Gas Turbine Market Size

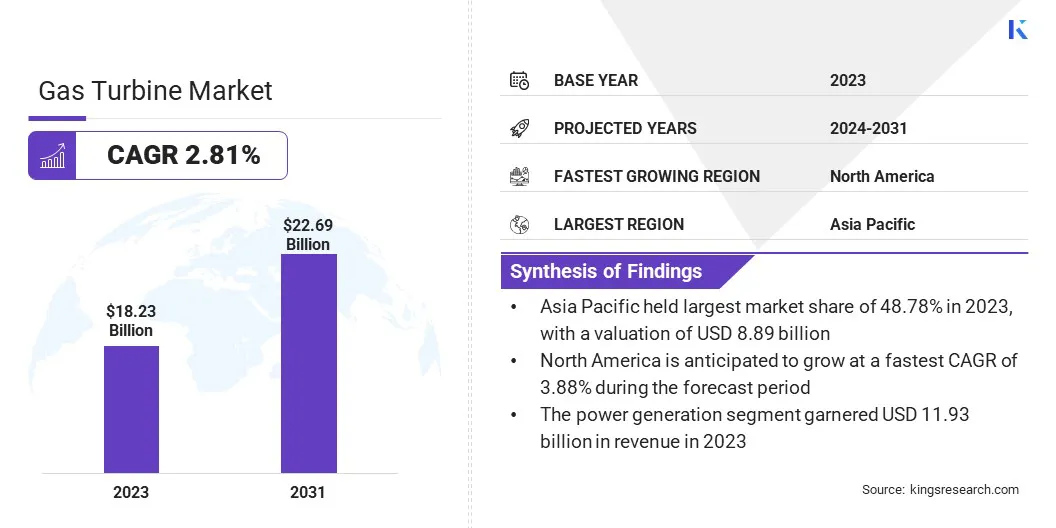

The global Gas Turbine Market size was valued at USD 18.23 billion in 2023 and is projected to grow from USD 18.69 billion in 2024 to USD 22.69 billion by 2031, exhibiting a CAGR of 2.81% during the forecast period. The expanding global population and increasing industrialization have created a significant demand for reliable power generation systems. Their adaptability to various energy sources, including natural gas, is boosting the growth of the gas turbine market.

In the scope of work, the report includes products offered by companies such as General Electric Company, Mitsubishi Heavy Industries Limited, Siemens Energy, Ansaldo Energia S.p.A., Kawasaki Heavy Industries, Ltd., Caterpillar, BHEL, Rolls-Royce plc, MAN Energy Solutions, Doosan Enerbility, and others.

Advances in materials, combustion systems, and turbine designs are significantly enhancing the performance, efficiency, and durability of gas turbines. These innovations improve thermal efficiency and reduce maintenance costs, essential for industries seeking cost-effective energy solutions.

Additionally, industrial sectors such as oil and gas, petrochemicals, and manufacturing are increasingly deploying gas turbines for cogeneration systems. These systems produce both electricity and thermal energy, improving energy utilization and reducing overall operational costs. Industries benefit from the high efficiency and reliability of gas turbines, which contribute to the growth of the market.

A gas turbine is a type of internal combustion engine that converts energy from burning fuel into mechanical energy through the expansion of high-pressure gases. It operates on the principle of the Brayton cycle, where compressed air is mixed with fuel, ignited, and the resulting hot gases drive a turbine to generate power.

Gas turbines are widely used in power generation, aviation, and industrial applications due to their efficiency, reliability, and ability to operate at high speeds and temperatures. They operate on various fuels, including natural gas, diesel, and kerosene, and are essential in both stationary and mobile power systems.

Analyst’s Review

Companies operating in the gas turbine market are implementing several strategies focused on innovation and supply chain optimization. Companies are investing heavily in green hydrogen and green ammonia technologies, recognized as next-generation clean energy sources. These fuels, highly valued for their zero-carbon emissions during production and combustion, align with global sustainability objectives.

By developing gas turbines compatible with these fuels, companies are positioning themselves to meet future energy demands while supporting environmental goals. Additionally, market players are prioritizing acquisitions and partnerships to strengthen their domestic and global supply chains. This strategy enables them to cater to the rising demand for heavy-duty gas turbines and modernization projects, ensuring timely delivery and enhanced service capabilities.

