Market Definition

The market comprises connected instruments that collect, transmit, and analyze patient data through internet-based networks. These devices enable real-time monitoring, diagnosis, and treatment management, improving clinical efficiency and patient outcomes.

The market includes wearable, implantable, stationary, and remote devices integrated through wireless technologies such as Wi-Fi, Bluetooth, and cellular networks, supporting data-driven and patient-centered medical care.

IoT Medical Devices Market Overview

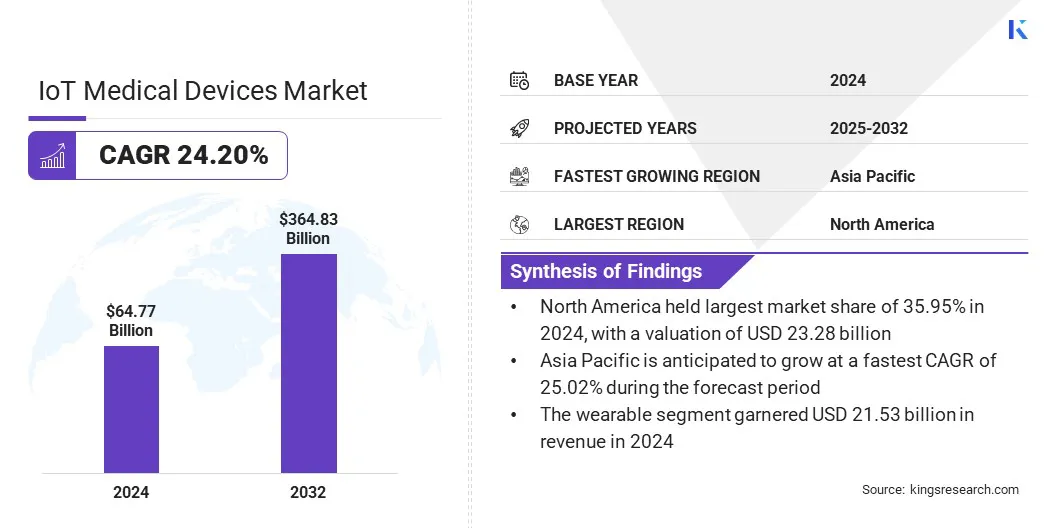

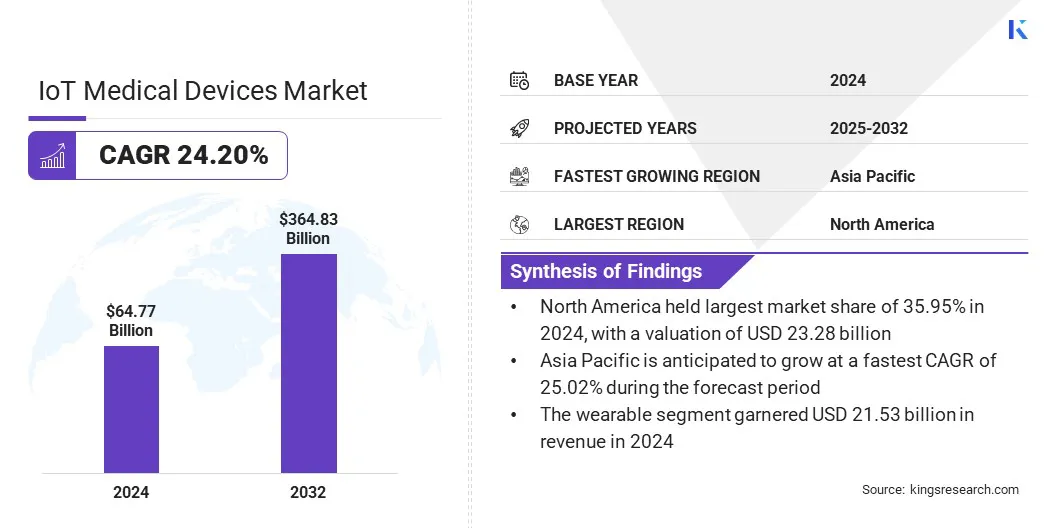

The global IoT medical devices market size was valued at USD 64.77 billion in 2024 and is projected to grow from USD 80.03 billion in 2025 to USD 364.83 billion by 2032, exhibiting a CAGR of 24.20% during the forecast period.

This growth is driven by advancements in sensor technology, data analytics, and miniaturization, enhancing functionality and patient comfort. The increasing adoption of connected wearables is further supporting remote health monitoring.

Key Highlights:

- The IoT medical devices industry size was recorded at USD 64.77 billion in 2024.

- The market is projected to grow at a CAGR of 24.20% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 23.28 billion.

- The wearable segment garnered USD 21.53 billion in revenue in 2024.

- The Wi-Fi segment is expected to reach USD 88.22 billion by 2032.

- The nursing homes segment is anticipated to witness the fastest CAGR of 24.63% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 25.02% through the projection period.

