Market Definition

Food service packaging refers to containers, wraps, and materials used for storing, serving, and transporting food and beverages in commercial and institutional settings. It includes products such as cups, trays, lids, boxes, and cutlery designed to preserve safety, freshness, and convenience.

These packaging solutions are essential for maintaining hygiene, enhancing brand visibility, and meeting sustainability standards across restaurants, catering services, and food delivery operations.

Food Service Packaging Market Overview

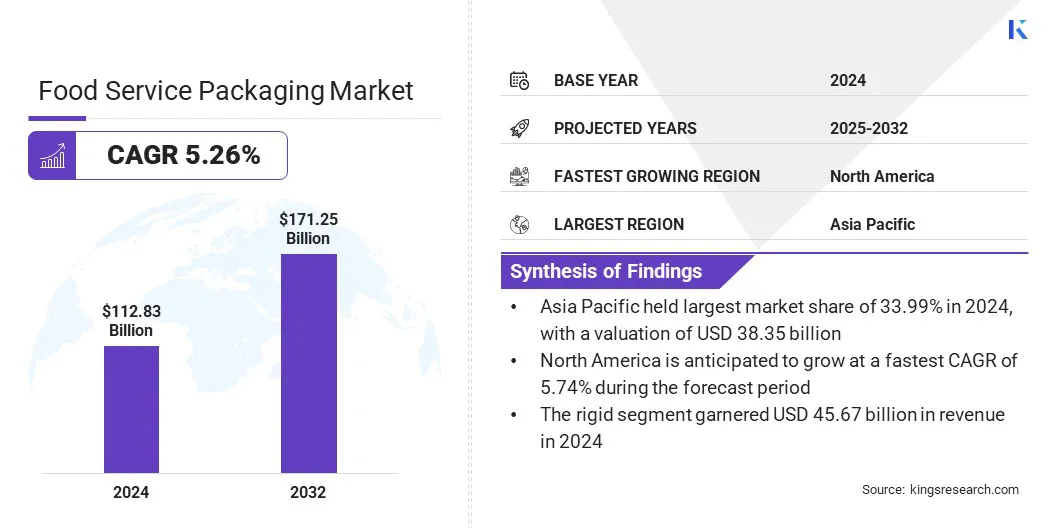

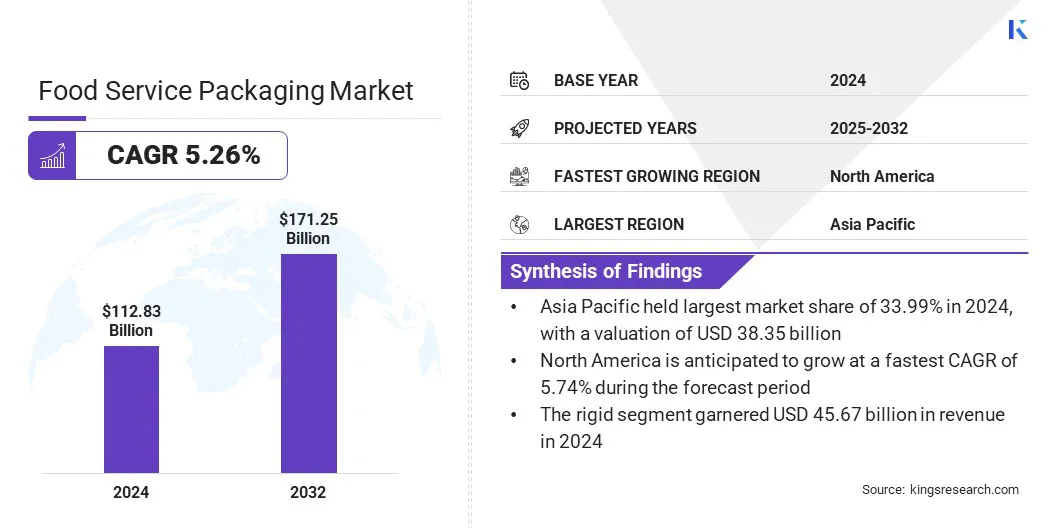

The global food service packaging market size was valued at USD 112.83 billion in 2024 and is projected to grow from USD 118.28 billion in 2025 to USD 171.25 billion by 2032, exhibiting a CAGR of 5.26% during the forecast period.

This growth is driven by rising consumer emphasis on safe and contamination-free food packaging. Increasing preference for tamper-evident, leak-proof, and single-use solutions enhances trust and supports hygienic food handling, contributing significantly to market expansion.

Key Highlights:

- The food service packaging industry was recorded at USD 112.83 billion in 2024.

- The market is projected to grow at a CAGR of 5.26% from 2025 to 2032.

- Asia Pacific held a share of 33.99% in 2024, valued at USD 38.35 billion.

- The rigid segment garnered USD 45.67 billion in revenue in 2024.

