Market Definition

The market involves the production and consumption of PTFE, a high-performance polymer known for its chemical resistance, low friction, and thermal stability.

It serves various industries, including automotive, aerospace, chemical processing, electronics, and healthcare. The market is driven by the increasing demand for durable materials in sealing, insulation, and coatings applications.

Polytetrafluoroethylene Market Overview

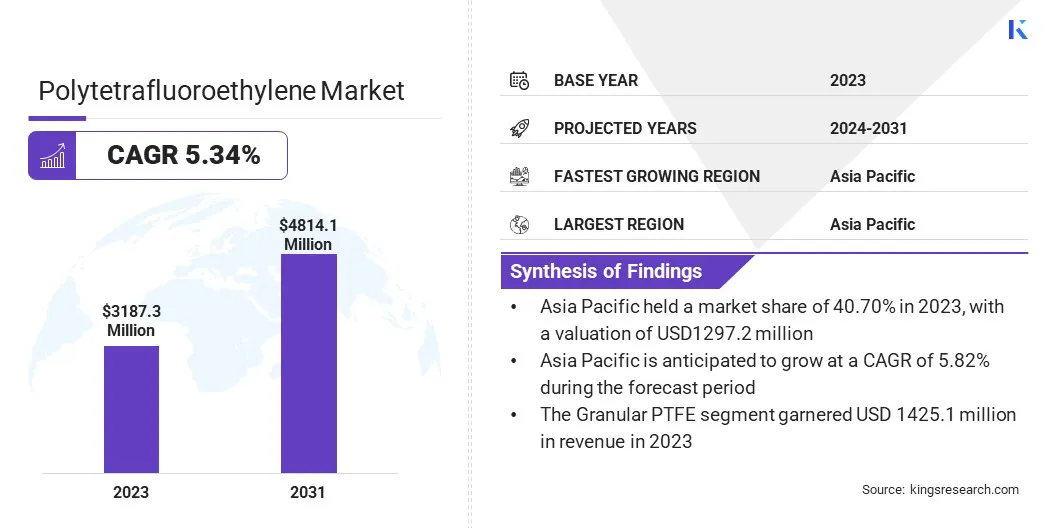

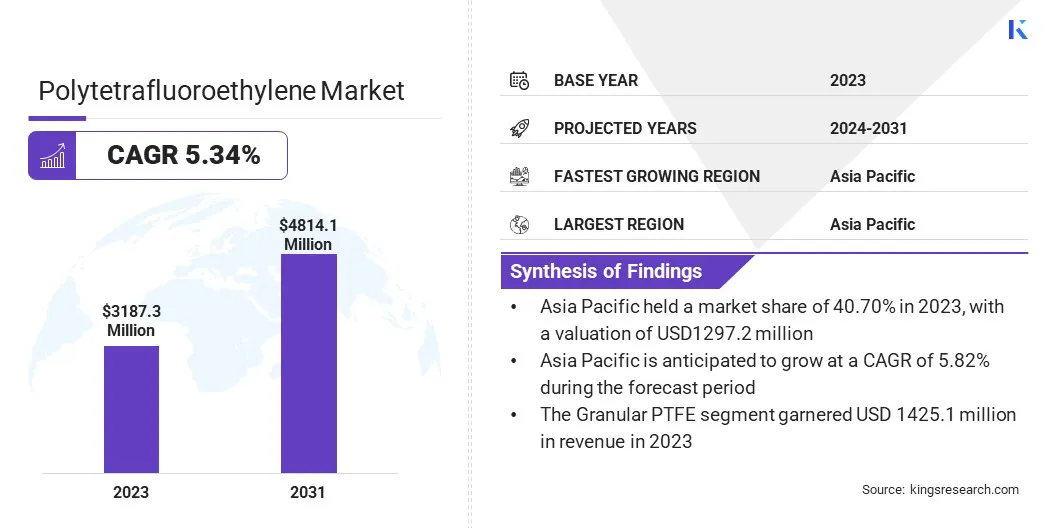

The global polytetrafluoroethylene market size was valued at USD 3187.3 million in 2023, which is estimated to be USD 3345.7 million in 2024 and reach USD 4814.1 million by 2031, growing at a CAGR of 5.34% from 2024 to 2031.

The growing demand for high-performance materials in the electrical and electronics sectors is a key growth factor for the PTFE market. PTFE's excellent dielectric properties make it ideal for insulation, wiring, and cable coatings, ensuring safety and performance in high-temperature, high-voltage environments.

Major companies operating in the polytetrafluoroethylene industry are AGC Inc., The Chemours Company, HaloPolymer Trading Inc, Gujarat Fluorochemicals Limited, 3M, AFT Fluorotec Coatings, Syensqo, Micro Powders, Inc, DAIKIN INDUSTRIES, Ltd., Saint-Gobain, Reprolon Texas, Hubei Wentai New Material Co., Ltd., hindustanpolymer, VESCOAT INDIA, and Metal Coatings.

A significant opportunity in the polytetrafluoroethylene (PTFE) market is the growing demand for sustainable materials in renewable energy applications.

As industries focus on energy efficiency, PTFE's exceptional properties, such as chemical resistance and thermal stability, make it a key material in enhancing the performance of solar power systems and electric vehicles, presenting substantial growth potential in these rapidly expanding sectors.

- According to the Renewable Energy Progress Tracker by the International Energy Agency (IEA), the share of renewable energy in global power generation was 30% in 2023, which is projected to rise to 46% by 2030, creating a growth opportunity for the PTFE market in renewable technologies.

