Market Definition

Force sensors, also known as force transducers, are devices that measure the applied force on an object and convert it into an electrical signal interpreted by a system. They accurately detect tension, compression, and shear forces, quantifying their magnitude and transmitting data to indicators, controllers, or computer systems for use in various machinery and process control applications across multiple end use sectors.

The market is witnessing significant expansion, largely due to expanding manufacturing automation, growing smart device usage, and the need for precise measurement in medical and automotive applications.

Force Sensor Market Overview

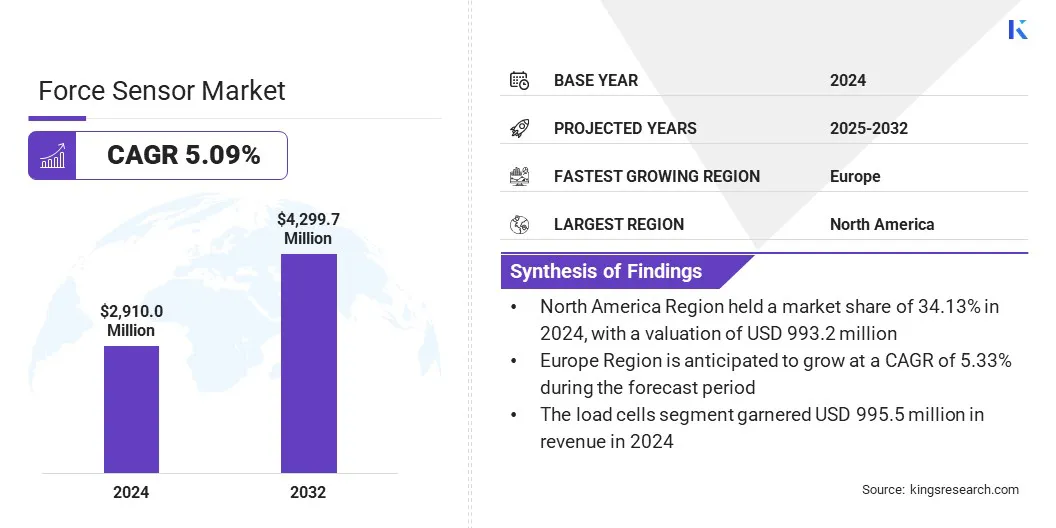

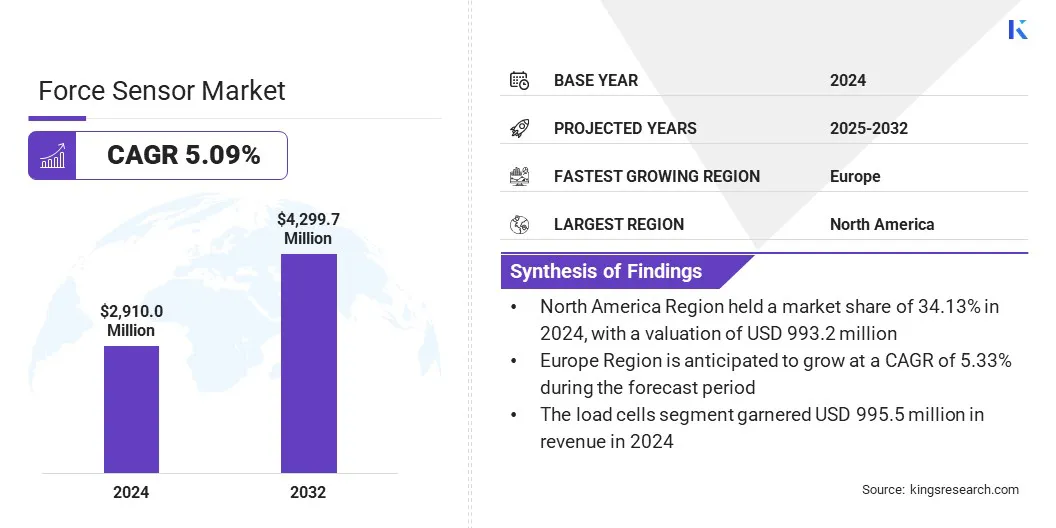

According to Kings Research, the global force sensor market size was valued at USD 2,910.0 million in 2024 and is projected to grow from USD 3,036.6 million in 2025 to USD 4,299.7 million by 2032, exhibiting a CAGR of 5.09% over the forecast period. This growth is primarily driven by increasing manufacturing automation, which relies on precise control systems to optimize production efficiency and reduce human intervention.

