Market Definition

Recombinant proteins are engineered proteins produced through recombinant DNA technology, where genetic material encoding a specific protein is inserted into a suitable host cell, such as bacteria, yeast, or mammalian cells, to enable large-scale production. This process allows for the generation of highly specific, functional proteins that can replicate the structure and activity of natural proteins.

Recombinant proteins play a critical role in advancing modern biotechnology and medicine, as they are widely used in therapeutic treatments, diagnostics, and research applications. Their controlled production ensures consistency, purity, and reduced risk of contamination compared to proteins derived from natural sources.

Recombinant Proteins Market Overview

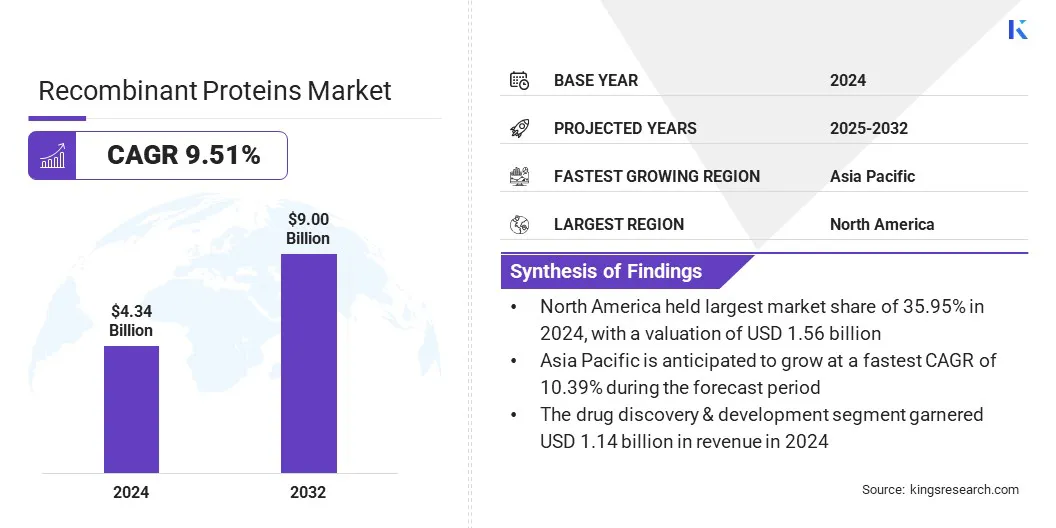

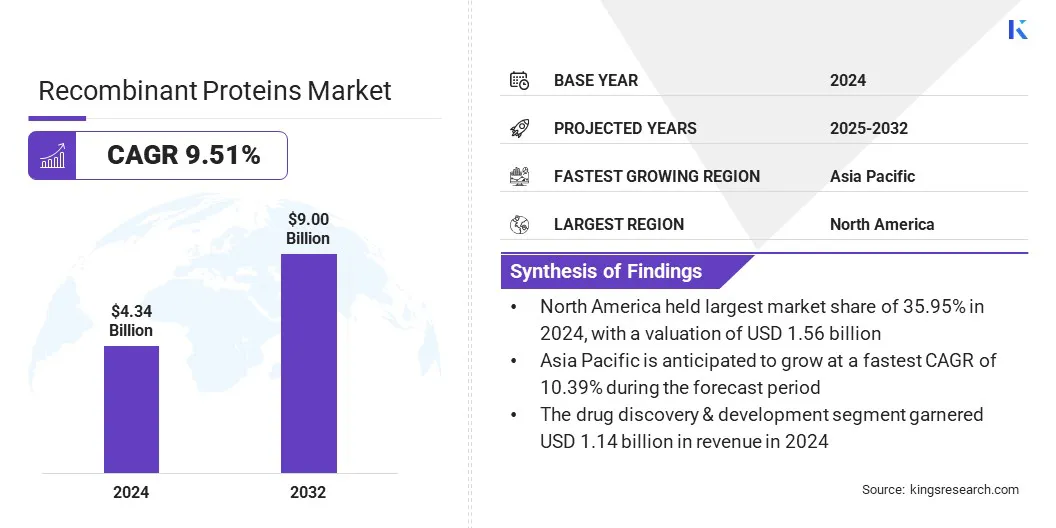

The global recombinant proteins market size was valued at USD 4.34 billion in 2024 and is projected to grow from USD 4.75 billion in 2025 to USD 9.00 billion by 2032, exhibiting a CAGR of 9.51% over the forecast period.

Increasing adoption of recombinant proteins in personalized medicine is transforming treatment models by enabling targeted therapies tailored to patient-specific genetic profiles. In the market, this trend accelerates demand for advanced protein-based drugs, strengthening their role in precision healthcare solutions.

Key Highlights:

- The recombinant proteins industry was recorded at USD 4.34 billion in 2024.

