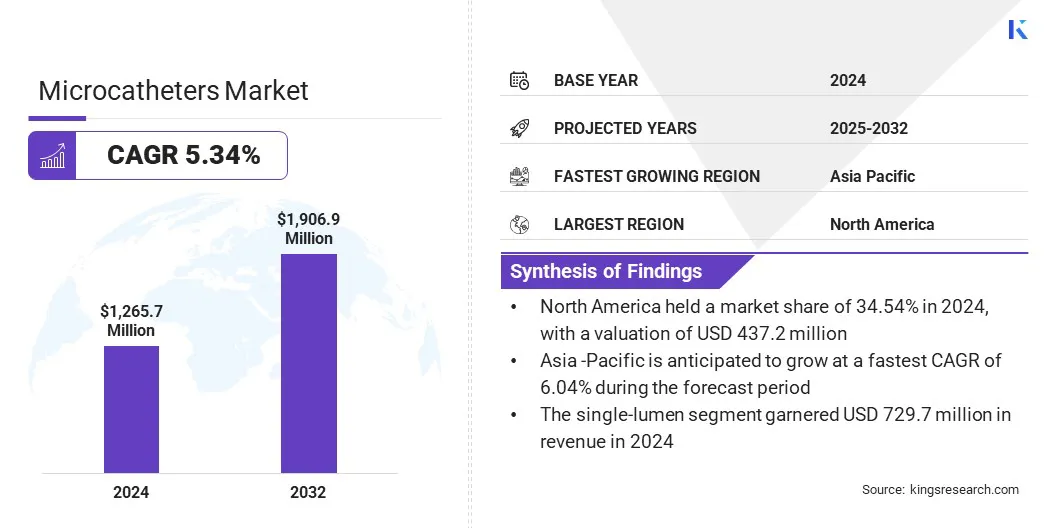

According to Kings Research, the global microcatheters market size was valued at USD 1,265.7 million in 2024 and is projected to grow from USD 1,324.4 million in 2025 to USD 1,906.9 million by 2032, exhibiting a CAGR of 5.34% over the forecast period.

Market growth is driven by increasing awareness and adoption of minimally invasive procedures among clinicians and patients. Increasing adoption of microcatheters in oncology and peripheral vascular treatments is further supporting the adoption of advanced microcatheters devices.

Key Highlights

- The microcatheters industry size was recorded at USD 1,265.7 million in 2024.

- The market is projected to grow at a CAGR of 5.34% from 2024 to 2032.

- North America held a 34.54% market share in 2024, which was valued at USD 437.2 million.

- The aspiration microcatheters segment garnered USD 486.7 million in revenue in 2024.

- The single-lumen segment is expected to reach USD 1,037.8 million by 2032.

- The neurovascular segment is anticipated to witness the fastest CAGR of 6.12% over the forecast period.

- The hospitals segment held a share of 54.22% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 6.04% over the forecast period.

Major companies operating in the microcatheters market are Terumo Group, Boston Scientific Corporation, Merit Medical Systems, Inc., Stryker Corporation, ASAHI INTECC USA, INC., Medtronic Inc., Cook Group Incorporated, Penumbra, Inc., AngioDynamics, Inc., Acandis GmbH, Embolx, Inc., BrosMed Medical Co., Ltd, Integer Holdings Corporation, NeuroSafe Medical Co., Ltd, and Shenzhen MicroApproach Medical Technology Co., Ltd.

The increasing prevalence of cardiovascular diseases (CVDs) create a strong demand for minimally invasive interventional procedures, such as angioplasty, thrombectomy, and embolization, where microcatheters are essential. Growing incidence of CVDs are leading hospitals and clinicians to adopt advanced microcatheters to improve outcomes and enhance patient survival, which is expected to boost market growth.

- In May 2024, the World Health Organization (WHO) reported that cardiovascular diseases are the primary cause of disability and premature mortality in the European Region. CVDs account for over 42.5% of all deaths annually and claim approximately 10,000 lives each day.

