Market Definition

The market comprises components and technologies that initiate combustion within aircraft engines by generating and delivering a high-voltage spark to ignite the air-fuel mixture. These systems ensure reliable engine performance, efficient fuel combustion, and stable operation under varying flight conditions.

The report covers segmentation by type, engine type, component, platform, and region, offering insights into market trends, growth drivers, and technological developments. Aircraft ignition systems are used across turbine and reciprocating engines in commercial, military, and general aviation fleets, supporting enhanced fuel efficiency, reduced emissions, and improved operational reliability.

Aircraft Ignition System Market Overview

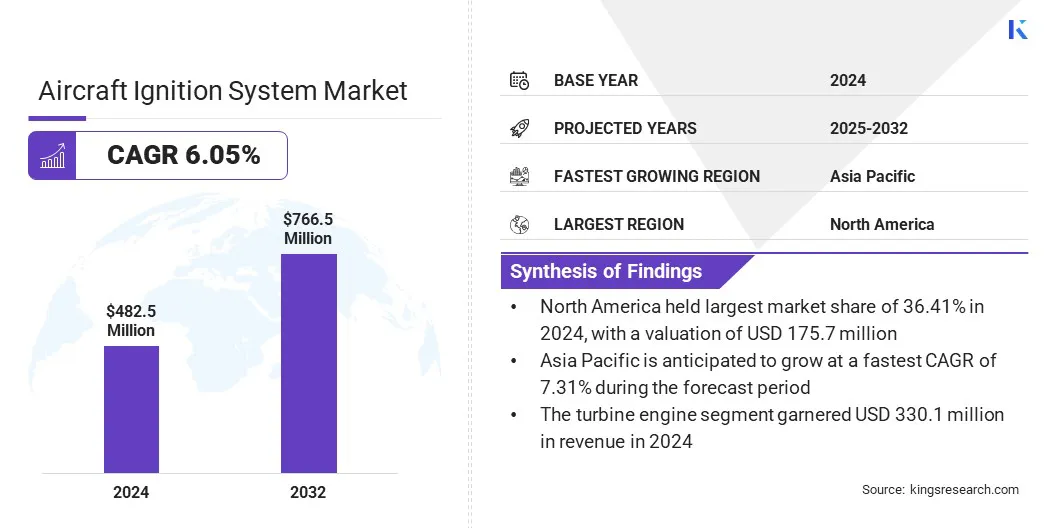

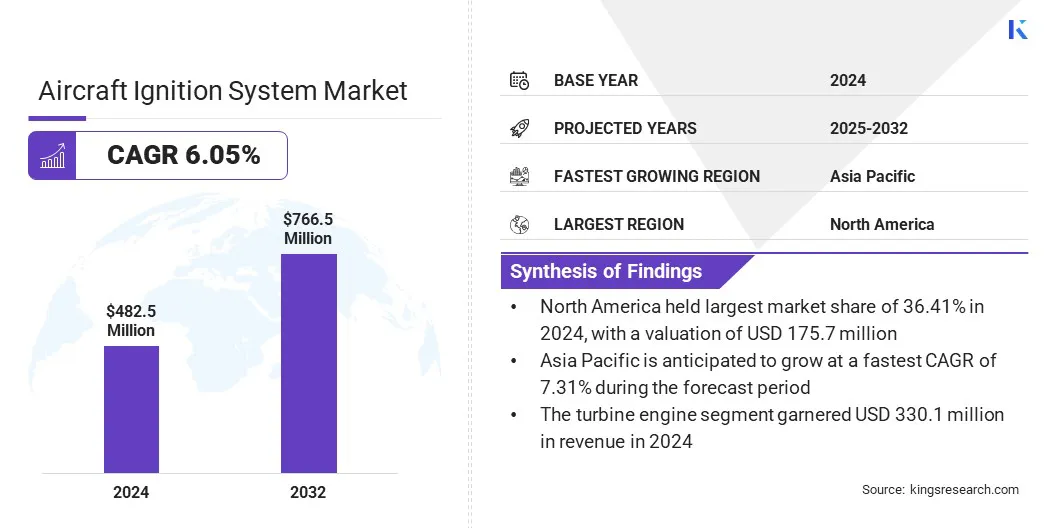

The global aircraft ignition system market size was valued at USD 482.5 million in 2024 and is projected to grow from USD 508.1 million in 2025 to USD 766.5 million by 2032, exhibiting a CAGR of 6.05% over the forecast period.

Market growth is primarily driven by rising aircraft production and increasing adoption of advanced ignition technologies that enhance fuel efficiency and engine reliability. The transition from traditional magneto systems to modern electronic ignition systems is improving operational safety, reducing maintenance requirements, and supporting compliance with emission standards.

Key Highlights

- The aircraft ignition system industry size was valued at USD 482.5 million in 2024.

- The market is projected to grow at a CAGR of 6.05% from 2025 to 2032.