- The market is projected to grow at a CAGR of 9.51% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 1.56 billion.

- The cytokines & growth factors segment garnered USD 1.00 billion in revenue in 2024.

- The drug discovery & development segment is expected to reach USD 2.36 billion by 2032.

- The academic & research institutes segment is anticipated to witness the fastest CAGR of 9.82% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 10.39% through the projection period.

Major companies operating in the recombinant proteins market are Bio-Techne, Thermo Fisher Scientific Inc., Merck KGaA, Abcam Limited, F. Hoffmann-La Roche Ltd, Novartis AG, Proteintech Group, Inc, Sanofi, GenScript, Sino Biological, Inc., Novo Nordisk Pharmatech A/S, ProteoGenix SAS, RayBiotech, Inc., Lonza Group Ltd, and STEMCELL Technologies.

Recombinant proteins are increasingly recognized as pivotal tools in regenerative medicine, supporting tissue repair, wound healing, and organ regeneration. Their ability to mimic natural growth factors, cytokines, and structural proteins allows them to guide cell differentiation and stimulate tissue repair with high precision. For example, recombinant bone morphogenetic proteins are widely used in orthopedic applications, while growth factors are applied in skin regeneration therapies.

The expanding applications of these proteins present a significant opportunity for market growth, as the demand for advanced therapies addressing chronic diseases, trauma injuries, and age-related degeneration continues to rise. Investments in regenerative medicine research and clinical trials further strengthen the commercial prospects of recombinant proteins.

- In January 2025, Qkine Ltd., a Cambridge spin-out specializing in bioactive proteins, partnered with REPROCELL Inc. to globally distribute high-quality proteins, including growth factors and cytokines. Qkine’s expertise lies in animal-origin free production of complex growth factors with superior purity and bioactivity.

Market Driver

Advancements in Protein Expression Systems Enhance Production Efficiency

The development of advanced protein expression systems has significantly improved the efficiency and scalability of recombinant protein production. Modern expression platforms, including mammalian, yeast, and insect cell systems, enable higher yields, improved protein folding, and better post-translational modifications.

These advancements reduce production costs, enhance product quality, and shorten development timelines, which are critical factors in meeting the growing global demand for recombinant proteins. For pharmaceutical companies, efficient expression systems translate into faster commercialization of protein-based therapies and greater market competitiveness.

This driver underpins the sector’s ability to address complex healthcare needs, supporting the delivery of innovative biologics for oncology, immunology, and rare diseases.

- In March 2025, Shiru partnered with GreenLab, a pioneer in plant-based protein expression, to commercialize novel food proteins. Leveraging GreenLab’s corn expression system, the collaboration enhances Shiru’s scalable manufacturing, enabling sustainable functional ingredients for CPG and broader bioindustrial applications beyond traditional fermentation methods.

Market Challenge

High Manufacturing Costs Create Barriers for Widespread Commercialization

Recombinant protein production requires advanced facilities, costly raw materials, and stringent quality assurance protocols, which contribute to high manufacturing costs. These expenses create barriers to widespread commercialization, particularly for smaller biotech firms. Moreover, this results in limited accessibility of protein-based therapies in emerging economies, slowing global market expansion.

However, companies are taking efforts to optimize expression systems, integrate automation, and adopt continuous manufacturing technologies which is expected to reduce production expenses significantly. Strategic collaborations with contract development and manufacturing organizations further enhance cost efficiency.

Moreover, adopting advanced bioprocessing technologies, leveraging contract manufacturing partnerships, and optimizing expression systems mitigate cost burdens, enabling broader commercialization of recombinant proteins while ensuring high-quality production standards remain intact.

Market Trend

Growing Use of Recombinant Proteins in Advanced Drug Development

The pharmaceutical industry increasingly incorporates recombinant proteins into advanced drug development pipelines due to their ability to replicate natural biological functions with high specificity. These proteins are critical in developing novel therapeutics for oncology, metabolic disorders, and autoimmune diseases.

Their use in drug screening, target validation, and biomarker discovery accelerates research timelines and enhances precision in therapy development. This trend reflects the rising emphasis on biologics and targeted therapies, where recombinant proteins serve as both therapeutic agents and research tools

- In October 2023, ARTES Biotechnology and Basic Pharma announced a strategic collaboration focused on driving pharmaceutical innovation, combining expertise to accelerate development and transfer of advanced therapeutic solutions.

Recombinant Proteins Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Cytokines & Growth Factors, Antibodies, Immune Checkpoint Proteins, Virus Antigens, Enzymes, Recombinant Regulatory Proteins, Hormones, Others

|

|

By Application

|

Drug Discovery & Development, Academic Research Studies, Research, Biopharmaceutical Production, Others

|

|

By End Use

|

Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Diagnostic Laboratories, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Cytokines & Growth Factors, Antibodies, Immune Checkpoint Proteins, Virus Antigens, Enzymes, Recombinant Regulatory Proteins, Hormones, and Others): The cytokines & growth factors segment earned USD 1 billion in 2024, due to increasing therapeutic applications in regenerative medicine, oncology, and immunology, coupled with rising demand for targeted protein-based treatments.

