Market Definition

Calcium gluconate is a mineral supplement and medication that provides calcium, an essential mineral for various bodily functions. It is used to treat and prevent calcium deficiencies, including conditions such as hypocalcemia, calcium loss due to certain diseases, and calcium depletion during surgeries or emergencies. The market encompasses the production, distribution, and sale of calcium gluconate in various forms, such as oral tablets, powders, and injectable solutions.

Calcium Gluconate Market Overview

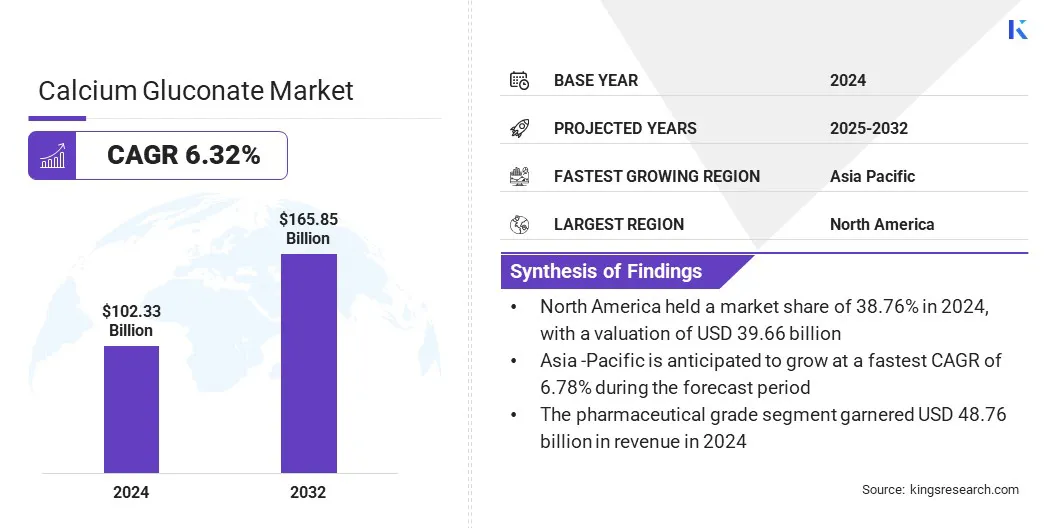

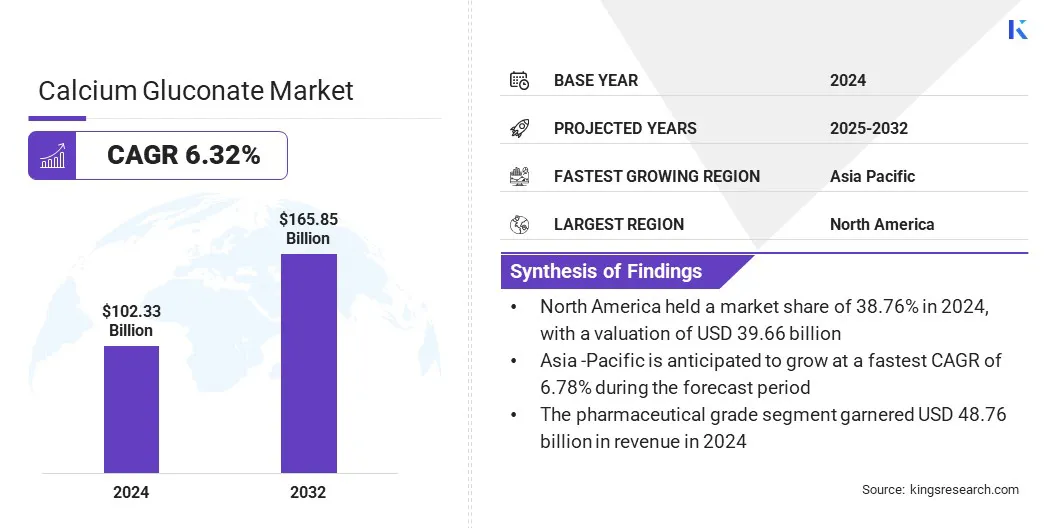

The global calcium gluconate market size was valued at USD 102.33 billion in 2024 and is projected to grow from USD 107.96 billion in 2025 to USD 165.85 billion by 2032, exhibiting a CAGR of 6.32% over the forecast period.

The growth of the market is driven by the rising prevalence of calcium deficiency due to dietary gaps and health conditions. The increasing incorporation of calcium gluconate in functional foods and beverages is further supporting its adoption across nutritional, pharmaceutical, and clinical care sectors.

