Active Implantable Medical Devices Market Overview

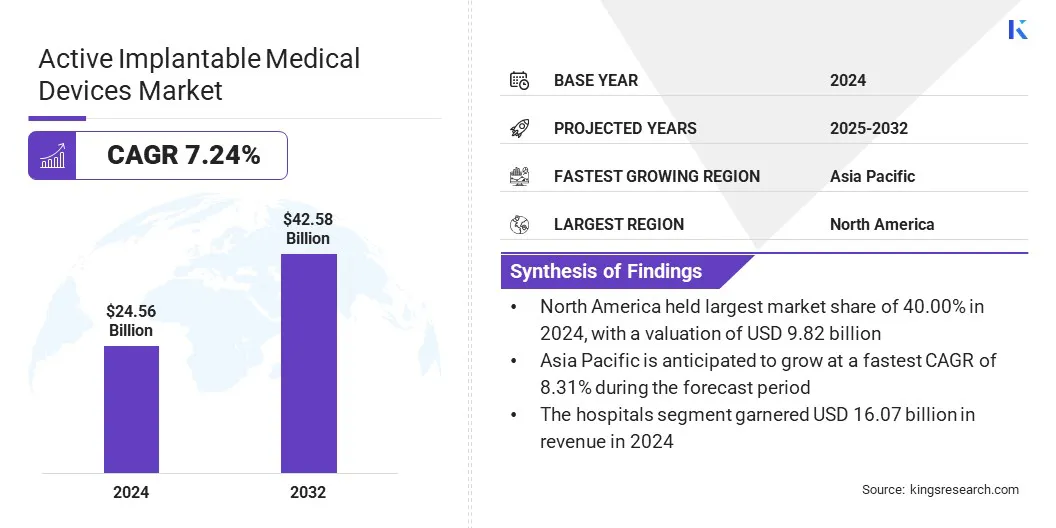

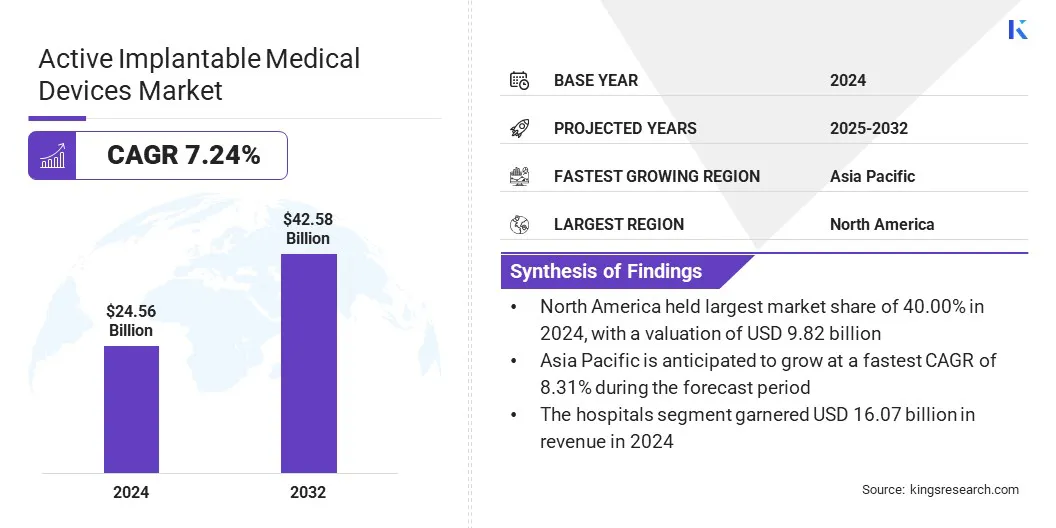

The global active implantable medical devices market size was valued at USD 24.56 billion in 2024 and is projected to grow from USD 26.11 billion in 2025 to USD 42.58 billion by 2032, exhibiting a CAGR of 7.24% during the forecast period.

Market growth is primarily driven by the rising prevalence of chronic cardiovascular and neurological conditions that require long-term, device-assisted management. Increasing adoption of connected and remotely monitored implants is improving clinical oversight, enhancing treatment precision, and reducing hospital visits. These advancements are enabling more proactive disease management and strengthening the value proposition of next-generation implants.

