Market Definition

Biosimilar monoclonal antibodies are biologic medicines designed to replicate the structure, efficacy, and safety profile of an already approved reference monoclonal antibody. They exhibit high similarity to the original approved product and maintain consistent therapeutic performance in terms of quality, purity, and potency.

The market includes the research, production, and commercialization of biosimilar antibody therapies across oncology, autoimmune diseases, hematology, and ophthalmology, serving hospitals, specialty treatment centers, and infusion facilities.

Biosimilar Monoclonal Antibody Market Overview

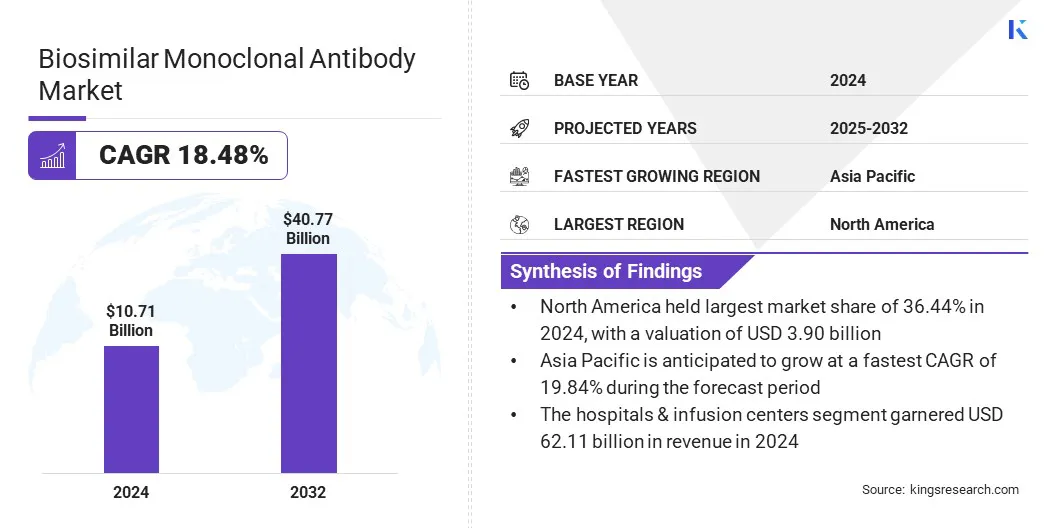

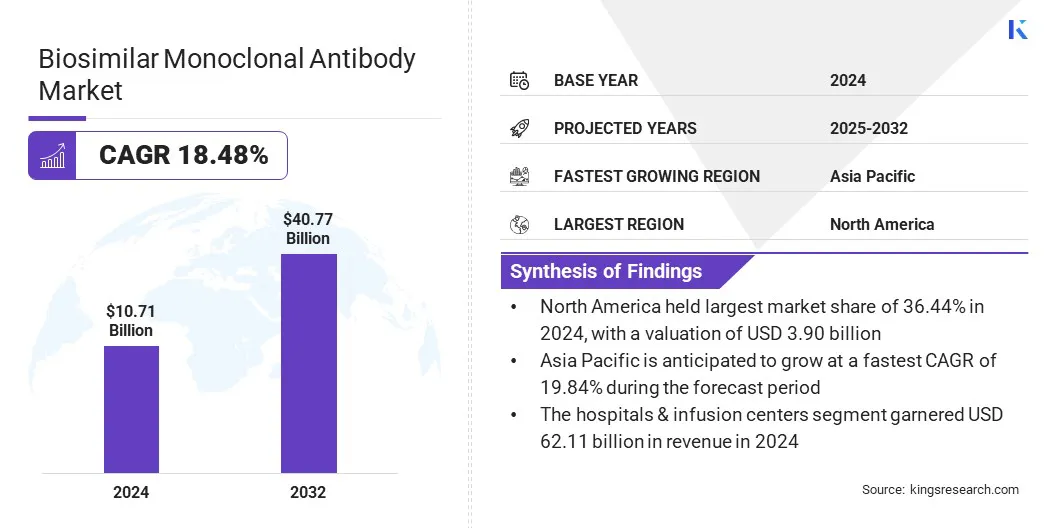

The global biosimilar monoclonal antibody market size was valued at USD 10.71 billion in 2024 and is projected to grow from USD 12.44 billion in 2025 to USD 40.77 billion by 2032, exhibiting a CAGR of 18.48% during the forecast period. The market is experiencing significant growth due to the rising prevalence of cancer and autoimmune diseases worldwide.

Increasing adoption of cost-effective biologic therapies is expanding patient access while stimulating market demand and encouraging investment in biopharmaceutical research and development. Biosimilars reduce treatment costs and enhance drug availability, and supportive healthcare infrastructure coupled with clear regulatory frameworks accelerates their production and commercial adoption across multiple therapeutic areas.

