Market Definition

An industrial internet of things (IIoT) platform connects industrial devices and sensors to collect and analyze real-time data. It offers predictive maintenance, process optimization, energy efficiency, asset management, and supply chain visibility. The market includes hardware, software, connectivity solutions, and services catering to energy, transportation, automotive, and healthcare industries.

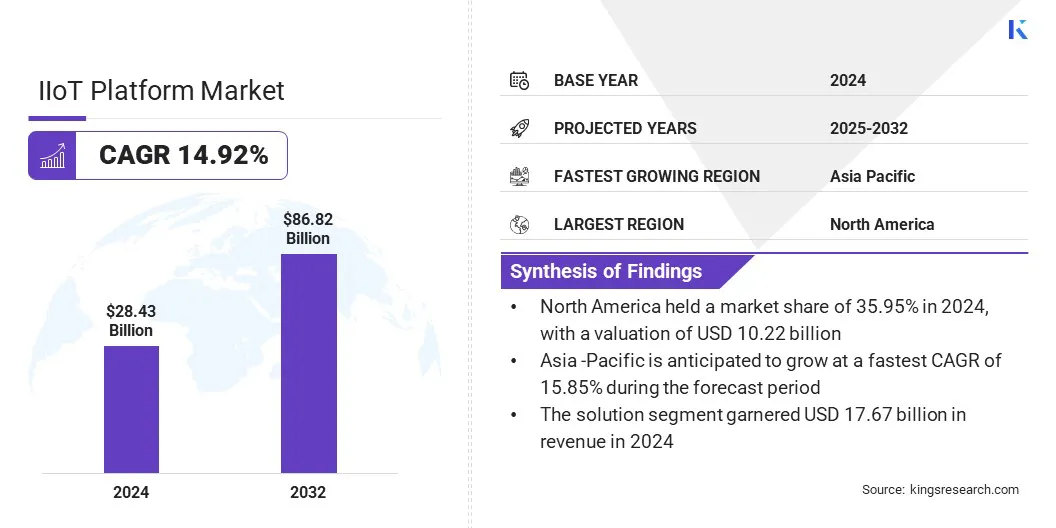

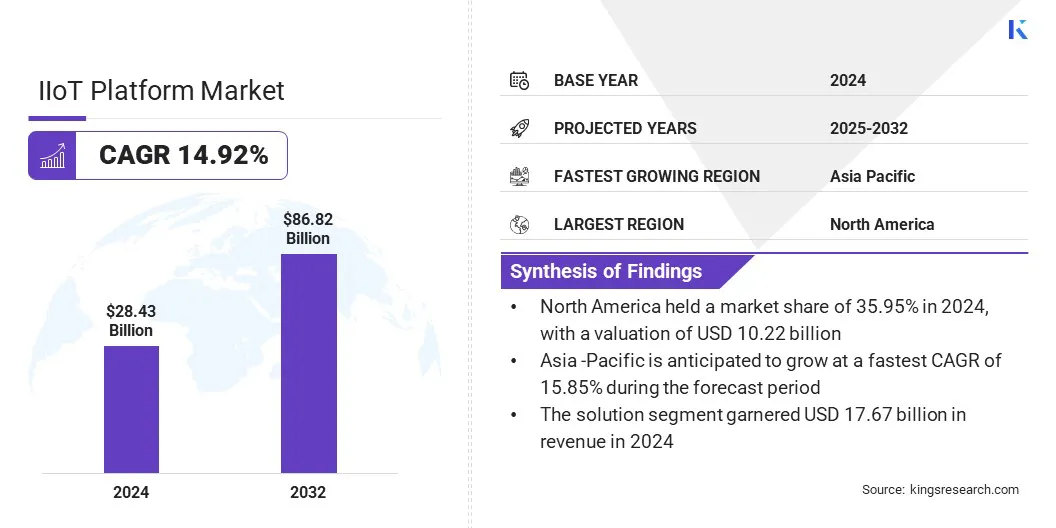

The global IIoT platform market size was valued at USD 28.43 billion in 2024 and is projected to grow from USD 32.60 billion in 2025 to USD 86.82 billion by 2032, exhibiting a CAGR of 14.92% over the forecast period.

Market growth is driven by the growing demand for operational efficiency and cost reduction across industrial sectors. The integration of AI and machine learning is improving process optimization and predictive maintenance in manufacturing, energy, and logistics.

Key Highlights:

- The IIoT platform industry size was recorded at USD 28.43 billion in 2024.

- The market is projected to grow at a CAGR of 14.92% from 2024 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 10.22 billion.

- The solution segment garnered USD 17.67 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 45.92 billion by 2032.