Key Highlights:

- The calcium gluconate industry size was recorded at USD 102.33 billion in 2024.

- The market is projected to grow at a CAGR of 6.32% from 2025 to 2032.

- North America held a share of 38.76% in 2024, valued at USD 39.66 billion.

- The pharmaceutical grade segment garnered USD 48.76 billion in revenue in 2024.

- The powder segment is expected to reach USD 69.64 billion by 2032.

- The personal care & cosmetics segment is anticipated to witness the fastest CAGR of 7.34% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.78% over the forecast period.

Major companies operating in the calcium gluconate market are Global Calcium Pvt. Ltd, Corbion NV, Jungbunzlauer Suisse AG, Spectrum Chemical Mfg. Corp, Tomita Pharmaceutical Co., Ltd, Shandong Xinhong Pharmaceutical Co., Ltd, Ruibang Pharmaceutical Co., Ltd, Nantong Feiyu Food Technology Co., Ltd, Jiaan Biotech, Thermo Fisher Scientific Inc, Fresenius Kabi Ltd, AdvaCare Pharma, Hikma Pharmaceuticals PLC, Kronox Lab Sciences Ltd, and Eklavya Biotech Private Limited.

The aging population is increasing the demand for calcium gluconate to combat age-related bone loss and deficiencies. This demographic shift is leading to a higher prevalence of conditions such as osteoporosis and chronic kidney disease, thereby driving greater demand for effective calcium supplementation therapies.

- According to a June 2025 report by the U.S. Census Bureau, the population aged 65 and older in the U.S. increased by 3.1% from 2023 to 2024, reaching 61.2 million.

Market Driver

Increasing Incidence of Hypocalcemia

A key factor propelling the growth of the calcium gluconate market is the increasing incidence of hypocalcemia, a condition characterized by low blood calcium levels that poses serious health risks. Rising cases are linked to chronic kidney disease, surgical procedures, and certain medication use.

Regulatory safety alerts and clinical guidelines are increasing awareness of this condition. This is driving demand for effective treatments such as calcium gluconate, particularly in hospital and emergency care settings, to rapidly restore calcium levels and prevent severe complications.

- In January 2024, the U.S. Food and Drug Administration (FDA) issued a Boxed Warning on denosumab-induced hypocalcemia, emphasizing the need for calcium supplementation to address the risk.

Market Challenge

Volatility of Raw Materials Prices

A key challenge impeding the growth of the calcium gluconate market is the price volatility of raw materials required for the production of calcium gluconate. The manufacturing of calcium gluconate relies on materials such as calcium carbonate and gluconic acid. Global supply-demand changes, energy cost variations, and geopolitical tensions cause fluctuations in the prices of these materials. This volatility increases production expenses and disrupts supply chains.

To address this challenge, market players are diversifying their supply sources and entering long-term procurement agreements to secure stable pricing of raw materials. They are also investing in local manufacturing facilities to reduce dependence on imports and mitigate currency fluctuation risks. Market players are forming strategic partnerships with raw material suppliers to improve efficiency and lower the costs of producing calcium gluconate.

Market Trend

Increasing Development of Advanced Injectable Formulations

A key trend influencing the calcium gluconate market is the increasing development of advanced injectable formulations. Manufacturers are introducing innovative dosage forms, varied vial sizes, and ready-to-use presentations to improve stability, ease of administration, and patient compliance.

These advancements address urgent clinical needs in emergency and critical care where rapid calcium supplementation is required. Increasing focus of key players on formulation innovation is enhancing treatment efficiency, expanding therapeutic applications, and supporting broader adoption of calcium gluconate in healthcare settings.

- In October 2023, Somerset Pharmaceuticals launched the first generic version of Calcium Gluconate 100 mg/mL in 50 mL and 100 mL vials. The launch strengthens the availability of advanced injectable formulations and enhances patient convenience.

Calcium Gluconate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Pharmaceutical Grade, Food Grade, Industrial Grade

|

|

By Form

|

Powder, Liquid, Tablets/Capsules

|

|

By Application

|

Pharmaceuticals, Food & Beverages, Nutraceuticals, Personal Care & Cosmetics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Grade (Pharmaceutical Grade, Food Grade, and Industrial Grade): The pharmaceutical grade segment earned USD 48.76 billion in 2024, due to its extensive use in treating hypocalcemia and related medical conditions.

- By Form (Powder, Liquid, Tablets/Capsules, and Others): The powder segment held 42.30% of the market in 2024, driven by its stability, ease of incorporation in formulations, and cost-effectiveness.

