Market Definition

The market comprises specialized separation media used in chromatographic processes to isolate, purify, and analyze biomolecules such as proteins, nucleic acids, and antibodies. These resins are made from natural, synthetic, or inorganic materials and serve as the stationary phase in chromatography columns, enabling selective interaction with target molecules based on charge, size, or affinity.

The report covers segmentation by type, technique, end-use industry, and region, providing insights into market trends, growth drivers, technological developments, and key applications. Chromatography resins are widely used across pharmaceutical and biotechnology manufacturing, food and beverage testing, environmental analysis, and academic research to ensure high-purity product recovery and process efficiency.

Chromatography Resin Market Overview

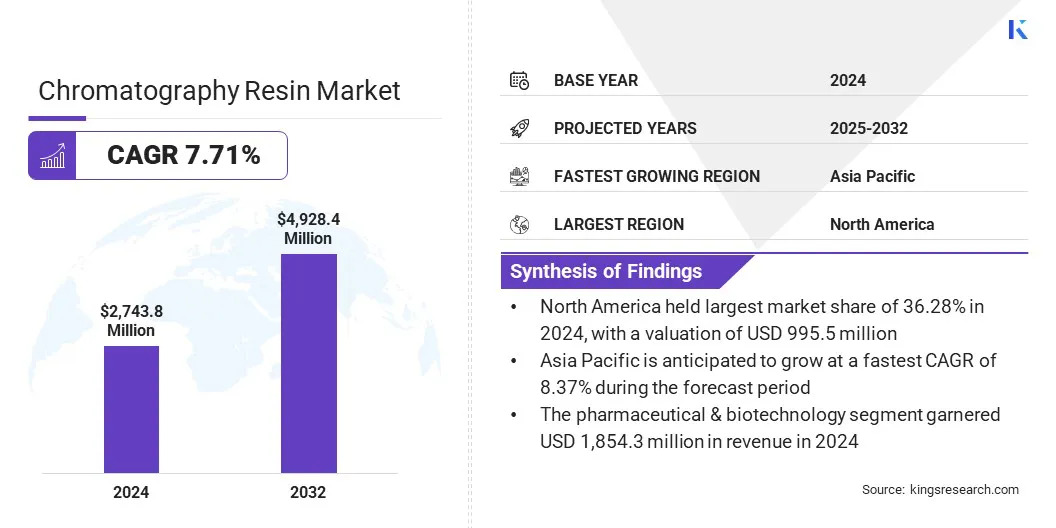

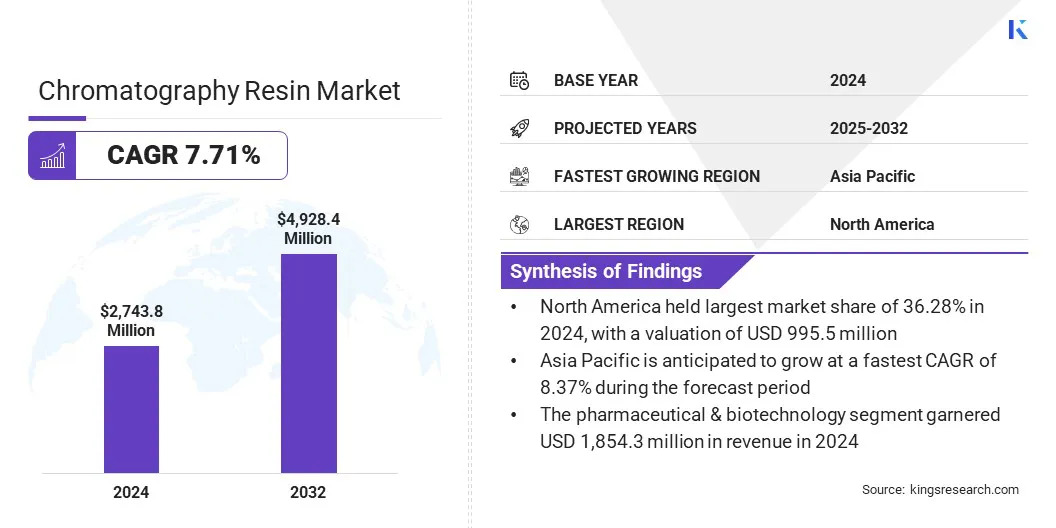

The global chromatography resin market size was valued at USD 2,743.8 million in 2024 and is projected to grow from USD 2,930.0 million in 2025 to USD 4,928.4 million by 2032, exhibiting a CAGR of 7.71% over the forecast period.

This growth is attributed to the increasing demand for high-performance chromatography resins that enable efficient purification and separation of complex biomolecules across pharmaceutical, biotechnology, and research applications. Expanding use in the production of monoclonal antibodies, vaccines, and other biologics is further supporting widespread adoption, ensuring product purity, consistency, and regulatory compliance in critical bioprocessing environments.