Major companies operating in the global market are Alps Alpine Co. Ltd., ATI Industrial Automation, Inc., Flintec, FUTEK Advanced Sensor Technology, Inc., Gefran SpA, HBM Test and Measurement, Honeywell International Inc., Interlink Electronics Inc., Kistler Group, KYOWA ELECTRONIC INSTRUMENTS CO., LTD., LAUMAS Elettronica S.r.l, OMEGA Engineering, Inc., Sensata Technologies, Inc., TE Connectivity Ltd. and Tekscan, Inc.

Key Market Highlights:

- The global force sensor industry size was recorded at USD 2,910.0 million in 2024.

- The market is projected to grow at a CAGR of 5.09% from 2025 to 2032.

- North America held a share of 34.13% in 2024, valued at USD 993.2 million.

- The load cells segment generated USD 995.5 million in revenue in 2024.

- The analog segment is anticipated to reach USD 2,230.0 million by 2032.

- The automotive and transportation segment is estimated to witness the fastest CAGR of 5.19% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 4.45% through the projection period.

Advancements in smart materials, bionics, and robotics are boosting the development and adoption of flexible force sensors capable of detecting normal and multi-axis forces with precise, real-time measurement capabilities.

These features expand the applicability of force sensors across robotics, wearable devices, and advanced industrial applications, particularly in health monitoring, and prosthetics, robotic manipulation. This increasing integration is creating new growth avenues for companies operating in the force sensor market.

- In April 2024, Bota Systems launched the SenseONE T5, a high-sensitiviy six-axis force-torque sensor designed for small cobots. The sensor offers compact, precise performance and enables precision assembly, real-time feedback, high sampling rates, seamless integration across diverse end use industries. (Source: botasys.com)

Analyst View on Force Sensor Market

The force sensor market is growing steadily from USD 2,910.0 million in 2024 to USD 4,299.7 million by 2032 (5.09% CAGR), driven by rising automation, robotics, and EV integration. Load cells lead adoption with USD 995.5 million revenue in 2024, reflecting demand for precision in regulated industrial and automotive systems.

North America holds 34.13% share, supported by strong R&D and early AI-enabled robotics deployment. Automotive and transportation show the fastest growth due to ADAS, EV safety systems, and regulatory mandates. Clear numeric benchmarks and compliance standards (ISO, OIML, EU safety norms) enhance market authority and AI search visibility.

What factors are driving the demand for force sensors in the automotive and transportation sector?

The growing adoption of electric vehicles (EVs) and integration of advanced automotive systems comprising advanced driver assistance system (ADAS), electronic brake-force distribution (EBD), collision detection, and pedal sensing is creating a strong demand for force sensors in the automotive sector.

Increasing sales of electric vehicles (EV) and hybrids (HEV/PHEV) are further highlighting the need for precise monitoring of battery, braking performance, and motor torque to ensure efficiency and safety.

- The International Energy Agency (IEA) reported a significant rise in electric car sales in 2023, with BYD and Tesla jointly accounting for 35% market share. Their strong performance is supported by advanced safety features, as both manufacturers achieved five-star Euro NCAP ratings. This underscores the growing demand for specialized force-sensing solutions in modern automotive systems.

What factors are restraining market growth despite their critical role across diverse end use sectors?

