Market Definition

The market covers the production, distribution, and sale of products that provide vitamins, minerals, amino acids, herbs, enzymes, and other beneficial nutrients for daily uptake in addition to the regular diet. These supplements are available in various forms, including tablets, capsules, powders, gummies, and liquids. The market serves a wide range of consumer needs related to health, wellness, fitness, and nutritional deficiencies.

Dietary Supplements Market Overview

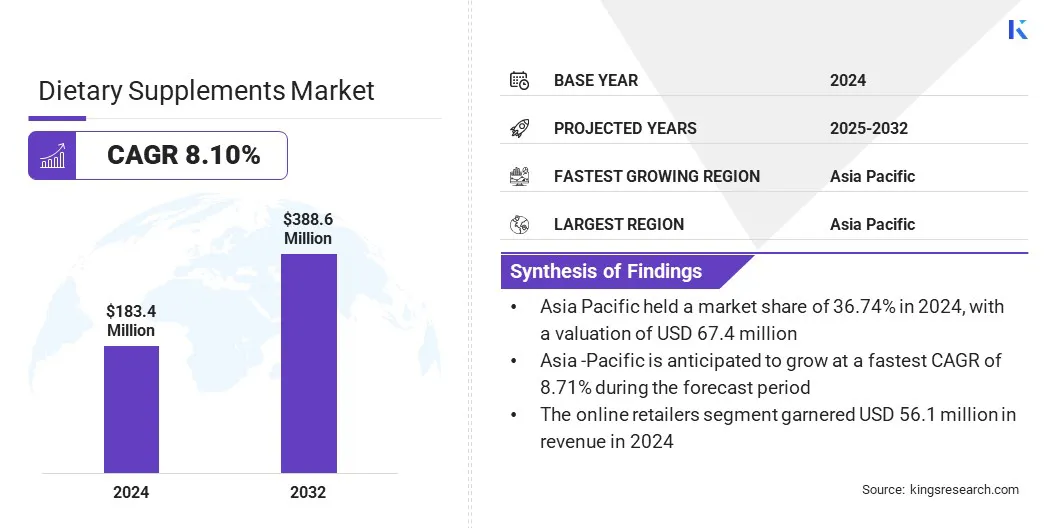

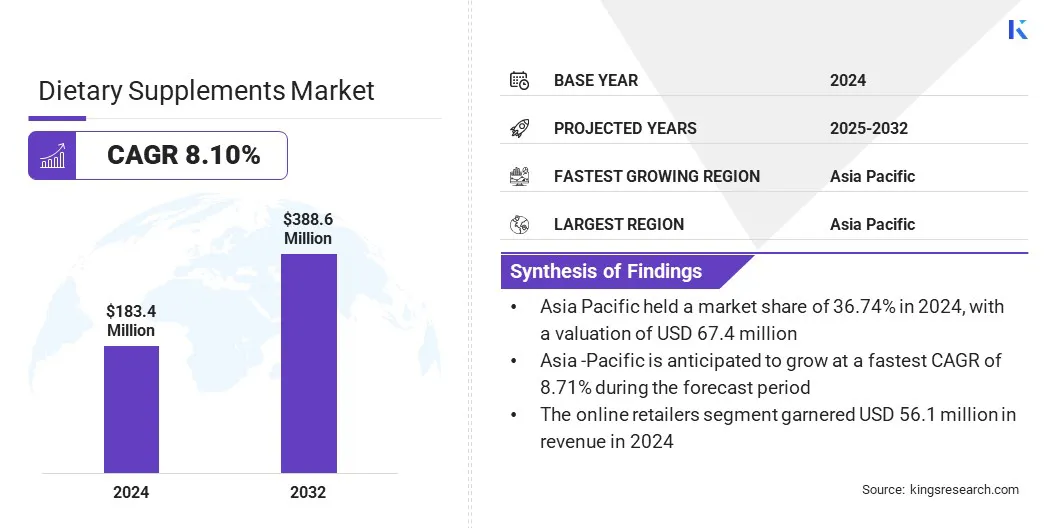

The global dietary supplements market size was valued at USD 183.4 million in 2024 and is projected to grow from USD 196.7 million in 2025 to USD 338.6 million by 2032, exhibiting a CAGR of 8.07% over the forecast period.

Market growth is mainly driven by rising health consciousness among consumers seeking preventive healthcare solutions and nutritional support. The growing preference for clean-label, science-backed dietary supplements is further leading manufacturers to innovate and offer high-quality formulations to meet modern healthcare needs.

