Market Definition

Polylactic acid (PLA) is a biodegradable thermoplastic polymer made from renewable resources, typically derived from fermented plant sugars, such as corn starch or sugarcane.

It is commonly used in applications such as packaging, textiles, and medical devices due to its environmentally friendly nature and ability to break down into non-toxic components when exposed to environmental conditions.

Polylactic Acid Market Overview

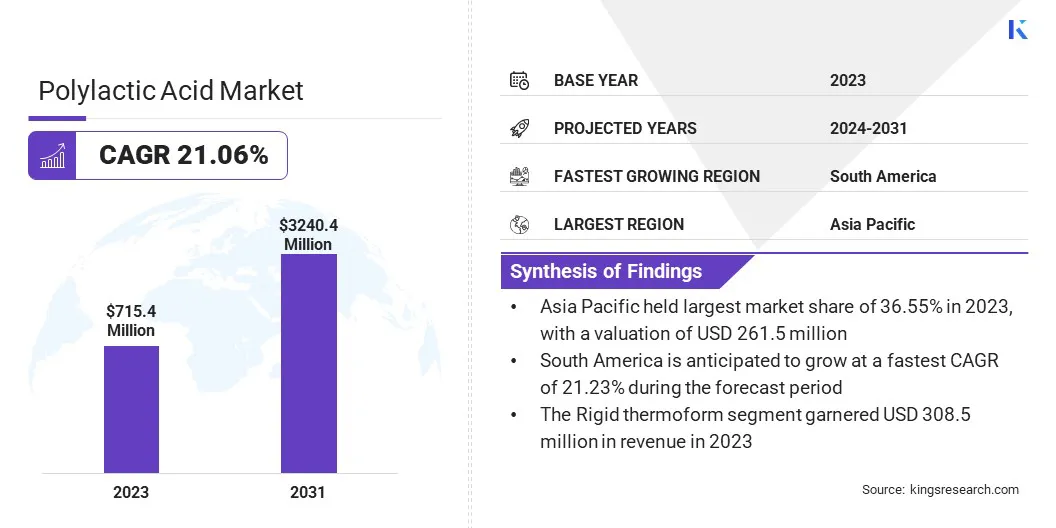

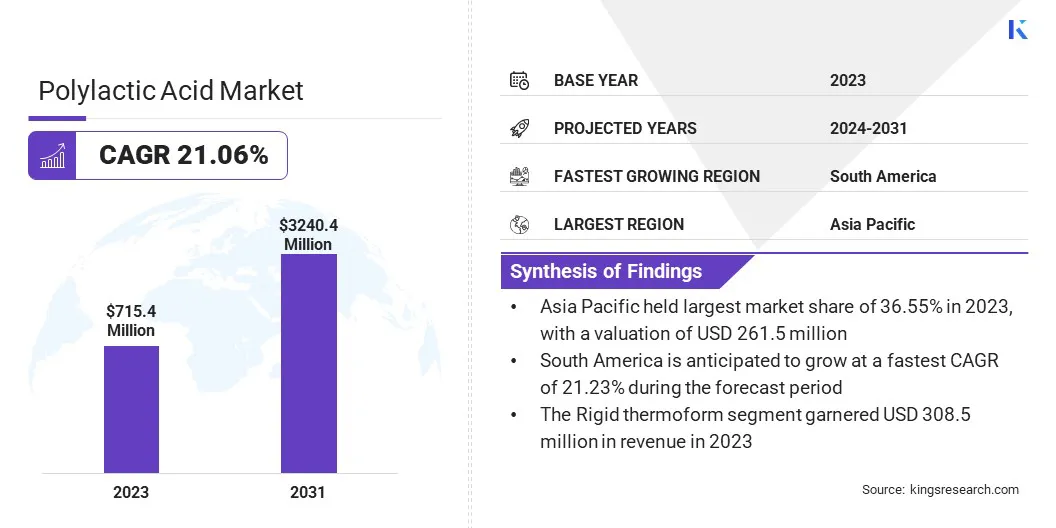

Global polylactic acid market size was valued at USD 715.4 million in 2023 and is projected to grow from USD 850.3 million in 2024 to USD 3240.4 million by 2031, exhibiting a CAGR of 21.06% during the forecast period. The polylactic market is experiencing significant growth, driven by the increasing demand for sustainable alternatives to petroleum-based plastics.

PLA, derived from renewable resources such as corn starch or sugarcane, is gaining popularity in various industries, including packaging, textiles, agriculture, and medical applications, due to its biodegradability and lower environmental impact.

Major companies operating in the polylactic acid market are Cargill, Incorporated, Corbion NV, Futerro, Sulzer Ltd, TEIJIN LIMITED, TORAY INDUSTRIES, INC., Shenzhen Esun Industrial Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd., BASF, Danimer Scientific, COFCO International, ABMcomposite., RAG-Stiftung, UNITIKA LTD., and others.

The growing adoption of PLA across various industries, combined with continuous advancements in production technologies, is anticipated to drive market growth throughout the forecast period. Additionally, substantial investments in research and development aimed at enhancing PLA’s properties and optimizing production processes are fueling its widespread use.

