Market Definition

Cathodic protection is an electrochemical method used to prevent corrosion in metallic structures exposed to corrosive environments such as soil, seawater, or concrete. It functions by converting the protected surface into a cathode of an electrochemical cell through an external current or a sacrificial anode. This process minimizes oxidation reactions, extending asset lifespan and structural reliability.

Cathodic Protection Market Overview

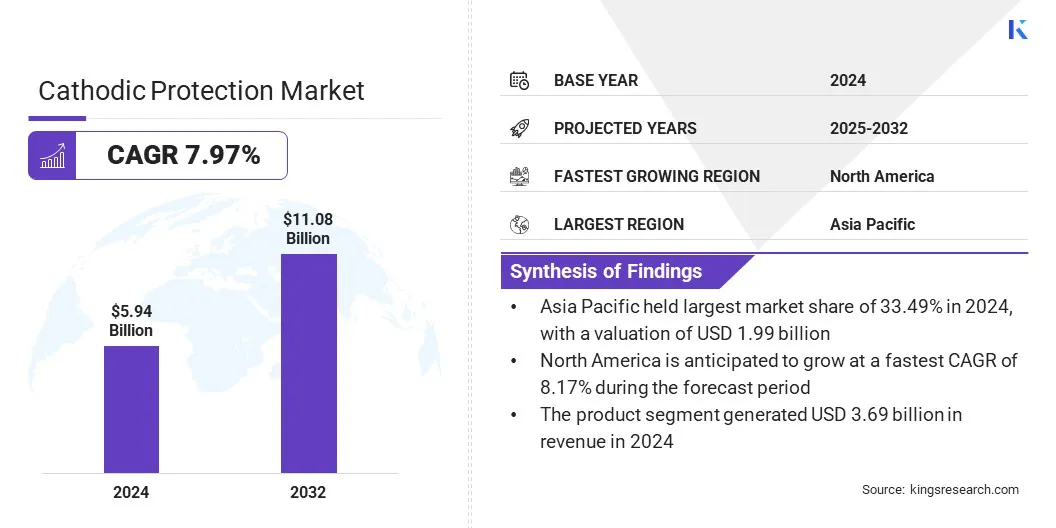

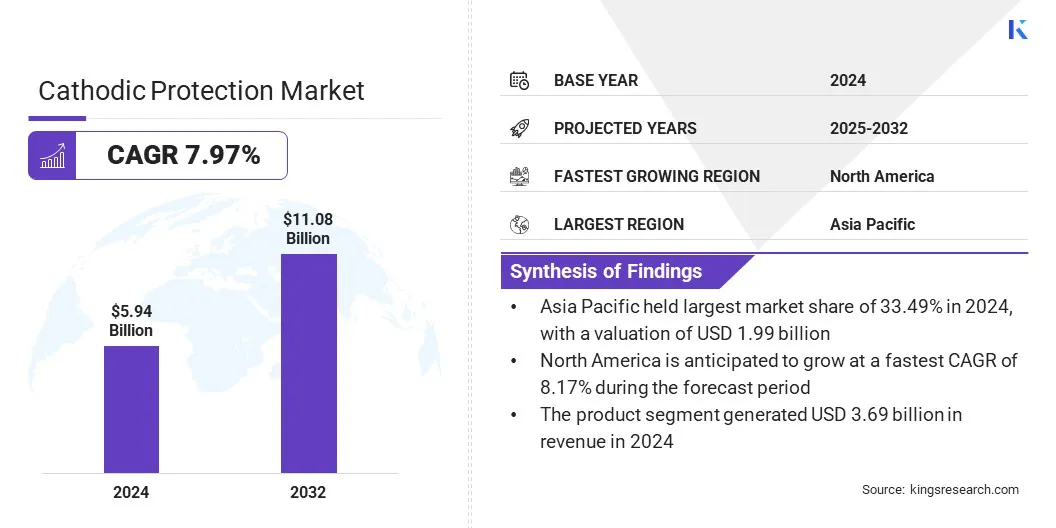

According to Kings Research, the global cathodic protection market size was valued at USD 5.94 billion in 2024 and is projected to grow from USD 6.38 billion in 2025 to USD 11.08 billion by 2032, exhibiting a CAGR of 7.97% during the forecast period.

This growth is driven by the increasing need to rehabilitate deteriorating oil, gas, and water pipelines. Aging infrastructure requires corrosion prevention solutions, accelerating the adoption of cathodic protection systems for long-term asset reliability.

Key Market Highlights:

- The cathodic protection industry size was recorded at USD 5.94 billion in 2024.

- The market is projected to grow at a CAGR of 7.97% from 2025 to 2032.

- Asia Pacific held a share of 33.49% in 2024, valued at USD 1.99 billion.

- The product segment generated USD 3.69 billion in revenue in 2024.

- The impressed current segment is expected to reach USD 4.23 billion by 2032.

- The processing plants segment is anticipated to witness the fastest CAGR of 8.12% over the forecast period.

