Market Definition

Hydrogen recovery and purification involve extracting hydrogen from mixed gas streams and refining it to high purity for industrial and energy applications. The process employs advanced technologies such as pressure swing adsorption, cryogenic recovery, membrane separation, and electrochemical purification to ensure efficiency and minimal loss.

This technology is applied across petroleum refining, chemical and petrochemical processes, fuel cells, and electronics manufacturing. Industries such as chemicals, energy, automotive, and electronics utilize these solutions to enhance operational efficiency and meet high-performance standards.

Hydrogen Recovery and Purification Market Overview

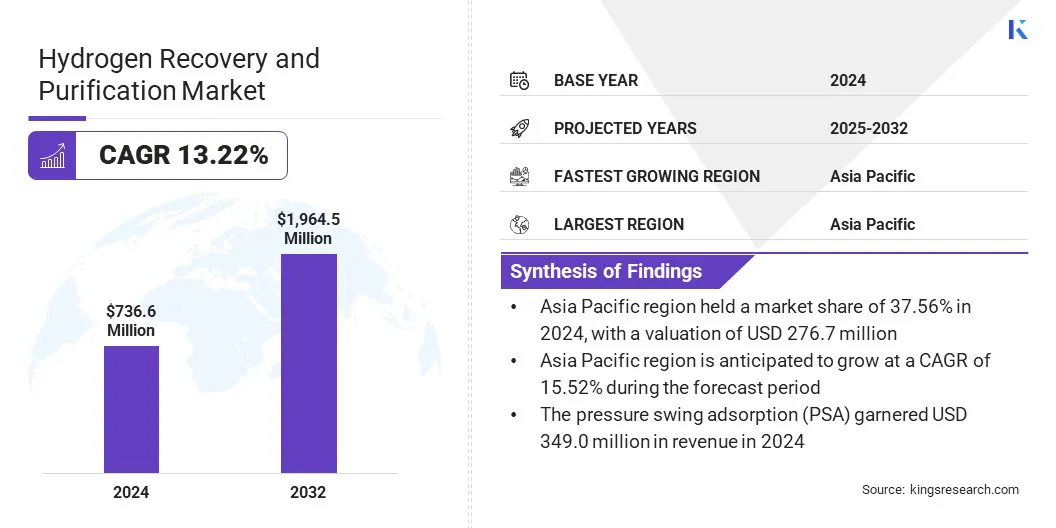

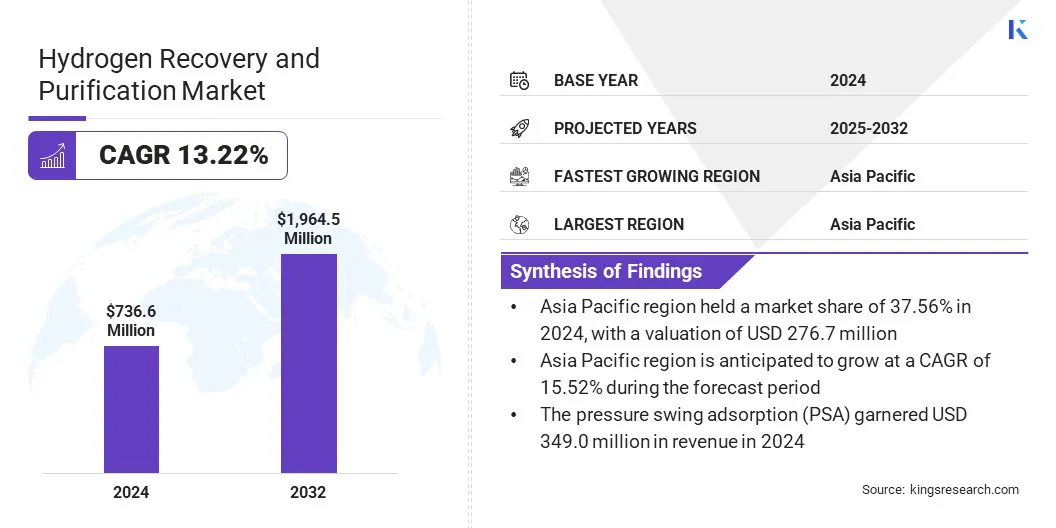

The global hydrogen recovery and purification market size was valued at USD 736.6 million in 2024 and is projected to grow from USD 823.6 million in 2025 to USD 1,964.5 million by 2032, exhibiting a CAGR of 13.22% during the forecast period.

This growth is fueled by the growing demand for fuel cell-grade hydrogen, which is increasing the adoption of advanced recovery and purification technologies across industrial and energy applications. Rising research and development in hydrogen recovery from biogas and steam reforming effluents is supporting the diversification of hydrogen sources and the development of more efficient purification methods.