- In February 2024, Balrampur Chini Mills Limited announced its entry into Poly Lactic Acid manufacturing with India's first fully integrated industrial bioplastic plant. The project, expected to be completed within 30 months, aligns with the country's sustainability goals.

Key Highlights:

- The polylactic acid industry size was recorded at USD 715.4 million in 2023.

- The market is projected to grow at a CAGR of 21.06% from 2024 to 2031.

- Asia-Pacific held a share of 36.55% in 2023, valued at USD 261.5 million, and is anticipated to grow at a CAGR of 21.73% over the forecast period.

- The corn starch segment garnered USD 302.0 million in revenue in 2023.

- The rigid thermoform segment is expected to reach USD 1454.5 million by 2031.

- The packaging segment is anticipated to grow at the fastest CAGR of 22.39% through the forecast period

Market Driver

"Rising Demand for Eco-Friendly Products and Strict Regulations on Plastic Waste"

This market is driven by increasing consumer demand for sustainable products and the growing availability of renewable feedstocks. As awareness of environmental issues rises, consumers are actively seeking biodegradable and compostable alternatives, pushing industries to adopt PLA-based solutions.

- For instance, in April 2024, NatureWorks and IMA Coffee unveiled a compostable coffee pod solution for Keurig brewers in North America. The solution uses NatureWorks' Ingeo PLA biopolymer and IMA Coffee's packaging technologies to create a high-performance, sustainable coffee pod that preserves taste and aroma while being produced at commercial speeds.

Advances in fermentation and polymerization are improving PLA production by increasing efficiency, reducing waste, and lowering energy consumption. Optimized microbial fermentation enhances lactic acid yield, while innovative polymerization techniques improve scalability and cut costs.

These developments make PLA more competitive with conventional plastics, supporting its wider adoption. These combined forces are propelling the growth of the polylactic acid market, offering viable solutions that align with both consumer values and environmental policies.

Market Challenge

"High Production Cost and Performance Limitations"

The high production cost of PLA is a major hurdle to its widespread adoption, primarily because it relies on renewable raw materials such as corn and sugarcane. Unlike petroleum-based plastics, which benefit from well-established extraction and refining processes, PLA production involves more complex and resource-intensive steps.

Advancements in production processes and economies of scale are reducing costs, enhancing PLA's competitiveness. The limited infrastructure for industrial-scale PLA recycling poses a significant challenge to its sustainability potential. Unlike traditional plastics which have well-established recycling systems, PLA requires specialized facilities for proper recycling and composting.

Most recycling programs do not accept PLA, as it cannot be processed using conventional mechanical recycling methods and can contaminate existing plastic waste streams. Addressing this requires investments in recycling technologies and improved compatibility with existing recycling systems.

PLA's performance limitations, particularly its low heat resistance, present a significant barrier to its widespread adoption. Unlike traditional petroleum-based plastics which can withstand high temperatures, standard PLA begins to soften at low temperature.

This makes it unsuitable for applications that require heat stability. Ongoing R&D into advanced formulations with enhanced heat resistance and mechanical properties is expanding its use across industries, including packaging and textiles.

Market Trend

"Increasing Use of PLA and Innovative Biodegradation Technologies"

The increasing use of PLA as a biodegradable alternative to petroleum-based plastics, particularly in packaging, textiles, and foodservice products, is emerging as a notable trend in the polylactic acid market. This shift is fueled by rising consumer demand for eco-friendly products and growing regulatory pressure to reduce plastic waste.

Additionally, advancements in PLA formulations, including enhanced heat resistance and mechanical strength, are expanding it's applications beyond traditional uses.

The adoption of innovative biodegradation technologies, including the incorporation of specialized additives to accelerate PLA’s breakdown in natural environments, further support sustainability efforts. These trends are propelling the growth of the PLA market , reinforcing its role in the transition to a circular economy.

- In October 2024, Teijin Frontier Co., Ltd. announced the globally available BIOFRONT biodegradable PLA resin, designed for accelerated decomposition in oceans, rivers, and soil. The resin incorporates a novel biodegradation accelerator to enhance decomposition without compromising its strength, crystallinity, or moldability.

Polylactic Acid Market Report Snapshot

| Segmentation |

Details |

| By Raw Material |

Corn Starch, Sugarcane, Sugar beets, Others |

| By Application |

Rigid thermoform, Film & sheets, and Bottles |

| By End-use |

Packaging, Agriculture, Automotive & transportation, and Electronics |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Raw Material (Corn Starch, Sugarcane, Sugar beets, and Others): The corn starch segment earned USD 302.0 million in 2023 due to its widespread use as a cost-effective and renewable feedstock for polylactic acid production.

- By Application (Rigid thermoform, Film & sheets, and Bottles): The rigid thermoform held a notable share of 43.12% in 2023, fueled by its extensive use in packaging as a result of its durability, heat resistance, and verstality in molding.

- By End-use (Packaging, Agriculture, Automotive & transportation, and Electronics): The packaging segment is projected to reach USD 1202.5 million by 2031, largely attributed to the increasing demand for sustainable and biodegradable alternatives and growing regulatory pressure to reduce plastic waste.

