Market Definition

The market encompasses the production and application of high-performance composite materials composed of fibers and a matrix, offering enhanced strength, durability, and lightweight properties. Comon materials include carbon fiber, glass fiber, aramid fibers, and specialized resins. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Advanced Composites Market Overview

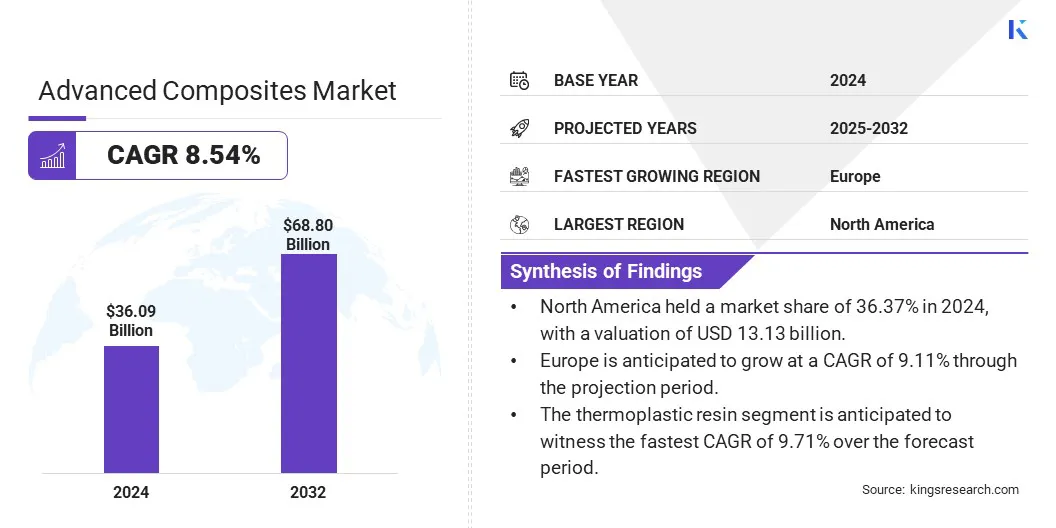

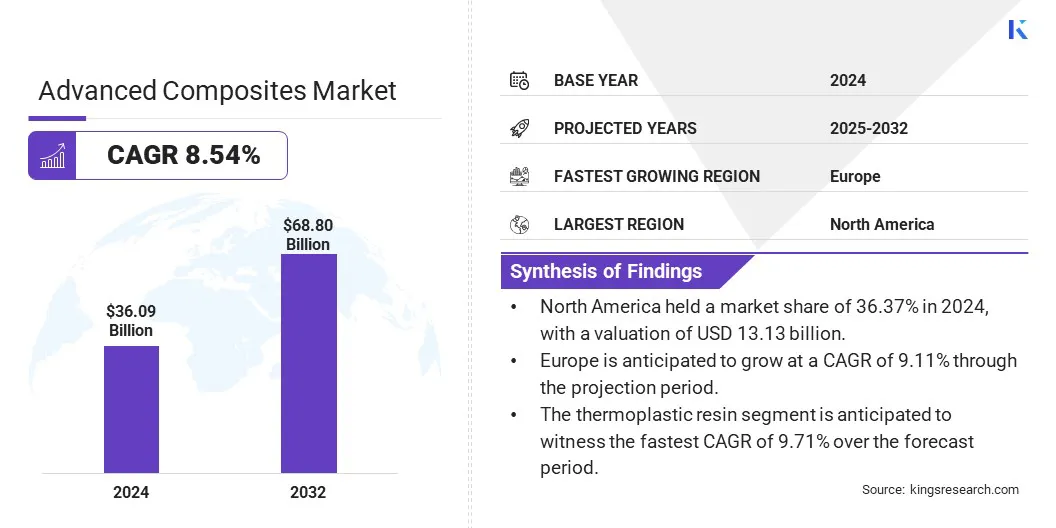

The global advanced composites market size was valued at USD 36.09 billion in 2024 and is projected to grow from USD 38.76 billion in 2025 to USD 68.80 billion by 2032, exhibiting a CAGR of 8.54% during the forecast period.