- North America is projected to grow at a CAGR of 8.17% through the projection period.

Major companies operating in the global cathodic protection market are MME Group, Cathodic Protection Co. Ltd., Cor-Pro, TC Energy, Deepwater Corrosion Services Inc, Sika Limited, Industrie De Nora S.p.A., Corrtech International Pvt Ltd., MATCOR, Inc., Azuria, BAC Corrosion Control LTD, Mears, Wilson Walton International S.A., Omniflex, and Anotec Industries Ltd.

Market growth is supported by the increasing development of offshore wind farms, subsea pipelines, and marine platforms requiring corrosion protection. Growing investments in renewable and deep-water energy projects are accelerating the use of cathodic protection systems to ensure asset durability and reduce operational risks.

Additionally, the rising replacement of aging offshore assets is further supporting demand, emphasizing the need for technologically advanced systems capable of performing effectively in harsh marine environments.

- In April 2025, the Global Wind Energy Council reported an additional 8 GW of offshore wind installed capacity during the year, bringing total global offshore wind capacity to 83 GW. This expansion addresses the rising demand for cathodic protection systems essential to safeguard subsea foundations and metallic structures in offshore energy infrastructure.

How are strict regulatory frameworks fueling market expansion?

Stringent regulatory frameworks mandating corrosion prevention across industrial sectors are propelling the growth of the cathodic protection market. International standards established by organizations such as NACE and ISO require the adoption of cathodic protection in pipelines, marine, and infrastructure applications.

Additionally, governments are promoting corrosion management programs to reduce safety risks and environmental damage. These regulations have intensified demand for certified systems, enhancing accountability and system quality. The compliance landscape continues to influence procurement decisions and promotes investment in advanced monitoring and design solutions.

- In February 2025, the U.S. Department of Defense awarded Corrpro a USD 19.9 million firm-fixed-price, five-year IDIQ contract to provide cathodic protection surveys and corrosion control services, supporting the U.S. Army Corps of Engineers through advanced corrosion engineering expertise and infrastructure protection capabilities.

How is limited availability of skilled professionals affecting cathodic protection market progress?

The growth of the market is hindered by a shortage of qualified professionals for system design, installation, and monitoring. Inadequate technical expertise affects performance accuracy and leads to inefficiencies in corrosion management, particularly in emerging economies.

This shortage also increases project delays and dependency on specialized consultants, constraining large-scale deployments. The lack of structured training programs and standardization further restricts workforce development, making it difficult for companies to maintain consistent quality and operational reliability across diverse infrastructure projects.

To address this challenge, companies are investing in workforce development through structured training programs, certification initiatives, and partnerships with technical institutions. Automation, remote monitoring, and AI-assisted diagnostics are streamlining system management, reducing dependency on specialized personnel and improving overall operational consistency.

How is growing trend toward intelligent monitoring solutions influencing the cathodic protection market?

The market is witnessing a rapid shift toward intelligent monitoring solutions that improve operational control and data transparency. Integration of IoT sensors and cloud-based analytics enables real-time tracking of corrosion activity, enhancing maintenance efficiency and predictive performance.

- In February 2024, GPT Industries introduced Iso-Smart, a remote pipeline monitoring system designed for comprehensive asset integrity management. The solution is designed to remotely assess cathodic protection performance, isolation status, bond currents, and AC/DC line conditions through a user-focused digital platform.

Asset operators increasingly prefer automated systems that reduce manual inspection costs and ensure continuous compliance with safety standards. This trend supports digital transformation within the industry, aligning cathodic protection with broader asset integrity management frameworks and long-term operational reliability goals.

- In July 2025, Mopeka Products introduced the Mopeka Cathodic Sentinel Plus, an enhanced version of its existing Cathodic Sentinel system. The upgraded solution integrates cathodic protection monitoring with tank level measurement, enabling remote oversight of underground tank integrity and fuel levels through cellular, satellite, and cloud connectivity, providing unified, real-time asset visibility and improved operational control.

Cathodic Protection Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Product, Services

|

|

By Type

|

Galvanic Anode, Impressed Current, Hybrid

|

|

By Application

|

Pipeline, Storage facilities, Processing plants, Water & Wastewater, Transportation, Buildings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Product and Services): The product segment generated USD 3.69 billion in revenue in 2024, mainly due to increased adoption of advanced anode materials and rectifier systems supporting large-scale pipeline and offshore infrastructure protection projects.

- By Type (Galvanic Anode, Impressed Current, and Hybrid): The galvanic anode segment is poised to record a CAGR of 8.09% through the forecast period, propelled by rising deployment in marine, storage tank, and small-scale corrosion prevention applications.

- By Application (Pipeline, Storage facilities, Processing plants, Water & Wastewater, Transportation, Buildings, and Others): The pipeline segment is estimated to hold a share of 24.29% by 2032, fueled by ongoing replacement of aging transmission lines and stringent corrosion control mandates in the oil and gas industry.