Key Highlights:

- The hydrogen recovery and purification industry size was recorded at USD 736.6 million in 2024.

- The market is projected to grow at a CAGR of 13.22% from 2025 to 2032.

- Asia Pacific held a share of 37.56% in 2024, valued at USD 276.7 million.

- The pressure swing adsorption (PSA) segment garnered USD 349.0 million in revenue in 2024.

- The petroleum refining segment is expected to reach USD 594.3 million by 2032.

- The chemicals & petrochemicals segment is estimated to reach USD 587.3 million by 2032.

- North America is anticipated to grow at a CAGR of 12.90% over the forecast period.

Major companies operating in the hydrogen recovery and purification market are Linde PLC, Air Products and Chemicals, Inc., Honeywell International Inc., Air Liquide Advanced Separations, Chart Industries, Parker Hannifin Corp, HyGear, JSC Grasys, Noxair Engineering Private Limited, BORSIG, GENERON, ZEOCHEM AG, NGK INSULATORS, LTD.

Manufacturers are designing advanced systems that separate hydrogen from hydrogen-nitrogen gas mixtures through membrane-based technology to achieve higher purity and better process efficiency. These solutions are introduced to address the rising demand across industries that require stable and high-quality hydrogen supply.

The use of membrane purification streamlines operations, lowers energy use, and supports flexible installation in various industrial facilities. This technological advancement is encouraging wider implementation of hydrogen recovery systems and strengthening progress within the hydrogen purification field.

- In April 2024, Mitsubishi Heavy Industries and NGK Insulators announced a joint project to develop a hydrogen purification system from hydrogen-nitrogen gas mixtures after ammonia cracking. The system uses membrane separation to produce high-purity hydrogen and aims to support the establishment of a hydrogen and ammonia supply chain.

Market Driver

Growing Demand for Fuel Cell-Grade Hydrogen

The hydrogen recovery and purification market is driven by the growing demand for fuel cell-grade hydrogen. Industries such as automotive, energy, and electronics increasingly require high-purity hydrogen for fuel cells and advanced energy applications.

This demand is prompting the development and adoption of new recovery and purification systems that can consistently deliver hydrogen at the required purity levels. These advanced systems enhance process efficiency and reduce hydrogen losses, enabling a reliable supply for critical industrial and energy applications.

- In February 2025, BGR Tech Ltd. launched a 100 kW Hydrogen Purification System capable of producing 99.999% pure hydrogen suitable for fuel cells and high-precision industrial applications. The system operates efficiently under pressures up to 30 bar and features a modular, plug-and-play design for scalable deployment and simplified commissioning. It is designed to optimize hydrogen purity from electrolysis and support various industrial processes.

Market Challenge

High Capital Investment Restricts Deployment

A major challenge impeding the progress of the hydrogen recovery and purification market is the substantial capital required for installing advanced recovery and purification systems. The high upfront cost can deter small and medium-sized industrial players from adopting these technologies.

To overcome this challenge, companies are exploring modular and scalable system designs that reduce initial investment requirements. Additionally, partnerships and financing models are being leveraged to distribute costs and make advanced hydrogen recovery solutions more accessible across different industrial sectors.

Market Trend

Rising R&D in Hydrogen Recovery from Biogas and Steam Reforming Effluents

A key trend in the hydrogen recovery and purification market is the increasing focus on research and development aimed at recovering hydrogen from biogas and steam reforming effluents. Ongoing research is exploring advanced technologies to extract high-purity hydrogen from alternative feedstocks, reducing dependence on conventional natural gas streams.

This trend fosters innovation in purification methods, enhances process efficiency, and enables industries to adopt more sustainable hydrogen solutions. Growing R&D efforts are expected to improve hydrogen recovery rates and accelerate technological advancement.

- In January 2025, a study published in Chemical Engineering Science demonstrated a hybrid membrane cascade system combining CO2-selective polymeric and H2-selective ceramic membranes for hydrogen recovery from biogas reforming effluents. The prototype achieved hydrogen purities exceeding 99.2% and recoveries up to 10.7% in once-through operation, with simulations predicting up to 68% recovery using optimized recycling.