Market Driver

Rising Incidence of Peripheral Vascular Diseases

A key factor propelling the growth of the microcatheters market is the rising incidence of peripheral vascular diseases (PVDs). The increasing burden of these diseases is creating a demand for minimally invasive treatments that improve safety and outcomes of medical procedures.

Microcatheters support precise navigation in complex vascular anatomies and help physicians perform highly controlled interventions with greater accuracy. This growing reliance on microcatheters for precise navigation and targeted delivery is driving their adoption in interventional procedures.

- In 2023, the American Heart Association (AHA) reported that peripheral artery disease (PAD) affects more than 200 million individuals worldwide, including over 12 million Americans.

Market Challenge

High Production Cost

A key challenge impeding the growth of the microcatheters market is their high production cost. Manufacturing microcatheters involves precision engineering, specialized materials, and advanced features such as braided shafts, hydrophilic coatings, and tapered tips.

These components require sophisticated equipment and skilled labor which increase the production costs and subsequent pricing. This creates barriers for smaller manufacturers and limits large-scale adoption of microcatheters.

To address this challenge, market players invest in advanced manufacturing technologies, including automation, precision machining to improve efficiency and reduce manufacturing expenses. They also adopt cost-effective materials and optimize design features without compromising performance. Market players also engage in strategic partnerships, outsourcing component manufacturing, and packaging activities to lower microcatheter production costs.

Market Trend

Advancements in Microcatheter Design

A key trend influencing the microcatheters market is continuous advancements in microcatheter design. Manufacturers are developing devices with braided shafts and hydrophilic coatings to enhance flexibility, trackability, and precision in complex vascular anatomies. These innovations improve efficiency, enable targeted delivery of therapeutic agents, and reduce complications of interventional procedures.

The adoption of advanced microcatheters is enhancing product differentiation and prompting product adoption across neurovascular, peripheral vascular, and oncology interventions.

- In September 2025, ASAHI INTECC launched Veloute and Tellus embolization microcatheters in the U.S. These products have been designed for precise navigation and delivery in peripheral vasculature.

Microcatheters Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Aspiration Microcatheters, Delivery Microcatheters, Diagnostic Microcatheters, Steerable Microcatheters

|

|

By Design

|

Single-Lumen, Dual-Lumen

|

|

By Application

|

Cardiovascular, Neurovascular, Peripheral Vascular, Oncology, Others

|

|

By End-User

|

Hospitals, Specialty Clinics, Ambulatory Surgical Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Aspiration Microcatheters, Delivery Microcatheters, Diagnostic Microcatheters, and Steerable Microcatheters): The aspiration microcatheters segment earned USD 486.7 million in 2024 due to their high adoption in peripheral and neurovascular interventions for targeted embolization and improved procedural efficiency.

- By Design (Single-Lumen, and Dual-Lumen): The single-lumen segment held 57.65% of the market in 2024, driven by its simplicity, cost-effectiveness, and widespread use in standard interventional procedures.

- By Application (Cardiovascular, Neurovascular, Peripheral Vascular, Oncology, and Others): The cardiovascular segment is projected to reach USD 807.0 million by 2032, owing to the rising prevalence of heart diseases and a clear shift toward minimally invasive procedures.

- By End-User (Hospitals, Specialty Clinics and Ambulatory Surgical Centers): The ambulatory surgical centers segment is anticipated to witness the fastest CAGR of 6.11% over the forecast period, driven by rising outpatient procedures and growing adoption of minimally invasive interventions.

Microcatheters Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America microcatheters market stood at 34.54% in 2024, valued at USD 437.2 million in the global market. This dominance is primarily driven by the rising prevalence of cardiovascular and neurovascular diseases, which is creating sustained demand for minimally invasive treatment options that enhance patient safety and clinical effectiveness.

Advancements in microcatheter design are further improving flexibility, trackability, and precision, enabling successful navigation in complex vascular anatomies. Growing adoption of microcatheters in oncology and peripheral vascular interventions is broadening their therapeutic scope across specialties. Additionally, regional players are continuously driving product innovation and expanding their portfolios, thereby driving market expansion in the region.