Polylactic Acid Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific polylactic acid market captured a substantial share of around 36.55% in 2023, valued at USD 261.5 million. This dominance is reinforced by the region's growing emphasis on sustainability and the increasing demand for eco-friendly alternatives to conventional plastics.

Countries such as China, Japan, and India are at the forefront of this growth, characterized by strong manufacturing sectors and the rapid adoption of bioplastics in packaging, agriculture, and consumer goods. The availability of abundant agricultural raw materials, such as corn and sugarcane, significantly lowers PLA production costs, making it more economically viable.

- For instance, in May 2024, NatureWorks secured USD 350 million from Krungthai Bank for its new Ingeo PLA manufacturing facility in Thailand. This facility, part of the Bio-Circular-Green (BCG) economy model, will produce sustainable Ingeo biopolymers from locally sourced sugarcane, catering to the growing demand in Asia Pacific for 3D printing, compostable packaging, and hygiene products.

North America polylactic acid industry is set to grow at a robust CAGR of 20.73% over the forecast period. The rapid growth is bolstered by increasing environmental awareness and consumer demand for sustainable products.

The United States, in particular, contributing significantly to this growth, with major industries such as packaging, automotive, and electronics turning to PLA as a sustainable alternative to petroleum-based plastics. Strong regulatory support, such as bans on single-use plastics and incentives for using bioplastics, further accelerates PLA adoption in the region.

Additionally, North America's well-established infrastructure for research and development, along with ongoing innovations in PLA formulations, is likely to boost regional market expansion.

Regulatory Framework

- In the U.S., polylactic acid is regulated by the FDA for food safety and the Environmental Protection Agency (EPA) for environmental impact, with state-level policies supporting sustainable and compostability standards.

- In Europe, PLA is governed by the European Union’s Circular Economy Action Plan, the European Standard for compostability, and the European Food Safety Authority’s food-contact safety regulations.

- In APAC, China promotes polylactic acid through government policies and incentives for biodegradable plastics and biodegradability standards enforced by the Ministry of Ecology and Environment (MEE).

- Japan’s regulatory framework promtoes the use of polylactic acid through laws such as the Plastic Resource Recycling Law, with food packaging governed by the Food Sanitation Law.

- In India, Plastic Waste Management Rules and the Bureau of Indian Standards (BIS) supports the use of biodegradable materials such as polylactic acid, reinforcing sustainability and waste reduction efforts.

Competitive Landscape

The polylactic acid industry is characterized by a large number of participants, including both established corporations and emerging players. Key market participants are actively competing for market share through innovations in production technologies, the development of advanced PLA formulations, and the expansion of production capacities.

- For instance, in December 2024, Emirates Biotech selected Sulzer Technology for its upcoming Polylactic Acid production plant in the United Arab Emirates, which will become the world's largest PLA production facility upon completion.

Established corporations leverage their strong financial resources, global distribution networks, and brand recognition to maintain a competitive edge. Moreover, emerging players are focusing on niche markets, technological advancements, and sustainability-driven solutions to differentiate themselves in this competitive market.

Additionally, strategic collaborations, mergers, and acquisitions are prevalent as companies enhance capabilities, optimize production costs, and expand market presence. Intensified competition in the PLA market is propelled by the growing global demand for eco-friendly alternatives, fostering continuous innovation and expansion.

List of Key Companies in Polylactic Acid Market:

- Cargill, Incorporated

- Corbion NV

- Futerro

- Sulzer Ltd

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

- Shenzhen Esun Industrial Co., Ltd.

- Zhejiang Hisun Biomaterials Co., Ltd.

- BASF

- Danimer Scientific

- COFCO International

- ABMcomposite.

- RAG-Stiftung

- UNITIKA LTD.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In October 2024, Praj Industries inaugurated India’s first demonstration facility for biopolymers, showcasing its proprietary Polylactic Acid (PLA) technology. With an annual production capacity of 55 tons, the facility aims toaccelerate India’s transition tow sustainable bioplastics in sectors such as food, agriculture, and pharmaceuticals.

- In August 2024, Nagase & Co., Ltd. and TotalEnergies Corbion partnered to distribute Luminy PLA bioplastics in Japan. The collaboration seeks to expand market reach while advancing research and development to enhance material properties and applications.

- In March 2024, Sulzer and Balrampur Chini Mills Limited announced plans to build India’s first bioplastics plant. Sulzer will provide advanced PLA production technologies, enabling BCML to produce 75,000 tonnes of compostable, recyclable bioplastics annually using sugarcane as a feedstock.

- In February 2024, TotalEnergies Corbion and Bluepha expanded their partnership, originally initiated in May 2023, to develop sustainable fibers using Luminy PLA and Bluepha PHA. The initiative aims to advance PLA and PHA applications in China by addressing challenges in dyeing, color stability, and thermal stability.

- In December 2023, Sulzer launched its new SULAC technology for lactide production, enhancing its portfolio of solutions for polylactic acid manufacturing. This innovation enhances the conversion of lactic acid into lactide, improving efficiency and meeting rising demand for high-quality, sustainable bioplastics.