Market Definition

The market comprises engineered substances designed to protect personnel, vehicles, infrastructure, and equipment against ballistic, impact, and blast threats. These materials include metals and alloys, ceramics, and advanced composites, known for their high strength, durability, and ability to withstand extreme conditions.

The report covers segmentation by material, application, and region, offering insights into market trends, growth drivers, technological advancements, and regulatory frameworks. Armor materials are applied across vehicle, aerospace, body, civil, and marine protection systems, ensuring operational safety, resilience, and reliability.

Armor Materials Market Overview

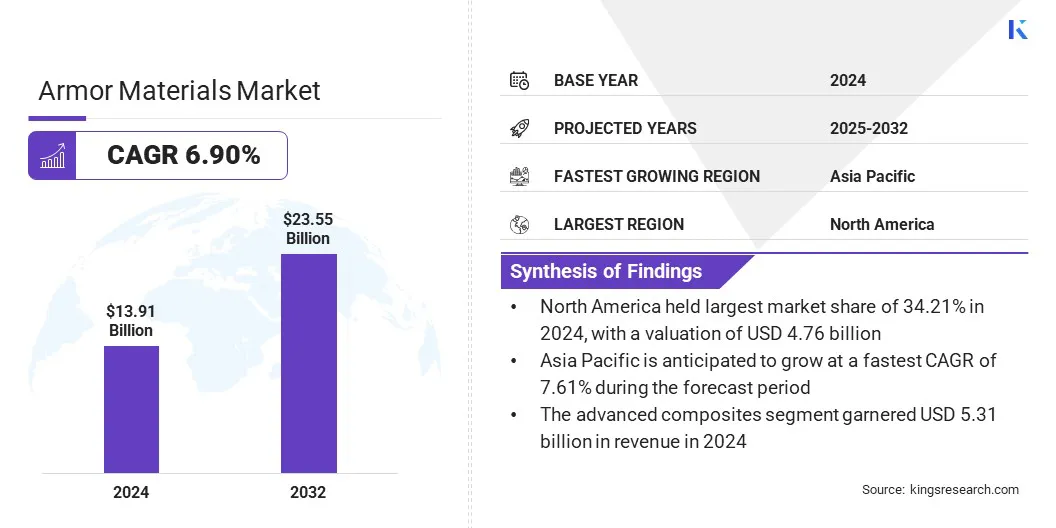

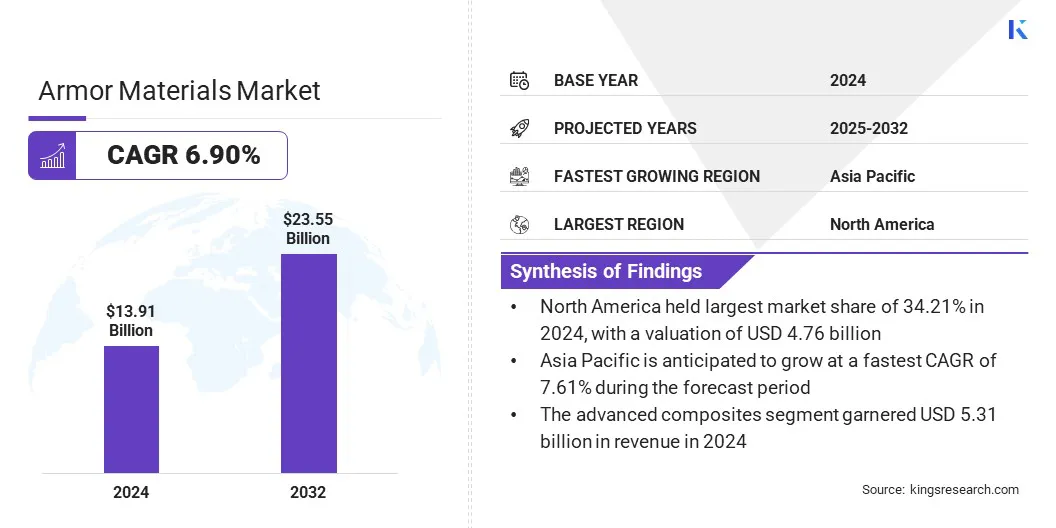

The global armor materials market size was valued at USD 13.91 billion in 2024 and is projected to grow from USD 14.76 billion in 2025 to USD 23.55 billion by 2032, exhibiting a CAGR of 6.90% over the forecast period.

