Market Definition

The market involves protective coating systems engineered to maintain surface integrity and performance under extreme heat, thermal cycling, and chemical exposure. These coatings enhance durability, corrosion resistance, and operational reliability of metals and other substrates used in demanding environments.

They are applied across industries such as automotive, aerospace, energy, and industrial manufacturing, where components are exposed to sustained high-temperature conditions. The report includes segmentation based on resin type, technology, and end-use industry across key regions.

High Temperature Coatings Market Overview

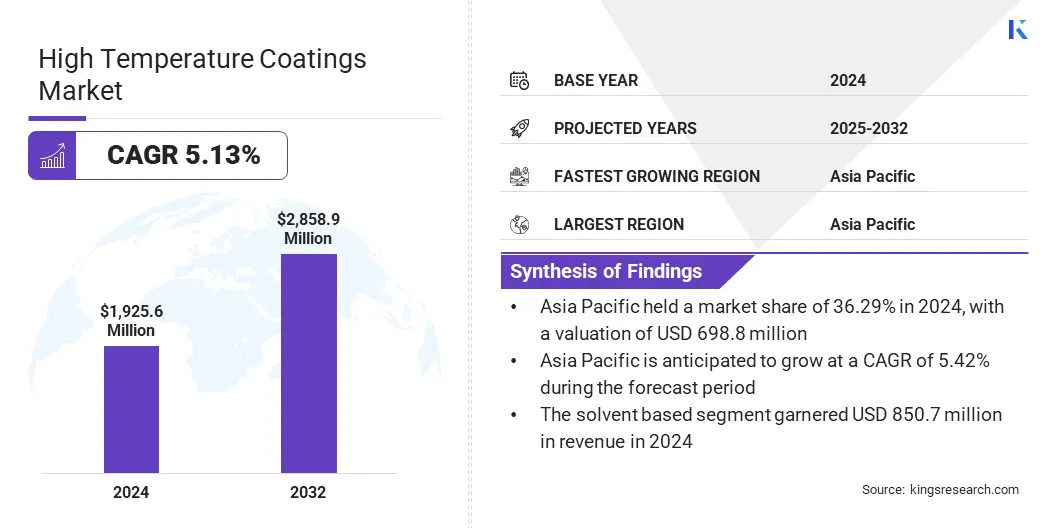

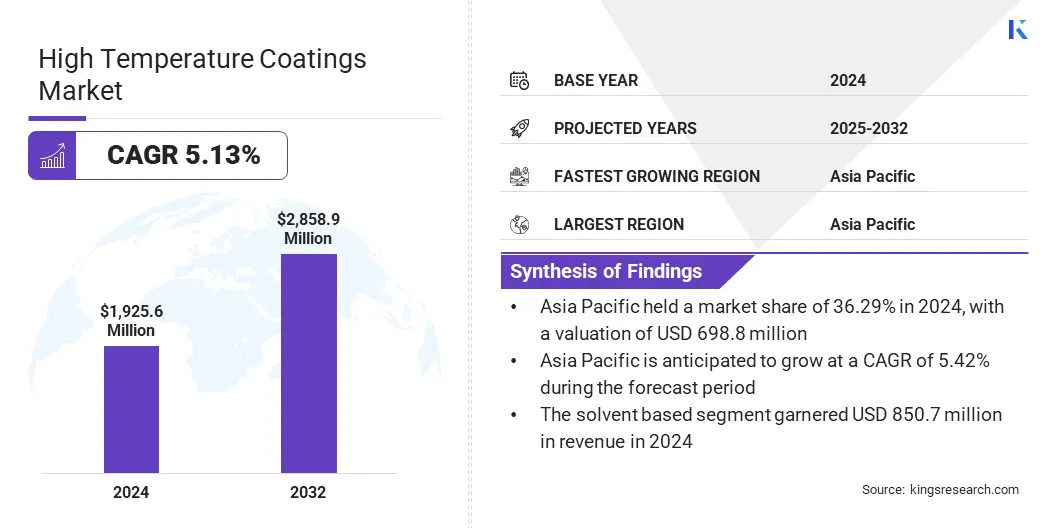

The global high temperature coatings market size was valued at USD 1,925.6 million in 2024 and is projected to grow from USD 2,014.0 million in 2025 to USD 2,858.9 million by 2032, exhibiting a CAGR of 5.13% over the forecast period.