- In January 2025, Argon Medical acquired SeQure and DraKon microcatheters from Guerbet SA, expanding its therapeutic oncology portfolio. This strengthens Argon’s position in interventional procedures by adding innovative, high-performance devices that enhance precision and treatment outcomes.

Asia Pacific is set to grow at a CAGR of 6.04% over the forecast period. This growth is driven by the rising prevalence of cardiovascular and neurovascular diseases in the region, fueled by aging populations and increasing incidence of lifestyle-related conditions such as diabetes and hypertension. Expansion of healthcare infrastructure by governments and private healthcare providers is also improving region’s access to advanced interventional procedures.

Increasing awareness and adoption of minimally invasive techniques among clinicians and patients are further boosting demand for precise and effective treatment solutions. Additionally, increasing government investment in healthcare initiatives and local manufacturing is enhancing the availability of high-quality microcatheters.

- In May 2025, the Technology Development Board (TDB), Department of Science and Technology (DST), granted funding to S3V Vascular Technologies to establish India’s first integrated manufacturing facility for neuro-intervention devices. The facility will produce microcatheters, aspiration catheters, and stent retriever systems for mechanical thrombectomy, strengthening indigenous manufacturing capabilities.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) regulates microcatheters as medical devices under the Center for Devices and Radiological Health (CDRH). It oversees device classification, pre-market approvals, and safety and performance standards. The FDA also monitors labeling compliance, clinical trials, post-market surveillance, and reporting of adverse events to ensure patient safety and procedural efficacy in cardiovascular, neurovascular, and peripheral interventions.

- In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) regulates microcatheters as medical devices. It oversees safety, quality, and performance standards and evaluates pre-market approvals and clinical evidence. MHRA also monitors adverse events, enforces labeling compliance, and facilitates the safe introduction of innovative interventional devices in healthcare settings.

- In China, the National Medical Products Administration (NMPA) regulates microcatheters, overseeing registration, manufacturing, and marketing. It enforces product safety, quality control, and clinical evaluation. NMPA also manages labeling standards, approves clinical trials, and monitors adverse events, ensuring domestic and imported devices meet rigorous performance and safety benchmarks.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates microcatheters under the Medical Device Rules. It manages device registration, clinical trials, and quality standards. CDSCO also oversees labeling compliance, import and domestic production approvals, and post-market monitoring to safeguard patient safety and ensure reliable performance in interventional procedures.

Competitive Landscape

Major players operating in the microcatheters industry are developing advanced microcatheters with improved flexibility, trackability, and precision to enable safe and efficient navigation through complex vascular anatomies.

They are expanding their product portfolios by introducing specialized devices that support targeted therapeutic delivery and improve procedural efficiency in cardiovascular and peripheral interventions. Additionally, players are strengthening regional presence and production capabilities through investments in local manufacturing and advanced facility development.

- In February 2024, BIOTRONIK and IMDS launched the Micro Rx rapid exchange microcatheter in the U.S. It is designed for enhanced guidewire support and navigation in complex coronary lesions. This launch strengthens BIOTRONIK’s interventional cardiology portfolio by offering advanced, high-precision devices that improve procedural efficiency and patient safety.

Top Companies in Microcatheters Market:

- Terumo Group

- Boston Scientific Corporation

- Merit Medical Systems, Inc

- Stryker Corporation

- ASAHI INTECC USA, INC

- Medtronic Inc.

- Cook Group Incorporated

- Penumbra, Inc.

- AngioDynamics, Inc.

- Acandis GmbH

- Embolx, Inc.

- BrosMed Medical Co., Ltd

- Integer Holdings Corporation

- NeuroSafe Medical Co., Ltd

- Shenzhen MicroApproach Medical Technology Co., Ltd.

Recent Developments

- In February 2025, Penumbra launched the ACCESS25 microcatheter for precise neurovascular aneurysm access and coil delivery. This device enhances procedural efficiency, stability, and clinical outcomes and strengthen Penumbra’s neurovascular portfolio.

- In November 2024, APT Medical’s Braidin Pro large sheath and Distail microcatheter received CE certification under the EU MDR, confirming compliance with European safety and performance standards. This enables APT Medical to expand its presence in Europe by offering advanced and high-performance microcatheters.