Market Definition

Heat shrink tubing is a polymer-based material that contracts when exposed to heat, providing insulation, protection, and strain relief for electrical connections and wires. It offers secure coverage for diverse diameters and shapes while maintaining mechanical and electrical integrity.

Applications include wire bundling, insulation, sealing, and corrosion protection across automotive, electronics, industrial, and telecommunications sectors. Organizations use heat shrink tubing to enhance durability, reliability, and safety of cables, connectors, and components in demanding environments.

Heat Shrink Tubing Market Overview

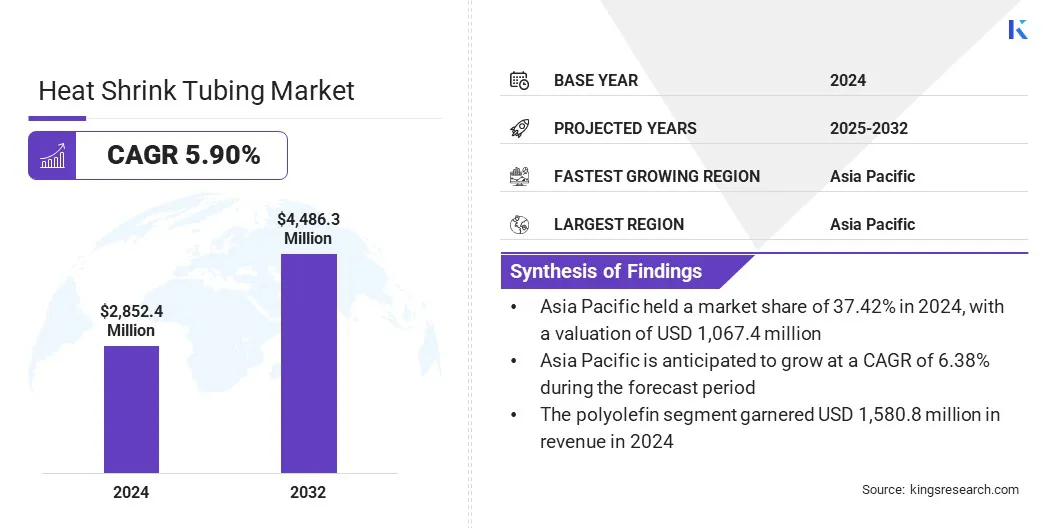

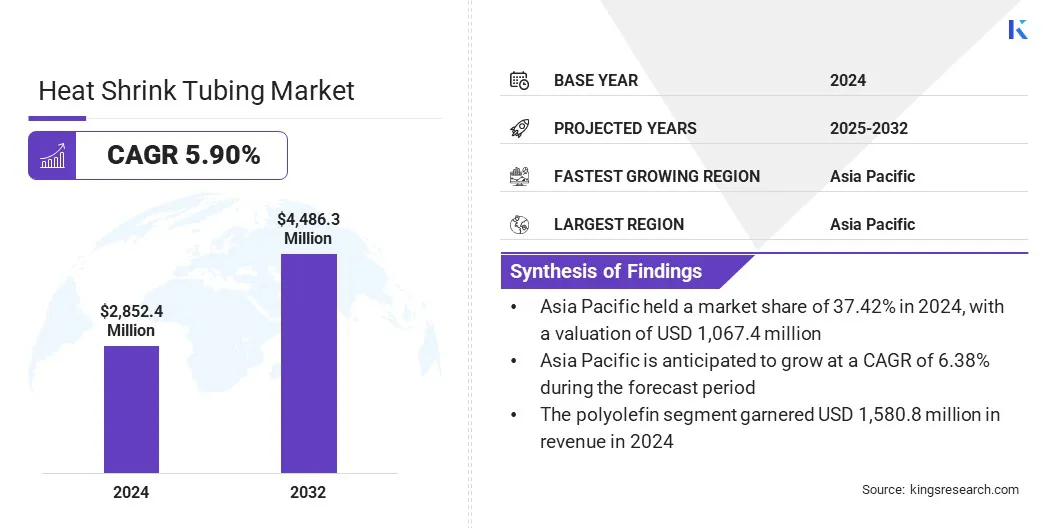

The global heat shrink tubing market size was USD 2,852.4 million in 2024 and is projected to grow from USD 3,003.4 million in 2025 to USD 4,486.3 million by 2032, exhibiting a CAGR of 5.90% during the forecast period.

This growth is attributed to the increasing demand for reliable insulation and protective solutions to safeguard electrical connections and wiring across industries. Expanding adoption of heat shrink tubing in automotive, electronics, industrial, and medical applications is enhancing durability, electrical safety, and operational efficiency.

Key Highlights

- The heat shrink tubing industry was valued at USD 2,852.4 million in 2024.

- The market is projected to grow at a CAGR of 5.90% from 2025 to 2032.

- Asia Pacific held a share of 6.38% in 2024, valued at USD 1,067.4 million.

- The low voltage segment garnered USD 1,350.9 million in revenue in 2024.

- The polyolefin segment is expected to reach USD 2,469.1 million by 2032.