Key Market Highlights:

- The active implantable medical devices industry size was valued at USD 24.56 billion in 2024.

- The market is projected to grow at a CAGR of 7.24% from 2025 to 2032.

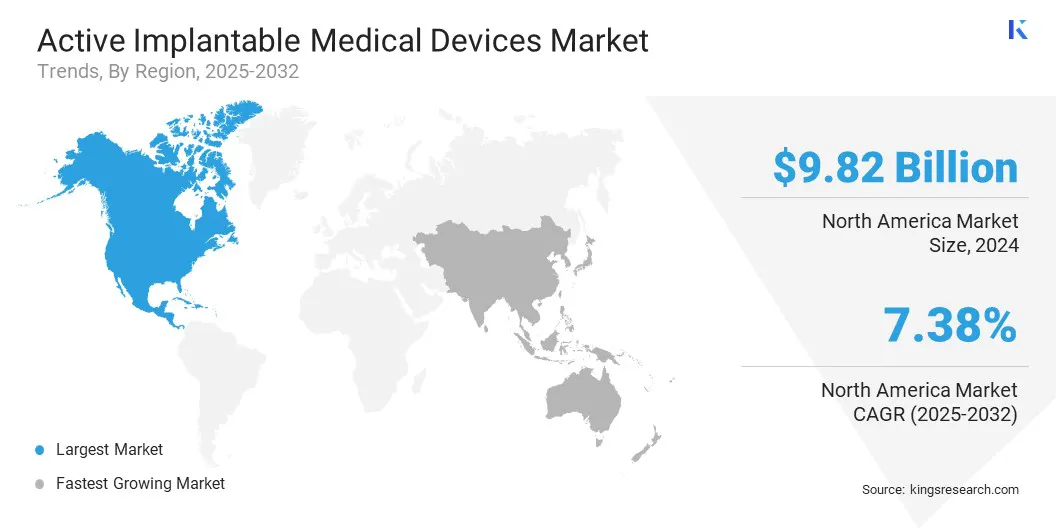

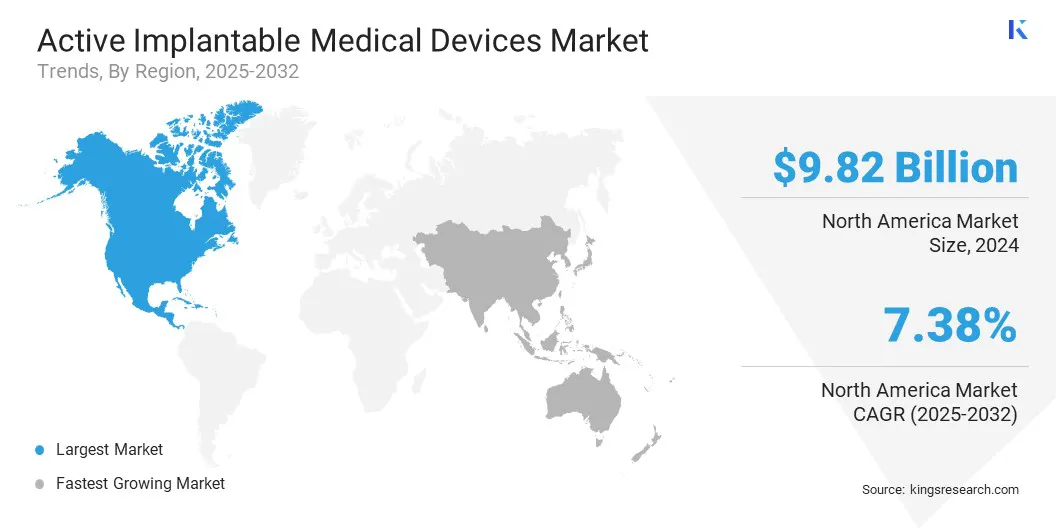

- North America held a market share of 40.00% in 2024, valued at USD 9.82 billion.

- The implantable cardioverter defibrillators segment garnered USD 6.96 billion in revenue in 2024.

- The hospitals segment is expected to reach USD 27.85 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 8.31% through the projection period.