Key Highlights

- The chromatography resin industry size was valued at USD 2,743.8 million in 2024.

- The market is projected to grow at a CAGR of 7.71% from 2025 to 2032.

- North America held a market share of 36.28% in 2024, valued at USD 995.5 million.

- The natural segment garnered USD 1,187.2 million in revenue in 2024.

- The ion exchange segment is expected to reach USD 1,356.8 million by 2032.

- The pharmaceutical & biotechnology segment is anticipated to witness the fastest CAGR of 8.20% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.37% through the projection period.

Major companies operating in the chromatography resin market are Avantor, Inc., Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Cytiva, Merck KGaA, Sartorius AG, Purolite, Repligen Corporation, Agilent Technologies, Inc., Sepragen Corporation, YMC CO., LTD., JNC CORPORATION, GenScript, RESINDION S.r.l., and Bio-Works Technologies AB.

The rising focus on advanced resin chemistries with higher binding capacity, selectivity, and reusability is driving innovation in purification technologies, aligning with evolving process efficiency and sustainability requirements. Additionally, continuous advancements in ion exchange, affinity, and multimodal resin technologies, combined with the growing adoption of single-use and continuous chromatography systems are boosting market growth globally.

- In June 2025, Ecolab Life Sciences launched the Purolite AP+50 affinity chromatography resin, designed to enhance dynamic binding capacity and process durability in monoclonal antibody purification. The resin featured a 50-micron bead size that improved throughput and scalability in biopharmaceutical manufacturing, supporting high-efficiency downstream processing.

How is the growing production of biopharmaceuticals and biologics driving the expansion of this market?

Rising demand for biopharmaceuticals and biologics production is significantly contributing to the growth of the chromatography resin market, as these products require advanced purification processes to ensure high quality and regulatory compliance.

Pharmaceutical and biotechnology companies are expanding production of monoclonal antibodies, recombinant proteins, and vaccines to address increasing global healthcare needs, driving the use of chromatography resins in downstream processing.

These resins enable precise separation and purification of complex biomolecules, ensuring product consistency, safety, and efficacy. The growing prevalence of chronic and infectious diseases, coupled with expanding biosimilar manufacturing, is further accelerating resin adoption.

- In May 2025, DuPont expanded its bioprocessing portfolio with the launch of the AmberChrom TQ1 chromatography resin, an agarose-based anion exchange medium designed for the purification of oligonucleotides and peptides. The resin provided higher loading capacity, improved throughput, and reduced pressure build-up, supporting efficient and scalable biopharmaceutical manufacturing.

Why do the high costs of chromatography resins and purification processes create a significant barrier to the growth of the chromatography resin market?

The high cost of chromatography resins and purification processes poses a major challenge to the growth of the market. Specialty resins such as Protein A and affinity types involve complex production methods and stringent quality control, resulting in high manufacturing and procurement costs.

Large-scale biopharmaceutical production further amplifies these expenses, as resins must be replaced periodically and undergo rigorous cleaning and validation procedures. Maintaining process efficiency and product purity under these conditions significantly increases operational expenditure. Smaller biotechnology firms and research institutions face greater financial constraints, limiting their access to advanced resin technologies.

To address these challenges, manufacturers are investing in the development of cost-effective alternatives, reusable resin materials, and continuous purification systems aimed at reducing process costs while maintaining performance and regulatory compliance.

How are advancements in high-capacity and multimodal resin technologies shaping the growth and efficiency of the chromatography resin market?

The market is evolving with a strong focus on advancements in high-capacity and multimodal resin technologies to improve purification efficiency and process performance. High-capacity resins enable greater binding of target biomolecules, reducing the volume of resin required and optimizing overall throughput in large-scale bioprocessing.

Multimodal resins combine multiple interaction mechanisms such as ionic, hydrophobic, and hydrogen bonding within a single matrix, allowing superior selectivity and flexibility in separating complex biological mixtures. These innovations streamline purification workflows, reduce processing steps, and lower manufacturing costs while maintaining high product purity and yield.

Biopharmaceutical manufacturers are increasingly investing in next-generation resin chemistries and base materials with enhanced mechanical strength, pH stability, and reusability to meet evolving production demands.

- In January 2025, Bio-Rad Laboratories launched the Nuvia wPrime 2A media, a mixed-mode chromatography resin that combined weak anion exchange and hydrophobic interaction functionalities for biomolecule purification. The resin was designed to provide high selectivity, improved yield, and scalability from process development to commercial manufacturing, enhancing efficiency in biopharmaceutical production.