Market growth is supported by the increasing need for durable, heat-resistant coatings across automotive, aerospace, and industrial manufacturing applications. Factors such as rising industrial activity, enhanced safety requirements, and the pursuit of greater operational efficiency are also boosting adoption.

Key Highlights

- The high temperature coatings industry size was valued at USD 1,925.6 million in 2024.

- The market is projected to grow at a CAGR of 5.13% from 2025 to 2032.

- Asia Pacific held a market share of 36.29% in 2024, valued at USD 698.8 million.

- The epoxy segment generated USD 717.9 million in revenue in 2024.

- The water based segment is expected to reach USD 1,154.9 million by 2032.

- The aerospace and defense segment is anticipated to witness the fastest CAGR of 5.40% over the forecast period.

- Europe is anticipated to grow at a CAGR of 5.13% through the projection period.

Major companies operating in the high temperature coatings market are Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., Axalta Coating Systems, LLC, Jotun, Hempel A/S, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., Asian Paints PPG Pvt. Ltd., RPM International Inc., Carboline Global Inc., Belzona International Ltd, Dow, Covestro AG, and KCC Corporation.

Expanding use of advanced application techniques, innovative formulations, and specialized high-temperature materials is promoting wider deployment of these coatings across regions. Additionally, ongoing research, technological improvements, and strategic collaborations are supporting sustained market expansion.

- In June 2024, Oerlikon opened an Advanced Coating Technology Center in Westbury, NY, integrating thermal spray and PVD technologies. The facility focuses on high-temperature coatings for aerospace and gas turbine industries, enhancing efficiency, durability, and performance while accelerating tailored solution development.

How is the rising demand from automotive and aerospace sectors driving market growth?

The rapid expansion of the automotive and aerospace sectors is significantly increasing the need for advanced materials and high-performance components that can withstand extreme operating conditions. Increasing vehicle production, aerospace modernization programs, and strict performance and safety standards are encouraging investments in durable, heat- and corrosion-resistant solutions.

Accordingly, manufacturers are adopting advanced materials and protective technologies to improve operational efficiency, reliability, and lifespan of critical components. Continuous industry expansion and focus on efficiency, safety, and technological innovations are further supporting market growth and wider adoption across applications.

- In October 2025, Axalta launched Alesta e-PRO FG Black and Alesta e-PRO Dielectric Gray at The Battery Show North America. These coatings improve EV battery safety with thermal stability and electrical insulation, providing fire resistance up to 1200°C and reliable high-voltage protection. These innovations reflect Axalta’s commitment to advancing EV safety with cutting-edge technologies.

Performance limitations under extreme conditions pose a significant challenge to the expansion of the high temperature coatings market. Exposure to prolonged heat, thermal cycling, and corrosive environments can compromise adhesion, thermal stability, and surface integrity, leading to equipment failure, higher maintenance costs, and reduced operational efficiency. These issues make it challenging for manufacturers to ensure consistent coating reliability across demanding applications.

Industries requiring high-performance coatings face additional hurdles, as achieving optimal results demands precise formulations, skilled application, and strict quality control. Inconsistent material performance under extreme conditions further adds to these challenges.

To address these limitations, manufacturers are investing in advanced coating technologies, improved application methods, and rigorous testing protocols. These measures aim to improve durability, ensure consistent performance, and support wider adoption across automotive, aerospace, and industrial sectors.

The high temperature coatings market is expanding rapidly due to advancements in coating technologies and growing demand for durable, heat-resistant materials across automotive, aerospace, energy, and industrial sectors.

Innovations such as ceramic-metal composites, nanotechnology-based coatings, and enhanced epoxy and silicone systems, are improving thermal stability, corrosion resistance, and mechanical strength. At the same time, optimized application techniques are improving coating precision and efficiency.

This trend has gained further traction as manufacturers seek to extend equipment lifespan, reduce maintenance costs, and meet strict performance standards. Leading coating producers, research institutions, and technology providers are investing in next-generation materials, advanced application techniques, and collaborative projects to expand the market growth.

