Market Definition

The market encompasses the global ecosystem of technologies, services, and solutions involved in non-contact printing using inkjet mechanisms. It includes hardware such as industrial and commercial printers, software solutions for print management, and a wide range of consumables including inks and substrates.

The market serves diverse sectors, including packaging, textiles, advertising, publishing, and electronics. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the forecast period.

Inkjet Printing Market Overview

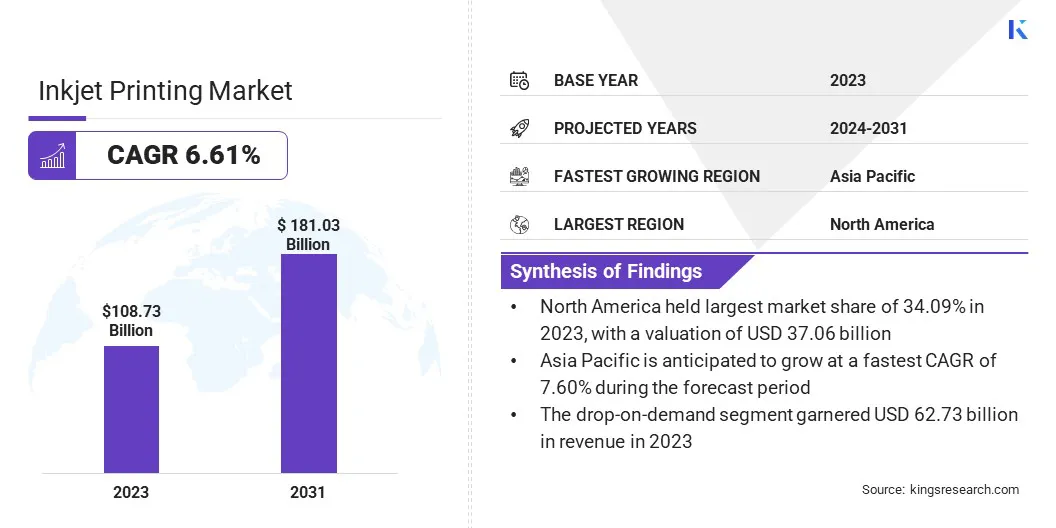

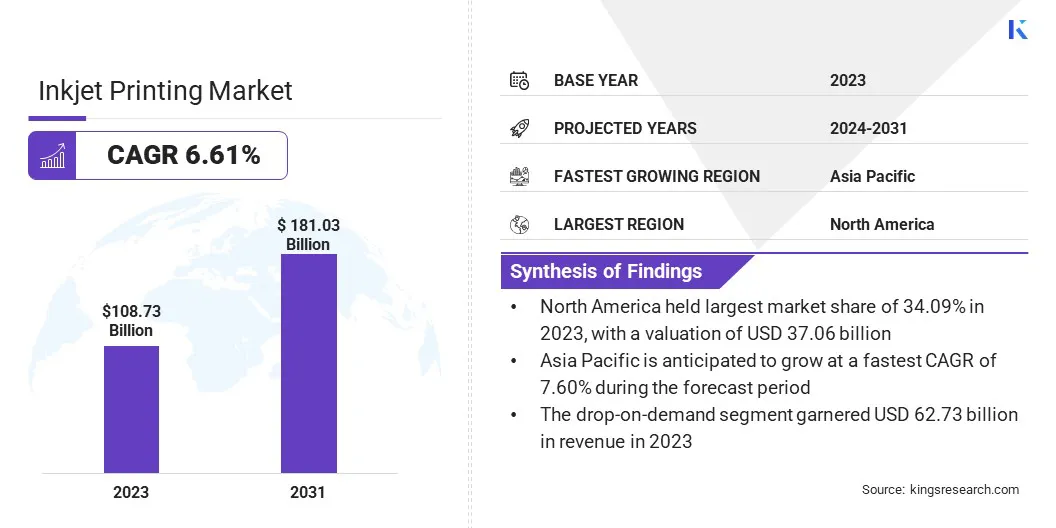

The global inkjet printing market size was valued at USD 108.73 billion in 2023 and is projected to grow from USD 115.66 billion in 2024 to USD 181.03 billion by 2031, exhibiting a CAGR of 6.61% during the forecast period.

The market is growing as more industries use this technology for fast and flexible printing. It is becoming popular in packaging, clothing, and advertising, as it offers good print quality at lower costs. Many companies prefer inkjet printing for short runs and custom designs, as it is faster, more flexible, and cost-effective.

