Market Definition

Graphite electrodes are essential carbon conductors in steelmaking and metallurgical operations. They are primarily used in electric arc furnaces and ladle furnaces for scrap steel melting and refining processes. Their applications extend to basic oxygen furnaces and non-steel processes such as ferroalloy and silicon metal production.

Available in ultra-high power, high power, and regular power grades, these electrodes meet varying energy demands while ensuring consistent performance in energy-intensive industrial processes.

Graphite Electrode Market Overview

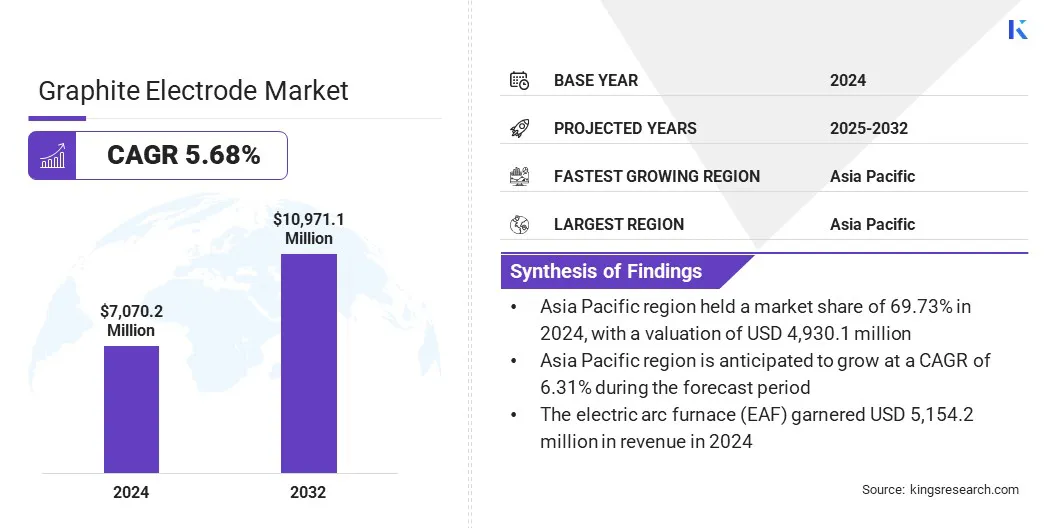

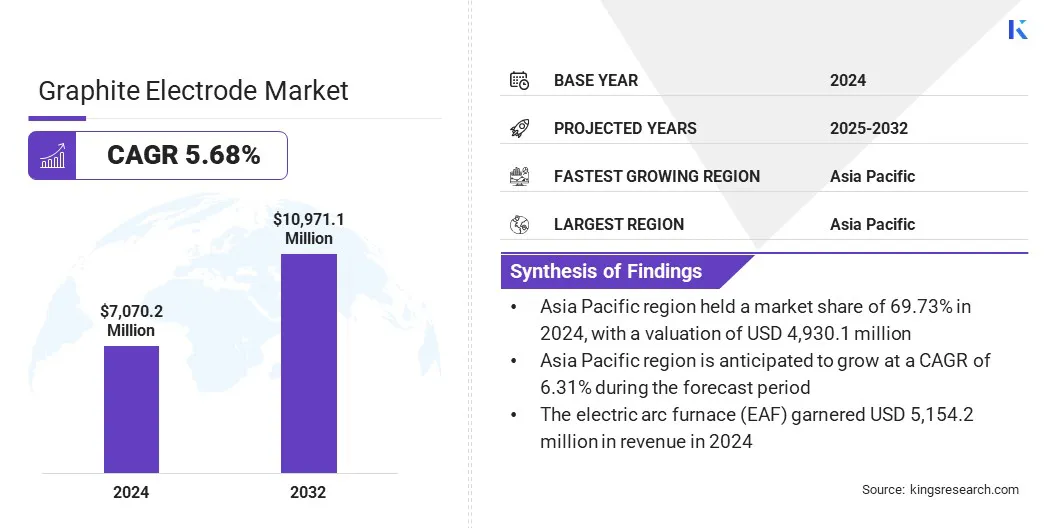

The global graphite electrode market size was valued at USD 7,070.2 million in 2024 and is projected to grow from USD 7,451.4 million in 2025 to USD 10,971.1 million by 2032, exhibiting a CAGR of 5.68% during the forecast period.

This growth is fueled by the growing demand for graphitized electrodes in electric arc furnaces (EAFs) to enhance efficiency and output in steel production. Additionally, the market is witnessing a trend toward natural graphite in electric vehicle (EV) batteries to meet rising energy storage and conductivity requirements.

