Market Definition

The market encompasses technologies and systems that reproduce digital images directly onto various substrates, such as paper, fabric, plastics, and metals, without the need for traditional printing plates. These systems convert digital data into precise, high-resolution prints using methods such as inkjet, laser, or UV-based processes, enabling fast, customizable, and on-demand production.

Digital printing plays a crucial role in enhancing efficiency, reducing waste, and supporting personalization across industries including packaging, textiles, commercial printing, and advertising. The market can be segmented based on printing technology, ink type, substrate and application across key regions.

Digital Printing Market Overview

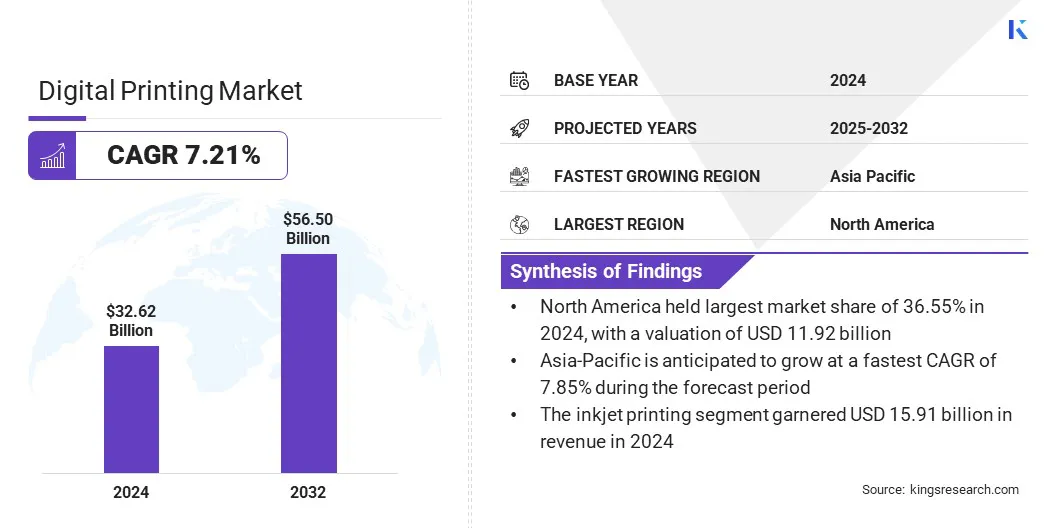

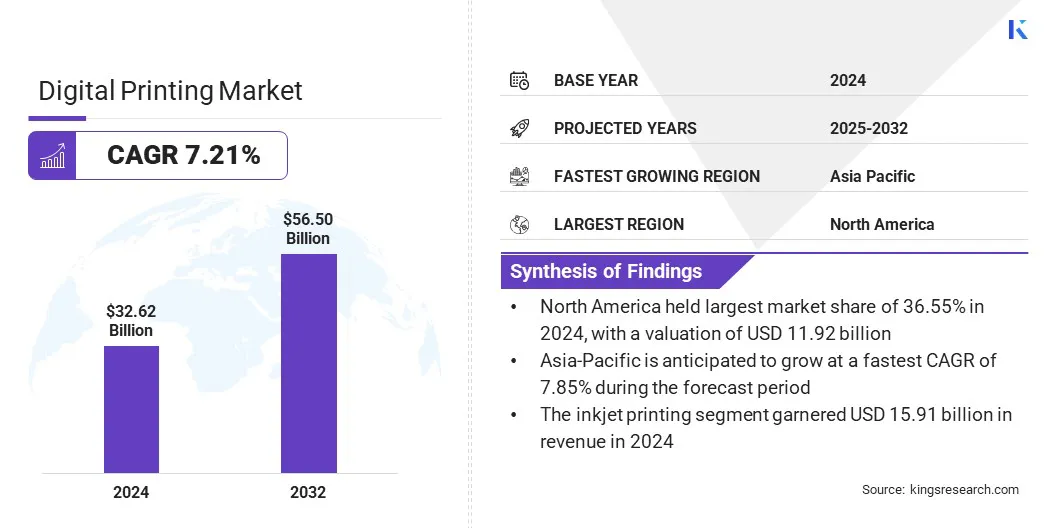

The global digital printing market size was valued at USD 32.62 billion in 2024 and is projected to grow from USD 34.70 billion in 2025 to USD 56.50 billion by 2032, exhibiting a CAGR of 7.21% over the forecast period.

The market is expanding rapidly, driven by the increasing need for on-demand, high-quality, and customizable printing solutions across packaging, textiles, and commercial applications. Advancements in printing technology, workflow automation, and the adoption of eco-friendly inks are boosting market expansion.

Key Highlights:

- The digital printing industry size was recorded at USD 32.62 billion in 2024.