Major companies operating in the IoT medical devices market are Medtronic, Koninklijke Philips N.V., Abbott, General Electric Company, Boston Scientific Corporation, Siemens AG, Johnson & Johnson, OMRON Healthcare, Inc., AliveCor, Inc., Hamilton Medical, Drägerwerk AG & Co. KGaA, Resmed Corp., AMD Global Telemedicine, Huntleigh Healthcare Limited, and Wipro.

The growing prevalence of diabetes, cardiovascular disorders, and respiratory illnesses is creating a strong demand for advanced medical monitoring systems. Aging populations and sedentary lifestyles are further contributing to the global rise in chronic conditions. According to the International Diabetes Federation, diabetes cases are projected to reach 853 million by 2050, reflecting a 46% increase.

Healthcare systems are emphasizing proactive and continuous monitoring to reduce hospital visits and optimize treatment outcomes. IoT medical devices enable consistent data tracking and remote supervision, improving chronic disease management and allowing early diagnosis through connected diagnostic capabilities.

- In May 2025, Abbott presented results from its REFLECT real-world studies, demonstrating that the FreeStyle Libre continuous glucose monitoring system significantly reduces hospitalization risks from cardiovascular complications in individuals with diabetes. The studies confirmed consistent benefits for both Type 1 and Type 2 diabetes patients using Libre biowearable technology.

What key factors are contributing to the rising deployment of remote patient monitoring systems?

The growing preference for home-based care and shortage of healthcare professionals are accelerating the adoption of remote patient monitoring (RPM) devices, fueling IoT medical devices market growth.

Rising healthcare expenditure and patient awareness are creating opportunities for connected medical systems that support continuous monitoring outside hospital settings. These devices reduce clinical burden, enhance patient convenience, and provide physicians with real-time health data. The expansion of connected ecosystems and wireless network integration is further supporting the global deployment of remote patient monitoring devices.

- In March 2025, Circadian Health partnered with Tenovi to strengthen remote patient monitoring for chronic disease management. The collaboration integrates Tenovi’s IoT-based healthcare platform and Cellular Gateway, enabling real-time connectivity for Bluetooth-enabled RPM devices and strengthening Circadian’s virtual-first specialty care model for continuous monitoring and timely clinical interventions.

How do limited battery capacity and energy efficiency challenges hamper IoT medical devices market progress?

Limited battery capacity and energy efficiency constraints remain key challenges affecting the performance and reliability of IoT medical devices. Continuous data transmission, high-frequency monitoring, and sensor integration increase power consumption, reducing device lifespan and operational continuity.

These limitations particularly impact wearable and implantable devices that require compact designs and long-lasting power sources. Energy inefficiency leads to higher maintenance and patient inconvenience, restricting widespread adoption across remote healthcare and chronic disease management applications.

To address this challenge, manufacturers are investing in ultra-low-power chipsets, energy harvesting technologies, and advanced power management systems to extend device longevity, optimize data transmission, and improve operational sustainability.

The IoT medical devices market is influenced by the integration of artificial intelligence to enhance predictive analytics and clinical decision-making. AI algorithms are improving diagnostic precision, enabling real-time anomaly detection, and supporting personalized treatment planning.

Machine learning further enhances device autonomy and operational efficiency by reducing manual intervention in healthcare workflows. These AI-driven devices rely on compact electronic components for data transmission, where miniaturized board-to-board connectors enable seamless connectivity, performance reliability, and space optimization in advanced medical monitoring systems.

- In June 2024, AliveCor received FDA clearance and launched the KAI 12L AI technology alongside the Kardia 12L ECG System, the first handheld, AI-powered 12-lead ECG device capable of detecting life-threatening cardiac conditions through a reduced leadset. This launch enhances diagnostic accuracy and accessibility across clinical and remote healthcare environments.

IoT Medical Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Device

|

Wearable, Implantable, Stationary, Remote

|

|

By Connectivity

|

Wi-Fi, Bluetooth Low Energy (BLE), Zigbee, Near Field Communication (NFC), Cellular, Others

|

|

By End User

|

Hospitals & clinics, Nursing homes, Ambulatory Surgical Centers, Home care settings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Device (Wearable, Implantable, Stationary, and Remote): The wearable segment generated USD 21.53 billion in revenue in 2024, mainly due to rising adoption of connected fitness trackers, glucose monitors, and ECG wearables supporting preventive and personalized healthcare monitoring.

- By Connectivity (Wi-Fi, Bluetooth Low Energy (BLE), Zigbee, Near Field Communication (NFC), Cellular, and Others): The near field communication (NFC) segment is poised to record a staggering CAGR of 24.35% through the forecast period, propelled by its capability for secure short-range data exchange that facilitates seamless device pairing and patient information transfer.

- By End User (Hospitals & clinics, Nursing homes, Ambulatory Surgical Centers, Home care settings, and Others): The hospitals & clinics segment is estimated to hold a share of 26.26% by 2032, fueled by increasing integration of connected monitoring systems improving patient data management, workflow efficiency, and treatment precision.

What is the market scenario in North America and Asia Pacific region?

Based on region, the global IoT medical devices market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America IoT medical devices market accounted for a share of 35.95% in 2024, valued at USD 23.28 billion. This rapid growth is propelled by the widespread adoption of connected medical technologies, integration of advanced monitoring systems, and expansion of digital health infrastructure.