This growth is attributed to the increasing demand for high-performance armor materials that offer superior strength, durability, and resistance across military, defense, and law enforcement applications. Expanding use in armored vehicles, aerospace platforms, personal protective equipment, and civil infrastructure is further supporting widespread adoption, enhancing safety and operational reliability in critical environments.

Key Highlights

- The armor materials industry size was valued at USD 13.91 billion in 2024.

- The market is projected to grow at a CAGR of 6.90% from 2025 to 2032.

- North America held a market share of 34.21% in 2024, valued at USD 4.76 billion.

- The advanced composites segment garnered USD 5.31 billion in revenue in 2024.

- The vehicle armor segment is expected to reach USD 7.88 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.61% through the projection period.

Major companies operating in the armor materials market are DuPont, Saint-Gobain, Honeywell International Inc., ATI, CoorsTek Inc., Avient Corporation, SSAB group, Röchling SE & Co. KG, Alcoa Corporation, BAE Systems, CeramTec GmbH, HS HYOSUNG Corporation, JPS Composite Materials, Morgan Advanced Materials, and NP Aerospace.

The rising focus on lightweight, high-strength, and technologically advanced materials is driving innovation in armor solutions, aligning with evolving performance and regulatory requirements. Additionally, continuous advancements in metals, ceramics, and composite technologies, combined with expanding applications, are boosting market penetration.

- In January 2025, Dyneema launched its HB330 and HB332 hard ballistic materials, featuring third-generation fiber technology that enabled a 45% weight reduction in protective armor systems. These unidirectional materials offered improved stiffness, thermal stability, and superior V50 ballistic performance, setting a benchmark for lightweight, high-performance armor solutions.

How is rising defense and military expenditure driving the market?

The growth of the armor materials market is fueled by rising defense and military expenditure across the globe. These materials provide critical protection for armored vehicles, aircraft, naval vessels, and personal protective equipment, ensuring operational safety and resilience.

Defense forces are increasingly adopting metals, ceramics, and advanced composites to enhance battlefield performance, personnel safety, and mission reliability. Adoption is being reinforced by continuous modernization programs, strategic procurement initiatives, and the need for high-strength, lightweight solutions. This trend is strengthening manufacturers’ ability to meet performance, protection, and operational objectives.

- In February 2025, Dyneema showcased its latest law enforcement and defense armor materials at Enforce Tac 2025, highlighting ultra-high molecular weight polyethylene fiber solutions for body armor, helmets, and hard panels. The company introduced its lightest hard ballistic materials, Dyneema HB330 and HB332, which offer enhanced protection with reduced weight.

How does the limited availability & scalability of advanced composites restrict growth in the market?

Limited availability and scalability of advanced composites create a significant barrier to the growth of the armor materials market. Many high-performance composites require specialized raw materials, precise formulations, and complex manufacturing processes that restrict large-scale production.

Scaling up production while maintaining consistent strength, durability, and cost-efficiency often demands significant investment and advanced technical expertise, which can be challenging for smaller manufacturers. Defense, aerospace, marine, and civil protection sectors face additional hurdles, as materials must meet strict performance and safety standards for critical applications.

To address these constraints, companies are increasingly investing in supply chain optimization, process innovation, and strategic partnerships with specialized material suppliers. These approaches aim to improve production capacity and ensure material reliability.

How is the integration of smart materials and nanotechnology shaping the market?

The armor materials market is witnessing a growing trend toward the integration of smart materials and nanotechnology to enhance protection and performance. Smart materials enable adaptive responses to impact, pressure, or temperature changes, offering self-healing and energy-dissipating capabilities in armor systems.

Nanotechnology improves mechanical strength, flexibility, and ballistic resistance while reducing overall weight, enabling the development of lighter yet stronger protective solutions. This advancement is particularly valuable for defense, aerospace, and law enforcement sectors, where operational efficiency and survivability are critical.

Organizations are increasingly investing in nano-engineered composites, ceramics, and coatings to enhance durability and extend the service life of armor systems. Continuous innovation in this area is positioning smart and nanotechnology-based materials as key enablers of next-generation armor development and long-term market growth.

- In August 2024, Elsevier published a study highlighting the use of lightweight composites, including metal, polymer, ceramic, and fiber-based materials, to enhance ballistic protection, reduce weight, and improve overall performance in armor systems.

Armor Materials Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Metals & Alloys, Ceramics, Advanced Composites, and Others

|

|

By Application

|

Vehicle Armor, Aerospace Armor, Body Armor, Civil Armor, and Marine Armor

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Metals & Alloys, Ceramics, Advanced Composites, and Others): The advanced composites segment earned USD 5.31 billion in 2024 due to their superior strength-to-weight ratio and enhanced ballistic protection capabilities.