Major companies operating in the inkjet printing industry are REA Elektronik GmbH, Canon Inc., Seiko Epson Corporation, Ricoh Company Ltd., Xerox Corporation, KYOCERA Corporation, Mimaki Engineering Co., Ltd., Konica Minolta, Inc., Videojet Technologies Inc., Dover Corporation, Sumitomo Mitsui Financial Group, KGK Jet India Private Limited, Matica Technologies Group SA, Domino Printech India LLP, and Leibinger Group.

Technological improvements, such as faster print speeds and better color accuracy, are making inkjet systems more appealing. Additionally, the growing use of inkjet printing in electronics and healthcare for precise and contactless applications is further expanding the market’s reach.

- In January 2025, Markem-Imaje launched the 9712 Bi-Jet continuous inkjet printer. The printer is designed for construction, pharmaceuticals, and food manufacturers, offering improved production line performance by coding two times faster and reducing capital costs.

Key Highlights

- The inkjet printing industry size was valued at USD 108.73 billion in 2023.

- The market is projected to grow at a CAGR of 6.61% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 37.06 billion.

- The drop-on-demand segment garnered USD 62.73 billion in revenue in 2023.

- The paper segment is expected to reach USD 54.20 billion by 2031.

- The books/publications segment is expected to reach USD 43.97 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.60% during the forecast period.

Market Driver

"Growing Demand for Sustainable and Low-waste Printing Solutions"

The inkjet printing market is registering significant growth, driven by the increasing demand for sustainable and low-waste printing solutions. Inkjet technology has emerged as an ideal response as industries strive to minimize their environmental impact.

Unlike traditional printing methods that often result in overspray and material waste, inkjet technology precisely applies ink only where needed, significantly reducing waste. Furthermore, the ability to use water-based and eco-friendly inks aligns with global efforts to lower harmful emissions and promote greener production processes.

This shift not only meets the rising consumer demand for eco-conscious products but also supports broader environmental goals, further solidifying inkjet printing's role in a more sustainable future.

- In March 2025, Osaka Sealing Printing Co., Ltd. began the full-scale operation of a water-based inkjet printing machine for flexible packaging films. The printer, developed by Miyakoshi Co., Ltd. to Osaka Sealing Printing's specifications, features high-speed, high-quality production capabilities, reducing environmental impact and improving sustainability in the flexible packaging industry.

Market Challenge

"Substrate Compatibility in Inkjet Printing"

One of the main challenges in the inkjet printing market is its limited compatibility with different types of substrates. For inkjet printing to work effectively, the ink must stick well to the surface, dry quickly, and deliver sharp, consistent results.

However, non-porous materials like plastics, metals, and coated films do not absorb ink easily, leading to smudging, weak adhesion, or inconsistent print quality. These issues become more pronounced in fast-paced industrial settings with little time for ink to dry properly.

This reduces the flexibility of inkjet technology and slows its adoption in industries that require printing on a variety of materials. Manufacturers are creating advanced inks and coatings, along with improved printhead systems designed for better adhesion and adaptability. These developments are expanding the range of materials that inkjet systems can handle, making the technology more useful across a wider set of applications.

Market Trend

"Advancements in Drop-on-Demand Technology"

A notable trend in the inkjet printing market is the increasing adoption of Drop-on-Demand (DoD) technology. This innovation allows ink droplets to be released only when needed, enhancing operational efficiency by minimizing ink consumption.

DoD systems are becoming a key choice for industries that require high-quality, customizable prints with reduced waste. This trend is driving continuous advancements in printhead technology, drying times, and specialized inks tailored for DoD applications.

The need for on-demand, personalized printing is growing in sectors such as packaging, textiles, and commercial printing. DoD technology helps businesses respond quickly and cost-effectively to market needs while maintaining high-quality standards.

- In June 2024, Windmöller & Hölscher (W&H) unveiled a new digital printing concept for the flexible packaging market at drupa 2024. The upcoming industrial-scale press combines flexographic and piezo drop-on-demand inkjet technologies in a hybrid setup. Designed for short to medium runs, the system supports high-resolution, water-based printing on diverse substrates, offering speed, flexibility, and sustainability.

Inkjet Printing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Drop-on-Demand, Continuous Inkjet

|

|

By Substrate

|

Plastic, Metal, Paper, Fabric, Ceramic, Others

|

|

By Application

|

Books/Publications, Commercial Printing, Advertising, Transactions, Labels, Packaging, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Drop-on-Demand, Continuous Inkjet): The drop-on-demand segment earned USD 62.73 billion in 2023, due to its precise ink usage, reduced waste, and suitability for high-quality, short-run printing.