Continuous improvements in coating technologies are expected to enhance operational efficiency and reliability, supporting significant market growth over the forecast period.

- In October 2025, Fujifilm launched “Prescale for High Temperature 100/200”, a pressure measurement film for heat pressing inspections up to 220°C. The film uses high-precision coating and heat-resistant materials for accurate measurements without cooling equipment. Supported by the “Prescale Mobile” app, it converts color changes into numerical data, improving inspection efficiency and quality control in manufacturing.

High Temperature Coatings Market Report Snapshot

|

Segmentation

|

Details

|

|

By Resin

|

Epoxy, Silicone, Polyester, Acrylic, Alkyd, and Others

|

|

By Technology

|

Water Based, Solvent Based, and Powder Coatings

|

|

By End-user Industry

|

Automotive, Petrochemical, Aerospace & Defense, Building & Construction, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Resin (Epoxy, Silicone, Polyester, Acrylic, Alkyd, and Others): The Epoxy segment earned USD 717.9 million in 2024 primarily due to its superior adhesion, chemical resistance, and ability to withstand high thermal stress across industrial and automotive applications.

- By Technology (Water Based, Solvent Based, and Powder Coatings): The solvent based held a share of 44.18% of the market in 2024, due to its excellent film-forming properties, strong adhesion on diverse substrates, and proven performance in high-temperature and corrosive environments.

- By End-user Industry (Automotive, Petrochemical, Aerospace & Defense, Building & Construction, and Others): The automotive segment is projected to reach USD 844.2 million by 2032, owing to the increasing use of heat-resistant coatings in engines, exhaust systems, and other high-performance components to enhance durability and thermal efficiency.

How are regional dynamics shaping the growth of the global high temperature coatings market?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