- By Application (Drug Discovery & Development, Academic Research Studies, Research, Biopharmaceutical Production, and Others): The drug discovery & development held 26.23% of the market in 2024, owing to widespread utilization of recombinant proteins for target validation, biomarker identification, and accelerating precision-based therapeutic pipeline advancements.

- By End Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Diagnostic Laboratories, and Others): The pharmaceutical & biotechnology companies segment is projected to reach USD 2.96 billion by 2032, propelled by increasing R&D investments, expanding biopharmaceutical pipelines, and growing reliance on recombinant proteins for innovative therapeutics.

Recombinant Proteins Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America recombinant proteins market share stood at 35.95% in 2024, with a valuation of USD 1.56 billion. This leadership position is attributed to strong research infrastructure, substantial investments in biotechnology by companies, and a high adoption rate of advanced protein-based therapeutics.

The region benefits from a well-established biopharmaceutical ecosystem, fostering continuous innovation in therapeutic protein development, regenerative medicine, and drug discovery. Moreover, increasing prevalence of chronic and rare diseases drives demand for recombinant proteins in clinical applications, while robust funding from both public and private entities accelerates pipeline expansion.

Asia Pacific is poised for significant growth at a robust CAGR of 10.39% over the forecast period. This growth is due to the rising healthcare expenditure, rapid advancements in biotechnology, and increasing adoption of protein-based therapeutics. Academic institutions and research organizations across the region are investing heavily in recombinant protein research, fueling innovation in regenerative medicine, oncology, and vaccine development.

Expanding pharmaceutical manufacturing capabilities are supporting cost-effective production, thereby enhancing accessibility of recombinant protein products across broader patient populations. Growing demand for personalized medicine and targeted therapies is further strengthening the regional market outlook.

Regulatory Frameworks

- In the U.S., the Food, Drug, and Cosmetic Act (FDCA) regulates biologics and recombinant proteins. It ensures the safety, efficacy, and quality of therapeutic proteins through stringent FDA oversight, covering clinical trials, approvals, and manufacturing compliance.

- In the EU, the European Medicines Agency’s Regulation (EC) No 726/2004 regulates recombinant protein-based medicinal products. It centralizes the marketing authorization process, ensuring harmonized standards for quality, safety, and efficacy across EU member states.

- In Japan, the Pharmaceuticals and Medical Devices Act (PMD Act) regulates recombinant proteins. It mandates rigorous evaluation of biologics for safety, quality, and clinical effectiveness, supporting the approval and monitoring of therapeutic protein products.

- In China, the Regulations for the Administration of Biologics (issued by the NMPA) regulate recombinant proteins. They establish approval pathways, clinical trial oversight, and post-market surveillance for biologic and protein-based therapies.

- In India, the Drugs and Cosmetics Act, 1940 and Rules regulate recombinant proteins. It governs clinical research, manufacturing, and commercialization of biologics, ensuring adherence to quality and biosafety standards.

Competitive Landscape

Key players operating in the recombinant proteins market are pursuing strategies centered on innovation, partnerships, and operational efficiency to secure a competitive advantage. Companies are actively expanding their R&D pipelines, focusing on novel therapeutic applications such as regenerative medicine, oncology, and immune modulation.

Mergers and strategic alliances are being leveraged to broaden portfolios and enhance global reach. Moreover, market players are investing in advanced expression systems and bioprocessing technologies to improve scalability, product quality, and cost efficiency.

- In May 2025, Biomay announced the launch of its CRISPR/Cas9 nuclease, expanding its genome-editing portfolio. Biomay, an FDA-approved GMP manufacturer and supplier of Cas9 for CASGEVY, the first marketed CRISPR therapy leverages proven expertise to provide high-quality recombinant proteins for advanced research and therapeutic applications.

Key Companies in Recombinant Proteins Market:

- Bio-Techne

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Abcam Limited

- Hoffmann-La Roche Ltd

- Novartis AG

- Proteintech Group, Inc

- Sanofi

- GenScript

- Sino Biological, Inc.

- Novo Nordisk Pharmatech A/S

- ProteoGenix SAS

- RayBiotech, Inc.

- Lonza Group Ltd

- STEMCELL Technologies

Recent Developments (Product Launch)

- In January 2025, Bio-Techne introduced advanced designer proteins developed through AI-driven design platforms and protein evolutionary workflows. These next-generation recombinant proteins aim to enhance cellular therapy workflows and research applications by improving cell culture efficiency, supporting optimized cell expansion, and addressing critical performance needs in life sciences innovation.

and in price-sensitive regions