- The paper & paperboard segment is expected to reach USD 44.98 billion by 2032.

- The trays & plates segment is anticipated to witness the fastest CAGR of 5.56% over the forecast period.

- The quick service restaurants (QSR) segment is estimated to hold a share of 28.11% by 2032.

- North America is anticipated to grow at a CAGR of 5.74% through the projection period.

Major companies operating in the food service packaging market are Novolex, Dart Container Corporation, Amhil, Genpak LLC, Huhtamäki Oyj, Sabert Corporation, Graphic Packaging International, LLC, Amcor plc, Winpak LTD., Mondi Group, Sealed Air Corporation, WestRock Company, Coveris GmbH, DS Smith, and Lecta Group.

Market growth is driven by the rising consumption of convenience foods, particularly among urban and working populations. Food service providers are adopting lightweight, portable, and easy-to-dispose packaging solutions to support on-the-go consumption trends. Increasing demand for single-portion and resealable containers is fostering product innovation.

Manufacturers are focusing on materials that maintain freshness, resist leakage, and offer extended shelf life. This shift is reinforcing steady demand for functional, user-friendly, and cost-efficient packaging in quick-service and retail-ready applications. Companies are also expanding regional presence and supporting growth across key commercial sectors, including consumer goods, food & beverage, and e-commerce.

- In August 2025, ProAmpac signed a definitive agreement to acquire PAC Worldwide, expanding its geographic presence and strengthening vertical integration across e-commerce, consumer packaged goods, and industrial sectors.

How is the growing presence of quick service and cloud kitchen outlets contributing to the rising demand for specialized food service packaging?

The rising growth of quick service restaurants and cloud kitchens is creating a demand for specialized food service packaging that ensures food integrity during delivery. These outlets require efficient, standardized, and tamper-evident packaging solutions that maintain food integrity during delivery. The surge in online food orders has further strengthened partnerships between packaging suppliers and food chains to develop customized packaging formats.

The need for maintaining temperature consistency and minimizing spillage is leading to continuous innovations across clamshells, bowls, and containers for delivery and takeaway applications, which is fueling the expansion of the food service packaging market.

- In January 2025, Genpak LLC introduced Grab-A-Bowl, a new polypropylene bowl and lid line featuring easy-grip tabs for improved usability. The containers support on- and off-premises dining and are compatible with both hot and cold meal applications, enhancing convenience and operational efficiency.

How do fluctuations in raw material costs affect overall production efficiency?

The progress of the food service packaging market is hindered by fluctuations in raw material costs, particularly plastics, paper pulp, and aluminum. These price variations disrupt production planning, cost structures, and supplier contracts. Manufacturers face margin instability, mainly when dependent on imported raw materials, affected by energy prices and geopolitical factors.

Such volatility impacts supply chains and affects pricing strategies across packaging categories, prompting companies to enhance operational efficiency, adopt strategic sourcing, and diversify material supply bases.

To address this challenge, manufacturers are adopting long-term procurement contracts, regional material sourcing, and process optimization to stabilize input costs. Strategic partnerships with raw material suppliers and investment in recyclable or alternative materials further mitigate pricing risk and enhance cost predictability.

The rising trend of adopting eco-friendly packaging reflects the industry’s transition to materials that address regulatory pressure and sustainability goals. Food service operators are increasingly replacing conventional plastics with compostable and biodegradable alternatives such as bagasse, polylactic acid (PLA), and molded fiber.

These materials offer adequate strength and thermal resistance for both hot and cold food applications. Rising awareness of waste management and corporate sustainability commitments is driving product development in environmentally responsible formats, reshaping procurement strategies across restaurants, cafes, and delivery service providers.

- In July 2025, Huhtamaki launched new ice cream cups featuring an innovative design and strong consumer appeal. These cups are home- and industrial-compostable, recyclable, and provide a sustainable packaging solution, highlighting a trend toward sustainability and environmental responsibility in the foodservice sector.

Food Service Packaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Rigid, Flexible, Semi-rigid

|

|

By Material

|

Paper & Paperboard, Metal, Plastics, Foam, Others

|

|

By Product

|

Corrugated Boxes & Cartons, Cups & Lids, Bottles, Food Containers, Trays & Plates, Others

|

|

By End-Use

|

Quick Service Restaurants (QSR), Food Delivery & Takeaway, Full-service Restaurants, Institutional & Hospital Services, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Rigid, Flexible, and Semi-rigid): The rigid segment generated USD 45.67 billion in 2024, mainly driven by rising demand for durable, leak-resistant containers and trays that maintain food quality, safety, and convenience in delivery and takeaway services.

- By Material (Paper & Paperboard, Metal, Plastics, Foam, and Others): The metal segment is expected to record a CAGR of 5.78%, supported by its high durability, thermal resistance, and suitability for long-shelf-life applications in food service and institutional sectors.