- By Application (Vehicle Armor, Aerospace Armor, Body Armor, Civil Armor, and Marine Armor): The vehicle armor held 32.87% of the market in 2024, due to rising defense modernization programs and increased demand for lightweight, high-performance protection systems in military and tactical vehicles.

What is the market scenario in North America and Asia Pacific region?

Based on region, the global armor materials market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America armor materials market share stood at 34.21% in 2024, valued at USD 4.76 billion. T This dominance is driven by substantial defense and military modernization programs aimed at upgrading armored vehicles, protective gear, and surveillance systems. Governments are investing in advanced protective materials and processes including lightweight composites and high-performance ceramics to enhance soldier safety and vehicle survivability.

Leading manufacturers and defense contractors in the region are prioritizing research and development of next-generation armor solutions that improve operational efficiency in terms of mobility, fuel economy, and ease of deployment during military and homeland security operations. These combined efforts are strengthening the regional ecosystem for innovation and large-scale production of advanced armor materials.

- In October 2025, Ace Link Armor unveiled its Thermacore Heat Dispersion System at SHOT Show 2026 in Las Vegas. The system utilized graphene and phase-change molecule (PCM) technology to transfer heat away from the body, improving comfort and reducing heat stress under ballistic protection.

The Asia Pacific armor materials industry is set to grow at a CAGR of 7.61% over the forecast period. This growth is driven by rising defense spending, expanding procurement of armored vehicles, and increasing demand for personal protective equipment across military, aerospace, and civil sectors.

The growing adoption of high-strength metals, ceramics, and advanced composites, along with innovations in lightweight and modular armor systems, is enhancing protection capabilities, operational efficiency, and material performance. Regional governments and defense agencies are investing in local manufacturing, research and development, and technology transfer to strengthen domestic production capabilities.

These initiatives are driving the Asia Pacific market by reducing reliance on imports, accelerating the adoption of advanced materials, and enabling cost-effective, large-scale production to meet growing defense and security requirements.

Regulatory Frameworks

- In the U.S., the International Traffic in Arms Regulations (ITAR) regulates the export and import of defense-related materials. It ensures that advanced metals, ceramics, and composites used in military and defense applications are controlled for national security and foreign policy compliance.

- In India, the Defence Procurement Procedure (DPP) regulates the acquisition of armor materials for the armed forces. It outlines requirements for material quality, domestic manufacturing preference, and compliance with technical and safety standards.

- Internationally, North Atlantic Treaty Organization (NATO) Standardization Agreements (STANAGs) regulate the design, testing, and performance of armor materials among member countries. They ensure interoperability, consistent protection levels, and safety standards across allied military forces.

Competitive Landscape

Companies operating in the armor materials industry are maintaining competitiveness through investments in advanced manufacturing technologies, high-performance composites, and strategic partnerships and acquisitions. They are producing metals, ceramics, and composite armor solutions for applications in vehicles, aerospace, personal protection, marine, and civil infrastructure to meet strength, durability, and regulatory requirements.

Market players are expanding their offerings with lightweight, modular, and smart material-based armor systems to address evolving defense and civil protection needs.

Moreover, they are establishing regional production facilities and collaborating with technology providers and research institutions to enhance innovation and supply chain efficiency. Additionally, companies are providing technical support, material testing, and application guidance to improve operational performance and sustain competitive positioning.

- In October 2025, Atomic-6 introduced Space Armor tiles, a space composite designed to protect spacecraft and astronauts from orbital debris. The tiles resist high-velocity impacts while maintaining radio communications, offering scalable protection for commercial and government satellites.

Top Key Companies in Armor Materials Market:

- DuPont

- Saint-Gobain

- Honeywell International Inc.

- ATI

- CoorsTek Inc.

- Avient Corporation

- SSAB group

- Röchling SE & Co. KG

- Alcoa Corporation

- BAE Systems

- CeramTec GmbH

- HS HYOSUNG Corporation

- JPS Composite Materials

- Morgan Advanced Materials

- NP Aerospace

Recent Developments (Launch)

- In April 2023, DuPont launched Kevlar EXO, a next-generation aramid fiber offering improved protection, flexibility, and reduced weight for body armor and tactical gear. The material enhanced ballistic and thermal resistance to meet evolving performance needs in defense and law enforcement applications.