Chromatography Resin Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Natural, Synthetic, and Inorganic

|

|

By Technique

|

Ion Exchange, Affinity, Hydrophobic Interaction, Size Exclusion, Multimodal, and Others

|

|

By End Use Industry

|

Pharmaceutical & Biotechnology, Food & Beverage, Environmental and Water Testing, Academic & Research Institutes, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Natural, Synthetic, and Inorganic): The natural segment earned USD 1,187.2 million in 2024, primarily due to its widespread use in protein purification and biopharmaceutical applications requiring high biocompatibility and selectivity.

- By Technique (Ion Exchange, Affinity, Hydrophobic Interaction, Size Exclusion, Multimodal, and Others): The ion exchange held a share of 28.42% of the market in 2024, due to its broad applicability in protein purification, desalting, and separation of charged biomolecules with high resolution and cost efficiency.

- By End Use Industry (Pharmaceutical & Biotechnology, Food & Beverage, Environmental and Water Testing, Academic & Research Institutes, and Others): The pharmaceutical & biotechnology segment is projected to reach USD 4,928.4 million by 2032, owing to the rising production of biologics, vaccines, and biosimilars that require high-purity separation and purification processes using advanced chromatography resins.

Chromatography Resin Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America chromatography resin market share stood at 36.28% in 2024, valued at USD 995.5 million. This dominance is driven by strong biopharmaceutical manufacturing activity, extensive research capabilities, and early adoption of advanced purification technologies.

Companies are investing in next-generation chromatography systems such as continuous chromatography, simulated moving bed (SMB) systems, and multi-column capture platforms, along with resin innovations to support large-scale biologics, biosimilar, and vaccine production.

The strong presence of major life sciences manufacturers, contract development and manufacturing organizations, and research institutions continues to reinforce the region’s technological and commercial capabilities. Collectively, these strengths are solidifying North America’s leadership in chromatography innovation, large-scale bioprocessing, and high-purity pharmaceutical production.

Asia Pacific chromatography resin industry is set to grow at a CAGR of 8.37% over the forecast period. This growth is driven by the rapid expansion of pharmaceutical and biotechnology manufacturing, increasing demand for high-purity biologics, and growing investments in research and analytical capabilities.

Advancements in healthcare infrastructure and the rising establishment of bioprocessing facilities are further supporting large-scale adoption of chromatography technologies in this region.

- In September 2024, Japan-based JSR Life Sciences launched Amsphere A+, a next-generation Protein A chromatography resin developed using proprietary ligand and polymer technologies. The new resin offers higher binding capacity, improved alkali resistance, and enhanced pressure-flow performance compared to the previous Amsphere A3 product.

Regulatory Frameworks

- In the European Union, Regulation (EC) No 1907/2006 (REACH) regulates the registration, evaluation, authorisation, and restriction of chemical substances. It governs the use of raw materials and ligands in chromatography resin formulations to ensure environmental safety and compliance across production and supply chains.

- In the U.S., 21 CFR Part 211 (Good Manufacturing Practice for Finished Pharmaceuticals) regulates the manufacturing, processing, and packaging of pharmaceutical products. It ensures that chromatography resins used in purification and separation processes meet stringent quality, safety, and consistency standards for drug production.

Competitive Landscape

Companies in the chromatography resin industry are enhancing their competitive position through continuous innovation in resin chemistry, expansion of production capacities, and strategic collaborations or acquisitions. Market players are also strengthening supply chain efficiency and regional distribution networks to meet the growing demand from the pharmaceutical, biotechnology, and food industries.

Additionally, they are investing in sustainable manufacturing practices and collaborating with end users to deliver customized purification solutions to meet regulatory and quality standards.

- In June 2024, Ecolab Life Sciences and Repligen Corporation announced the commercial launch of the DurA Cycle affinity chromatography resin for large-scale biologic manufacturing. The resin is designed to enhance binding performance, increase operational durability, and lower purification costs in monoclonal antibody production, thereby improving process scalability and efficiency.

Key Companies in Chromatography Resin Market:

- Avantor, Inc.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Cytiva

- Merck KGaA

- Sartorius AG

- Purolite

- Repligen Corporation

- Agilent Technologies, Inc.

- Sepragen Corporation

- YMC CO., LTD.

- JNC CORPORATION

- GenScript

- RESINDION S.r.l.

- Bio-Works Technologies AB

Recent Developments (M&A/Partnerships)

- In October 15, 2025, Merck KGaA’s life science business MilliporeSigma, signed a definitive agreement to acquire the chromatography business of JSR Life Sciences, including the Amsphere Protein A resin portfolio. The transaction, expected to close by the end of the second quarter of 2026, will add advanced Protein A chromatography technologies to Merck’s downstream processing portfolio to strengthen monoclonal antibody purification and accelerate biologics manufacturing.

- In March 2024, Arcmed Group and Argento Scientific established a strategic partnership to enhance column-packing capabilities for biotechnology and pharmaceutical applications. The collaboration combined Arcmed’s Omnifit glass column technology with Argento’s downstream process expertise to improve production efficiency and support complex purification processes.