Market Definition

Fintech as a service (FaaS) provides cloud-based financial technology solutions that companies integrate into their operations to enable payment processing, digital banking, lending platforms, insurance solutions, and wealth management tools. This includes applications such as banks, fintech start-ups, insurance providers, and e-commerce companies seeking seamless financial operations.

Financial institutions and businesses adopt Fintech as a Service to accelerate digital transformation, reduce costs, improve customer experience, and enable faster deployment of innovative financial products.

Fintech as a Service Market Overview

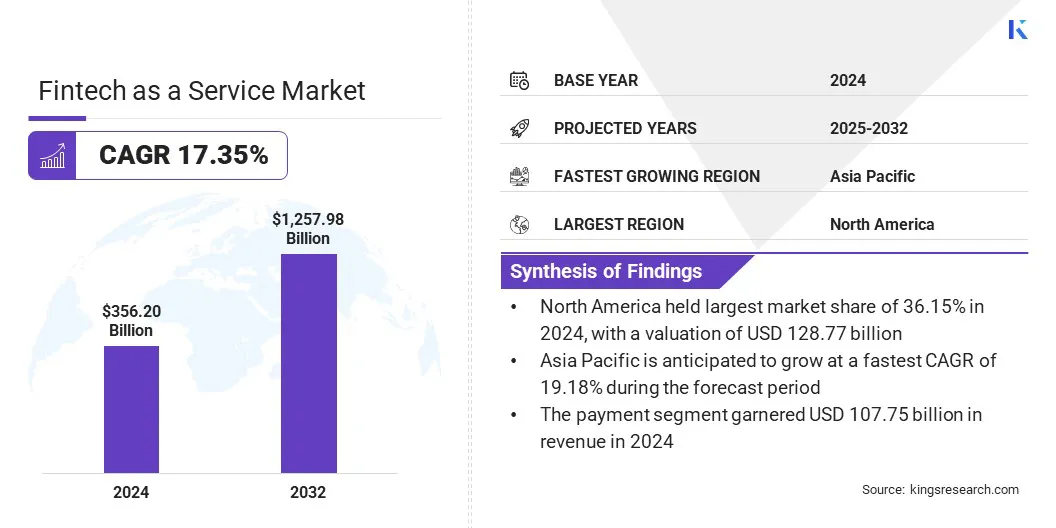

The global fintech as a service market size was valued at USD 356.20 billion in 2024 and is projected to grow from USD 410.49 billion in 2025 to USD 1,257.98 billion by 2032, exhibiting a CAGR of 17.35% over the forecast period.

The growth of the market is supported by API-driven integration, which enables seamless connectivity between banks, fintechs, and third-party services, improving scalability. The adoption of blockchain and digital ledger technologies boosts transparency, security, and speed of cross-border transactions.

Key Highlights

- The fintech as a service industry size was valued at USD 356.20 billion in 2024.

- The market is projected to grow at a CAGR of 17.35% from 2025 to 2032.

- North America held a market share of 36.15% in 2024, with a valuation of USD 128.77 billion.

- The payment segment generated USD 107.75 billion in revenue in 2024.

- The hybrid segment is expected to reach USD 697.76 billion by 2032.

- The KYC verification segment secured the largest revenue share of 45.62% in 2024.

- The consumers segment is poised for a robust CAGR of 18.61% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 19.18% during the forecast period.

Major companies operating in the fintech as a service market are PayPal, Inc., Block, Inc., Upstart Network, Inc., Rapyd Financial Network Ltd, Solid Financial Technologies, Inc., Railsbank Technology Ltd., Synctera Inc., Stripe, Inc., Adyen N.V., Mastercard, Finastra, OpenPayd Ltd, Revolut Ltd, Fiserv, Inc., and LendAPI.

Rising demand for digital financial services from banks, fintech companies, and startups is driving the growth of the market. These organizations are seeking platforms to efficiently manage payments, lending, wealth management, and insurance.

- In October 2024, Galaxy Digital launched GalaxyOne, a consumer finance app and web platform for experienced U.S. investors. The platform offers commission-free trading of over 2,000 stocks and ETFs, along with the ability to buy, sell, and transfer major cryptocurrencies like Bitcoin and Ethereum.

Increasing adoption of mobile banking and online financial services is creating the need for seamless integration and secure transaction processing. Expansion of cross-border payments and digital wallets is pushing providers to use flexible fintech platforms for faster service delivery.

Market Driver

Rapid Adoption of API-Driven Integration

The rising use of API-driven integration is driving the growth of the market. Open banking initiatives and API-based architectures are enabling banks, fintechs, and startups to seamlessly connect with third-party services which allow providers to offer features such as payments, lending, wealth management, and insurance from a single platform.

- In February 2025, Alinma Bank launched a new API Platform, powered by IBM Hybrid Cloud & AI technology. The deployment streamlined internal systems integration, including onboarding, pricing, and payments, while allowing fintechs and SMEs to access digital services via paid APIs.

Increasing demand for personalized and customizable financial solutions is encouraging organizations to leverage APIs for faster service deployment. Growing focus on interoperability and secure data exchange is also supporting the usage of API-enabled fintech platforms.