- By Substrate (Plastic, Metal, Paper, Fabric, Ceramic, and Others): The paper segment held 29.90% share of the market in 2023, due to its widespread use in publishing, packaging, and office printing applications.

- By Application (Books/Publications, Commercial Printing, Advertising, Transactions, Labels, Packaging, Others): The books/publications segment is projected to reach USD 43.97 billion by 2031, owing to the increased need for on-demand and small-batch book printing, driven by digital printing technology.

Inkjet Printing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America inkjet printing market share stood at around 34.09% in 2023, with a valuation of USD 37.06 billion. This market dominance is driven by the strong presence of key players, who have established North America as a hub for advanced inkjet printing technology.

The U.S. leads the region in terms of both market share and technological advancements, with significant demand coming from the commercial printing sector, especially in packaging, direct mail, and photo printing.

Moreover, the widespread adoption of inkjet printing in the booming e-commerce industry, where personalization and on-demand production are crucial, has further solidified North America’s market position. The region’s continued innovation in high-speed, high-quality inkjet systems remains a key driver of growth.

- In April 2025, FUJIFILM North America Corporation and SumnerOne announced their partnership, making SumnerOne the first North American dealer partner focused on FUJIFILM REVORIA PRESS and FUJIFILM ACUITY Wide Format Inkjet print solutions.

The inkjet printing industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 7.60% over the forecast period. The market is primarily fueled by the rapid expansion of the packaging and textile industries in countries like China and India, where inkjet technology is increasingly used for its flexibility and cost-effectiveness in short-run printing.

China, as a global manufacturing hub, leads in the adoption of inkjet printers for product labeling, electronics, and industrial applications. Additionally, the shift toward digital textile printing, particularly in India, is driving significant demand for inkjet solutions. The rise of e-commerce in the region has also boosted the demand for customized, on-demand packaging, further accelerating market growth.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the disposal and recycling of electronic waste (e-waste), including printers, under the Resource Conservation and Recovery Act (RCRA). The Federal Communications Commission (FCC) ensures that printers meet electromagnetic interference (EMI) and radio frequency interference (RFI) standards.

- In Europe, the European Union's RoHS Directive (Restriction of Hazardous Substances) limits the use of hazardous materials in printers and other electronic devices. The CE Marking ensures that printers comply with European safety, health, and environmental protection standards.

Competitive Landscape

The inkjet printing industry is characterized by companies focusing on technological advancements and strategic partnerships to maintain a competitive edge. Key players in the market are heavily investing in research and development to enhance the performance, speed, and versatility of inkjet printers.

Companies are prioritizing innovations in print head technology, ink formulations, and digital printing software to improve print quality and reduce operational costs. Many companies are entering into collaborations with manufacturers where the demand for inkjet solutions is rapidly growing.

Companies are establishing local production facilities and distribution networks in these regions to meet the rising demand while reducing supply chain costs.

- In November 2024, Monotech Systems Limited and Alliance Printech entered a strategic partnership to distribute JETSCI inkjet printing systems and integrate them with flexographic presses. The collaboration also involves co-developing web transport solutions for inkjet integration, aiming to enhance print quality, productivity, and flexibility in the label & packaging sectors.

List of Key Companies in Inkjet Printing Market:

- REA Elektronik GmbH

- Canon Inc.

- Seiko Epson Corporation

- Ricoh Company Ltd.

- Xerox Corporation

- KYOCERA Corporation

- Mimaki Engineering Co., Ltd.

- Konica Minolta, Inc.

- Videojet Technologies Inc.

- Dover Corporation

- Sumitomo Mitsui Financial Group

- KGK Jet India Private Limited

- Matica Technologies Group SA

- Domino Printech India LLP

- Leibinger Group

Recent Developments (Product Launches)

- In November 2024, IPR Robotics introduced the ACCURA product family, utilizing Drop-on-Demand (DoD) technology for precise, environmentally friendly coatings. The technology focuses on energy efficiency and sustainability, offering tailored solutions for industries like electronics, automotive, and medical devices.

- In May 2024, Canon expanded its production inkjet portfolio with the varioPRESS iV7, a B2 sheetfed inkjet press capable of producing up to 8,700 B2 4/0 sheets per hour. The press supports a wide range of media up to 450 gsm and aims to address short-run, high-quality commercial printing with enhanced productivity, media versatility, and reduced production costs.