This growth is attributed to the rising adoption of advanced composites across diverse end-use sectors such as aerospace, automotive, wind energy, and construction. Increasing demand for lightweight, high-strength materials that enhance fuel efficiency, reduce emissions, and improve structural performance is accelerating their integration.

Major companies operating in the advanced composites industry are Hexcel Corporation, TORAY INDUSTRIES, INC., SGL Carbon, Honeywell International Inc., TEIJIN AUTOMOTIVE TECHNOLOGIES., Solvay, TPI Composites Inc, BASF, DuPont, Kineco Kaman Composites India, DowAksa, Mitsubishi Chemical Group, Arkema, Axiom Materials, and Advanced Composites Inc.

The growing emphasis on sustainable materials and stringent environmental regulations is boosting market progress, particularly in the transportation and energy sectors. Additionally, ongoing innovations in resin chemistry, fiber reinforcement technologies, and cost-effective manufacturing processes along with expanding applications in defense, marine, and sporting goods are bolstering the development of the market.

- In August 2024, Fives Machining Systems Inc. joined the Advanced Composites Consortium (ACC) to support NASA’s HiCAM project, which aims to increase the production of lightweight composite aircraft. As a Tier 2 member, Fives will contribute its expertise in automated manufacturing and digital technologies to improve efficiency, quality, and scalability in aerospace composites.

Key Highlights

- The advanced composites industry size was valued at USD 36.09 billion in 2024.

- The market is projected to grow at a CAGR of 8.54% from 2025 to 2032.

- North America held a market share of 36.37% in 2024, with a valuation of USD 13.13 billion.

- The carbon fiber segment garnered USD 14.22 billion in revenue in 2024.

- The lay-up segment is expected to reach USD 28.32 billion by 2032.

- The thermoplastic resin segment is anticipated to witness the fastest CAGR of 9.71% over the forecast period.

- The aerospace & defense segment garnered USD 18.02 billion in revenue in 2024.

- Europe is anticipated to grow at a CAGR of 9.11% through the projection period.

Market Driver

Increasing Demand for High-Performance Lightweight Structural Materials

The growth of the advanced composites market is stimulated by the increasing demand for high-performance lightweight structural materials across key industries such as aerospace, automotive, and renewable energy. With rising emphasis on fuel efficiency, emissions reduction, and enhanced system performance, manufacturers are actively seeking materials that offer superior strength-to-weight ratios and long-term durability.

This is prompting widespread adoption of advanced composites such as carbon fiber and glass fiber-reinforced polymers, which offer significant weight reduction without compromising structural integrity. These materials are increasingly used in aircraft components, vehicle bodies, and wind turbine blades to optimize operational efficiency and meet evolving regulatory standards.

This shift is further supported by advancements in material science and manufacturing technologies, which are improving the affordability, scalability, and performance characteristics of lightweight composites. The surging demand for sustainable, high-efficiency solutions across both established and emerging sectors is propelling market expansion.

- In September 2024, Toray Advanced Composites introduced Toray Cetex TC1130 PESU, a high-performance thermoplastic composite material designed for lightweight and sustainable aircraft interiors. It offers superior mechanical strength, flame resistance, and processability, meeting advanced aerospace manufacturing requirements.

Market Challenge

Complex Manufacturing Procedures

The complexity of advanced composite manufacturing procedures presents a significant challenge to the growth of the advanced composites market, particularly in aerospace, automotive, and renewable energy sectors. The fabrication processes, such as autoclaving, resin transfer molding, and automated fiber placement, require precise control and skilled labor to ensure product quality and consistency.

Additionally, the extended production times and risk of defects during manufacturing can increase costs and limit scalability, impacting timely delivery and overall reliability. These procedural challenges can hinder mass production and slow down innovation cycles.

To address these issues, manufacturers are increasingly adopting automation and digital monitoring technologies that enhance precision and reduce manual errors. Process optimization software and real-time quality control systems are being implemented to streamline production and minimize waste.

Furthermore, workforce training and standardized fabrication protocols are developed to improve efficiency and consistency. Collaborative efforts across the supply chain are fostering innovations that simplify manufacturing.

Market Trend

Advancements in Manufacturing Techniques

Advancements in manufacturing techniques are significantly transforming the advanced composites industry by enhancing production efficiency, precision, and scalability. Modern fabrication methods such as automated fiber placement (AFP), resin transfer molding (RTM), and additive manufacturing enable the creation of complex composite structures with improved accuracy and reduced material waste. These innovations enable faster, cost-effective of high-quality components, supporting applications in aerospace, automotive, and renewable energy sectors.