- The market is projected to grow at a CAGR of 7.21% from 2024 to 2032.

- North America held a share of 36.55% in 2024, valued at USD 11.92 billion.

- The inkjet printing segment generated USD 15.91 billion in revenue in 2024.

- The UV-cured ink segment is expected to reach USD 22.42 billion by 2032.

- The paper segment is expected to register a share of 36.28% by 2032.

- The packaging segment accounted for a share of 52.34% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 7.85% over the forecast period.

Major companies operating in the digital printing market are HP Development Company, L.P., Canon Inc., Xerox Corporation, Epson Corporation, Ricoh, Konica Minolta, Inc., Fujifilm Holdings Corporation, Eastman Kodak Company., MIMAKI ENGINEERING CO., LTD., Roland DG Corporation, Durst Group AG, Electronics For Imaging, Inc., Brother Industries, Ltd., Mutoh Industries, Ltd, and Seiko Instruments Inc.

The market is influenced by sustainability trends and environmental regulations that promote the use of green technologies. Key players in the market are focusing on developing energy-efficient printers, low-VOC and water-based inks, and recyclable or biodegradable substrates. These efforts, combined with sustainable production workflows and carbon footprint reduction strategies, are supporting market expansion.

- In May 2025, Roland DGA announced the launch of the TrueVIS Roland DG XG-640, a 64-inch professional-level eco-solvent printer/cutter designed for high-demand print environments. The system enhances image quality, productivity, and profitability, reinforcing the shift toward large-format digital printing in commercial and industrial applications.

How is the rising demand for personalized, short-run, and on-demand printing influencing market adoption?

Market players are adopting digital printing technologies that allow rapid production of customized outputs, enabling them to respond quickly to changing customer preferences and market trends.

The ability of digital systems to handle variable data printing, ensure consistent image quality, and deliver cost-effective small-batch production is further driving widespread adoption. This growing requirement for speed, precision, and customization continues to support the expansion of the digital printing market globally.

- In May 2025, Seiko Epson Corporation launched three new inkjet printheads based on its PrecisionCore technology to address rising demand in commercial and industrial applications. The products offer high-quality output and enhanced productivity to address the increasing demand and diverse application requirements of customers.

How do high capital and operational costs affect adoption of advanced digital printing systems?

One of the major challenges restraining the growth of the digital printing market is the high capital and operational expenditure required for industrial-grade systems. Procuring and deploying high-speed inkjet, UV, or hybrid printers requires substantial upfront investment, along with specialized maintenance and trained operators, which increases overall expenses. These cost limitations hinder adoption, particularly among small and medium-sized print service providers, limiting large-scale deployment of digital printing technologies.

To address this challenge, market players are investing in energy-efficient printing solutions, featuring modular and scalable designs. Companies are also adopting predictive maintenance tools, automating workflows, and strengthening local service networks to minimize downtime and improve cost efficiency. Such strategies are aimed at improving accessibility and promoting wider adoption of advanced digital printing solutions.

How is the integration of automation, AI, and cloud-based workflows influencing print operations?

The integration of automation, AI, and cloud-based workflows is transforming print operations by enabling smart, data-driven production environments. Automated systems optimize job scheduling, monitor equipment performance in real time, and reduce manual intervention, while AI algorithms analyze production data to improve print quality, minimize errors, and predict maintenance needs.

Cloud-based workflows facilitate remote management, seamless file handling, and collaboration across multiple sites. These technological developments enhance production efficiency, reduce operational costs, and improve consistency and quality across commercial, packaging, and industrial printing applications.

The deployment of advanced digital printing technologies is driving wider adoption among print service providers, manufacturers, and enterprises seeking flexible, high-speed, and scalable printing solutions.

- In January 2024, Roland DG Corporation launched Roland DG Assemble, a cloud-based production improvement solution for small and medium-sized manufacturers. The platform supports workflow optimization and operational efficiency, accelerating the adoption of digital printing and intelligent production technologies.

Digital Printing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Printing Technology

|

Inkjet Printing, Laser Printing, Others

|

|

By Ink Type

|

Aqueous Ink, UV-Cured Ink, Solvent Ink, Latex Ink, Dye Sublimation Ink

|

|

By Substrate

|

Paper, Plastic Films, Fabric/Textiles, Ceramic and Glass, Others

|

|

By Application

|

Packaging, Textile Printing, Commercial Printing, Decorative Printing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Printing Technology (Inkjet Printing, Laser Printing, and Others): The inkjet printing segment earned USD 91 in 2024 driven by its high-speed production capabilities, superior print quality, and growing adoption across packaging, textiles, and commercial printing applications.