Key Highlights:

- The dietary supplements industry size was recorded at USD 183.4 million in 2024.

- The market is projected to grow at a CAGR of 8.07% from 2025 to 2032.

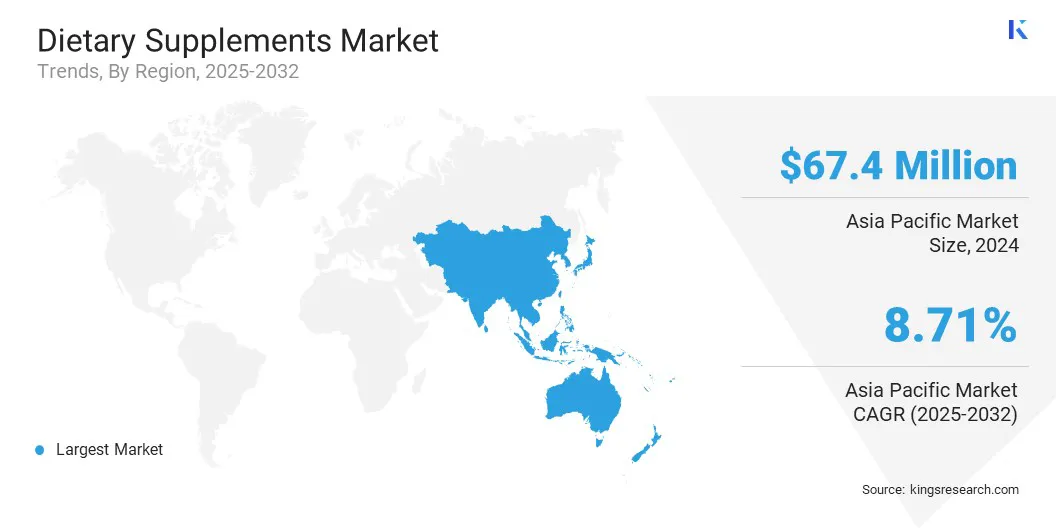

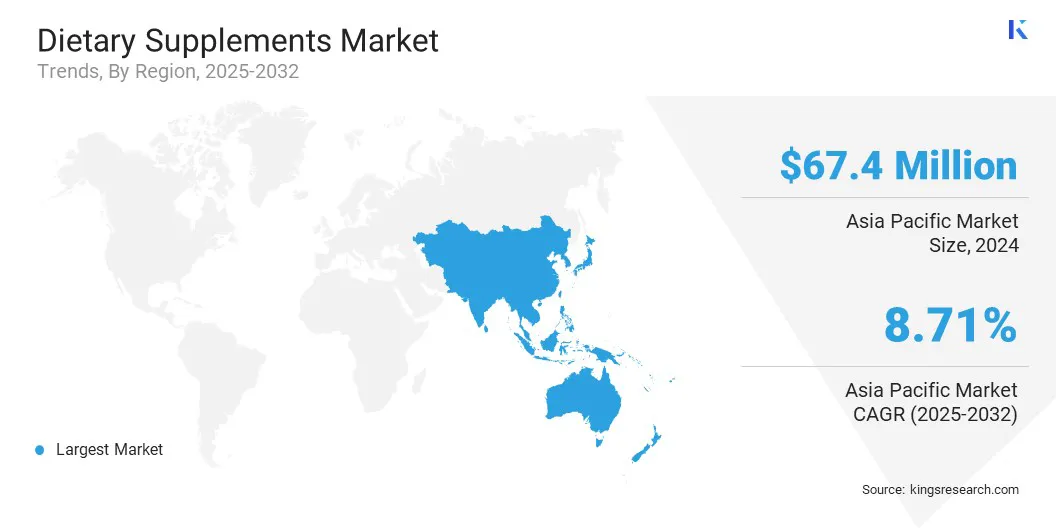

- Asia Pacific held a 36.74% in 2024, with a valuation of USD 67.4 million.

- The vitamins segment garnered USD 65.03 million in revenue in 2024.

- The tablet segment is expected to reach USD 101.7 million by 2032.

- The immunity segment is anticipated to grow at a CAGR of 10.29% over the forecast period.

- The pharmacies/drugstores segment held a share of 39.66% in 2024.

- The market in Europe is anticipated to grow at a CAGR of 8.41% over the forecast period.