- The automotive segment is anticipated to witness the fastest CAGR of 6.11% over the forecast period.

- North America is anticipated to grow at a CAGR of 5.75% through the projection period.

Major companies operating in the heat shrink tubing market are TE Connectivity, 3M, Sumitomo Electric Industries, Ltd., ABB, HellermannTyton, Molex, Amphenol Industrial Products, PrysmianGroup, Nexans, Alpha Wire, Qualtek Electronics Corp., Panduit Corp, Acim Jouanin, Shrinkable Material Co., Ltd., and Zeus Company LLC.

Growing focus by manufacturers, system integrators, and regulatory bodies on safety, performance, and compliance is promoting wider integration of heat shrink tubing into core electrical and mechanical systems. Additionally, ongoing material innovations, customized solutions, and technological advancements by suppliers, along with rising infrastructure development and industrial automation, are boosting market growth.

- In September 2025, Junkosha launched its Clear Peelable Heat Shrink Tubing at the Medical Technology Ireland 2025 exhibition. The tubing offers improved optical clarity for accurate catheter assembly while minimizing handling risks. Its peelable design eliminates the need for skiving, enhancing manufacturing efficiency, and supports a broad range of catheter sizes, including structural heart and AAA repair applications.

Market Driver

Growing Requirement for Secure Electrical Insulation & Protection

The growth of the heat shrink tubing market is fueled by the rising requirement for secure electrical insulation and protection in modern wiring and cabling systems. The material safeguards against electrical faults, mechanical stress, moisture, and chemical exposure, ensuring durability in challenging environments.

Industries such as automotive, electronics, telecommunications, and industrial manufacturing are increasingly adopting these solutions to enhance system reliability, prevent failures, and meet stringent safety standards. Moreover, regulatory mandates, infrastructure development, and the need for high-performance electrical systems are reinforcing its importance as a critical component for operational efficiency and long-term reliability.

- In June 2023, AccuPath launched ultra-thin PET heat shrink tubing for medical devices, offering wall thicknesses as low as 0.0002 inches and a 2:1 shrink ratio. The tubing ensures superior electrical insulation, biocompatibility, and resistance to sterilization methods such as ethylene oxide, gamma, and electron beam.

Market Challenge

Fluctuations in Raw Material Prices

Fluctuations in raw material prices pose a significant challenge to the growth of the heat shrink tubing market. Production depends on polymers and specialty materials, and volatility directly impacts manufacturing costs, pricing, and profit margins. Sudden price increases can force higher product costs, potentially reducing demand and affecting competitiveness.

Smaller manufacturers with limited procurement flexibility face greater difficulties managing these pressures. Industries such as automotive, electronics, telecommunications, and industrial manufacturing require consistent material quality and availability to ensure performance, safety, and regulatory compliance, while supply chain disruptions and price instability further intensify operational challenges.

To address these constraints, manufacturers are increasingly adopting strategic sourcing, bulk procurement, alternative material exploration, and cost-optimization measures. These approaches aim to stabilize production costs, maintain product reliability, and support sustained market growth.

Market Trend

Surging Demand from Electric Vehicles & Advanced Electronics

The heat shrink tubing market is influenced by the surging demand from electric vehicles and advanced electronics. This trend is further fueled by the need for reliable insulation, protection, and strain relief in complex wiring harnesses, battery systems, and electronic components.

For instance, TE Connectivity's VOLINSU Electric Vehicle Busbar heat shrink tubing provides high-voltage protection and insulation for electric vehicle applications. Its flexible design allows easy installation, and the 2:1 shrink ratio fits various busbar shapes.

Heat shrink tubing provides consistent performance, durability, and safety, making it essential for automotive, consumer electronics, and industrial applications. Industries are increasingly adopting high-performance tubing solutions to support electrification, smart devices, and automation initiatives.

Advanced materials and customized designs help improve operational efficiency, ensure regulatory compliance, and protect sensitive components. The growing use of electric mobility and connected electronics is establishing heat shrink tubing as a critical component in safe, efficient, and future-ready electrical systems.

Heat Shrink Tubing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Voltage

|

Low Voltage, Medium Voltage, and High Voltage

|

|

By Material

|

Polyolefin, Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), Perfluoroalkoxy Alkane (PFA), Ethylene Tetrafluoroethylene (ETFE), and Others

|

|

By End User

|

Automotive, Electrical & Electronics, Energy & Utilities , Industrial Machinery & Equipment, Healthcare, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Voltage (Low Voltage, Medium Voltage, and High Voltage): The low voltage segment earned USD 1,350.9 million in 2024, mainly due to its widespread use in consumer electronics, automotive wiring, and general electrical applications.

- By Material (Polyolefin, Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), Perfluoroalkoxy Alkane (PFA), Ethylene Tetrafluoroethylene (ETFE), and Others): The polyolefin segment held a share of 55.42% in 2024, propelled by its cost-effectiveness, excellent electrical insulation properties, and broad applicability across automotive, electronics, and industrial sectors.