- By Ink Type (Aqueous Ink, UV-Cured Ink, Solvent Ink, Latex Ink, and Dye Sublimation Ink): The UV-cured ink held 37.65% of the market in 2024, attributed to its fast-drying properties, superior durability, and suitability for a wide range of rigid and flexible substrates in commercial and industrial applications.

- By Substrate (Paper, Plastic Films, Fabric/Textiles, Ceramic and Glass, and Others): The paper segment is projected to reach USD 20.50 billion by 2032, owing to its widespread use in commercial printing, high compatibility with digital printing technologies, and growing demand for customized and on-demand print materials.

- By Application (Packaging, Textile Printing, Commercial Printing, Decorative Printing, and Others): The packaging segment is projected to reach USD 30.12 billion by 2032, fueled by the rising e-commerce industry, increased demand for personalized and sustainable packaging, and the shift toward short-run, on-demand production.

- Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

What is the market scenario in North America and Asia-Pacific region?

North America digital printing market share stood at 36.55% in 2024 in the global market, with a valuation of USD 11.92 billion. This dominance is attributed to the increasing adoption of on-demand, short-run, and personalized printing solutions across various sectors.

The region benefits from the presence of several established global and local digital printing manufacturers, which are continuously investing in product innovation, workflow automation, and sustainable printing technologies.

Additionally, regional players are adopting advanced inkjet, UV, latex, and hybrid printing technologies that enhance print quality, reduce turnaround times, and offer flexibility across multiple substrates, including paper, plastics, textiles, and specialty materials, thereby further contributing to the market demand in the region.

- In March 2024, HP Inc., a California-based company, announced the launch of the HP Indigo 120K Digital Press and the HP Indigo 18K Digital Press, designed to deliver high productivity, advanced automation, and offset-matching quality for digital B2 sheet-fed printing.

Asia-Pacific is poised for significant growth at a CAGR of 7.85% over the forecast period, driven by expanding industrialization, rising consumer demand for customized products, and rapid adoption of digital technologies across printing applications.

Strong growth in packaging, textile, and advertising sectors is encouraging a shift from analog to digital printing methods to meet diverse design and production requirements. The increasing preference for on-demand, short-run printing and localized packaging production among SMEs is further propelling market expansion.

Regulatory Frameworks

Globally, the International Organization for Standardization (ISO) provides standards like ISO 14001 for environmental management and ISO 12647 for printing quality, promoting harmonization, sustainability, and best practices across the digital printing industry. Some other major authorities overseeing the market are as follows:

- In North America, regulatory oversight for digital printing primarily focuses on environmental compliance and chemical safety. The U.S. Environmental Protection Agency (EPA) enforces limits on volatile organic compounds (VOCs) and hazardous air pollutants in printing inks and processes.

- In Europe, the European Chemicals Agency (ECHA) governs chemical usage under REACH regulations, controlling the production and use of hazardous substances in inks and coatings.

- In China, the Ministry of Ecology and Environment (MEE) and the State Administration for Market Regulation (SAMR) enforce guidelines for chemical safety, emissions control, and energy efficiency in industrial printing operations, including mandatory monitoring of VOC emissions and solvent use.

Competitive Landscape

Leading players in the digital printing industry are actively investing in product innovation, technology integration, and sustainable solutions to strengthen market adoption. Companies are introducing high-speed, automated digital presses designed for superior image quality and reduced production time, addressing the growing demand for short-run and customized printing.

Firms are also focusing on expanding their portfolios with eco-friendly inks and recyclable substrates to align with environmental standards and meet end-user sustainability goals.

- In February 2025, Mimaki Engineering Co., Ltd, announced the launch of the Tx330-1800 and Tx330-1800B direct textile inkjet printers. These models introduce a waterless digital textile printing solution, significantly reducing water consumption while maintaining high image quality and versatility across multiple fabric types.

Key Companies in Digital Printing Market:

- HP Development Company, L.P.

- Canon Inc.

- Xerox Corporation

- Epson Corporation

- Ricoh

- Konica Minolta, Inc

- Fujifilm Holdings Corporation

- Eastman Kodak Company.

- MIMAKI ENGINEERING CO., LTD.

- Roland DG Corporation

- Durst Group AG

- Electronics For Imaging, Inc.

- Brother Industries, Ltd.

- Mutoh Industries, Ltd

- Seiko Instruments Inc.

Recent Developments

- In March 2024, Mimaki Engineering Co., Ltd. launched “TRAPIS”, a next-generation, eco-friendly textile printing system. This reduces wastewater by 90%, offers simple operation, and flexible installation, and was first showcased at FESPA Global Print Expo 2024 in Amsterdam.

- In April 2025, HP India launched the HP Latex R530 large-format printer, part of the HP Latex Series, marking its debut in the Indian market at Media Expo Mumbai 2025. The 64-inch all-in-one printer, designed for both rigid and flexible applications, offers advanced print capabilities and innovation.