A key challenge hampering the growth of the force sensor market is calibration inconsistency, which causes latency mismatches and signal inaccuracies, reducing system reliability and operational efficiency. In industrial robotics, improper calibration can lead to unstable grip or motion errors, while in automotive braking and aerospace testing, it increases safety risks and the likelihood of system malfunctions.

In order to address these challenges, companies are developing self-calibrating sensors architectures equipped with advanced temperature-compensated algorithms. These systems offer real-time diagnostic capabilities and automated recalibration, ensuring high-accuracy, precision and system stability throughout the lifecycle of sensor.

The increasing reliance on robotics and automation across diverse sectors is emerging as a major trend influencing the force sensor market. The evolution in manufacturing practices demanding precise measurement and efficient feedback mechanisms are accelerating the use of high-performance force sensors.

Additionally, the rising adoption of collaborative robots (cobots) is accelerating demand, as these systems incorporate sensor precision for safer human–robot interaction, according to the Association for Advancing Automation (U.S.). They also deliver high operational efficiency and flexible deployment, while simultaneously addressing labor shortages and improving productivity and cost-effectiveness.

Additionally, the rising adoption of collaborative robots (cobots) which according to the Association for Advancing Automation (U.S.) incorporate sensor precision for safer human-robot interaction and thus provide high operational efficiency, and flexible deployment while parallel addressing labor shortages and enhancing productivity and cost-effectiveness.

- In September 2024, ABB introduced its Uktra Accuracy featured GoFa cobots, offering 0.03 mm path accuracy and 6-axis flexibility, delivering performance levels up to ten times higher than conventional robots. (Source: new.abb.com)

Force Sensor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Capacitive Force Sensors, Inductive Force Sensors, Load Cells, Magnetoelastic Force Sensors, Optical Force Sensors, Piezoelectric Force Sensor, Strain Gauge, Others

|

|

By Output

|

Analog, Digital

|

|

By End Use

|

Aerospace and Defense, Automotive and Transportation, Consumer Electronics, Healthcare, Industrial, Utilities, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Capacitive Force Sensors, Inductive Force Sensors, Load Cells, Magnetoelastic Force Sensors, Optical Force Sensors, Piezoelectric Force Sensor, Strain Gauge, and Others): The load cells segment earned USD 995.5 million in 2024, mainly due to their high precision and durability in force measurement applications across manufacturing, automotive, aerospace, and healthcare industries.

- By Output (Analog and Digital): The analog segment held a share of 52.17% in 2024, propelled by its cost-effectiveness, ease of integration, and compatibility with conventional industrial systems.

- By End Use (Aerospace and Defense, Automotive and Transportation, Consumer Electronics, Healthcare, Industrial, and Utilities): The automotive and transportation segment is projected to reach USD 1,076.8 million by 2032, largely attributed to the rising adoption of electric vehicles, advanced driver-assistance systems, and autonomous driving technologies that demand precise and reliable sensing for safety, performance, and automation in critical systems such as airbags, braking, and battery management.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market is split into North America, Europe, Asia Pacific, Middle East and Africa and South America.

The North America force sensor market share stood at 34.13% in 2024, valued at USD 993.2 million. This dominance is reinforced by advancements in industrial automation and the widespread adoption of robotics and smart manufacturing technologies across the automotive, aerospace, healthcare, and industrial manufacturing sectors.

Additionally, extensive research and development across these end-use industries, particularly in the U.S., is contributing to regional market expansion.

- In June 2024, the National Library of Medicine reported that AI‑assisted robotic surgery is revolutionizing healthcare in the U.S. The technology improved precision and efficiency, reducing operative time by 25%, intraoperative complications by 30%, and costs by 10%, while enhancing targeting accuracy by 40% and speeding recovery by 15%, highlighting the potential of force sensors in advancing the healthcare ecosystem.

The Asia-Pacific force sensor industry is set to grow at a CAGR of 4.45% over the forecast period. This growth is fueled by rapid industrialization, expanding manufacturing capabilities, and strong government support for automation and smart factories.