Market Challenge

Data Privacy and Cybersecurity Risks

A key challenge in the fintech as a service market is protecting sensitive financial information stored and processed on third-party platforms. The outsourcing of core financial operations increases exposure to unauthorized access, data breaches, and cyber-attacks, creating regulatory pressures as institutions must comply with strict data protection laws.

To address this challenge, market players are adopting end-to-end encryption, secure API frameworks, and continuous monitoring systems to strengthen data protection and ensure adherence to financial regulations while integrating third-party fintech solutions.

- In May 2025, Plaid introduced product updates across its API stack, covering Account Verification & Payments, Fraud & Risk, Onboarding, Network Connectivity, and other areas. The updates offer more clarity on fund availability dates, improved webhooks for error details, and better endpoint support to improve integration.

Market Trend

Adoption of Blockchain and Digital Ledger

A key trend in the fintech as a service market is the usage of blockchain and distributed ledger technologies to improve transaction security and transparency. These technologies offer tamper-resistant records and immutable audit trails, reducing fraud and other operational risks.

Smart contract integration is streamlining contract execution and payment settlement, lowering manual intervention and processing time. Financial institutions and fintech platforms are leveraging digital ledgers to enhance cross-border payments and regulatory compliance.

- In November 2024, UBS piloted UBS Digital Cash, a blockchain-based payment system designed to improve cross-border transactions. The system uses a private, permissioned blockchain network and executes settlements via smart contracts in multiple currencies, including the U.S. dollar, Swiss franc, euro, and Chinese yuan.

Fintech as a Service Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service Type

|

Payment, Banking, Loan, Insurance, Wealth & Investment Services, Others

|

|

By Deployment Model

|

Public Cloud, Private Cloud, Hybrid

|

|

By Application

|

KYC Verification, Fraud Monitoring, Others

|

|

By End User

|

Consumers, Banks, Insurance Companies, Governments, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service Type (Payment, Banking, Loan, Insurance, Wealth & Investment Services, and Others): The payment segment earned USD 107.75 billion in 2024 due to the growing demand for fast, secure, and seamless digital transactions across banks, businesses, and consumers globally.

- By Deployment Model (Public Cloud, Private Cloud, and Hybrid): The hybrid segment held 50.34% of the market in 2024, due to its ability to combine the scalability and flexibility of cloud-based deployment with the security and control of on-premise systems.

- By Application (KYC Verification, Fraud Monitoring, and Others): The KYC verification segment is projected to reach USD 557.70 billion by 2032, owing to the increasing compliance requirements and the growing need for secure digital financial transactions.

- By End User (Consumers, Banks, Insurance Companies, Governments and Others): The consumers segment is poised for significant growth at a CAGR of 18.61% over the forecast period, driven by rapid adoption of digital financial services, including mobile banking, digital wallets, and online payment solutions.

Fintech as a Service Market Regional Analysis

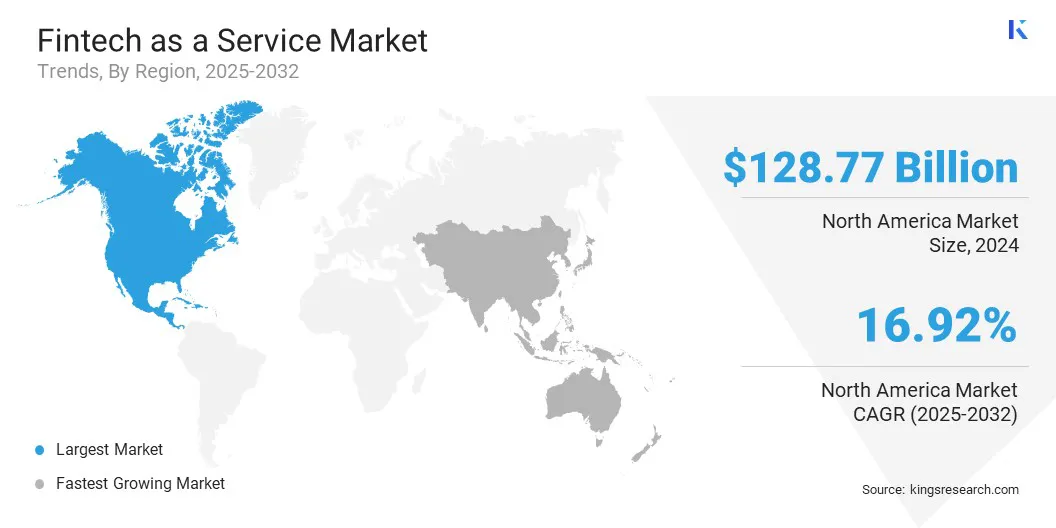

The global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America on the basis of region.

The North America fintech as a service market share stood around 36.15% in 2024 in the global market, with a valuation of USD 128.77 billion. This dominance stems from the increasing integration of financial services into e-commerce, logistics, and enterprise platforms. Businesses are embedding payment gateways, digital wallets, and credit products directly into their platforms to improve customer retention and revenue streams.