Major companies operating in the active implantable medical devices industry are Medtronic, Abbott, Boston Scientific Corporation, Biotronik, Cochlear Ltd., Sonova Holding AG., Oticon Medical A/S, LivaNova PLC, Nevro Corp, Axonics, Inc., Inspire Medical Systems, Inc., Cirtec Medical Corp., MicroPort Scientific Corporation, MicroTransponder Inc., and Saluda Medical Pty Ltd.

Advancements in miniaturization, biocompatible materials, and extended-life power systems are further accelerating device innovation across cardiac rhythm management, neuromodulation, and hearing restoration applications. Additionally, expanding healthcare infrastructure, broader reimbursement support, and growing clinical acceptance of implant-based therapies are strengthening global market growth.

- In July 2025, FineHeart was designated as the lead entity for the IPCEI Health Tech4Cure initiative, a multinational program supported by six European Union Member States. The initiative focuses on advancing energy technologies for long-term implants, enhancing digital interoperability, and strengthening sustainable and competitive manufacturing capabilities within Europe’s implantable medical device sector.

How is the rising prevalence of chronic cardiovascular and neurological disorders driving the adoption of active implantable medical devices?

Adoption of active implantable medical devices is increasing as chronic cardiovascular and neurological disorders become more prevalent and require sustained therapeutic support. Conditions such as arrhythmias, heart failure, epilepsy, Parkinson’s disease, and chronic pain are increasing globally, prompting greater adoption of pacemakers, implantable cardioverter defibrillators, and neurostimulation systems.

Healthcare providers rely on these devices to deliver precise, sustained physiological support that improves clinical outcomes and quality of life. This expanding patient population, along with the growing need for reliable implant-based interventions, continues to strengthen demand and drive market growth.

How do the high costs associated with implantable devices and surgical interventions constrain market growth?

High cost of implantable systems and surgical procedures poses a major challenge to the growth of the active implantable medical devices market. These devices rely on advanced materials, intricate components, and extensive clinical validation, which increases manufacturing expenses and elevates overall treatment costs.

Hospitals face additional financial pressure due to implantation requirements, post-operative care, and long-term monitoring protocols that further raise the economic burden. Cost barriers are amplified in Latin America, parts of Asia Pacific, and the Middle East & Africa where reimbursement frameworks are less developed and healthcare budgets are limited.

To address these challenges, healthcare systems and manufacturers are exploring cost-optimized designs, improved reimbursement pathways, and value-based procurement models that support wider adoption.

How is the growing shift toward connected and remotely monitored implants influencing the evolution of active implantable medical devices?

The growing shift toward connected and remotely monitored implants is reshaping how long-term cardiac and neurological conditions are managed. Clinicians gain continuous insight into device function and patient status, allowing care teams to move beyond scheduled in-clinic evaluations.

Real-time alerts, trend analyses, and diagnostic data delivered through wireless telemetry and cloud systems enable earlier detection of arrhythmias, device malfunctions, or therapy adjustments. Integration with analytics tools, remote monitoring dashboards, and digital care pathways strengthens clinical decision-making and coordination.

Platforms such as Medtronic CareLink, Abbott Merlin.net, Boston Scientific Latitude, and BIOTRONIK Home Monitoring provide real-time device data, diagnostic trends, alert notifications, and therapy insights that support timely clinical intervention. As manufacturers expand connected pacemakers, implantable cardioverter defibrillators, and neurostimulators, patients benefit from more proactive care, fewer avoidable hospital visits, and more stable long-term outcomes.

Active Implantable Medical Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Implantable Cardioverter Defibrillators, Implantable Cardiac Pacemakers, Ventricular Assist Devices, Implantable Heart Monitors, Neurostimulators, and Implantable Hearing Devices

|

|

By End User

|

Hospitals, Ambulatory Surgery Center, and Specialty Clinics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Implantable Cardioverter Defibrillators, Implantable Cardiac Pacemakers, Ventricular Assist Devices, Implantable Heart Monitors, Neurostimulators, and Implantable Hearing Devices): The implantable cardioverter defibrillators segment earned USD 6.96 billion in 2024 primarily due to strong clinical demand for effective arrhythmia management and prevention of sudden cardiac death.