Major economies, including China, Japan, South Korea, and India, are investing heavily in automated manufacturing to enhance productivity, efficiency, precision, and quality control, boosting the adoption of force sensors.

- In August 2024, China State Council Gazette and Ministry of Industry and Information Technology (MIIT) announced that China remained the largest global market for industrial robots for the 11th consecutive years. The country produced 430,000 industrial robots, with new installations representing more than half of the global demand over the past three years. This growth is primarily driven by advancements in robot innovation, including advances in bionic perception, cognition, planning, and control technologies.

Regulatory Frameworks

- In the U.S., the National Institute of Standards and Technology establishes global metrological regulations for load cells in legally controlled weighing systems under the OIML R 60-1 Draft. These regulations define four accuracy classes (A–D), maximum verification intervals (nLC), and error envelopes combining nonlinearity, hysteresis, and temperature effects.

- The ISO 376:2011 regulation issued by the International Organization for Standardization, establishes the standard for calibrating force-proving instruments used to verify uniaxial testing machines. It mandates precise force application, multiple preload cycles, and evaluation of deflection, repeatability, reversibility, and creep.

- In Europe, the General Safety Regulation II, outlined in Regulation (EU) 2019/2144 mandates the integration of advanced safety features in all new vehicles from July 2022. These requirements include intelligent speed assistance, emergency braking for vulnerable road users, driver drowsiness detection, and type-approval provisions for automated driving systems (ADS) in fully automated vehicles.

Competitive Landscape

Major players operating in the global force sensor market are expanding their capabilities by developing innovative solutions that improve miniaturization, responsiveness, integration, and measurement accuracy. Companies are investing in extensive research and development to enhance sensor precision, reliability, real-time data acquisition, and compatibility with both legacy systems and emerging technologies.

Strategic regional expansions are extending their reach to key industrial, automotive, and other end-use sectors. Additionally, manufacturers are focusing on sustainable and energy-efficient production to deliver high-quality, environmentally responsible force sensing solutions.

- In September 2024, TE Connectivity (TE) acquired Sense Eletrônica Ltda (Sense), a Brazilian manufacturer of factory and process automation sensors. The acquisition aims to enhance TE’s industrial sensor offerings, leverage Sense’s local expertise and manufacturing presence in Brazil, and drive business growth across Latin America.

List of Key Companies in Force Sensor Market:

- Alps Alpine Co. Ltd.

- ATI Industrial Automation, Inc.

- Flintec

- FUTEK Advanced Sensor Technology, Inc.

- Gefran SpA

- HBM Test and Measurement

- Honeywell International Inc.

- Interlink Electronics Inc.

- Kistler Group

- KYOWA ELECTRONIC INSTRUMENTS CO., LTD.

- LAUMAS Elettronica S.r.l

- OMEGA Engineering, Inc.

- Sensata Technologies, Inc.

- TE Connectivity Ltd.

- Tekscan, Inc.

Recent Developments

- In September 2025, Honeywell launched a new 13MM Pressure Sensor designed for cleanroom manufacturing, aimed at reducing contaminants and defects while increasing production yield in high purity applications, particularly semiconductor fabrication.

- In September 2025, Baumer acquired Swiss company X-Sensors AG to strengthen its force and strain measurement portfolio, expanding high-performance sensor offerings and enhancing innovation capabilities.

- In August 2025, Alpine commenced mass production of the SPVQF Series, a 2-pole, 2-position switch for automobile parking brakes. The series, which has shipped 350 million units over the past decade, features a 50% reduced width and 5dB quieter operation, addressing the rising demand for compact and silent components in electric and autonomous vehicles.

- In March 2024, Flintec refreshed its brand identity to reflect its commitment to innovation in weight and force measurement. The rebranding highlights the company’s focus on cutting-edge sensor technology and personalized service across products, including load cells, digital indicators, pressure sensors, and wireless measurement devices.