Market Definition

Food waste management involves processes and solutions to collect, treat, and repurpose food waste generated through various channels, including production, processing, retail, hospitality, and households. It plays a critical role in reducing environmental impact, improving resource productivity, and supporting sustainability initiatives.

Food waste management solutions include composting, anaerobic digestion, animal feed production, energy recovery, and landfill diversion. The choice of method depends on waste composition, moisture content, operational scale, and regulatory requirements, ensuring optimal conversion of waste into value-added products like bioenergy, fertilizers, and animal feed.

Food Waste Management Market Overview

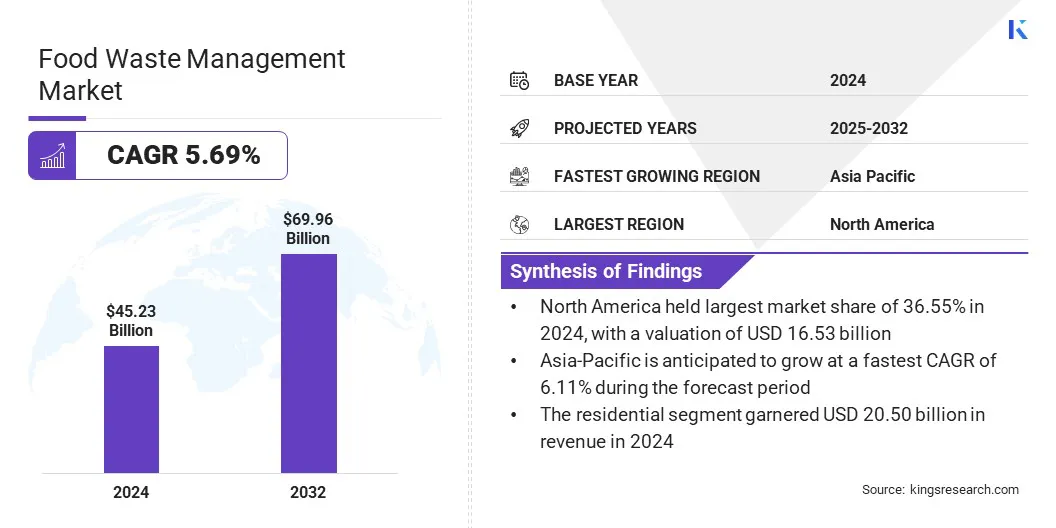

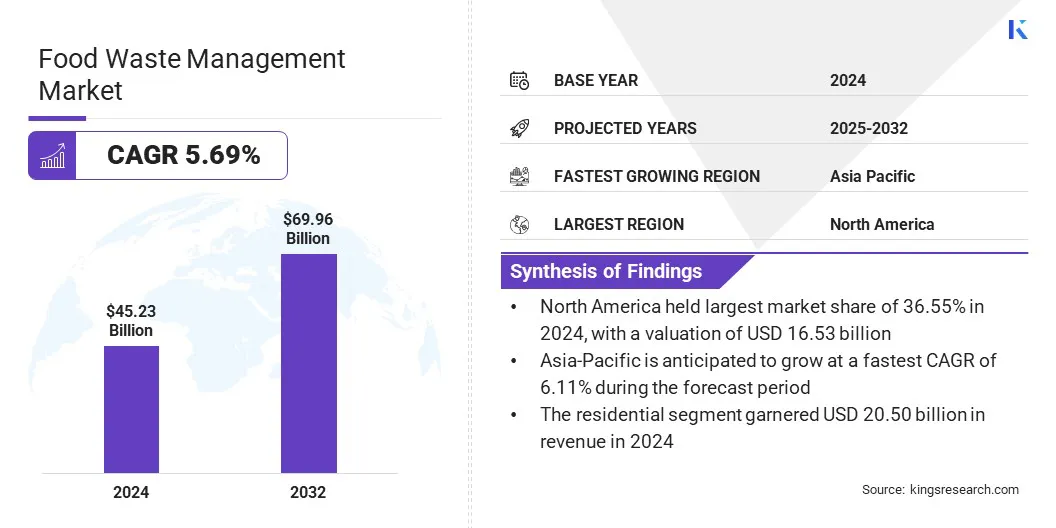

The global food waste management market size was valued at USD 45.23 billion in 2024 and is projected to grow from USD 47.50 billion in 2025 to USD 69.96 billion by 2032, exhibiting a CAGR of 5.69% over the forecast period.