- By End User (Hospitals, Ambulatory Surgery Center, and Specialty Clinics): The hospitals held a share of 65.43% of the market in 2024, due to higher procedural volumes, advanced surgical infrastructure, and greater availability of specialized cardiac and neurological care.

- Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

What is the current market scenario in North America and Asia Pacific for this market?

North America active implantable medical devices market share stood at 40.00% in 2024, valued at USD 9.82 billion. This strong position is supported by the region’s high clinical adoption of advanced implant technologies, high procedural availability, and consistent investment in modernizing cardiovascular and neurological care.

These structural advantages also enable wider use of connected implants, remote monitoring platforms, and digital follow-up systems across healthcare networks, strengthening therapy management and improving patient outcomes.

Increasing utilization of next-generation cardiac rhythm management systems and expanding access to neuromodulation therapies are further strengthening regional demand. Moreover, strategic collaborations between manufacturers, healthcare networks, and research institutions are accelerating innovation, clinical validation, and adoption of next-generation active implantable solutions across North America.

Asia Pacific active implantable medical devices industry is set to grow at a CAGR of 8.31% over the forecast period. Growth in the region is being driven by rapid improvements in hospital infrastructure, wider availability of electrophysiology and neuromodulation services, and increasing prioritization of advanced therapeutic technologies across both public and private healthcare systems.

Strengthening reimbursement support and government-led investments in clinical infrastructure are further accelerating uptake of pacemakers, defibrillators, neurostimulators, and cochlear implants.

Manufacturers are enhancing regional supply capabilities, introducing smaller and longer-lasting devices, and integrating wireless monitoring features that improve patient outcomes. These advancements, combined with growing participation from global and domestic medical technology companies, are solidifying Asia Pacific’s position as a rapidly expanding market for active implantable medical devices.

Regulatory Frameworks

- In the European Union, Regulation (EU) 2017/745 regulates active implantable medical devices. It strengthens clinical evidence requirements, post-market surveillance, and safety standards for high-risk implants such as pacemakers, implantable cardioverter defibrillators, and neurostimulators.

- In the United States, the U.S. Food and Drug Administration’s Premarket Approval (PMA) framework under 21 CFR Part 814 regulates active implantable medical devices. It ensures that Class III implants undergo rigorous safety, effectiveness, and quality evaluations before entering the market.

- In India, the Medical Devices Rules 2017 regulate active implantable medical devices. It classifies these products as high-risk devices under CDSCO oversight and defines approval pathways, clinical investigation requirements, and quality system standards.

Competitive Landscape

Companies in the active implantable medical devices industry are strengthening their competitive position through advancements in miniaturization, biocompatible materials, and connected implant technologies.

They are focusing on improving long-term device reliability, remote monitoring capabilities, and patient comfort to address the growing clinical needs in cardiology, neurology, and hearing restoration. Market players are expanding their portfolios with leadless systems, fully implantable designs, and next-generation neurostimulation platforms that enhance safety and therapeutic precision.

- In February 2025, BIOTRONIK outlined a strategic shift following the divestment of its Vascular Intervention division to Teleflex, confirming a renewed focus on active implantable medical devices. The company plans to expand investments in artificial intelligence, remote monitoring, and advanced cardiac and neuromodulation systems to enhance its core therapeutic portfolio and support improved patient management.

Key Companies in Active Implantable Medical Devices Market:

- Medtronic

- Abbott

- Boston Scientific Corporation

- Biotronik

- Cochlear Ltd.

- Sonova

- Oticon Medical A/S

- LivaNova PLC

- Nevro Corp

- Axonics, Inc.

- Inspire Medical Systems, Inc.

- Cirtec Medical Corp.

- MicroPort Scientific Corporation

- MicroTransponder Inc.

- Saluda Medical Pty Ltd.

Recent Developments

- In February 2024, King’s College London opened the MAISI facility at St Thomas’ Hospital to support the development and early manufacturing of Class II and Class III active implants and surgical instruments. The facility provides cleanroom production, regulatory guidance, and quality-assurance capabilities to help move healthcare engineering innovations into first-in-human clinical use.