These initiatives enable companies to expand their market presence while addressing the growing need for efficient and sustainable energy generation solutions.

- In November 2024, GE Vernova acquired Woodward's heavy-duty gas turbine combustion parts business based in Greenville, SC. This acquisition aims to meet increasing customer demand, support the nation's electrification needs, and reinforce GE Vernova's commitment to the industry and the local community.

This strategic expansion underscores the industry's dedication to innovation and sustainability, leading to robust market growth worldwide.

Gas Turbine Market Growth Factors

Environmental concerns and stricter emission regulations have accelerated the transition to cleaner energy systems, boosting the growth of the gas turbine market. Gas turbines emit significantly lower carbon dioxide and pollutants compared to traditional coal-based systems, aligning with global decarbonization goals. Their compatibility with renewable energy sources, such as solar and wind, makes them an integral part of hybrid energy systems.

By bridging the gap between conventional and renewable power generation, gas turbines provide flexibility and ensure grid stability, which propels their adoption in markets prioritizing sustainable energy solutions. Moreover, the aerospace industry is experiencing rapid expansion, largely due to increasing air passenger traffic and cargo transport.

- The Aerospace Industry Association reported that the U.S. aerospace sector achieved combined sales of USD 955 billion in 2023, reflecting a 7.1% growth compared to 2022.

Gas turbines are central to jet engines, offering the power and efficiency necessary for aviation. Airlines and aircraft manufacturers prefer gas turbines for their reliability and ability to operate under extreme conditions. Additionally, advancements in turbine technology are reducing fuel consumption and operational costs, making them more attractive to the aviation sector. This expansion in aerospace applications is supporting the growth of the gas turbine market globally.

Gas Turbine Industry Trends

Combined cycle power plants, which utilize both gas and steam turbines, have emerged as a preferred solution for maximizing energy efficiency. These plants use waste heat from gas turbines to generate additional electricity, thereby improving overall thermal efficiency. This dual-use system is gaining widespread adoption, especially in regions focused on energy optimization and reducing carbon emissions.

The higher efficiency of combined cycle plants compared to conventional power generation systems makes them a strategic choice for utility providers, boosting the growth of the gas turbine market. In addition, developing economies are prioritizing infrastructure development to support their growing industrial and urban sectors. This includes the establishment of new power plants and industrial facilities, where gas turbines are the preferred energy generation solution.

- The United Nations Human Settlements Programme reports that Asia accounts for over 54% of the global urban population, or more than 2.2 billion people. By 2050, the region’s urban population is projected to grow by 1.2 billion, a 50% increase.

The scalability and ability of gas turbines to provide reliable power make them ideal for meeting the energy demands of large-scale projects. Infrastructure initiatives, including transportation and smart city developments, are further fueling demand for gas turbines, solidifying their role in the global energy landscape.

Segmentation Analysis

The global market has been segmented based on type, technology, voltage, application, and geography.

.webp)

By Type

Based on type, the market has been segmented into heavy-duty gas turbines, industrial gas turbines, and aero derivative gas turbine. The heavy-duty gas turbines segment led the gas turbine market in 2023, reaching a valuation of USD 11.36 billion. These turbines are widely used in power generation, industrial operations, and oil and gas facilities due to their ability to handle large-scale electricity demands and continuous operation in challenging environments.

Their scalability, higher efficiency, and adaptability make them ideal for peak load management and grid stability. Moreover, advancements in turbine technology, such as fuel flexibility and lower emissions, have strengthened their market presence. Additionally, increasing investments in renewable energy integration and infrastructure projects bolster the dominance of heavy-duty gas turbines.

By Technology

Based on technology, the market has been classified into combined cycle and open cycle. The combined cycle segment secured the largest revenue share of 75.34% in 2023. Combined-cycle gas turbine (CCGT) systems integrate gas and steam turbines to optimize energy production by utilizing waste heat from the gas turbine to generate additional power. This process significantly improves overall efficiency compared to simple-cycle systems.

Additionally, CCGT systems reduce emissions, aligning with global decarbonization goals and stricter environmental regulations. Their adaptability to various fuel sources, including LNG and hydrogen, further strengthens their market position.