Key Highlights:

- The polytetrafluoroethylene market size was valued at USD 3187.3 million in 2023.

- The market is projected to grow at a CAGR of 5.34% from 2024 to 2031.

- Asia Pacific held a market share of 40.70% in 2023, with a valuation of USD 1297.2 million.

- The granular PTFE segment garnered USD 1425.1 million in revenue in 2023.

- The coatings segment is expected to reach USD 1534.7 million by 2031.

- The electrical & electronics segment is anticipated to register the fastest CAGR of 5.96% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 5.56% during the forecast period.

Market Driver

"Rising Demand in Automotive Industry"

The rising demand for durable, heat-resistant, and chemically resistant components in the automotive industry is a significant driver of the polytetrafluoroethylene market.

PTFE’s exceptional properties, including high thermal stability and resistance to harsh chemicals, make it an ideal material for seals, gaskets, bearings, and fuel system components. PTFE’s role in enhancing the reliability and longevity of critical components in the automotive sector will drive the market in the coming years.

- According to SIAM, the Indian automotive industry produced 2.84 crore vehicles in FY 2023-24, up from 2.59 crore vehicles in FY 2022-23. This growth highlights the increasing demand for high-performance materials like PTFE in automotive components for enhanced durability and efficiency.

Market Challenge

"Production Costs"

A significant challenge faced by the polytetrafluoroethylene market is the high production cost associated with its manufacturing process. PTFE’s complex polymerization and processing require specialized equipment and raw materials, which increase its overall cost.

Manufacturers are exploring advancements in production technologies, such as more efficient polymerization methods and the use of cost-effective raw materials. Additionally, developing recycling technologies for PTFE can reduce waste and improve cost-efficiency, making the material more accessible across industries.

Market Trend

"Technological Advancements"

A prominent trend in the polytetrafluoroethylene industry is the continuous technological advancements in its production. Innovations in processing techniques, such as improved polymerization methods and more efficient manufacturing processes, are enhancing the material’s quality and reducing production costs.

These advancements are not only improving the overall efficiency of PTFE production but also expanding its applications across various industries. As a result, PTFE is being increasingly utilized in specialized sectors such as renewable energy, medical devices, and electronics, further driving the market.

- In August 2024, AGC developed a surfactant-free fluoropolymer manufacturing process, enhancing sustainability and performance. This breakthrough, aimed at industrial-scale production by 2030, supports the PTFE market by providing high-performance materials for industries like semiconductors, automotive, and energy.

Polytetrafluoroethylene Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Granular PTFE, Fine Powder PTFE, Others

|

|

By Application

|

Lubricants and Greases, Coatings, Electrical Insulation, Others

|

|

By End-use Industry

|

Automotive, Aerospace, Electrical & Electronics, Medical, Other

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Granular PTFE, Fine Powder PTFE, Others): The granular PTFE segment earned USD 1425.1 million in 2023, driven by its widespread use in seals and gaskets.

- By Application (Lubricants and Greases, Coatings, Electrical Insulation, Others): The coatings segment held 31.52% share of the market in 2023, driven by PTFE's non-stick and chemical-resistant properties.

- By End-use Industry (Automotive, Aerospace, Electrical & Electronics, Medical, Other): The electrical & electronics segment is projected to reach USD 1503.0 million by 2031, owing to the increasing demand for PTFE in high-performance insulation.

Polytetrafluoroethylene Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a market share of around 40.70% in 2023, with a valuation of USD 1297.2 million. Asia Pacific is the largest and most dominant market for PTFE, accounting for significant global demand. Rapid industrialization, especially in countries like China, India, and Japan, has fueled growth across the automotive, electronics, and chemical processing sectors in the region.

The increasing demand for PTFE in manufacturing high-performance components, combined with cost-effective production capabilities, continues to drive the market in this region. As a result, Asia Pacific remains the primary hub for PTFE production and consumption globally.

The market in North America is poised for significant growth at a robust CAGR of 5.56% over the forecast period. North America is a fast-growing region in the polytetrafluoroethylene market, driven by advancements in technology and the increasing demand for high-performance materials in industries such as aerospace, automotive, and electronics.

The region is registering strong growth in the adoption of PTFE for applications like electrical insulation, coatings, and seals, owing to its excellent thermal stability and resistance to chemicals. Amid the growing focus on sustainability and innovation, the demand for PTFE in North America is expected to continue rising, further establishing it as a key growth market.

Regulatory Frameworks:

- BIS is the National Standard Body of India established under the BIS Act 2016 for the harmonious development of activities of standardization, marking, and quality certification of goods.

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

Competitive Landscape:

The polytetrafluoroethylene industry is characterized by a large number of participants, including established corporations and rising organizations. In the market, companies are forming strategic partnerships to drive innovation, improve product performance, and expand their market presence.

These collaborations focus on joint R&D, enhancing production efficiency, and developing specialized PTFE applications. By pooling resources, companies can meet the growing demand in sectors like aerospace, automotive, and renewable energy while optimizing manufacturing processes and cost structures.

List of Key Companies in Polytetrafluoroethylene Market:

- AGC Inc.

- The Chemours Company

- HaloPolymer Trading Inc

- Gujarat Fluorochemicals Limited

- 3M

- AFT Fluorotec Coatings

- Syensqo

- Micro Powders, Inc

- DAIKIN INDUSTRIES, Ltd.

- Saint-Gobain

- Reprolon Texas

- Hubei Wentai New Material Co., Ltd.

- hindustanpolymer

- VESCOAT INDIA

- Metal Coatings