- North America held a market share of 36.41% in 2024, with a valuation of USD 175.7 million.

- The magneto segment garnered USD 279.0 million in revenue in 2024.

- The turbine engine segment is expected to reach USD 540.1 million by 2032.

- The exciters segment is anticipated to witness the fastest CAGR of 6.45% over the forecast period.

- The fixed-wing aircraft segment garnered USD 305.3 million in revenue in 2024.

- The OEM segment held a market share of 54.68% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 7.31% over the forecast period.

Major companies operating in the aircraft ignition system market are Woodward, TransDigm Group, Continental Aerospace Technologies, G3ignition, Electroair, Champion Aerospace Inc., Hartzell Engine Tech, General Electric Company, PBS Group, SureFly Partners, LTD., Avco Corporation, Tempest Aero Group, Meggitt PLC, High Energy Devices, LLC, and Superior Air Parts.

Expanding modernization programs across commercial, military, and general aviation fleets are further driving the demand for aircraft ignition systems. Additionally, continuous technological advancements focused on performance optimization and lifecycle management by component manufacturers are further supporting market growth.

- In July 2025, Textron Aviation Inc. introduced a solid-state dual electronic ignition system as standard equipment on the Cessna Skyhawk, replacing the traditional dual magneto configuration. The new system improves engine efficiency, performance, and reliability while reducing maintenance requirements.

How is rising aircraft production and fleet expansion driving the growth of this market?

The growth of the aircraft ignition system market is driven by rising aircraft production and fleet expansion across commercial, military, and general aviation sectors. Increasing global air travel demand and the replacement of aging fleets are encouraging airlines and operators to invest in new, fuel-efficient aircraft equipped with advanced ignition systems.

Manufacturers are increasing production capacity to meet rising order volumes from major aircraft programs, supported by continued growth in regional and business aviation segments. This shift is further supported by ongoing fleet modernization initiatives and regulatory emphasis on performance, safety, and emission efficiency, thereby driving market growth.

How do complex design and integration requirements hinder the development and implementation of advanced aircraft ignition systems?

Complex design and integration requirements pose a major challenge to the growth of the aircraft ignition system market. Modern aircraft engines require ignition systems that deliver precise spark control, high thermal endurance, and consistent performance across extreme flight conditions. Developing compact and lightweight systems that meet these demands while maintaining reliability and compliance with strict aviation standards is highly complex.

Integration is further complicated by evolving propulsion architectures, electronic engine controls, and hybrid-electric systems that demand seamless compatibility and advanced communication interfaces. To overcome these challenges, manufacturers are investing in advanced simulation tools, modular designs, and collaborative development with engine OEMs to streamline integration, enhance performance, and ensure safety compliance.

How are advancements in hybrid and electric aircraft technologies influencing the development of modern aircraft ignition systems?

Advancements in hybrid and electric aircraft technologies are significantly influencing the development of modern aircraft ignition systems. The aviation industry’s transition toward low-emission and energy-efficient propulsion is creating new requirements for ignition components that deliver high efficiency, rapid response, and seamless integration with advanced power management systems.

As a result, manufacturers are designing lightweight, heat-resistant ignition solutions tailored to hybrid engines, ensuring optimal combustion and operational safety. Ongoing innovation in this area supports the industry’s sustainability goals and enables ignition system suppliers to play a vital role in the evolution of next-generation hybrid and electric aircraft.

- In July 2025, Piper Aircraft announced the Seminole DX, powered by DeltaHawk Engines’ DHK4A180 heavy-fuel engine, marking an advancement in multi-engine trainer performance. The turbocharged, liquid-cooled engine delivered about 40% higher fuel efficiency than conventional avgas engines and was designed to reduce maintenance and operating costs.

Aircraft Ignition System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Magneto, and Electronic

|

|

By Engine Type

|

Turbine Engine, and Reciprocating Engine

|

|

By Component

|

Igniters, Exciters, Ignition Leads, Spark Plugs, and Others

|

|

By Platform

|

Fixed-Wing Aircraft, Rotary-Wing Aircraft, and Unmanned Aerial Vehicle

|

|

By End-user

|

OEM, and Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Magneto and Electronic): The magneto segment earned USD 279.0 million in 2024, primarily due to its widespread use in general aviation and smaller aircraft for reliable, self-contained ignition without external power dependence.

- By Engine Type (Turbine Engine and Reciprocating Engine): The turbine engine held a share of 68.42% of the market in 2024, due to its extensive use in commercial and military aircraft, driven by high fleet demand, superior power output, and efficiency in long-haul operations.

- By Component (Igniters, Exciters, Ignition Leads, Spark Plugs, and Others): The igniters segment is projected to reach USD 213.0 million by 2032, owing to increasing replacement demand, advancements in high-temperature materials, and the growing use of advanced igniter designs to enhance engine reliability and performance.