Key Highlights:

- The graphite electrode industry size was recorded at USD 7,070.2 million in 2024.

- The market is projected to grow at a CAGR of 5.68% from 2025 to 2032.

- Asia Pacific held a share of 69.73% in 2024, valued at USD 4,930.1 million.

- The ultra high power (UHP) segment garnered USD 3,181.6 million in revenue in 2024.

- The electric arc furnace (EAF) segment is expected to reach USD 8,061.7 million by 2032.

- North America is anticipated to grow at a CAGR of 4.21% over the forecast period.

Major companies operating in the graphite electrode market are GrafTech International, Tokai Carbon Co., Ltd., SGL Carbon, Resonac Holdings Corporation, Fangda Carbon New Materials Technology Co., Ltd., Graphite India (GIL), HEG Limited, BENHONG GRAPHITE, KAIFENG CARBON CO., LTD, Nippon Carbon Co Ltd., Suzhou Xiangyun Platform Information Technology Co., Ltd, El 6, Sangraf International, Nantong Yangzi Carbon Co., Ltd, and Ameri-Source Specialty Products.

Companies are developing large-diameter graphite electrodes that provide higher current carrying capacity, improved thermal stability, and longer service life. These solutions address the rising demand for high-capacity electrodes in electric arc furnaces (EAFs) and other steelmaking applications.

The adoption of large-diameter electrodes enables more efficient steel production, reduces operational interruptions, and supports continuous high-volume melting processes. This approach allows manufacturers to cater to evolving industry requirements and strengthens the overall supply capabilities.

- In October 2024, El 6 Novocherkassk began producing graphitized UHP electrodes with a diameter of 750 mm using needle coke. The electrodes offer high current capacity, improved thermal stability, and enhanced durability for steel and other industrial applications. The production process successfully handled large-diameter, heavy workpieces, and quality audits confirmed compliance with international standards.

Market Driver

Growing Demand for Graphitized Electrodes in Electric Arc Furnaces

The progress of the graphite electrode market is driven by the growing demand for graphitized electrodes in new-generation electric arc furnaces (EAFs). EAF technology is increasingly adopted by steelmakers for scrap-based steel production due to its efficiency and lower carbon footprint compared to traditional blast furnaces.

Graphitized electrodes are essential for conducting high electric currents required to melt scrap steel in these furnaces. The rising adoption of EAFs increases the consumption of high-quality electrodes, prompting manufacturers to expand production capacity to meet industrial demand.

- In October 2024, El 6 Novocherkassk began producing 750 mm EGSP-UHP graphitized electrodes using needle coke. The electrodes provide high current capacity, thermal stability, and durability for steel smelting in electric arc furnaces. These large-sized electrodes support modern steelmaking and expand the company’s global product portfolio.

Market Challenge

High Energy Consumption

A major challenge impeding the expansion of the graphite electrode market is the high energy consumption in manufacturing. Production involves energy-intensive graphitization and baking processes, leading to increased operational costs and pricing pressures.

To address this challenge, companies are investing in energy-efficient technologies and optimizing furnace operations. Market players are also exploring alternative energy sources and improving process automation to reduce energy consumption and stabilize production costs.

Market Trend

Notable Shift toward Natural Graphite in EV Battery Applications

The graphite electrode market is witnessing a notable shift toward the use of natural graphite in electric vehicle (EV) battery applications. Rising demand for EVs is boosting the need for high-quality, energy-efficient electrodes that can support battery performance and longevity.

Manufacturers are increasingly developing electrodes from natural graphite to meet strict energy density and conductivity requirements. This shift is promoting advancements in electrode manufacturing processes and fueling the adoption of sustainable materials.

- In July 2025, POSCO Future M signed a supply contract with a major Japanese battery company for natural graphite anode materials. The materials will be produced at the Sejong plant and supplied for electric vehicle batteries in Japan. The company leverages process innovations, diverse raw material sourcing, and integrated supply chain capabilities to maintain productivity and competitiveness.

Graphite Electrode Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Ultra High Power (UHP), High Power (HP), Regular Power (RP)

|

|

By Application

|

Electric Arc Furnace (EAF), Ladle Furnace (LF), Basic Oxygen Furnace (BOF), Non-steel Applications

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Grade (Ultra High Power (UHP), High Power (HP), and Regular Power (RP)): The ultra high power (UHP) segment earned USD 3,181.6 million in 2024, mainly due to rising adoption in electric arc furnaces for high-efficiency steel production.