- By End User (Automotive, Electrical & Electronics, Energy & Utilities, Industrial Machinery & Equipment, Healthcare, and Others): The electrical & electronics segment is projected to reach USD 1,411.2 million by 2032, owing to the growing demand for reliable insulation, protection, and component safety in consumer devices, industrial electronics, and advanced electronic systems.

Heat Shrink Tubing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific heat shrink tubing market share stood at 37.42% in 2024, valued at USD 1,067.4 million. This dominance is reinforced by rapid industrialization, a strong electronics manufacturing base, and a robust automotive sector. Moreover, the regional market benefits from increasing adoption of electric vehicles, renewable energy initiatives, and advanced consumer electronics, which are creating demand for reliable insulation and protection solutions.

Supportive government policies, growing infrastructure investments, and rising industrial automation further increase growth prospects. Continuous advancements in high-performance materials, customized tubing solutions, and manufacturing technologies strengthen Asia Pacific’s position as a key hub for heat shrink tubing adoption.

- In October 2024, Japan-based Junkosha expanded its Peelable Heat Shrink Tubing range at MD&M Minneapolis 2024, adding six new sizes with a 1.8:1 shrink ratio. The tubing offers improved dimensional tolerance, elongation, and wall thickness, enabling integration of complex catheter designs. Its peelable design allows easy removal without tools, offering OEMs tailored solutions to improve manufacturing efficiency and device performance.

The North America heat shrink tubing industry is set to grow at a CAGR of 5.75% over the forecast period. This growth is fueled by increasing industrial automation, expansion of the electronics and automotive sectors, and rising adoption of high-performance heat shrink tubing across applications such as wiring harnesses, connectors, and component protection.

Expanding manufacturing and infrastructure projects are leveraging advanced materials and customized tubing solutions to enhance safety, durability, and operational efficiency. Additionally, supportive government policies, investments in renewable energy, and the rise of electric vehicle production are promoting technological development, aiding regional market progress.

- In August 2024, Mercury Plastics expanded its Middlefield, Ohio, facility with a 10 MeV electron beam accelerator, becoming one of the few North American companies with this technology. The upgrade enhances durability, chemical resistance, and temperature performance for tubing, wire and cable, molded components, and heat shrink products, supporting the company’s growth and innovation in thermoplastics.

Furthermore, manufacturers are prioritizing material innovation, precise application techniques, and integration with automated assembly to enhance reliability and performance. The rise of smart manufacturing and increasing demand for energy-efficient, durable electrical systems are propelling regional market expansion.

Regulatory Frameworks

- In the European Union, the Low Voltage Directive regulates electrical equipment operating within specified voltage limits. It ensures that heat shrink tubing used in electrical assemblies complies with insulation, dielectric strength, and fire-resistance standards for safe end-user operation.

- Internationally, the International Electrotechnical Commission IEC 60684 regulates flexible insulating sleeving for electrical applications. It sets standards for dimensions, shrink ratios, temperature resistance, and performance, ensuring uniform quality, safety, and reliability for heat shrink tubing.

- In Canada, the CEC (Canadian Electrical Code) regulates electrical installations and material safety standards. It ensures that heat shrink tubing meets insulation, temperature, and durability requirements for residential, commercial, and industrial wiring systems.

Competitive Landscape

Companies operating in the heat shrink tubing industry are maintaining competitiveness through investments in high-performance materials, customized tubing solutions, and strategic partnerships and acquisitions. They are supplying heat shrink tubing for insulation, protection, and strain relief across automotive, electronics, industrial, and energy applications.

- In January 2023, Shoal Group acquired Shrinktek Polymers International to strengthen its presence in the European market. The acquisition expands its product portfolio, enhances distribution capabilities, and reinforces its ability to serve electrical and construction industry customers with high-performance tubing solutions.

Market players are expanding their portfolios with specialty materials, precision-engineered sizes, and tubing designed for high-temperature, chemical-resistant, and environmentally friendly applications to meet evolving industry requirements.

Moreover, they are establishing regional manufacturing and distribution facilities and collaborating with technology providers and industrial partners to enhance market reach and support adoption. Additionally, companies are offering technical guidance, application support, and training programs to ensure optimal performance and sustain competitive positioning.

Top Key Companies in Heat Shrink Tubing Market:

- TE Connectivity

- 3M

- Sumitomo Electric Industries, Ltd.

- ABB

- HellermannTyton

- Molex

- Amphenol Industrial Products

- PrysmianGroup

- Nexans

- Alpha Wire

- Qualtek Electronics Corp.

- Panduit Corp

- Acim Jouanin

- Shrinkable Material Co., Ltd.

- Zeus Company LLC

Recent Developments (Partnerships)

- In February 2024, Medical Extrusion Technologies (MET) partnered with Chamfr to offer over 30 sizes of FEP heat shrink tubing on the Chamfr.com platform. The collaboration aims to accelerate medical device R&D by providing in-stock, high-performance tubing with controlled elongational growth of 2–5%, compared to the standard 10%. The expanded inventory is regularly updated to support rapid prototyping and efficient product development.