Hospitals and healthcare providers are increasingly deploying IoT-enabled devices for real-time patient tracking and remote diagnostics. Regional market expansion is further supported by ongoing investments in interoperability standards, cybersecurity frameworks, and AI-based analytics that facilitate data-driven healthcare delivery and enhance connected care across the region.

The Asia-Pacific IoT medical devices industry is set to grow at a CAGR of 25.02% over the forecast period, boosted by the expansion of healthcare digitization and increasing deployment of connected monitoring systems. Regional healthcare providers are adopting smart medical devices to improve operational efficiency and accessibility in urban and remote settings.

Increasing healthcare expenditure and the rise of local technology manufacturers are improving the availability of cost-effective connected medical devices. Moreover, increasing use of wireless communication technologies and data analytics is supporting the shift toward IoT-enabled patient care ecosystems.

- In March 2025, MediBuddy partnered with Japan’s ELECOM to launch IoT-enabled smart health devices, strengthening digital healthcare integration and daily health monitoring. The collaboration focuses on expanding access to connected medical technologies and data-driven preventive and remote care solutions.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) 510(k) Premarket Notification regulates the approval of connected medical devices. It ensures safety, effectiveness, and interoperability of IoT-enabled medical technologies before commercialization.

- In the European Union, the Medical Device Regulation (MDR) (EU) 2017/745 governs the design, manufacturing, and post-market surveillance of connected medical devices. It emphasizes cybersecurity, data integrity, and software validation to ensure patient safety.

- In Japan, the Pharmaceuticals and Medical Devices Act (PMD Act) oversees the quality, efficacy, and performance of IoT medical devices. It establishes approval pathways for digital healthcare technologies and connected monitoring systems.

- In China, the Regulation on the Supervision and Administration of Medical Devices (State Council Order No. 739) supervises device registration, production, and cybersecurity compliance. It mandates data protection and network security measures for IoT-enabled medical products.

- In India, the Medical Device Rules, 2017 govern the licensing, clinical evaluation, and performance monitoring of connected medical devices. It outlines compliance parameters for software-based and IoT-integrated medical systems.

- In Canada, the Medical Devices Regulations (SOR/98-282) enforce device classification, safety evaluation, and market authorization standards. It ensures connected devices meet cybersecurity and interoperability requirements prior to distribution.

- In Australia, the Therapeutic Goods (Medical Devices) Regulations 2002 regulate the conformity assessment and post-market monitoring of connected medical equipment. It directs manufacturers to meet quality system standards and electronic safety requirements applicable to IoT devices.

Competitive Landscape

Key players operating in the IoT medical devices industry are strengthening their competitive positions through sustained investments in product innovation, digital transformation, and portfolio diversification. Strategic initiatives include the expansion of IoT-integrated medical systems, partnerships with software providers, and the integration of cloud-based analytics platforms to support interoperability.

Companies are enhancing device intelligence through embedded AI and data security frameworks. Continuous focus on research and development is leading to the introduction of next-generation connected devices across therapeutic areas. Mergers, acquisitions, and technology collaborations remain key imperatives, enabling manufacturers to expand production capabilities, optimize supply chains, and accelerate connected healthcare deployment.

- In April 2025, Medtronic plc submitted 510(k) applications to the U.S. FDA for its MiniMed 780G insulin pump and SmartGuard algorithm to ensure compatibility with Abbott’s advanced CGM platform. This collaboration combines Abbott’s CGM technology with Medtronic’s smart dosing systems to enhance integrated diabetes management solutions.

Key Companies in IoT Medical Devices Market:

- Medtronic

- Koninklijke Philips N.V.

- Abbott

- General Electric Company

- Boston Scientific Corporation

- Siemens AG

- Johnson & Johnson

- OMRON Healthcare, Inc.

- AliveCor, Inc.

- Hamilton Medical

- Drägerwerk AG & Co. KGaA

- Resmed Corp.

- AMD Global Telemedicine

- Huntleigh Healthcare Limited

- Wipro

Recent Developments (Expansion/Product Launch)

- In June 2025, SEALSQ Corp expanded its IoMT security capabilities to strengthen device authentication, secure communication, and regulatory compliance. The upgrade introduced edge-based cryptographic authentication, enabling AI-driven medical devices to process data locally, minimize latency, and reduce cybersecurity risks within connected healthcare ecosystems.

- In April 2025, Abbott launched a next-generation delivery system under its neuromodulation business to improve electrode implantation for the Proclaim DRG neurostimulation system. The system enhances procedural precision and accessibility for physicians managing complex regional pain syndromes, integrating advanced IoT-enabled features that improve device connectivity, procedural efficiency, and data-driven pain management.

- In January 2025, Royal Philips introduced its AI-enabled CT 5300 at the 23rd Asian Oceanian Congress of Radiology and announced over 1,500 global installations of its Helium-Free 1.5T BlueSeal MRI systems. The CT 5300 system leverages AI-based imaging to enhance diagnostic precision, streamline workflows, and improve system uptime across connected healthcare environments.