What is the market scenario in Asia Pacific and North America region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific cathodic protection market accounted for a share of 33.49% in 2024, valued at USD 1.99 billion. This dominance is supported by extensive investments in oil and gas pipeline networks, marine infrastructure, and industrial facilities requiring corrosion control systems.

Rising construction activity and expanding utility infrastructure are creating a strong demand for both sacrificial anode and impressed current systems. Increasing focus on infrastructure longevity and asset integrity management is driving adoption among industrial operators.

Local manufacturers are enhancing product capabilities through partnerships and technology integration, which is strengthening regional competitiveness and operational efficiency. There is a sustained demand across diverse applications such as pipelines, storage tanks, marine structures, water treatment facilities, and reinforced concrete infrastructure, which is supporting regional market expansion.

- In January 2025, the Indian government reported an increase in the operational natural gas pipeline network from 15,340 km in 2014 to 24,945 km as of September 2024. The planned addition of 10,805 km by 2025 is expected to significantly boost demand for advanced cathodic protection systems.

The North America cathodic protection industry is projected to grow at a CAGR of 8.17% over the forecast period. This expansion is fostered by increased investments in oil and gas transportation infrastructure and strict regulatory enforcement for corrosion prevention standards.

Rising emphasis on maintenance of existing assets and adoption of advanced monitoring technologies is influencing product development and system upgrades. Industrial operators are shifting toward digital corrosion management platforms that enhance monitoring accuracy and operational efficiency.

Market participants are focusing on expanding service portfolios, integrating automation, and strengthening long-term maintenance contracts to address the region’s evolving asset protection requirements.

- In January 2025, Mopeka partnered with Metsa Tanks to integrate its Cathodic Sentinel technology into Metsa’s underground propane tanks. The initiative aims to deliver advanced cathodic monitoring solutions that protect against corrosion, extend tank lifespan, and enhance reliability across underground propane storage operations.

Regulatory Frameworks

- In the U.S., 49 CFR Part 192 – Transportation of Natural and Other Gas by Pipeline enforces corrosion control requirements for natural gas pipelines. It mandates the use of cathodic protection systems to prevent metal loss and ensure pipeline integrity under federal safety standards.

- In the EU, Directive 2014/68/EU on Pressure Equipment (PED) regulates design and maintenance standards for pressure systems. It governs corrosion protection measures, requiring cathodic protection implementation to maintain equipment safety and reliability across industrial installations.

- In India, ISO 15589-1:2015 – Petroleum, Petrochemical and Natural Gas Industries oversees cathodic protection for buried or submerged metallic pipelines. It provides detailed technical guidance on system design, operation, and maintenance to minimize corrosion-related failures.

- In the Middle East, NACE SP0169 – Control of External Corrosion on Underground or Submerged Metallic Piping Systems directs the application of cathodic protection in oil, gas, and water networks. It establishes performance criteria to ensure corrosion mitigation and compliance with industrial safety regulations.

Competitive Landscape

Key players operating in the cathodic protection market are expanding manufacturing capabilities to meet the rising demand for anode systems and power control units. Investments in digital monitoring solutions and remote corrosion assessment tools are increasing, aligning operations with data-driven maintenance strategies.

Many participants are forming alliances with engineering and procurement firms to secure large-scale infrastructure projects. Product development efforts are focused on durable materials and modular system designs to enhance installation efficiency.

Mergers, acquisitions, and regional expansions remain key imperatives, allowing companies to optimize distribution networks and increase participation in long-term service contracts.

- In July 2025, NDT Global acquired Entegra, a company in Ultra-High-Resolution Magnetic Flux Leakage inspection technologies. The acquisition seeks to enhance NDT Global’s cathodic protection and pipeline integrity capabilities, expanding its service portfolio and reinforcing its position in delivering advanced data-driven corrosion prevention and asset monitoring solutions across the pipeline industry.

List of Key Companies in Cathodic Protection Market:

- MME Group

- Cathodic Protection Co. Ltd.

- Cor-Pro

- TC Energy

- Deepwater Corrosion Services Inc

- Sika Limited

- Industrie De Nora S.p.A.

- Corrtech International Pvt Ltd.

- MATCOR, Inc.

- Azuria

- BAC Corrosion Control LTD

- Mears

- Wilson Walton International S.A.

- Omniflex

- Anotec Industries Ltd.

Recent Developments

- In August 2025, ALKUWAITI Industrial formed a strategic partnership with PSS Corporation, Russia, to deliver advanced cathodic protection solutions across Bahrain. The collaboration leverages local market presence and technical expertise to deliver comprehensive corrosion prevention systems for pipelines, marine assets, storage tanks, and industrial facilities.

- In March 2025, MATCOR, Inc., a BrandSafway company specializing in cathodic protection and AC mitigation solutions, announced that its PF Anode received NSF/ANSI 61 certification. This certification validates its suitability for potable water applications and reinforces MATCOR’s commitment to maintaining stringent industry standards in corrosion prevention technologies.