By Application

Based on voltage, the market has been divided into power generation, oil & gas, aviation, marine, and others. The aviation segment is poised to witness significant growth, registering a robust CAGR of 4.14% through the forecast period.

The growing number of commercial aircraft deliveries and the need for modern, fuel-efficient engines are aiding this trend. Airlines are focusing on reducing operational costs and carbon emissions, fueling the adoption of advanced gas turbines for improved performance and sustainability. Military aviation projects and defense modernization play a major role in spurring segmental growth.

Gas Turbine Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific gas turbine market accounted for a substantial share of around 48.78% in 2023, valued at USD 8.89 billion. The Asia-Pacific region is experiencing rapid industrial growth and urban expansion, creating a strong demand for reliable and efficient power generation solutions.

Gas turbines, known for their scalability and adaptability to various industrial needs, are increasingly deployed to support large-scale manufacturing facilities, urban infrastructure projects, and energy-intensive industries.

Moreover, the region is witnessing a notable shift from coal to natural gas as a cleaner and more sustainable energy source. Gas turbines are essential for natural gas power plants, providing efficient and low-emission power generation. For instance, Vietnam has accelerated its adoption of liquefied natural gas (LNG) in response to declining domestic gas reserves and opposition to coal-fired power.

The nation's Eighth Power Development Plan (PDP8), approved in May 2023, outlines a strategy to phase out coal while promoting renewables, hydrogen, ammonia, and battery storage. This positions LNG as a pivotal transitional energy source in Vietnam's transition to a cleaner, more sustainable energy mix.

- The 2024 Global Energy Monitor Report highlights Vietnam's 2030 energy transition targets. The country plans to limit coal-fired capacity to 30 GW, reducing coal’s share in power generation to 20%. Moreover, gas-fired capacity is projected to grow to 38 GW, accounting for 25% of the energy mix, up from 9.3% in 2022.

Gas turbines play a critical role in natural gas power plants, providing efficient and low-emission power generation, thereby contributing to the growth of the Asia Pacific market.

The North America gas turbine market is set to witness significant growth, recording a CAGR of 3.88% over the forecast period. The expansion of energy-intensive industries such as manufacturing, chemicals, and data centers in North America is driving the demand for reliable power generation systems.

- The September 2024 report by the National Telecommunications and Information Administration reveals that the United States has over 5,000 data centers. Demand for these facilities is expected to grow at an annual rate of 9% through 2030, fueled by the pressing need for robust data infrastructure to support digital transformation and expanding connectivity.

Gas turbines are increasingly deployed to meet the high power requirements of these sectors while enhancing energy efficiency and reducing emissions. Furthermore, supportive policies and financial incentives from the U.S. and Canadian governments are fostering the growth of the regional market.

Initiatives promoting the adoption of clean energy technologies and subsidies for low-emission power plants are leading to the increased use of gas turbines in the energy transition.

Competitive Landscape

The global gas turbine market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Gas Turbine Market

- General Electric Company

- Mitsubishi Heavy Industries Limited

- Siemens Energy

- Ansaldo Energia S.p.A.

- Kawasaki Heavy Industries, Ltd

- Caterpillar

- BHEL

- Rolls-Royce plc

- MAN Energy Solutions

- Doosan Enerbility

Key Industry Developments

- August 2024 (Partnership): Mitsubishi Heavy Industries partnered with Samsung C&T Corporation to supply a gas turbine in Saudi Arabia. Under this agreement, Mitsubishi Power will deliver its M501JAC combined-cycle hydrogen-ready gas turbine for a new industrial co-generation plant that aims to produce both steam and electricity.

- July 2023 (Collaboration): Bharat Heavy Electricals Limited (BHEL) signed a Technical Assistance and License Agreement with General Electric Technology GmbH, Switzerland, for gas turbines. This extended agreement provided BHEL with enhanced rights for existing and upgraded turbine models, as well as access to new gas turbine technologies.

The global gas turbine market has been segmented as:

By Type

- Heavy-duty gas turbines

- Industrial gas turbines

- Aeroderivative gas turbine

By Technology

- Combined Cycle

- Open Cycle

By Voltage

- 1 MW – 50 MW (Small)

- 50 MW – 200 MW (Medium)

- 200 MW Above (Large)

By Application

- Power Generation

- Oil & Gas

- Aviation

- Marine

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

.webp)