Key Market Highlights

- The global biosimilar monoclonal antibody market size was valued at USD 10.71 billion in 2024.

- The market is projected to grow at a CAGR of 18.48% from 2025 to 2032.

- North America held a market share of 36.44% in 2024, with a valuation of USD 3.90 billion.

- The oncology segment garnered USD 4.40 billion in revenue in 2024.

- The intravenous segment is expected to reach USD 19.69 billion by 2032.

- The hospitals & infusion centers segment is expected to reach USD 23.87 billion by 2032.

Major companies operating in the global biosimilar monoclonal antibody market are Biocon Limited, CELLTRION INC., Sandoz, SAMSUNG, Pfizer Inc., Amgen Inc., Viatris Inc., Dr. Reddy’s Laboratories Ltd., Coherus Oncology, Formycon AG, Alvotech, Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd, and Enzene Biosciences.

Companies are focusing on research and development to advance novel biosimilar monoclonal antibodies and explore expanded therapeutic applications. Companies are also pursuing strategic acquisitions to strengthen regional presence, enhance distribution capabilities, and accelerate commercialization, enabling broader patient access and strengthening their competitive position globally.

- In November 2024, Celltrion acquired iQone Healthcare Switzerland to accelerate direct commercialization of its biosimilars in Europe, strengthen its presence, and expand access to innovative therapies, leveraging iQone’s distribution, sales, and marketing expertise across Switzerland.

What are the major factors driving market growth?

The biosimilar monoclonal antibody market is witnessing significant growth due to the rising prevalence of chronic and oncology-related diseases worldwide. According to the Centers for Disease Control and Prevention’s Preventing Chronic Disease report, in 2023, 76.4% of United States adults (194 million) had at least one chronic condition, and 51.4% (130 million) had multiple chronic conditions, highlighting the growing patient populations requiring effective therapies.

Increasing incidence of cancer, autoimmune disorders, and other long-term conditions drives demand for targeted biologic treatments. Healthcare systems are seeking cost-efficient alternatives to reference biologics, promoting broader adoption of biosimilars.

The growing disease burden and emphasis on sustainable healthcare spending accelerate research, development, and commercialization of biosimilar monoclonal antibodies, fostering innovation and expanding global treatment access.

What are the major obstacles for this market?

A major challenge in the biosimilar monoclonal antibody market is regulatory complexity combined with high development costs. Developing biosimilars requires extensive clinical trials to prove similarity to the reference biologic, which consumes significant time and financial resources. Diverse regulatory frameworks across countries complicate market entry and increase the risk of delays.

To overcome these obstacles, manufacturers form strategic partnerships and collaborations to share costs and leverage specialized expertise. Companies invest in advanced manufacturing technologies and modular production platforms, enabling streamlined development, reduced expenses, and faster regulatory approvals, which supports efficient market entry while ensuring full compliance.

Which technological trends are shaping the market?

The biosimilar monoclonal antibody market is witnessing a growing trend toward developing interchangeable biosimilars, allowing direct substitution with reference biologics. Manufacturers increasingly focus on interchangeability to enhance adoption rates and strengthen market competitiveness. This trend supports improved patient access and more efficient treatment protocols while addressing healthcare system demands for cost-effective therapies.

Interchangeable biosimilars are reshaping prescribing practices, guiding portfolio strategies, and promoting wider acceptance across hospitals, specialty centers, and clinics globally, reflecting a shift in integrating biosimilar therapies into standard treatment pathways.

- In June 2025, Sandoz launched WYOST and Jubbonti, the first interchangeable FDA-approved denosumab biosimilars in the U.S., providing cost-effective treatment options for osteoporosis and cancer-related skeletal events while strengthening the company’s biosimilar portfolio and patient access initiatives.

Biosimilar Monoclonal Antibody Market Report Snapshot

|

Segmentation

|

Details

|

|

By Therapeutic Area

|

Oncology, Autoimmune & Inflammatory Diseases, Hematology, Ophthalmology, Others

|

|

By Route of Administration

|

Intravenous, Subcutaneous, Intravitreal, Others

|

|

By End-User

|

Hospitals & Infusion Centers, Specialty Treatment Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Therapeutic Area (Oncology, Autoimmune & Inflammatory Diseases, Hematology, Ophthalmology, and Others): The oncology segment earned USD 4.40 billion in 2024 one sentence each write relevant answers

- By Route of Administration (Intravenous, Subcutaneous, Intravitreal, Others): The intravenous segment held 55.26% of the market in 2024, due to its established use in hospital settings and compatibility with most biosimilar antibodies.