- By Application (Pharmaceuticals, Food & Beverages, Nutraceuticals, Personal Care & Cosmetics, and Others): The pharmaceuticals segment is projected to reach USD 68.43 billion by 2032, owing to growing demand for injectable and oral calcium gluconate in clinical treatments.

Calcium Gluconate Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America calcium gluconate market share stood at 38.76% in 2024, valued at USD 39.66 billion. This dominance is driven by the rising prevalence of calcium deficiency and associated conditions such as osteoporosis and hypocalcemia across the region.

Supportive government health initiatives, such as the U.S. Department of Health & Human Services’ dietary guidelines and CDC-led nutrition programs emphasizing sufficient calcium intake, are further accelerating the adoption of calcium gluconate.

Expanding applications in the food and beverage sector through fortification and functional nutrition are strengthening demand for calcium gluconate. Moreover, the introduction of advanced injectable formulations by pharmaceutical manufacturers is enhancing product accessibility and broadening treatment options across the region.

- In June 2024, Amneal Pharmaceuticals, Inc. expanded its broad injectables portfolio with the launch of six new therapies, including Calcium Gluconate Injection. This expansion brought the company’s total number of commercial injectable products in the U.S. to over 40.

Asia Pacific is set to grow at a CAGR of 6.78% over the forecast period. This growth is driven by the large population base and the high prevalence of nutritional deficiencies across Asia-Pacific, creating strong demand for calcium supplementation.

Rapid urbanization and lifestyle changes are contributing to rising cases of osteoporosis and related bone health disorders. Government-backed initiatives, such as China’s Healthy China 2030 plan are promoting fortified foods and dietary supplements to address widespread micronutrient gaps.

Expanding use of calcium gluconate in pediatric and maternal health programs is further accelerating market growth. Moreover, growing investments by regional pharmaceutical manufacturers in injectable and oral calcium formulations are strengthening local supply chains and improving access to essential calcium supplements and therapies across the region.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates calcium gluconate as both a pharmaceutical product and a food additive. The agency oversees its approval, labeling, manufacturing standards, and safe usage in medical treatments. It ensures compliance with established safety and efficacy requirements, while also permitting its use as a stabilizer and sequestrant in certain food products under specified regulations.

- In the UK, the Medicines and Healthcare products Regulatory Agency (MHRA) oversees calcium gluconate as a medicinal product. The agency manages its licensing, ensures quality and safety, and monitors adverse effects. The MHRA issues guidance and safety communications to healthcare providers to ensure correct usage and maintains strict regulatory oversight to protect patients.

- In China, the National Medical Products Administration (NMPA) governs the approval, quality control, and manufacturing standards of calcium gluconate products. It ensures that pharmaceutical-grade calcium gluconate meets safety and efficacy standards before market entry. The NMPA also monitors compliance with regulatory requirements and issues approvals for new product formulations, helping maintain treatment safety and accessibility.

- In India, the Central Drugs Standard Control Organisation (CDSCO) regulates the production and quality of calcium gluconate. It enforces adherence to national pharmacopoeia standards and Good Manufacturing Practices (GMP). The CDSCO reviews applications for approval, inspects manufacturing facilities, and monitors imported and locally produced calcium gluconate to ensure safe use in healthcare and nutrition.

Competitive Landscape

Major players in the calcium gluconate industry are expanding their product portfolios by introducing new injectable and oral formulations to address rising therapeutic and nutritional needs. They are strengthening manufacturing capacity and distribution networks to ensure the consistent availability of calcium gluconate products.

Additionally, players are actively focusing on research and development to enhance the formulation stability of calcium gluconate, improve its bioavailability, and increase patient convenience.

Top Key Companies in Calcium Gluconate Market:

- Global Calcium Pvt. Ltd

- Corbion NV

- Jungbunzlauer Suisse AG

- Spectrum Chemical Mfg. Corp

- Tomita Pharmaceutical Co.,Ltd

- Shandong Xinhong Pharmaceutical Co., Ltd

- Ruibang Pharmaceutical Co., Ltd

- Nantong Feiyu Food Technology Co., Ltd

- Jiaan Biotech

- Thermo Fisher Scientific Inc

- Fresenius Kabi Ltd

- AdvaCare Pharma

- Hikma Pharmaceuticals PLC

- Kronox Lab Sciences Ltd

- Eklavya Biotech Private Limited.

Recent Developments

- In June 2025, SSY Group Ltd. received regulatory approval from China’s National Medical Products Administration (NMPA) for its Calcium Gluconate Injection. This approval expands the company’s product portfolio and strengthens its presence in the Chinese pharmaceutical sector.