- By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, and Unmanned Aerial Vehicle): The unmanned aerial vehicle segment is anticipated to grow at a CAGR of 7.88% through the projection period, driven by expanding defense applications, increasing commercial drone usage, and rising demand for lightweight, high-efficiency ignition systems tailored for smaller propulsion units.

- By End-user (OEM and Aftermarket): The OEM segment earned USD 263.8 million in 2024, primarily due to increasing aircraft production and the integration of advanced ignition systems in new engine models.

What is the market scenario in North America and Asia Pacific region?

Based on region, the aircraft ignition system market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aircraft ignition system market share stood at 36.41% in 2024 in the global market, with a valuation of USD 175.7 million. This dominance is attributed to the presence of leading aircraft and engine manufacturers, robust defense procurement programs, and ongoing investments by government agencies and commercial airlines in aviation modernization.

Moreover, the presence of a strong maintenance, repair, and overhaul (MRO) network and the rapid adoption of advanced electronic ignition systems across new-generation aircraft.

Supportive government initiatives, continuous R&D efforts, and the presence of major aerospace suppliers enhance market competitiveness. Ongoing technological advancements focused on improving fuel efficiency, emission control, and operational reliability are further driving market growth in this region.

- In March 2024, Hartzell Engine Tech, a U.S.-based company, unveiled the POWERUP aircraft ignition systems portfolio featuring PMA-approved magnetos, ignition harnesses, and replacement kits for general aviation and military aircraft. The launch enhances the company’s aftermarket portfolio and supports improved engine reliability, performance, and maintenance efficiency.

The Asia Pacific aircraft ignition system industry is set to grow at a CAGR of 7.31% over the forecast period. This growth is fueled by the growing aircraft production, rising air travel demand, and increasing investments from governments and private airlines in aviation infrastructure across regions. Regional airlines are focusing on fleet modernization and efficiency improvement, driving the adoption of advanced ignition technologies across commercial and defense sectors.

Furthermore, the Asia Pacific market is advancing due to increasing focus on maintenance optimization, emission reduction, and adoption of modern ignition technologies. Ongoing fleet modernization, expansion of regional air networks, and investments by airlines and governments in next-generation propulsion systems are further boosting market growth.

Regulatory Frameworks

- In the U.S., Title 14 CFR (Code of Federal Regulations) Part 33 regulates the design, construction, and certification of aircraft engines and associated ignition systems. It ensures that ignition components meet stringent safety, reliability, and performance standards critical to maintaining continuous engine operation in the market.

- In Europe, the EASA (European Union Aviation Safety Agency) Certification Specifications for Engines (CS-E) regulate aircraft engine and ignition system design, testing, and certification. It establishes technical and performance requirements that ensure safe ignition reliability, electromagnetic compatibility, and compliance with airworthiness standards across the European aviation sector.

- In Canada, the Canadian Aviation Regulations (CARs), Part V – Airworthiness, regulate the approval and maintenance of aircraft ignition systems. It defines certification and reliability criteria to ensure consistent ignition performance and operational safety within Canadian-registered aircraft.

Competitive Landscape

Companies operating in the global aircraft ignition system industry are maintaining competitiveness through continuous investments in electronic ignition technologies, material innovation, and strategic collaborations with aircraft and engine manufacturers. They are developing advanced ignition solutions that offer higher reliability, energy efficiency, and compliance with stringent aviation standards across commercial, military, and general aviation platforms.

Market players are expanding product portfolios with lightweight, high-temperature-resistant components and integrated digital control systems to meet evolving propulsion requirements. Moreover, they are forming long-term supply partnerships, enhancing regional manufacturing capabilities, and adopting predictive maintenance technologies to strengthen operational efficiency.

Additionally, companies are focusing on R&D programs, testing infrastructure, and aftermarket support services to ensure product performance, certification readiness, and sustained market leadership.

- In December 2024, Jet Parts Engineering (JPE) received Federal Aviation Administration approval for 18 new Parts Manufacturer Approval components and five Designated Engineering Representative repairs. The newly approved parts included ignition exciters for CF34, CF6, CFM56, and GE90 engines, expanding the company’s certified component portfolio and supporting improved maintenance efficiency across commercial aviation fleets.

Key Companies in Aircraft Ignition System Market

- Woodward

- TransDigm Group

- Continental Aerospace Technologies

- G3ignition

- Electroair

- Champion Aerospace Inc.

- Hartzell Engine Tech

- General Electric Company

- PBS Group

- SureFly Partners, LTD.

- Avco Corporation

- Tempest Aero Group

- Meggitt PLC

- High Energy Devices, LLC

- Superior Air Parts

Recent Developments (M&A)

- In May 2025, Hartzell Engine Tech acquired E-MAG Electronic Ignitions, a manufacturer of lightweight electronic ignition systems for aircraft. The acquisition expands Hartzell’s POWERUP Ignition System portfolio into both certified and non-certified sectors, offering electronic replacements for traditional mechanical magnetos.