Enhanced process automation and real-time monitoring systems contribute to consistent quality control and minimize defects, thereby reducing production costs and lead times. Furthermore, the integration of digital technologies and advanced simulation tools is facilitating optimized design and fabrication workflows, enabling more customized and lightweight composite solutions.

As manufacturing techniques advances, they are leading to greater adoption of advanced composites by making them more accessible and economically viable across diverse industries.

- In May 2024, the Press Information Bureau of India reported that the Ministry of Textiles, in collaboration with the Confederation of Indian Industry and Ahmedabad Textile Industry’s Research Association, held a National Symposium in New Delhi on advancements in advanced composites. The event highlighted the growing use of composites in aerospace, automotive, defense, and infrastructure, emphasizing sustainability, innovation, and standards development.

Advanced Composites Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fiber Type

|

Carbon Fiber, Glass Fiber, Aramid Fiber, and Others

|

|

By Manufacturing Process

|

Lay-Up, Filament Winding, Injection Molding, Pultrusion, and Others

|

|

By Resin Type

|

Thermosetting Resin, Thermoplastic Resin, and Others

|

|

By Application

|

Aerospace & Defense, Automotive, Wind Energy, Construction, and Marine

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Fiber Type (Carbon Fiber, Glass Fiber, Aramid Fiber, and Others): The carbon fiber segment earned USD 14.22 billion in 2024, mainly due to its superior strength-to-weight ratio and increasing demand in aerospace and automotive applications.

- By Manufacturing Process (Lay-Up, Filament Winding, Injection Molding, Pultrusion, and Others): The lay-up segment held a share of 38.36% in 2024, propelled by its versatility and widespread use in producing large, complex composite structures with high structural integrity.

- By Resin Type (Thermosetting Resin, Thermoplastic Resin, and Others): The thermosetting resin segment is projected to reach USD 37.64 billion by 2032, owing to its excellent mechanical properties, thermal stability, and strong bonding capabilities in high-performance composite applications.

- By Application (Aerospace & Defense, Automotive, Wind Energy, Construction, and Marine): The aerospace & defense segment is anticipated to grow at a CAGR of 9.65% over the forecast period, largely fueled by increasing demand for lightweight, durable materials to enhance fuel efficiency and performance in aircraft and defense equipment.

Advanced Composites Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America advanced composites market share stood at around 36.37% in 2024, valued at USD 13.13 billion. This dominance is attributed to the presence of leading aerospace and automotive manufacturers, substantial investments in research and development, and stringent regulations promoting the use of lightweight, fuel-efficient materials.

- In April 2023, the U.S. Department of Energy renewed funding for the Institute for Advanced Composites Manufacturing Innovation (IACMI) with an initial investment of USD 6 million. The institute focuses on accelerating the development and commercialization of advanced composite materials to enhance energy efficiency and reduce manufacturing costs.

North America’s advanced manufacturing infrastructure and early adoption of innovative composite technologies support sustained regional market growth. Favorable government initiatives aimed at boosting defense spending, renewable energy projects, and advanced materials research further aid this expansion.

Furthermore, increasing demand for high-performance composites in sectors such as wind energy, construction, and marine is contributing to regional market expansion.

- In March 2024, Avient Corporation showcased its Polystrand thermoplastic composites at the American Composites Manufacturers Association (ACMA) Thermoplastic Composites Conference in San Diego. Highlights included lightweight ThermoBallistic panels, recycled-content fiber tapes, and Hammerhead Marine Composite Panels, emphasizing sustainability and innovation.

The Europe advanced composites industry is set to grow at a robust CAGR of 9.11% over the forecast period. This growth is attributed to the increasing focus on sustainability and the adoption of lightweight materials in automotive, aerospace, and renewable energy sectors, creating a demand for advanced composites.

The region’s strong regulatory framework promoting environmental compliance, along with major R&D initiatives and collaboration between industry and academia, supports continuous innovation in composite materials and manufacturing processes.