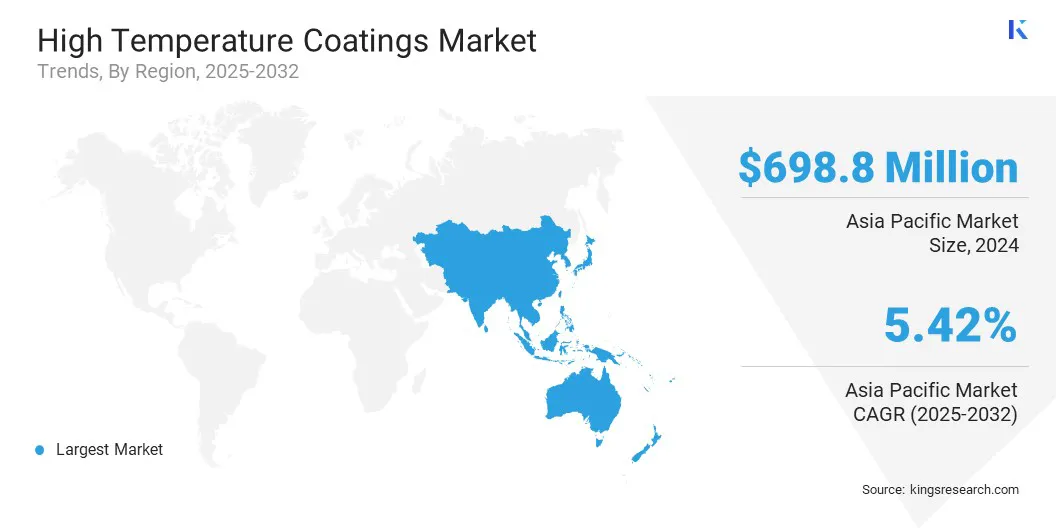

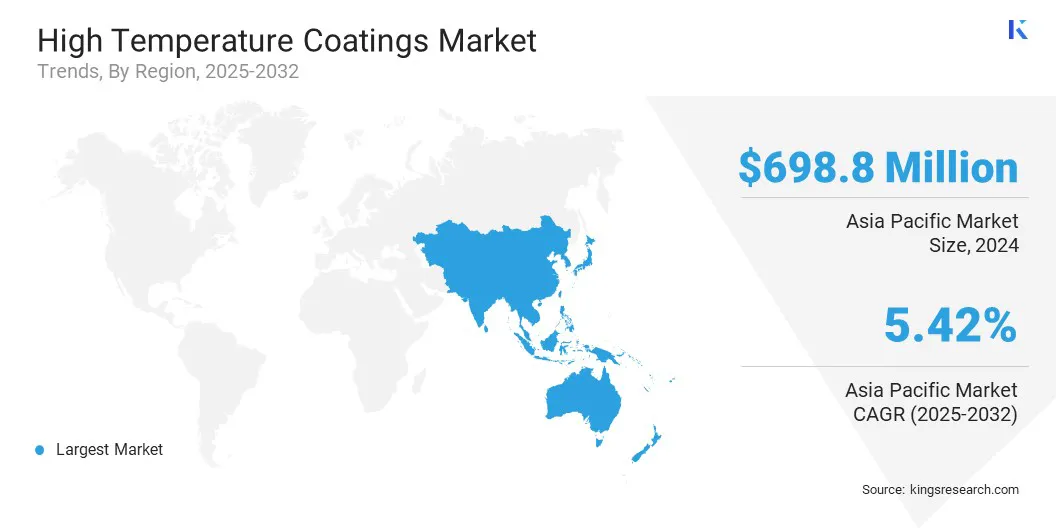

The Asia Pacific high temperature coatings market share stood at 36.29% in 2024, valued at USD 698.8 million. Significant investments in manufacturing facilities, energy projects, and technology modernization are promoting the adoption of high-performance coatings across key applications.

Strategic collaborations between regional manufacturers and global coating suppliers, along with government initiatives promoting industrial innovation and quality standards, are also boosting market growth. Continuous advancements in coating materials and application technologies position Asia Pacific as a key hub for high temperature coating development.

The European high temperature coatings industry is set to grow at a CAGR of 5.13% over the forecast period. This growth is fueled by the rising demand for durable and thermally stable coatings across industrial, automotive, and aerospace applications. Continuous innovation in material chemistry, process optimization, and environmentally compliant formulations is promoting product adoption across key industries.

The region’s strong emphasis on sustainability and quality performance is driving investments in advanced coating systems and testing technologies. In addition, collaboration between manufacturers, research institutions, and regulatory bodies is positioning Europe as a leading center for technological progress and product innovation in high temperature coatings.

Regulatory Frameworks

- In the European Union, Directive 2004/42/EC regulates the volatile organic compound (VOC) content of paints and varnishes. It ensures that high-temperature coatings meet environmental standards by limiting harmful emissions during application and curing processes.

- In the U.S., the Clean Air Act (Section 112, NESHAP) regulates emissions of hazardous air pollutants (HAPs) from surface coating operations. It enforces limits on VOCs and other harmful substances in high-temperature coatings to reduce air pollution and ensure workplace safety.

Competitive Landscape

Companies operating in the high temperature coatings industry are strengthening their market position through continuous investments in advanced materials, nanotechnology-based formulations, and process optimization. They are prioritizing the development of coatings with superior heat resistance, corrosion protection, and chemical stability to serve demanding applications in aerospace, automotive, energy, and industrial sectors.

Key players are expanding their product portfolios to include environmentally compliant, low-volatile organic compound (VOC) coatings and multifunctional solutions designed for metal protection and high-performance equipment.

Strategic collaborations, mergers, and acquisitions are being pursued to enhance R&D capabilities and extend geographic reach. Additionally, companies are using automation, data-driven process control, and digital service platforms to improve operational efficiency, ensure product consistency, and deliver customized technical support, thereby sustaining long-term competitiveness in the global market.

Key Companies in High Temperature Coatings Market:

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Axalta Coating Systems, LLC

- Jotun

- Hempel A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Asian Paints PPG Pvt. Ltd.

- RPM International Inc.

- Carboline Global Inc.

- Belzona International Ltd

- Dow

- Covestro AG

- KCC Corporation

Recent Developments (Launch)

- In August 2024, PPG launched PPG PITT-THERM 909, a silicone-based spray-on insulation coating for oil, gas, chemical, and petrochemical industries. The coating withstands temperatures up to 500°F (260°C), keeps surfaces safe up to 310°F (154°C), and reduces application time and costs. It also provides strong corrosion resistance and meets ASTM E84 Class A fire rating standards.