- The remote monitoring segment is anticipated to witness fastest the CAGR of 15.08% over the forecast period.

- The energy & power segment held a share of 24.47% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 15.85% over the forecast period.

Major companies operating in the IIoT platform market are PTC Inc, Siemens, Microsoft Corporation, Amazon Web Services, Inc, IBM Corporation, GE Vernova, Robert Bosch GmbH, ABB Group, Cisco Systems, Inc, Schneider Electric SE, SAP SE, Rockwell Automation, Inc, Emerson Electric Co, Software GmbH, and Telit Cinterion.

The rapid adoption of Industry 4.0 and smart manufacturing is driving the market by enabling interconnected, automated factories powered by real-time data analytics. Additionally, the expansion of integrated IIoT solutions combining software, hardware, and connectivity capabilities is accelerating product adoption by simplifying AI and machine learning deployment.

These solutions also enable efficient remote management across manufacturing, energy, utilities, and logistics industries, driving efficiency and making operations smarter.

- In November 2024, SECO and Raspberry Pi partnered to expand IIoT offerings by integrating SECO’s Clea IoT software with Raspberry Pi OS and hardware. This integration enables device management, data orchestration, AI/ML, and remote access.

Market Driver

Expansion of Connectivity Technologies

A key factor driving the growth of the IIoT platform market is the expansion of connectivity technologies. The deployment of advanced networks such as 5G is delivering the high-speed, low-latency, and reliable communication required for industrial operations.

This enhanced connectivity is supporting seamless integration of IoT-enabled devices and advanced remote monitoring capabilities across manufacturing plants, energy systems, and logistics networks. The expansion of connectivity technologies is allowing predictive maintenance and process automation applications, which boosts industrial digitalization and strengthens the adoption of IIoT platforms.

- In May 2025, the Organization for Economic Co-operation and Development (OECD) reported that total 5G subscriptions increased by 48% over the last year. This account for 33% of total mobile subscriptions across its OECD countries.

Market Challenge

Data Security and Privacy Concerns

A key factor limiting the growth of the IIoT platform market is the growing concern over data security and privacy. IIoT systems continuously generate and transmit large volumes of sensitive operational, equipment, and process data across networks. This exposes industrial operators to cyberattacks and data breaches, causing disruptions, financial losses, and reputational damage.

To address this, market players are implementing end-to-end encryption, multi-factor authentication, and secure network protocols. They are integrating AI and machine learning to detect anomalies and potential threats in real time. Additionally, companies are adopting standardized compliance frameworks and conducting regular security audits to ensure regulatory adherence.

Market Trend

Adoption of Edge Computing in IIoT

A key trend shaping the IIoT platform market is the widespread adoption of edge computing, wherein edge-enabled IIoT platforms process data locally, enabling industrial operators to achieve real-time decision-making and maintain continuity in industrial processes.

Edge computing also supports the integration of artificial intelligence and machine learning for predictive maintenance, anomaly detection, and secure data handling. These features accelerate the deployment of advanced IIoT solutions across manufacturing, power generation, and energy sectors.

- In October 2024, Qualcomm launched its Qualcomm IQ product portfolio, featuring industrial-grade chipsets and on-device AI for IIoT. The high-compute, power-efficient, and safety-grade technology enables real-time data processing, edge analytics, and advanced automation.

|

Segmentation

|

Details

|

|

By Component

|

Solution (Remote Monitoring, Data Management, Analytics, Security Solutions, Others), Services (Professional, Managed)

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By Application

|

Predictive Maintenance, Asset Tracking & Management, Remote Monitoring, Process Optimization, Safety & Security, Supply Chain & Management, Others

|

|

By End Use

|

Manufacturing, Chemical, Energy & Power, Oil & Gas, Healthcare, Transportation, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solution, and Services): The solution segment earned USD 17.67 billion in 2024 driven by the growing adoption of IIoT platforms for automation, data analytics, and operational optimization.

- By Deployment (On-premises, and Cloud-based): The on-premises segment held 53.91% of the market in 2024, due to enterprises preferring secure, localized control over critical industrial data.

- By Application (Predictive Maintenance, Asset Tracking & Management, Remote Monitoring, Process Optimization, Safety & Security, Supply Chain & Management, and Others): The predictive maintenance segment is projected to reach USD 21.09 billion by 2032, owing to rising demand for minimizing downtime and optimizing asset performance.

- By End Use (Manufacturing, Chemical, Energy & Power, Oil & Gas, Healthcare, Transportation, and Others): The manufacturing segment is anticipated to witness the fastest CAGR of 15.30% over the forecast period, driven by the fast adoption of smart factory and automation technologies.