The market growth is driven by rising concerns over environmental pollution, increasing food waste generation, and growing use of sustainable practices. Technological advancements in composting, anaerobic digestion, and energy recovery are improving efficiency, supporting resource recovery, and promoting circular economy initiatives.

Key Highlights:

- The food waste management industry size was recorded at USD 45.23 billion in 2024.

- The market is projected to grow at a CAGR of 5.69% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 16.53 billion.

- The residential segment generated USD 20.50 billion in revenue in 2024.

- The fruits & vegetables segment is expected to reach USD 31.80 billion by 2032.

- The anaerobic digestion segment is anticipated to witness fastest CAGR of 6.46% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.11% over the forecast period.

Major companies operating in the food waste management market are Veolia, SUEZ Group, WM Intellectual Property Holdings, L.L.C., Republic Services, Reworld, Stericycle, Inc., Remondis SE & Co., KG, Clean Harbors, Inc., Biffa, Rumpke, Advanced Disposal Services, Inc., Cleanaway, FCC Recycling (UK) Limited, DS Smith, and BioHiTech Global, Inc.

The market growth is fueled by increasing adoption of advanced waste processing technologies and innovative solutions. Key players are actively developing AI-powered food waste tracking systems, automated sorting technologies, and IoT-enabled monitoring platforms to streamline the process and reduce losses.

Companies are also partnering with restaurants, retailers, and municipalities to implement scalable composting and bioenergy projects, expanding their market presence while promoting sustainable practices across the food supply chain.

- In February 2024, Bollegraaf transferred its AI vision business to Greyparrot and invested USD 12.8 million for a non-controlling stake. The partnership focuses on retrofitting recycling facilities with advanced AI technologies to maximize recycling output and minimize the waste sent to landfills.

What major factor driving market growth?

The increasing generation of food waste across households, retail, and the food processing industry is creating a strong demand for effective food waste management solutions.

- According to UN Environment Programme (UNEP), approximately 1.05 billion tonnes of food were wasted globally in 2022 across retail, food service, and household sectors. This equates to 132 kilograms per capita annually, with households contributing 79 kilograms per capita.

This upward trajectory in food waste levels increases demand for composting, anaerobic digestion, and energy recovery, allowing effective resource utilization, reduced environmental impact, and sustainable waste handling.

What are the major obstacles for this market?

A key challenge limiting the growth of the food waste management market is the high cost associated with anaerobic digesters, in-vessel composters, and bioenergy recovery systems. Initial capital investment, maintenance expenses, and energy requirements can be expensive for municipalities, small businesses, and foodservice operators.

To address this, companies and local authorities are exploring public–private partnerships, government subsidies, and scalable modular solutions to reduce costs, improve operations, and promote adoption of sustainable food waste management practices.

Which technological trends are shaping the market?

The market is witnessing a growing trend toward the adoption of treatment technologies that enable efficient conversion of food waste into value-added products like biogas, fertilizers, and animal feed. Increasing investment in smart waste tracking, IoT-enabled monitoring, and automated sorting systems is also enhancing operations and supporting sustainable, circular economy initiatives across the food supply chain.

- In April 2025, Leanpath launched a mobile reporting application for the foodservice industry, using AI to simplify tracking and analysis of food waste. The app enables chefs and kitchen managers to monitor, record, and interpret food waste data more efficiently.

Food Waste Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Waste Type

|

Residential, Commercial, Industrial

|

|

By Source

|

Fruits & Vegetables, Meat & Seafood, Dairy Products, Bakery & Confectionery, Others

|

|

By Technology

|

Composting, Anaerobic Digestion, Incineration, Landfill, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Waste Type (Residential, Commercial, Industrial): The residential segment earned USD 20.50 billion in 2024, driven by increasing household food waste and growing consumer awareness of sustainable disposal practices.

- By Source (Fruits & Vegetables, Meat & Seafood, Dairy Products, Bakery & Confectionery, and Others): The fruits & vegetables held 43.23% of the market in 2024, due to their high perishability, large-scale consumption, and significant wastage at retail and household levels.