Hydrogen Recovery and Purification Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Pressure Swing Adsorption (PSA), Cryogenic Hydrogen Recovery, Membrane Separation, Electrochemical Purification, Others

|

|

By Application

|

Petroleum Refining, Chemical & Petrochemical Processes, Energy & Fuel Cells, Electronics & Semiconductor Processes, Others

|

|

By End User Industry

|

Chemicals & Petrochemicals, Energy and Power, Automotive, Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Pressure Swing Adsorption (PSA), Cryogenic Hydrogen Recovery, Membrane Separation, Electrochemical Purification, and Others): The pressure swing adsorption (PSA) segment earned USD 349.0 million in 2024, mainly due to high efficiency in separating hydrogen from mixed gas streams and its widespread adoption in industrial processes.

- By Application (Petroleum Refining, Chemical & Petrochemical Processes, Energy & Fuel Cells, Electronics & Semiconductor Processes, and Others): The petroleum refining segment held a share of 33.51% in 2024, attributed to the growing demand for high-purity hydrogen in hydrocracking and desulfurization processes.

- By End User Industry (Chemicals & Petrochemicals, Energy and Power, Automotive, Electronics, and Others): The chemicals & petrochemicals segment is projected to reach USD 587.3 million by 2032, owing to the increasing use of hydrogen in ammonia production, methanol synthesis, and other chemical processes.

Hydrogen Recovery and Purification Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific hydrogen recovery and purification market share stood at 37.56% in 2024, valued at USD 276.7 million. This dominance is reinforced by the growing use of hydrogen fuel cells, as industrial, residential, and energy sectors focus on lowering energy costs and improving efficiency.

Industrial plants in refining, chemicals, and heavy manufacturing are increasingly using fuel cells, while residential and commercial users adopt small-scale hydrogen solutions for cleaner and cheaper energy. This focus on energy savings increases the demand for high-purity hydrogen. Growing use of recovery and purification systems across applications supports regional market growth.

- In July 2024, Ulsan City in South Korea completed the Yuldong With You Apartment complex, which uses hydrogen fuel cells to supply electricity and heat to 437 residential units. The system utilizes hydrogen derived from nearby industrial by-products to generate up to 1.32 MW of electricity. The project aims to lower energy costs and demonstrate the feasibility of hydrogen-based energy systems in urban housing.

The North America hydrogen recovery and purification industry is poised to grow at a significant CAGR of 12.90% over the forecast period. This growth is propelled by significant government investments in clean hydrogen infrastructure, aimed at expanding production, storage, and distribution capacities. These initiatives foster private sector participation, accelerate the adoption of advanced technologies, and enhance the regional availability of hydrogen recovery and purification solutions.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates air separation plants under the Clean Air Act, ensuring compliance with emissions standards and air quality regulations.

- In Europe, the European Commission’s Hydrogen Strategy and the REPowerEU plan provide a regulatory framework to support renewable and low-carbon hydrogen production, distribution, and usage.

- In China, government authorities implement standards and regulations across the hydrogen value chain to ensure safe production, storage, and transport while promoting industrial development.

- In India, the Ministry of New and Renewable Energy (MNRE) developed a regulatory framework to certify green hydrogen and its derivatives, enforcing quality, safety, and sustainability standards.

- In Japan, the Ministry of Economy, Trade and Industry (METI) governs hydrogen production and supply under national safety and energy efficiency standards, including certification programs for hydrogen refueling stations.

Competitive Landscape

Key players in the hydrogen recovery and purification industry are expanding their geographic presence to access new regional markets and strengthen local distribution networks. Companies are increasing production capacities to meet growing demand and maintain a consistent supply across multiple regions. They are investing in additional manufacturing facilities and modernizing existing plants to improve operational efficiency and scale output.

Strategic collaborations, joint ventures, and regional partnerships are being employed to optimize logistics and enhance competitiveness in both emerging and established markets.

- In April 2024, Linde’s subsidiary White Martins announced plans to build a second green hydrogen electrolyzer in Jacareí, São Paulo, Brazil. The 5 MW pressurized alkaline electrolyzer will use local solar and wind power to produce certified green hydrogen for industrial customers, including glass manufacturer Cebrace.

Key Companies in Hydrogen Recovery and Purification Market:

- Linde PLC

- Air Products and Chemicals, Inc.

- Honeywell International Inc.

- Air Liquide Advanced Separations

- Chart Industries

- Parker Hannifin Corp

- HyGear

- JSC Grasys

- Noxair Engineering Private Limited

- BORSIG

- GENERON

- ZEOCHEM AG

- NGK INSULATORS, LTD.

Recent Developments

- In February 2025, SKYRE, in collaboration with a Texas research institute, deployed its H2RENEW electrochemical hydrogen separation system for natural gas pipelines. The system is designed to extract and purify hydrogen from natural gas containing impurities such as H2S, CO, CO2, and mercaptans. It supports industrial processing, vehicle fueling, and power-to-gas applications.