- By End-User (Hospitals & Infusion Centers, Specialty Treatment Centers, Others): The hospitals & infusion centers segment is projected to reach USD 23.87 billion by 2032, owing to expanding healthcare infrastructure and increasing patient access to advanced biologic therapies.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the biosimilar monoclonal antibody market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America biosimilar monoclonal antibody market share stood at around 36.44% in 2024 in the global market, with a valuation of USD 3.90 billion. This dominance is due to advanced healthcare infrastructure that enables hospitals and specialty centers to distribute and administer biologic therapies efficiently. Strong regulatory support from the U.S. FDA provides clear guidance on approval, interchangeability, and post-market monitoring, encouraging investment and increasing biosimilar adoption.

Robust research and development initiatives focus on novel monoclonal antibodies and expanded therapeutic applications. These efforts leverage the region’s advantages and drive innovation, reinforcing North America’s market position and sustaining its leadership in the market.

- In April 2025, Biocon Biologics received U.S. FDA approval for Jobevne, a biosimilar to Avastin, expanding its oncology portfolio alongside OGIVRI and FULPHILA. The approval strengthens Biocon’s presence in the U.S., Europe, and Canada and enhances its pipeline of 20 biosimilar assets across multiple therapies.

The biosimilar monoclonal antibody industry in Asia Pacific is expected to register fastest growth in the market, with a projected CAGR of 19.84% over the forecast period. This growth is fueled by the rising prevalence of cancer in China, India, and Japan, which increases the demand for effective biologic therapies.

Expanding healthcare infrastructure, growing awareness of biosimilar treatments, and supportive government initiatives enhance accessibility and adoption, enabling hospitals and specialty centers to deliver therapies efficiently.

Pharmaceutical companies are actively expanding their biosimilar portfolios through strategic commercialization and licensing initiatives, leveraging regional expertise in regulatory approvals, distribution, and market penetration, while collaborations with local partners support broader adoption in high-demand regions.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates biosimilar monoclonal antibodies providing a framework for approval, interchangeability, and post-market surveillance.

- In the Europe, the European Medicines Agency (EMA) evaluates and approves biosimilars ensuring they meet stringent standards of quality, safety, and efficacy.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees the approval, labeling, and pharmacovigilance of biosimilar monoclonal antibodies to maintain therapeutic equivalence with reference products.

- In China, the National Medical Products Administration (NMPA) governs the regulation, clinical evaluation, and commercialization of biosimilar products, promoting accessibility while ensuring patient safety.

- In India, the Central Drugs Standard Control Organization (CDSCO) sets comprehensive guidelines for the development, clinical trials, approval, and post-marketing surveillance of biosimilar monoclonal antibodies to ensure they meet global standards.

Competitive Landscape

Key players in the biosimilar monoclonal antibody industry are strengthening their competitive positions through strategic partnerships and investments. Companies are forming collaborations with regional distributors and healthcare providers to enhance market access, streamline regulatory approvals, and expand the commercial reach of biosimilar portfolios across high-growth regions.

Key players are also increasing investments in advanced manufacturing infrastructure and clinical research capabilities to accelerate product development and ensure consistent supply quality. These strategies enable firms to improve operational efficiency, establish strong regional footprints, and sustain long-term competitiveness in the evolving biosimilar landscape.

- In October 2025, Hikma Pharmaceuticals and Celltrion entered exclusive licensing agreements to introduce six biosimilar treatments across the MENA region. The collaboration aims to expand access to affordable biologics for oncology, immune, ophthalmic, and other chronic disease treatments.

Key Companies in Biosimilar Monoclonal Antibody Market:

- Biocon Limited

- CELLTRION INC.

- Sandoz

- SAMSUNG

- Pfizer Inc.

- Amgen Inc.

- Viatris Inc.

- Reddy’s Laboratories Ltd.

- Coherus Oncology

- Formycon AG

- Alvotech

- Teva Pharmaceutical Industries Ltd.

- Boehringer Ingelheim International GmbH

- Hoffmann-La Roche Ltd

- Enzene Biosciences

Recent Developments

- In March 2025, Bio-Thera Solutions and Dr. Reddy’s Laboratories entered into an exclusive commercialization and licensing agreement for BAT2206, a proposed Stelara biosimilar, and BAT2506, a proposed Simponi biosimilar, covering Southeast Asia and select emerging markets, including Colombia.

- In July 2024, Amneal Pharmaceuticals, Inc. expanded its biosimilar portfolio to eight products with the addition of omalizumab, a humanized monoclonal antibody, in partnership with Kashiv BioSciences, advancing development in allergy treatments and currently undergoing Phase III clinical trials in the U.S.

- In May 2024, the U.S. FDA approved Bkemv as the first interchangeable biosimilar to Soliris, offering treatment for paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome, with comparable safety, efficacy, and pharmacy-level substitution potential for patients.