Major companies operating in the dietary supplements market are Glanbia plc, Abbott, Bayer AG, Amway India Enterprises Pvt. Ltd, Nestlé S.A, Pharmavite, Herbalife International of America, Inc, NOW Foods, Softgel International Inc, Gemini Pharmaceuticals, Guardian Healthcare Services Pvt. Ltd, Himalaya Wellness Company, Agati Healthcare, Radisun Lifesciences, and ADM.

Aging population worldwide is another factor contributing to the demand for dietary supplements. This demographic shift is fueling the consumption of supplements to support joint health, bone density, heart function, and overall well-being.

- The World Health Organization (WHO) projects that by 2030, 1 in 6 people worldwide will be aged 60 or older, increasing the elderly population from 1 billion in 2020 to 1.4 billion. By 2050, this number is expected to reach 2.1 billion.

Market Driver

Rising Health Awareness

A major factor propelling the growth of the dietary supplements market is rising health awareness among consumers worldwide. Growing emphasis on preventive healthcare is encouraging individuals to adopt supplements to fill nutritional gaps, boost immunity, and enhance overall well-being.

Additionally, health organizations are conducting awareness campaigns, and digital media are providing widespread information to educate consumers about the long-term benefits of vitamins, minerals, and herbal products, further driving market growth.

- According to the Global Wellness Institute, the global wellness economy surged to USD 6.3 trillion in 2023, accounting for 6.03% of the global GDP.

Market Challenge

Supply Chain Disruptions

A key challenge impeding the growth of the dietary supplements market is supply chain disruption. These disruptions are primarily driven by a heavy reliance of companies on global raw material supply. Geopolitical tensions, trade restrictions, and unforeseen events such as pandemics or natural disasters disrupt the supply of essential ingredients.

Delays in transportation, rising freight costs, and shortages of raw materials increase manufacturing timelines and affect product availability. These factors create pricing pressures and profitability challenges, hindering companies from maintaining consistent product quality and meeting consumer demand.

To address this, companies in the market are diversifying their supplier base and investing in local sourcing strategies to reduce dependency on global networks. Manufacturers are building inventories of raw materials and adopting advanced supply chain management technologies for better visibility and agility. Additionally, they are vertically integrating operations to gain control over ingredient quality and availability.

Market Trend

Shift Toward Plant-Based Supplements

A key trend influencing the dietary supplements market is the shift toward plant-based formulations. Manufacturers are developing natural, clean-label products that use plant-derived ingredients such as herbal extracts, superfoods, and botanicals. These products offer improved safety, better digestibility, and ethical production, which meets vegan and vegetarian lifestyle requirements.

Growing consumer awareness regarding the health and environmental advantages of plant-based supplements is driving this transition and accelerating market adoption.

- In January 2025, West Family Ventures launched Zyra Protein Powder in Columbia, Maryland. The plant-based protein supplement features four natural ingredients: pea protein, date powder, strawberry powder, and salt. It offers a clean-label, gluten-free, vegan-friendly, and non-GMO option for health conscious consumers.

Dietary Supplements Market Report Snapshot

|

Segmentation

|

Details

|

|

By Ingredient Type

|

Vitamins, Minerals, Botanicals/Herbal Supplements, Proteins & Amino Acids, Others

|

|

By Form

|

Tablets, Capsules, Powders, Gummies, Others

|

|

By Application

|

Energy & Weight Management, General Health, Bone & Joint Health, Gastrointestinal Health, Immunity, Others

|

|

By Distribution Channel

|

Hypermarkets/Supermarkets, Pharmacies/Drugstores, Specialty Stores, Online Retailers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Ingredient Type (Vitamins, Minerals, Botanicals/Herbal Supplements, Proteins & Amino Acids, and Others): The vitamins segment earned USD 65.03 million in 2024 due to rising awareness of immune health and preventive healthcare practices.

- By Form (Tablets, Capsules, Powders, and Gummies): The tablets segment held 35.12% of the market in 2024, due to convenience, ease of storage, and longer shelf life.

- By Application (Energy & Weight Management, General Health, Bone & Joint Health, and Gastrointestinal Health, Immunity, and Others) : The general health segment is projected to reach USD 96.4 million by 2032, owing to increasing consumer focus on overall wellness and healthy aging.