Expanding investments in wind energy projects and infrastructure development are further accelerating the application of advanced composites across various industries. Additionally, advancements in bio-based composites and recycling technologies are enhancing the environmental profile of these materials, thereby propelling regional market growth.

- In October 2024, German company Envalior expanded its Tepex high-performance thermoplastic composites line with advanced matrix materials such as polyetherimide (PEI), polyphenylene sulfide (PPS), and polyamide 4.6 (PA4.6), targeting aerospace, automotive, and industrial applications.

Regulatory Frameworks

- In international markets, ISO/TC 61/SC 12 regulates thermosetting materials used in advanced composites by developing standards for the characterization, testing, and application. This subcommittee ensures the quality, performance, and safety of thermosetting resins and related materials, supporting consistency and reliability in composite manufacturing.

- In the European Union, the European Union Aviation Safety Agency (EASA) sets certification standards for advanced composites in aerospace, ensuring structural integrity, performance, and safety of aircraft components.

Competitive Landscape

The advanced composites industry is characterized by a diverse mix of well-established global manufacturers and emerging regional players, each focusing on expanding their product portfolios and market reach through technological innovation, capacity expansion, and strategic partnerships.

- In June 2024, Advanced Composites Solutions (ACS) announced a USD 4.35 million investment to open a second manufacturing facility in Tortoreto, Italy, aimed at expanding capacity to meet rising demand from the automotive and aerospace sectors.

Leading companies are heavily investing in research and development to enhance the mechanical properties, durability, and sustainability of composite materials, while also improving manufacturing efficiencies. They are developing cost-effective and lightweight composite solutions to meet the rising demand across aerospace, automotive, wind energy, and construction sectors. Additionally, firms are collaborating with key stakeholders in these industries to customize composite materials and accelerate the adoption of advanced composites in specialized applications.

List of Key Companies in Advanced Composites Market:

- Hexcel Corporation

- TORAY INDUSTRIES, INC.

- SGL Carbon

- Honeywell International Inc.

- TEIJIN AUTOMOTIVE TECHNOLOGIES.

- Solvay

- TPI Composites Inc.

- BASF

- DuPont

- Kineco Kaman Composites India

- DowAksa

- Mitsubishi Chemical Group

- Arkema

- Axiom Materials

- Advanced Composites Inc.

Recent Developments (M&A/Partnerships/Agreements/Product Launch)

- In May 2025, Tata AutoComp Systems and Katcon Global formed a joint venture in Monterrey, Mexico, to manufacture advanced composite materials for automotive and non-automotive applications in North America. This collaboration leverages Tata’s technology and Katcon’s local expertise to support lightweight, sustainable solutions for improved fuel efficiency and emissions reduction.

- In March 2025, Hexcel Corporation partnered with Spain’s FIDAMC to advance composite materials through joint R&D, focusing on performance, sustainability, and new applications in aerospace, automotive, and industrial sectors. This collaboration leverages advanced manufacturing, artificial intelligence, and digitalization to set new industry standards and foster innovation in composite materials.

- In February 2025, The Thermal Group expanded its capabilities by acquiring Advanced Composite Technologies (ACT) Aerospace, enhancing its portfolio in thermal management and composite solutions for aerospace and defense industries. This acquisition strengthens The compaany's position in advanced materials and supports its commitment to delivering innovative, high-performance solutions to global aerospace customers.

- In November 2024, ADDMAN Group and Continuous Composites partnered to advance Continuous Fiber 3D Printing (CF3D) technology for hypersonic and UAV applications. CF3D employs high-performance composite materials along with fast-curing thermoset resins to fabricate intricate, multifunctional components that integrate both structural and functional fibers.

- In November 2024, Daikin Industries invested in Advanced Composite Corporation to develop lightweight, energy-efficient aluminum-based composites for heating, ventilation, air conditioning, and refrigeration (HVAC&R) compressor components, supporting greener product innovation. This partnership highlights Daikin’s commitment to advancing sustainable technologies through the use of advanced composite materials.

- In June 2024, Germany’s Biesterfeld Group acquired South Africa’s Aerontec Pty Ltd, expanding its presence in sub-Saharan Africa and strengthening its position in advanced composite materials distribution across key industries. This acquisition supports Biesterfeld’s strategy to expand its global footprint and better serve customers in the marine, transportation, aerospace, and consumer goods sectors.