- By Product (Corrugated Boxes & Cartons, Cups & Lids, Bottles, Food Containers, Trays & Plates, and Others): The corrugated boxes and cartons segment is projected to hold 29.94% market share by 2032, fueled by rising demand for online food delivery and the growing preference for protective, lightweight, and recyclable packaging solutions.

- By End-Use (Quick Service Restaurants (QSR), Food Delivery & Takeaway, Full-service Restaurants, Institutional & Hospital Services, and Others): The quick service restaurants (QSR) segment is projected to reach USD 48.14 billion by 2032, owing to rapid urbanization, fast-paced lifestyles, and rising demand for convenient, on-the-go, and takeaway food solutions.

What is the market scenario in Asia Pacific and North America region?

Based on region, the global food service packaging market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific food service packaging market share stood at 33.99% in 2024, valued at USD 38.35 billion. This dominance is reinforced by rapid urbanization, increasing disposable income, and the growing presence of organized foodservice outlets. Rising consumer preference for convenience and ready-to-eat meals has led to the rising demand for portion-controlled and portable packaging formats.

Regulatory pressure on single-use plastics and increasing adoption of biodegradable and recyclable materials are influencing innovation. Expansion of online food delivery platforms and rising demand for eco-friendly packaging have prompted manufacturers to focus on lightweight, durable, and multi-functional containers suitable for both hot and cold food applications.

- For instance, in May 2025, Kouzina Food Tech formed a strategic partnership with Swiggy for the exclusive licensing of The Bowl Company (TBC) digital-first brands. Under the agreement, Kouzina will oversee operations, innovation, and growth, with full ownership transferring upon completion of specified conditions.

North America food service packaging industry is expected to grow at a CAGR of 5.74% over the forecast period, supported by increasing investments in automation and advanced packaging technologies. The rising demand for high-barrier packaging that extends shelf life is promoting product development. Growth of institutional foodservice, including hospitals, schools, and corporate cafeterias, is creating steady demand.

Companies are introducing insulated, tamper-evident, and leak-proof containers to address delivery and takeaway requirements. Sustainability trends, including recyclable and compostable materials, and adoption of digital printing for branding and product differentiation, are further propelling regional market expansion.

- In April 2025, Novolex acquired Pactiv Evergreen Inc., uniting two complementary businesses. The initiative aims to optimize operations, accelerate product innovation, and promote sustainable growth while strengthening their market presence and commercial performance.

Regulatory Frameworks

- In the U.S., the Food, Drug, and Cosmetic Act (FDCA) regulates materials that come into contact with food. It ensures that such materials are safe for use, protecting public health and maintaining industry standards.

- In the EU, Regulation (EC) No 1935/2004 governs materials and articles in contact with food. It prevents the transfer of harmful substances to food, safeguarding consumer health.

- In India, the Food Safety and Standards (Packaging) Regulations, 2018 establish safety requirements for food-contact materials to prevent contamination and ensure compliance within the food service packaging sector.

- In China, the National Food Safety Standard for Food Contact Materials and Articles (GB 4806 series) defines safety criteria to prevent contamination and protect consumer health.

Competitive Landscape

Key players operating in the food service packaging industry are focusing on expanding production capacity, establishing regional manufacturing facilities, and forming strategic partnerships with suppliers and distributors. They are increasing investment in research and development to advance material technology, product design, and sustainable packaging solutions.

Furthermore, companies are adopting advanced manufacturing processes, enhancing supply chain efficiency, and implementing standardized quality protocols. Mergers, acquisitions, and collaborations are helping strengthen market presence and portfolio diversification. Continuous monitoring of regulatory developments and technological advancements informs strategic decisions to remain competitive in the evolving market landscape.

- In July 2024, Suzano acquired industrial assets from Pactiv Evergreen, expanding its North American operations and entering the consumer and food service packaging segments. The company also included a long-term supply agreement for liquid packaging board.

Key Companies in Food Service Packaging Market:

- Novolex

- Dart Container Corporation

- Amhil

- Genpak LLC

- Huhtamäki Oyj

- Sabert Corporation

- Graphic Packaging International, LLC

- Amcor plc

- Winpak LTD.

- Mondi Group

- Sealed Air Corporation

- WestRock Company

- Coveris GmbH

- DS Smith

- Lecta Group

Recent Developments (Product Launch)

- In May 2025, Genpak launched its sustainable molded fiber line, Harvest Fiber, comprising hinged containers, trays, and tableware. Produced from renewable fibers without added PFAS, the microwavable range ensures durability and performance across hot and cold food service applications.

- In February 2025, Huhtamaki developed ProDairy, recyclable single-coated paper cups tailored for yogurt and dairy packaging. Manufactured in Europe using renewable wood fiber-based paperboard from responsibly managed forests, the solution reduces polymer content compared to conventional packaging alternatives.