- By Technology (Composting, Anaerobic Digestion, Incineration, Landfill, and Others): The composting segment is projected to reach USD 24.44 billion by 2032, owing to growing adoption of eco-friendly waste treatment methods and increasing government support for sustainable practices.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global food waste management market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America food waste management market share stood at 36.55% in 2024, with a valuation of USD 16.53 billion. This dominance is reinforced by the rising generation of food waste across households, restaurants, and the food processing industry.

Increasing environmental awareness, strict regulations on waste disposal, and growing emphasis on sustainability are fueling the demand for advanced food waste management solutions. Additionally, growing investment in AI-powered monitoring, IoT-enabled tracking, and automated sorting systems is reducing landfill dependency, and driving market expansion.

- In September 2025, the U.S. Environmental Protection Agency (EPA) launched the “Feed It Onward” initiative to reduce food waste and strengthen food security across the country, further emphasizing government-led efforts to promote sustainable waste management practices.

Asia-Pacific is poised for significant growth at a robust CAGR of 6.11% over the forecast period, driven by increasing food waste from households, restaurants, and the food processing industry in China, India, Japan, and South Korea. Rising urbanization, changing consumer lifestyles, and expanding food service and retail sectors are fueling the demand for food waste management solutions.

Growing adoption of anaerobic digestion, in-vessel composting, and bioenergy recovery, combined with AI-powered tracking and IoT-enabled monitoring systems, is improving operations, reducing landfill dependency, and supporting sustainable practices. Government initiatives, public–private partnerships, and regulatory frameworks are also promoting the deployment of efficient waste management solutions and encouraging circular economy models across the region.

Regulatory Frameworks

- In North America, the U.S. Environmental Protection Agency (EPA) enforces regulations on waste disposal and encourages food recovery through programs such as the Food Recovery Challenge. Additionally, local and state-level policies mandate proper segregation, collection, and treatment of organic waste.

- In Europe, the European Union Waste Framework Directive sets targets for food waste reduction, recycling, and landfill diversion, while individual countries implement complementary regulations and incentives to encourage sustainable waste management practices.

- In Japan, food waste management is guided by the Food Recycling Law (2001, revised in 2019), which mandates businesses across the food supply chain, including manufacturers, retailers, and restaurants, to reduce, reuse, and recycle food waste.

- In China, food waste management initiatives are expanding under policies such as the Anti-Food Waste Law (2021) and the broader national “Zero-Waste Cities” program. These frameworks emphasize waste segregation, the construction of anaerobic digestion and composting facilities.

- On the international stage, organizations, including the United Nations Environment Programme (UNEP) and the Food and Agriculture Organization (FAO), also provide guidelines and best practices to standardize food waste reduction efforts and support sustainable global waste management initiatives.

Competitive Landscape

Key players in the food waste management industry are actively pursuing strategic initiatives to meet demand and drive growth. Companies are investing in anaerobic digesters, in-vessel composters, and bioenergy recovery systems and also developing AI-powered monitoring and IoT-enabled tracking platforms to optimize collection, sorting, and treatment of food waste.

Strategic partnerships are being built with municipalities, restaurants, retailers, and foodservice operators to implement scalable, localized solutions, reinforcing market expansion.

- In November 2024, Too Good To Go introduced “Parcels”, a service designed to reduce food waste at the manufacturing stage by directly linking FMCG brands with consumers in the UK.

Top Key Companies in Food Waste Management Market:

- Veolia

- SUEZ Group

- WM Intellectual Property Holdings, L.L.C.

- Republic Services

- Reworld

- Stericycle, Inc.

- Remondis SE & Co., KG

- Clean Harbors, Inc.

- Biffa

- Rumpke

- Advanced Disposal Services, Inc.

- Cleanaway

- FCC Recycling (UK) Limited

- DS Smith

- BioHiTech Global, Inc.

Recent Developments

- In February 2024, Apeel Sciences developed an edible, plant-based coating designed to extend the shelf life of fresh produce. This tasteless coating reduces water loss and oxidation, keeping fruits and vegetables fresher for longer, thereby minimizing food waste at both retail and consumer levels.