The market has been segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America IIoT platform market share stood at 35.95% in 2024, valued at USD 10.22 billion in the global market. This dominance is due to the increasing adoption of Industry 4.0 and smart manufacturing practices that are leading industries to implement connected devices and automation systems to improve operational efficiency.

Rising demand for predictive maintenance solutions also increases usage, as companies seek to reduce downtime and optimize performance. Additionally, increasing regional emphasis on strengthening industrial digital infrastructure through investments in advanced connectivity frameworks, integrated IoT ecosystems, and cross-industry collaboration is reinforcing the scalability and resilience of IIoT platform deployments.

- In November 2024, Lantronix acquired DZS’s NetComm enterprise IoT portfolio for USD 6.5 million. The acquisition enhances Lantronix’s IIoT platform capabilities, adding industrial-grade 5G connectivity, Gateways, Routers, and Modems, and broadening its customer base.

Asia Pacific is set to grow at a CAGR of 15.85% over the forecast period. This growth is because of the rapid industrial modernization and the growing deployment of connected devices to improve operations across the region. Expanding industrial infrastructure and digital integration in manufacturing and energy sectors are accelerating IIoT platform usage for improved process optimization.

Increasing investments by regional players in industrial connectivity technologies, such as high-performance computing components, edge devices, and robust wireless networks, are enabling scalable IIoT deployments across region.

- In April 2025, ARTERY Technology introduced the AT32F455/F456/F457 series of high-performance microcontrollers Unit (MCUs) for IIoT that feature high clock speeds, large memory, and multiple connectivity interfaces. This enables industrial automation, intelligent connectivity, and real-time data processing.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates Industrial Internet of Things (IIoT)platforms by overseeing wireless spectrum allocation, communication standards, and network security requirements. In contrast to IoT regulations that encompass consumer and commercial connected devices, the FCC’s oversight of IIoT ensures secure, reliable, and seamless network operations, in alignment with national cybersecurity and data protection standards.

- In China, the National Internet Information Office (NIIO) governs IIoT platforms by regulating data security, cross-border data transfers, and network operation standards. It enforces cybersecurity laws, industrial control system protection, and IoT device registration.

- In India, the Bureau of Indian Standards (BIS) oversees IIoT platforms by establishing technical standards for industrial automation, connectivity, and device interoperability. It regulates cybersecurity, network safety, and performance benchmarks to ensure IIoT solutions align with industrial and energy sector requirements.

Competitive Landscape

Companies operating in the IIoT platform industry are expanding their industrial connectivity by integrating wireless, edge, and cloud technologies to enable seamless data flow and real-time insights.

They are developing platforms that combine hardware, software, and analytics tools to optimize industrial processes by implementing predictive maintenance. Additionally, market participants are focusing on strategic acquisitions to improve their IIoT offerings, integrate advanced wireless solutions, and expand their presence in industrial automation.

- In October 2024, IMI Plc acquired TWTG Group B.V. to expand its IIoT capabilities. The acquisition integrates TWTG’s wireless and LoRaWAN-enabled solutions into IMI’s Process automation sector, enhancing asset monitoring and efficiency.

Top Key Companies in IIoT Platform Market:

- PTC Inc

- Siemens

- Microsoft Corporation

- Amazon Web Services, Inc

- IBM Corporation

- GE Vernova

- Robert Bosch GmbH

- ABB Group

- Cisco Systems, Inc

- Schneider Electric SE

- SAP SE

- Rockwell Automation, Inc

- Emerson Electric Co

- Software GmbH

- Telit Cinterion.

Recent Developments

- In July 2025, Oerlikon Metco launched Surface Two, an IIoT-enabled thermal spray platform for broader industrial use across aerospace, power generation, automotive, medical, and semiconductors. The platform integrates embedded IIoT capabilities, advanced automation, and data-driven operations to enhance efficiency and improve process consistency.

- In January 2025, Digi International launched its Digi X-ON edge-to-cloud IIoT platform to support applications such as connected cities, and smart utilities which enable industrial users to achieve greater automation and operational visibility through scalable IIoT deployments.

- In June 2024, Henkel launched Smart Rotating Equipment Monitoring and Smart Pipes and Tanks Leak Detection, expanding its Loctite Pulse IIoT portfolio. These solutions integrate plug-and-play sensors and real-time monitoring capabilities and also enable maintenance and early leak detection.

- In April 2024, EyeOTmonitor partnered with the University of Wisconsin-Milwaukee’s Connected Systems Institute (CSI) to enhance IIoT integration, monitoring, and analysis. The partnership enables real-time industrial monitoring and supports predictive maintenance initiatives by leveraging EyeOTmonitor’s network visualization and digital twin technologies.