- By Application (Electric Arc Furnace (EAF), Ladle Furnace (LF), Basic Oxygen Furnace (BOF), and Non-steel Applications): The electric arc furnace (EAF) segment held a share of 72.90% in 2024, fueled by the growing shift toward scrap-based steelmaking processes.

Graphite Electrode Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific graphite electrode market share stood at 69.73% in 2024, valued at USD 4,930.1 million. This dominance is reinforced by growing demand for high-quality graphite from electric vehicle (EV) and consumer electronics manufacturers.

Regional players are expanding production facilities and investing in advanced manufacturing technologies and capacity enhancement. These private-sector investments enable increased output of premium-grade graphite electrodes, ensuring a stable supply for the rapidly growing EV and electronics sectors. This strategic expansion supports Asia Pacific’s global dominance.

- In September 2025, East Carbon (Eastcarb) inaugurated a new 32,000-square-meter graphite production facility in Jiashan, Zhejiang, China. The factory is equipped with modern machinery and advanced furnace technologies, including graphitization, direct heating, and Acheson furnaces, to produce a wide range of graphite grades, electrodes, and accessories. The expansion is projected to increase the company’s production by 67% while maintaining high-quality 99.9999% purity graphite and shorter lead times.

The North America graphite electrode industry is poised to grow at a significant CAGR of 4.21% over the forecast period. This growth is propelled by the rising adoption of electric arc furnace (EAF) steelmaking, which increases the demand for high-performance graphite electrodes.

Key regional players emphasize advanced steel production technologies and modernization of existing steel plants, supporting the higher consumption of electrodes. Continuous focus on process efficiency and quality standards in steel manufacturing nd reinforces North America’s position as a key market for graphite electrodes.

- In June 2024, JSW Steel USA announced a USD 110 million investment to modernize its Baytown, Texas, steel plate mill. The upgrades include sustainable technologies and advanced equipment to produce high-quality monopile steel plates for offshore wind towers, hydrocarbon pipelines, and high-density pressure vessels.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates graphite electrode manufacturing under the Clean Air Act through emission standards for hazardous air pollutants.

- In Europe, graphite electrode production is regulated under the Industrial Emissions Directive (IED), which sets limits on air, water, and soil pollution from industrial facilities.

- In India, the Central Pollution Control Board (CPCB) governs graphite electrode production under the Air (Prevention and Control of Pollution) Act, 1981.

- In Japan, the Ministry of the Environment monitors graphite electrode facilities under the Air Pollution Control Act, ensuring compliance with strict emission standards.

Competitive Landscape

Key players in the graphite electrode industry are focusing on acquisitions and geographic expansions to strengthen their competitive position. They are acquiring smaller regional manufacturers to enhance production capacity and secure access to key raw materials. They are also expanding operations into emerging markets to increase their global footprint and meet regional demand.

Strategic establishment of new manufacturing facilities in high-growth regions is being used to optimize supply chains. Additionally, firms are forming joint ventures and partnerships to accelerate market entry and broaden their operational reach.

- In September 2025, Graphite India acquired a 6.82% stake in GrafTech International through secondary market transactions. The investment provides potential access to new technologies, manufacturing processes, and international customers.

Top Companies in Graphite Electrode Market:

- GrafTech International

- Tokai Carbon Co., Ltd.

- SGL Carbon

- Resonac Holdings Corporation

- Fangda Carbon New Materials Technology Co., Ltd.

- Graphite India (GIL)

- HEG Limited

- BENHONG GRAPHITE

- KAIFENG CARBON CO., LTD

- Nippon Carbon Co Ltd.

- Suzhou Xiangyun Platform Information Technology Co., Ltd

- El 6

- Sangraf International

- Nantong Yangzi Carbon Co., Ltd

- Ameri-Source Specialty Products

Recent Developments

- In June 2025, Tokai Carbon sold its German subsidiary, Tokai Erftcarbon GmbH, a manufacturer of large-format graphite electrodes, to the LEO III Fund managed by DUBAG Group. TEG produces high-power, high-stability electrodes for electric steelmaking, contributing to decarbonization in the steel sector.

- In January 2025, POSCO Future M localized the production of 300mm diameter UHP synthetic graphite electrode rods for electric steelmaking. The rods, previously fully imported, convert electrical energy into thermal energy to enhance furnace efficiency and support low-carbon steel production. The project, led by POSCO Future M with RIST, POSCO MC Materials, POSTECH, and Kumoh National Institute of Technology, used needle coke by-products from steelmaking to stabilize the domestic supply chain.