Large retailers, ride-hailing companies, and online marketplaces are partnering with FaaS providers to enable instant payments and digital accounts. This trend is being driven by the shift toward cashless transactions and digital-first experiences. The rising number of strategic partnerships between fintech firms and non-financial businesses also supports the market’s performance.

- In March 2025, Walmart partnered with JPMorgan Chase to speed up payments for merchants on Walmart’s marketplace. The partnership allows U.S. merchants selling on Walmart’s online platform to receive faster payment settlement and manage cash flow using JPMorgan’s systems.

The market in Asia Pacific is projected to grow at a CAGR of 19.18% over the forecast period. This growth is due to the expansion of e-commerce and multi-service platforms integrating financial services. These platforms rely on FaaS providers to manage transactions, compliance, and settlements at scale.

Blockchain technology also improves the speed and transparency of international payments. Financial institutions are partnering with global technology providers to implement distributed ledger systems for real-time settlements.

- In March 2025, Axis Bank and J.P. Morgan, through J.P. Morgan’s Kinexys Digital Payments platform, launched a blockchain-based 24/7 USD clearing service for commercial clients in India. This service uses distributed ledger technology to enable real-time, around-the-clock cross-border payments.

Such initiatives are modernizing the payment infrastructure and reducing reliance on traditional clearing networks while enhancing transaction traceability and lowering costs for banks and fintech providers.

Regulatory Frameworks

- In the U.S., Fintech as a Service providers are regulated under the Bank Secrecy Act by the Financial Crimes Enforcement Network (FinCEN), which requires registration as Money Services Businesses for entities involved in money transmission. The Office of the Comptroller of the Currency (OCC) offers special-purpose fintech charters, and the Consumer Financial Protection Bureau (CFPB) oversees consumer protection, data security, and fair lending practices.

- In the UK, the Financial Conduct Authority (FCA) regulates Fintech as a Service operation under the Payment Services Regulations and the Electronic Money Regulations. Companies providing payment or e-money services must obtain FCA authorization and comply with rules on safeguarding customer funds, facilitating authentication, and offering data protection. The Financial Services and Markets Act governs additional financial products, and the UK’s evolving crypto asset framework extends oversight to virtual asset service providers.

- China governs Fintech as a Service through the Regulations on Supervision and Management of Non-Bank Payment Institutions, effective from 2024. These rules categorize payment services into stored-value operations and transaction processing, requiring licensing from the People’s Bank of China (PBoC). Institutions must comply with capital, reserve, and fund management standards. The revised Anti-Money Laundering Law strengthens KYC (Know Your Customer) and transaction monitoring obligations, extending oversight to fintech and non-financial payment entities.

- In Japan, the Financial Services Agency (FSA) oversees fintech operations under the Payment Services Act and the Financial Instruments and Exchange Act. Fintech as a Service providers offering payment, e-money, or crypto-asset exchange services must register and comply with segregation of customer funds, risk management, and AML (Anti-Money Laundering) procedures. Amendments introduced in 2023 regulate stablecoin issuers as electronic payment instrument providers, imposing redemption, reserve, and reporting requirements to ensure system integrity and consumer protection.

Competitive Landscape

Market players are investing in research and development, forming strategic partnerships, and implementing artificial intelligence and automation to remain competitive in the market. They are focusing on building scalable platforms that can manage complex workflows and high transaction volumes.

Collaborations with technology providers and fintech startups allow faster innovation and integration of new capabilities. Continuous enhancement of digital solutions streamlines decision-making processes and the use of AI-powered systems allows for automation of repetitive tasks, reducing errors and costs.

- In July 2025, Perfios.ai launched its next-generation Generative AI Powered Intelligence Stack to revolutionize the Banking, Financial Services, and Insurance (BFSI) sector. The stack includes Medical Insurance Claim Adjudication Solution, which automates insurance claim assessments, among other solutions. This suite is designed to improve efficiency, speed, and scalability by automating complex workflows across financial institutions.

Top Key Companies in Fintech as a Service Market:

- PayPal, Inc.

- Block, Inc.

- Upstart Network, Inc.

- Rapyd Financial Network Ltd

- Solid Financial Technologies, Inc.

- Railsbank Technology Ltd.

- Synctera Inc.

- Stripe, Inc.

- Adyen N.V.

- Mastercard

- Finastra

- OpenPayd Ltd

- Revolut Ltd

- Fiserv, Inc.

- LendAPI

Recent Developments

- In October 2025, Zoho launched a suite of fintech products, including point-of-sale (PoS) devices, QR devices, soundboxes, and a range of payment solutions in India. These offerings are designed to streamline collections and disbursements, integrating seamlessly with Zoho's existing ERP, payroll, and accounting software.

- In October 2024, Visa introduced the Visa Tokenized Asset Platform (VTAP), designed to help banks issue and manage fiat-backed tokens on blockchain networks. This platform enables financial institutions to mint, burn, and transfer tokens, such as tokenized deposits and stablecoins, facilitating the integration of fiat currencies with blockchain technology.