- By Distribution Channel (Hypermarkets/Supermarkets, Pharmacies/Drugstores, Specialty Stores, Online Retailers): The online retailers segment is anticipated to grow at a CAGR of 9.94% over the forecast period propelled by increasing internet penetration and consumer preference for convenient shopping options.

Dietary Supplements Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific dietary supplements market share stood at around 36.74% in 2024, valued at USD 67.4 million. This dominance is attributed to increasing consumer demand for personalized and science-backed nutrition in the market in the region. Major companies are expanding their product portfolios by integrating advanced health ingredients that address a variety of health concerns such as immunity, energy, and cognitive support.

The availability of such specialized supplements is boosting consumer confidence and increasing the consumer base in the region. Additionally, growing awareness of preventive healthcare across the region is supporting market growth. Product innovation and targeted marketing by regional players are enhancing consumer engagement and reinforcing the region’s leadership in the market.

- In November 2024, OmniActive Health Technologies acquired ENovate Biolife, a developer of clinically researched botanical ingredients, to enhance its position in the dietary supplements space. The acquisition aims to expand OmniActive’s global presence and strengthen its portfolio of high-quality, science-backed health ingredients.

The dietary supplements market in Europe is set to grow at a robust CAGR of 8.41% over the forecast period. This growth is fueled by increasing demand for science-backed and customized health solutions. Advancements in digital platforms are supporting the creation and development of innovative supplements, enabling faster product launches, enhancing formulation accuracy, and addressing evolving consumer health demands.

Additionally, the availability of high-quality botanical and functional ingredients is strengthening the region’s capability to produce effective and specialized formulations. Strong regulatory framework, rising health awareness, and focus on preventive healthcare further support market growth in the region.

- In December 2024, SUANNUTRA launched SuanBlend, a digital platform designed to support dietary supplement companies in concept creation and product development. The platform integrates science-based and botanical ingredients from Monteloeder, S.L., and Gonmisol, S.L., to offer tailored solutions for the European region.

Regulatory Frameworks

- In the U.S., Food and Drug Administration (FDA) is the primary regulatory authority for dietary supplements. They regulate the safety and labeling of these products, ensuring they are not adulterated or misbranded.

- In the UK, Food Standards Agency (FSA) regulates dietary supplements. The FSA is responsible for food safety and hygiene, including food supplements, across the UK.

- In India, Food Safety and Standards Authority of India (FSSAI) regulates dietary supplements under the Food Safety and Standards Act, 2006. FSSAI ensures the safety of food products, including dietary supplements, and regulates their production, distribution, and sale.

Competitive Landscape

Major players in the dietary supplements industry are focusing on strategic acquisitions to expand their market presence and product offerings. They are focusing on delivering high-quality, clean-label supplements that cater to the growing demand for healthier, science-backed nutrition.

They are creating in-house formulations to maintain better control over product quality and drive innovation in dietary supplement development. Additionally, players are expanding sales through direct-to-consumer platforms and e-commerce channels to improve customer reach and engagement.

- In November 2024, Paine Schwartz Partners acquired Promix LLC, a fast-growing brand specializing in high-quality, clean-label nutrition products, including protein mixes, supplements, and low-sugar, high-protein snacks. The acquisition enhances their portfolio with science-backed nutrition options sold through direct-to-consumer channels.

Key Companies in Dietary Supplements Market:

- Glanbia plc

- Abbott

- Bayer AG

- Amway India Enterprises Pvt. Ltd

- Nestlé S.A

- Pharmavite

- Herbalife International of America, Inc

- NOW Foods

- Softgel International Inc

- Gemini Pharmaceuticals

- Guardian Healthcare Services Pvt. Ltd

- Himalaya Wellness Company

- Agati Healthcare

- Radisun Lifesciences

- ADM

Recent Developments

- In December 2024, Auffüllen launched a new range of dietary supplements in India to support holistic wellness for men, women, and children. The product line integrates Ayurvedic, Unani, and herbal wisdom with modern nutraceutical science, offering targeted solutions for energy enhancement, immune support, and stress relief.

- In November 2024, Balchem launched Vital Trio, a three-in-one formula combining vitamin K2, vitamin D3, and magnesium bisglycinate to support immune, cardiovascular, and bone health.

- In April 2024, MiracleMe launched a range of orally dissolving, plant-based nutrition products designed to tackle global micronutrient deficiencies. The innovative formulations, developed without sugar or preservatives, are rich in fruits and vegetables and aim to seamlessly integrate wellness into everyday routines.